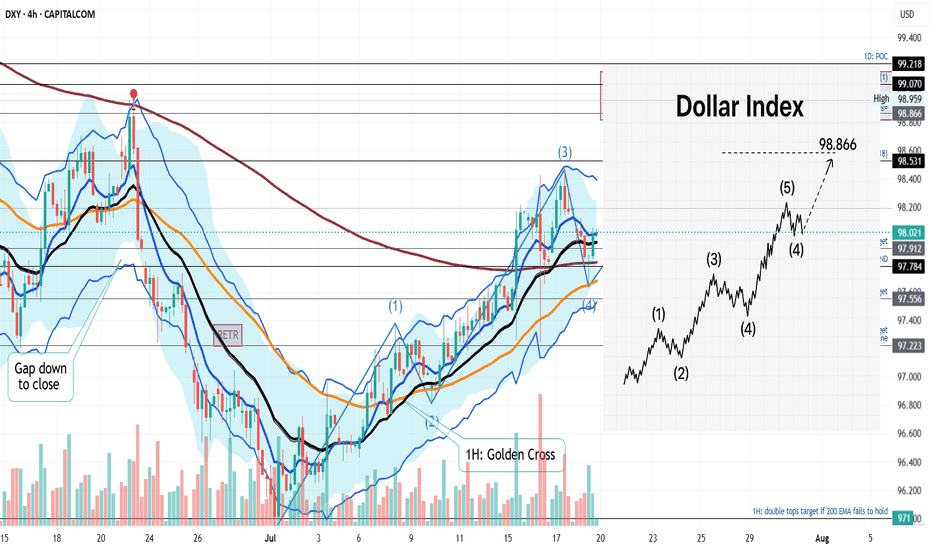

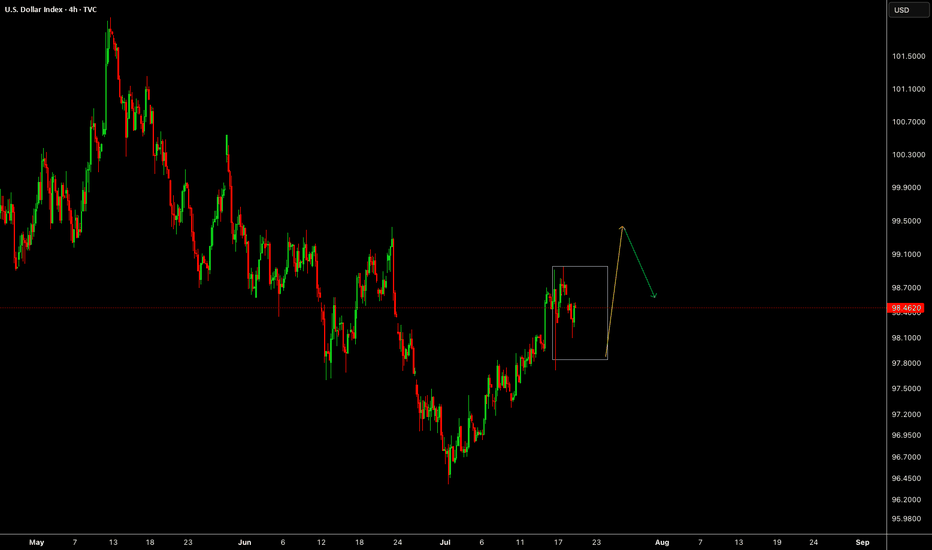

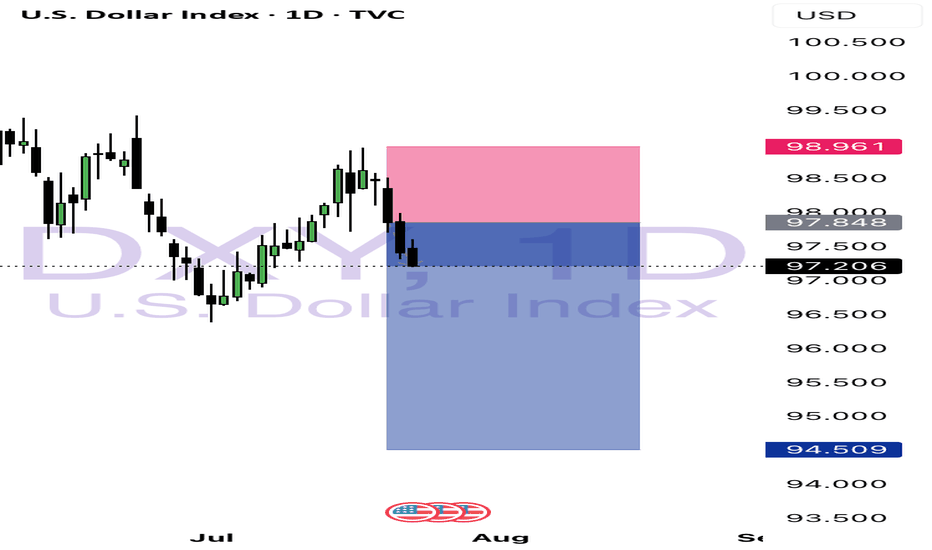

DOLLAR INDEX TO COMPLETE WAVE 5 TARGET at 98.866In this short video I dive into the technical breakdown of the U.S. Dollar Index (DXY) as it approaches the anticipated Wave 5 surge, aiming for the key resistance level of 98.866. Using Elliott Wave Theory, this analysis maps out the market’s current structure on the 4 hours timeframe, highlights critical pivot zones, and projects the bullish momentum that could reshape short-term outlooks. Whether you're a seasoned trader or a curious observer, this chart-driven insight offers clarity in the wave progression and what might come next.

USDX trade ideas

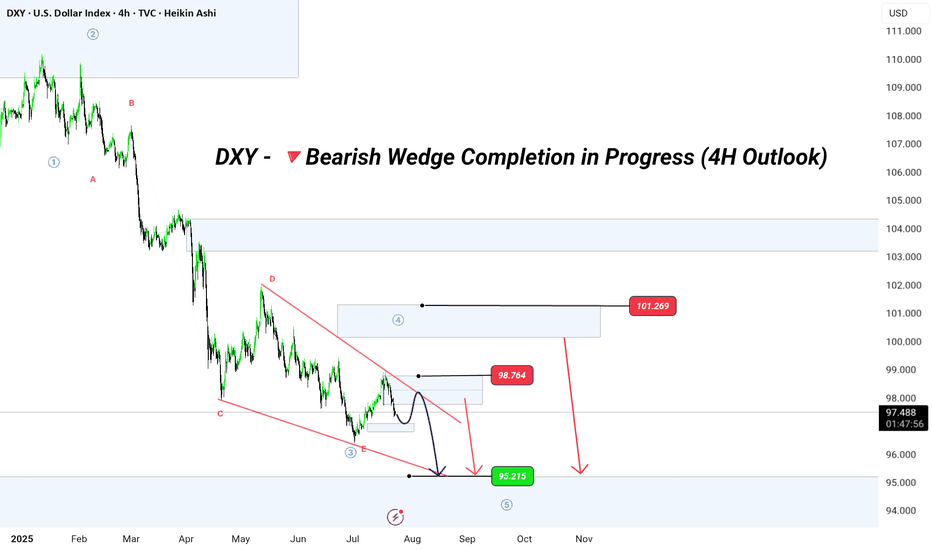

DXY – The Trap Is Set. The Drop Is Coming.Wave structure complete.

Retail thinks we’re going up. I know where it’s really going.

This is GreenFire Execution, not prediction.

🧠 Final liquidity hunt possibly toward 98.76 or even 101.40, then lights out.

Targeting the big liquidity pocket at 95.215

That’s where legends buy while the crowd panics.

📐 Elliott Wave | Wedge Mastery | Market Psychology

If you understand this chart — you don’t need signals. You need silence and execution.

#DXYSetup | #Wave5Ready | #SmartMoney | #ForexMillionaire | #TradingViewElite

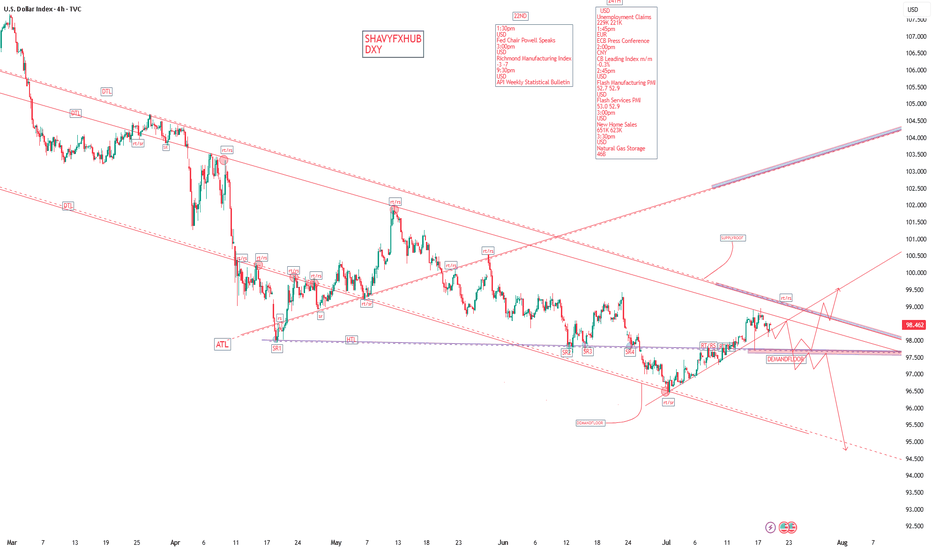

DXYDXY refers to the U.S dollar index ,an index that measures the value of united state dollar relative to a basket of six major foreign currencies ,it was originally developed by FED'S

THE SIX MEJOR CURRENCIES ARE ;

.euro,japaneses yen, pounds sterling, Canadian dollar, Swedish krona,swiss franc.

the index is used by investors ,traders and economist to gauge the overall strength of the U.S dollar in a global currency markets. Its rise and fall will influence trade ,investment and monetary policy decision in fx window.

on 4hr we are rejected and i will watch market open and close on Monday for trade directional bias for the following pairs (AUDUSD,USDCAD,USDZAR,GBPUSD,EURUSD,USDJPY,XAUUSD XAGUSD,XCUUSD,BITCOIN )

NOTE;TRADING IS 100% PROBABILITY,RISK MANAGEMENT IS KEY AND GET ACCOUNTABLITY PARTENER WHO WILL BE CHECKING YOUR WORK..

#DXY #DOLLAR

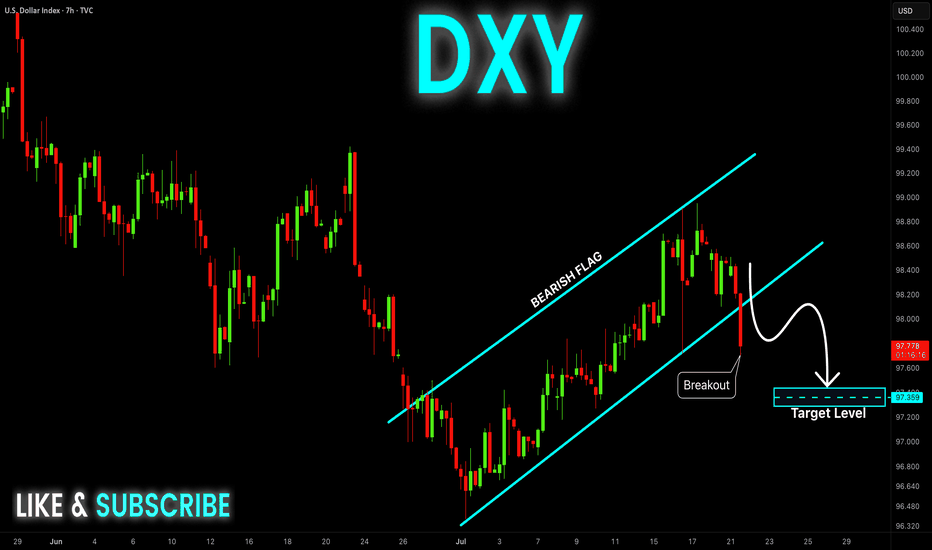

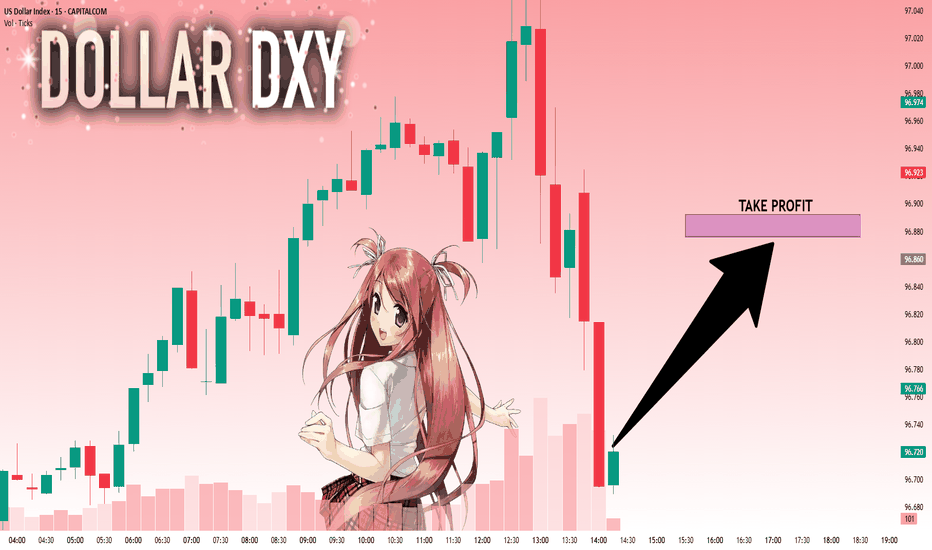

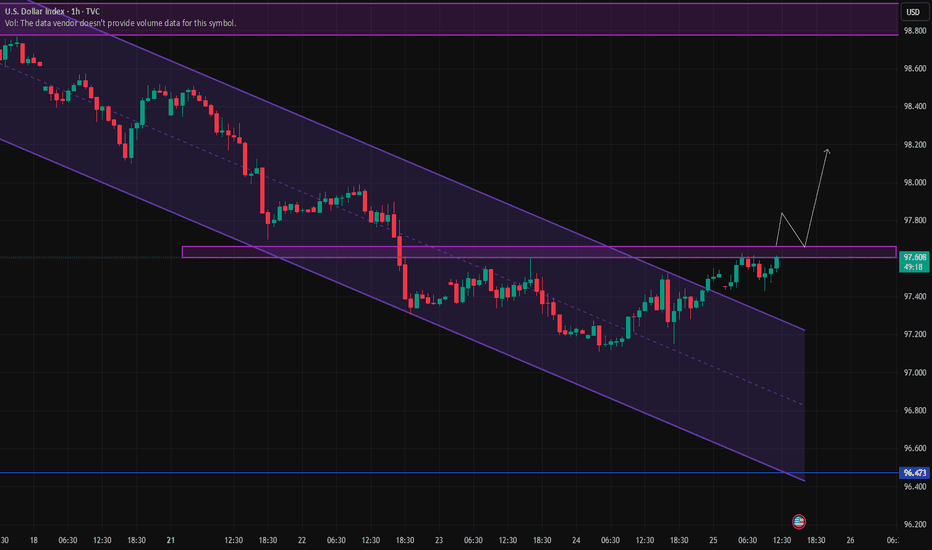

DXY Bearish Breakout! Sell!

Hello,Traders!

DXY is trading in a strong

Downtrend and the index

Made a bearish breakout

Out of the bearish flag pattern

So we are bearish biased

And we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

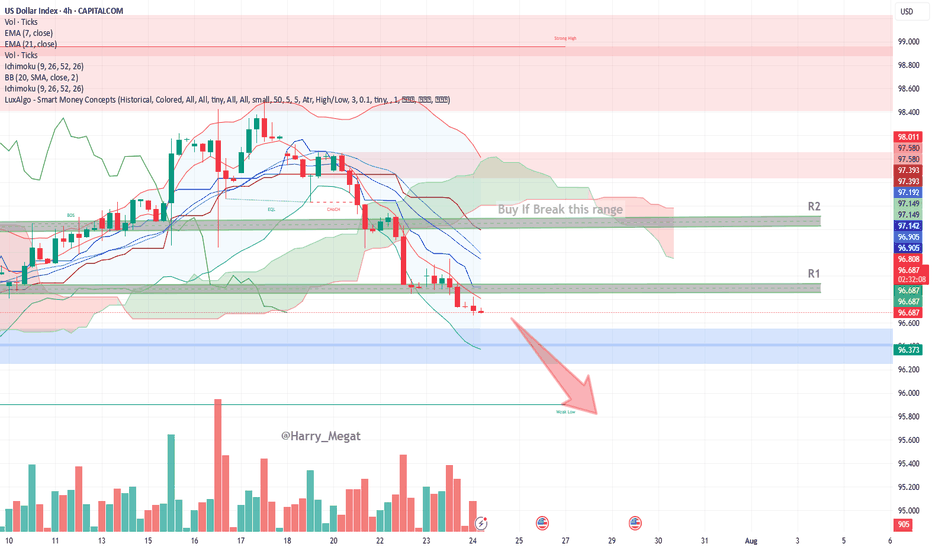

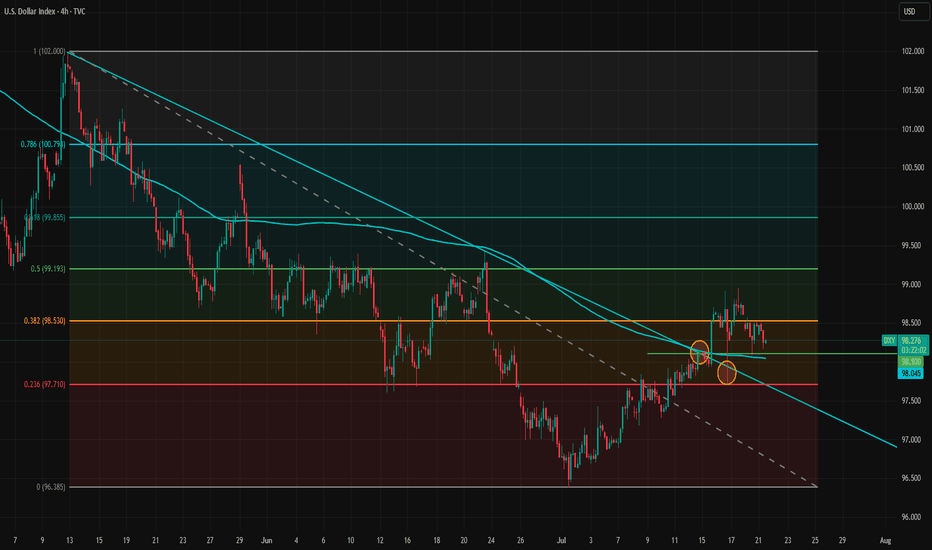

US Dollar Index (DXY) – 4H Chart AnalysisUS Dollar Index (DXY) – 4H Chart Analysis

**Current Trend:** Bearish

Price trades below EMAs, Ichimoku Cloud, and within a bearish channel.

#**Bearish Scenario (Favorable)**

* **Conditions:**

* Price remains below EMA 7 & 21

* Stays under Ichimoku Cloud and 96.812 resistance (R1)

* Lower lows forming, bearish momentum increasing

* **Confirmation:**

Break below **96.37 (blue zone)**

* **Target:**

* TP1: 96.00

* TP2: 95.60 (next weak support)

**Bullish Scenario (Reversal)**

* **Conditions:**

* Price must break above **96.81 (EMA 7 + resistance)**

* Break above **R1 → 96.90**, and then above **R2 → 97.14–97.19**

* Bullish candles close above the Ichimoku cloud

* **Confirmation:**

Break and retest of **97.20**

* **Target:**

* TP1: 97.39

* TP2: 97.58 (key structure)

* TP3: 98.00 (major resistance)

**Bias:** Bearish unless DXY breaks above **97.20** with strong volume and bullish structure.

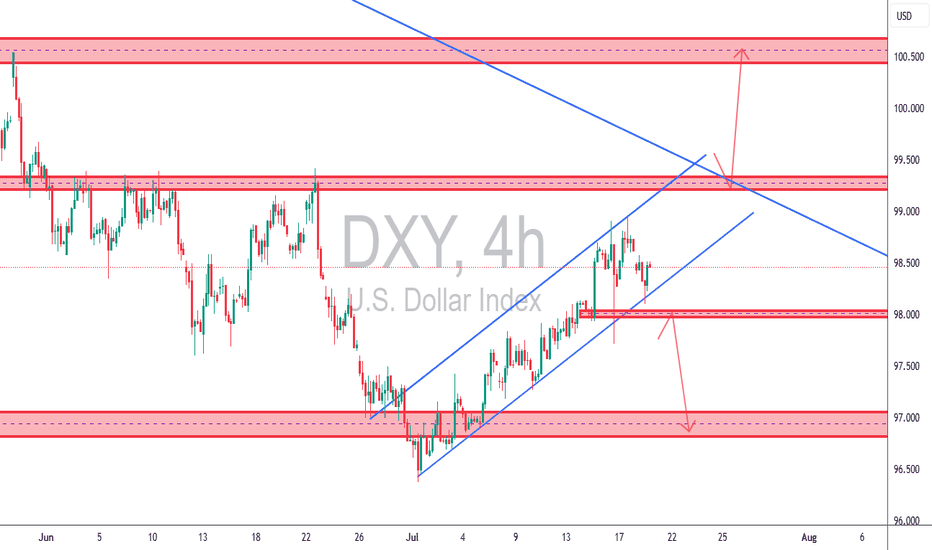

DXY: Strong Bullish Sentiment! Long!

My dear friends,

Today we will analyse DXY together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 96.722 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

DXY Eyes Breakout – Dollar Strength Gaining GroundThe U.S. Dollar Index (DXY) is testing its 50-day moving average on the daily chart, with bulls eyeing a potential breakout. A move above 98.75 could confirm a short-term trend reversal and open the path for further gains.

Stronger-than-expected U.S. economic data continues to support the greenback. Recent inflation prints, job market resilience, and solid retail spending have pushed back expectations for imminent Fed rate cuts. This shift in rate outlook provides fundamental support for the dollar.

In addition, strong U.S. corporate earnings are bolstering equity markets, attracting capital flows into U.S. assets and indirectly supporting dollar demand. Rising Treasury yields, especially on the short end, also offer more attractive returns for dollar-based investments.

Geopolitical uncertainties and trade tensions in Asia and Europe are prompting a rotation into the dollar as a safe-haven currency.

Meanwhile, some emerging market currencies are under pressure, increasing global demand for dollar liquidity.

Technically, a close above 98.75 could confirm bullish momentum, with 99.80 as the next upside target. As long as macro and risk dynamics lean in the dollar’s favor, DXY may continue its rebound from recent lows.

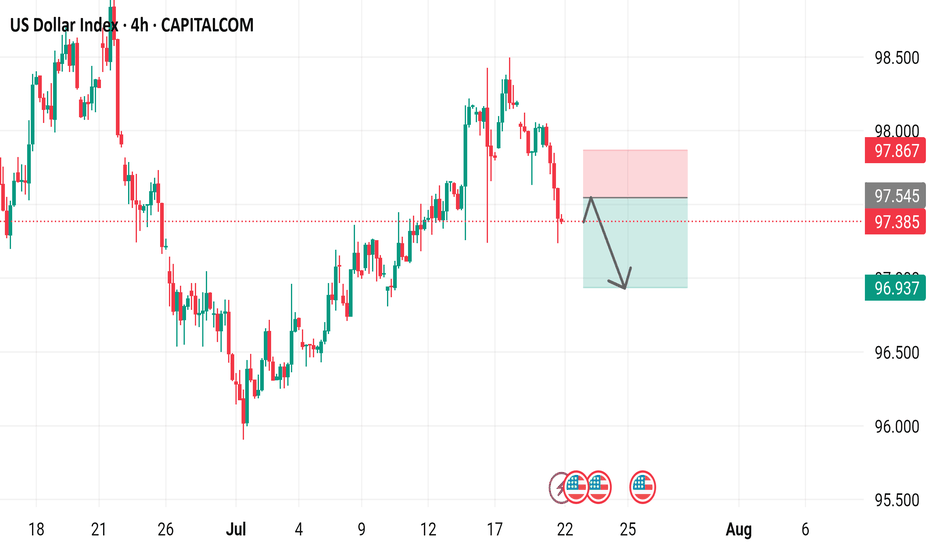

US Dollar Index 4-hour time frame, showcasing the US Dollar Index's performance over this period.

- The index is currently at 97.385, with a decrease of 0.636 (-0.65%) from its previous value.

- A red box indicates a "SELL" signal at 97.385, while a blue box suggests a "BUY" signal at 97.439.

- The chart includes various technical indicators, such as moving averages and relative strength index (RSI), to help traders analyze market trends.

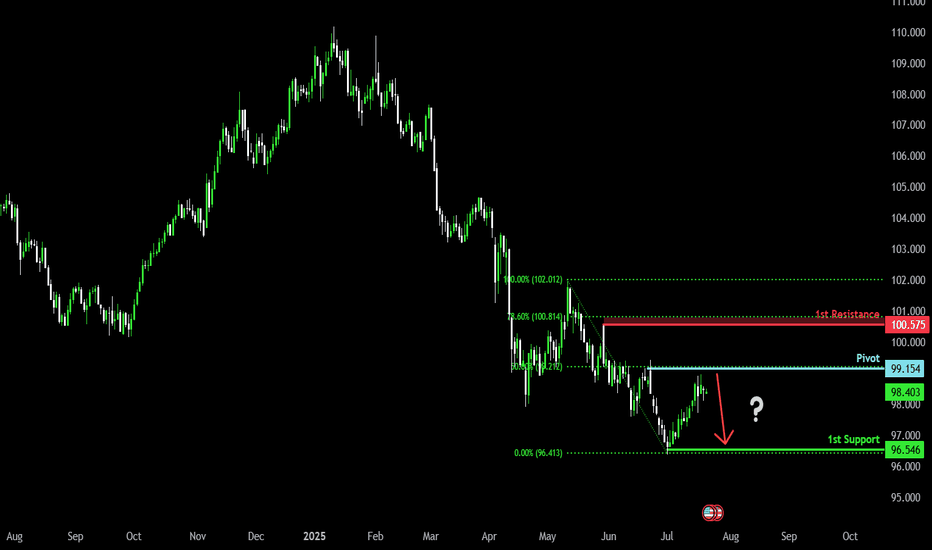

Bearish drop off 50% Fibonacci resistance?The US Dollar Index (DXY) is rising towards the pivot which acts as a pullback resistance and could drop to the 1st support.

Pivot: 99..15

1st Support: 96.54

1st Resistance: 100.57

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

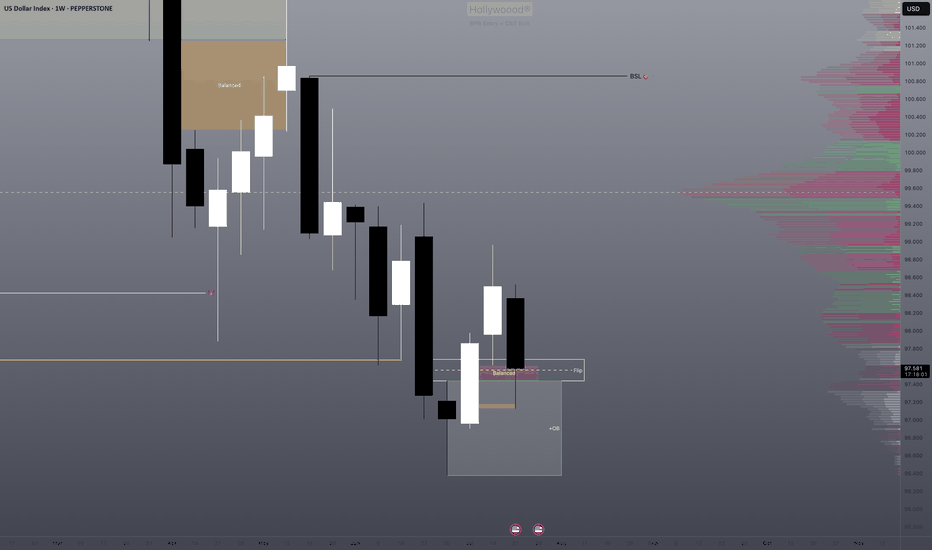

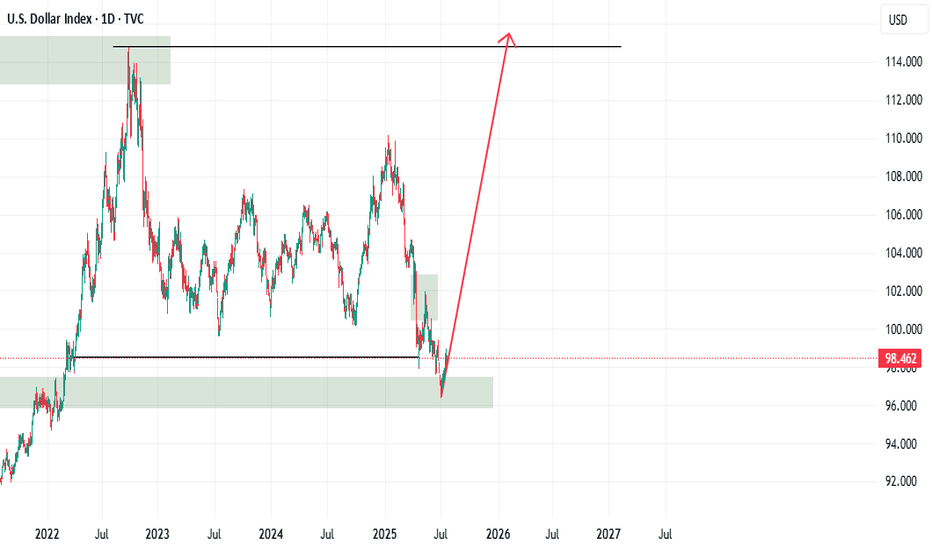

USD Snapback - Long-Term Trendline Back in-PlayThe trendline that originated in 2001 and connected to the 2020 high came in to hold the lows in July of 2023, and then again on Easter Monday. That level also held as support in June albeit temporarily, as bears grinded a sell-off into the Q2 close.

In early-Q3 trade, that trendline was resistance on a few different occasions, until buyers could eventually take it out. And then last week, on the heels of Trump's threat to fire Jerome Powell, price hurriedly pulled back until, eventually, support arrived via that same trendline projection, which is shown in black on the chart.

Now that trendline is back in-play as a test of today's lows. Given the persistent failure from USD bulls to fire anything more than a pullback, combined with the very clear push for USD-weakness from the current administration, it can be difficult to muster a bullish fundamental bias. But - this move had become very one-sided with that sell-off in the first-half of the year so the way that buyers respond to these support tests will be key for whether or not the currency can finally show a reversal theme for more than a couple of weeks. - js

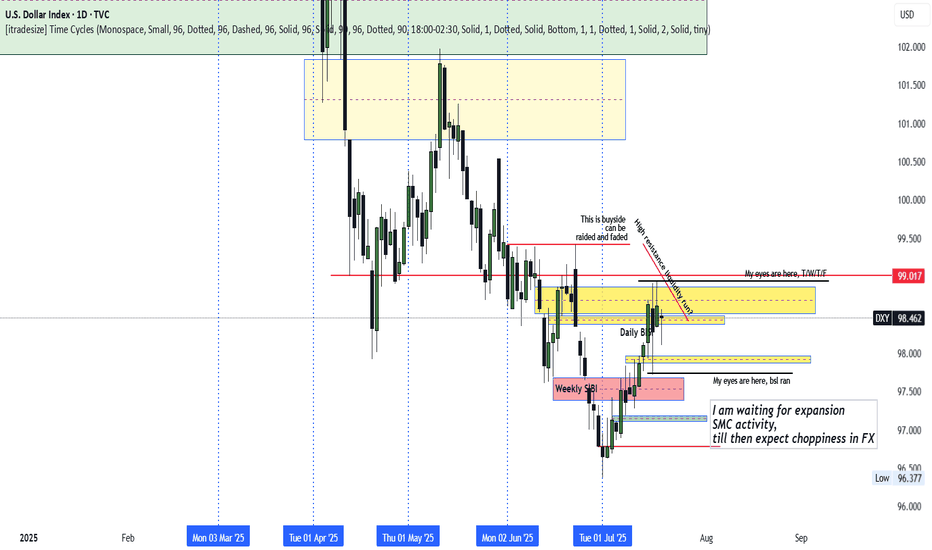

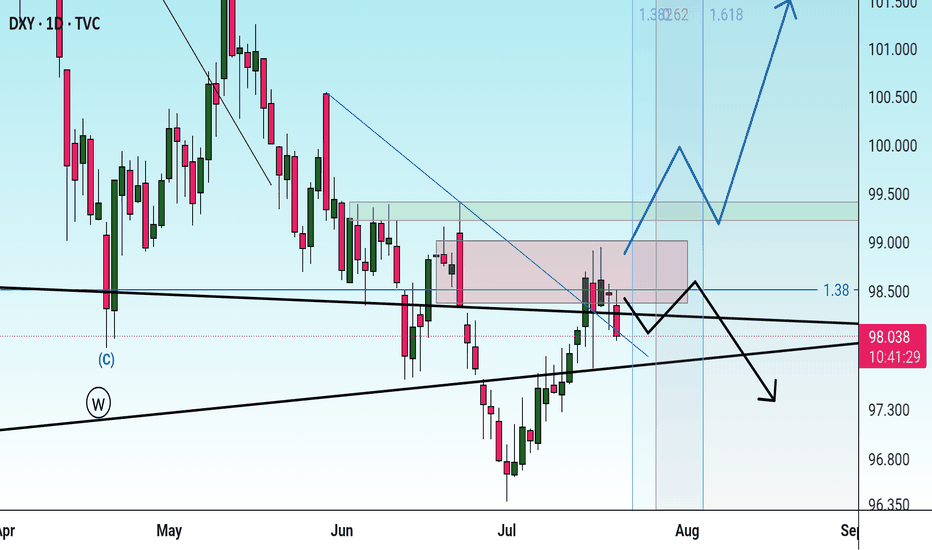

DXY Indecisive

DXY remains locked in its previous week's range, especially locked in Wednesday's range.

The Thursday rally above Wednesday's high appears to be a fake breakout aimed at trapping traders long.

With stops seemingly below Wednesday (Previous Week Low), how we trade past the previous week high or/and low should inform the unfolding direction.

With a run to the previous week's low and high possible, caution is recommended. Await expansion avoid the surge of new's release in the coming week and the choppiness that could unfold.

DXY – Short-Term OutlookThis week, we’ll be analyzing several currency pairs that are showing promising trading setups.

Unlike previous weeks, we plan to focus on lower timeframes and shorter market cycles to take advantage of more agile trading opportunities.

If the price manages to give us a clear confirmation within the marked zone, we can start considering a potential shift to a bullish trend on DXY.

This would set the stage for preparing long positions, as market structure would likely begin aligning in favor of the bulls.

Until that confirmation arrives, we stay cautious and wait for price action to validate the move.

USD Weakness Ahead (3-Month Outlook)EUR/USD: Breaking 1.0850, next target 1.1000

GBP/USD: Cleared 1.2750, heading toward 1.2950

AUD/USD: Rebounded from 0.6650, potential 0.6850

NZD/USD: Above 0.6150, could reach 0.6300

Key Drivers:

1. Fed likely cutting rates before ECB/BoE/RBNZ

2. Commodity recovery (helps AUD/NZD)

3. Political risks weighing on USD

Market Mood:

- Traders reducing long USD positions

- AUD/NZD shorts getting squeezed

Risks:

US inflation surprises upside

Geopolitical shocks boost USD safe-haven demand

Sasha Charkhchian

US Dollar Index (DXY) Chart AnalysisUS Dollar Index (DXY) Chart Analysis

The addition of the US Dollar Index (DXY) to FXOpen’s suite of instruments offers traders potential opportunities. This financial instrument:

→ serves as a measure of the overall strength of the US dollar;

→ is not tied to a single currency pair but reflects the value of the USD against a basket of six major global currencies, including the EUR, JPY, and GBP;

→ allows traders to capitalise on price fluctuations in the currency market;

→ is used in more advanced strategies for hedging risks in portfolios sensitive to sharp movements in the US dollar.

In today’s environment of heightened volatility, this instrument becomes particularly valuable. The active stance of US President Donald Trump — through the implementation of trade tariffs, sanctions, and unpredictable geopolitical rhetoric — gives traders even more reason to closely monitor the DXY chart.

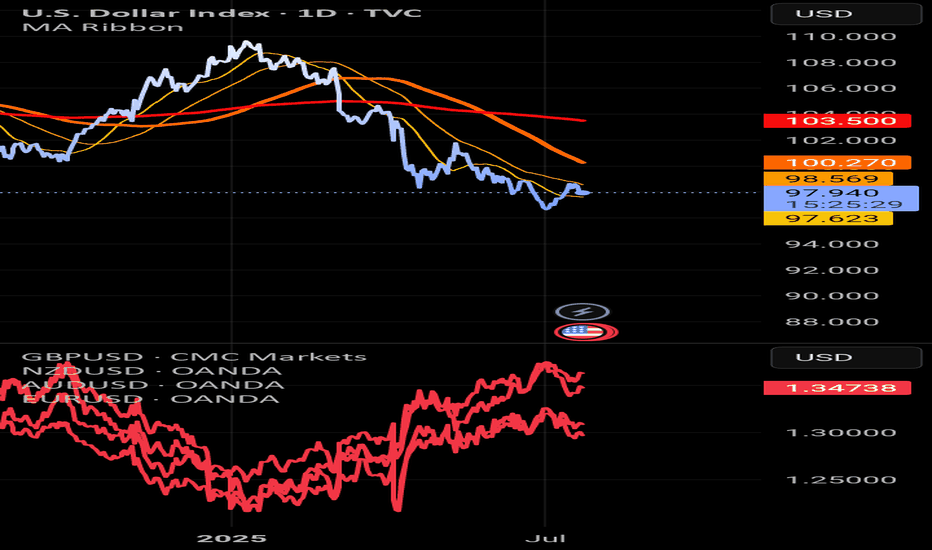

Technical Analysis of the DXY Chart

Moving averages show that the US Dollar Index displayed a predominantly bearish trend during the first half of 2025.

However, the picture shifted in July: the index began rising steadily (already up approximately +1.9% since the beginning of the month), highlighted by the blue ascending trend channel.

This suggests that the DXY may have found support following a prolonged decline, and a shift in market sentiment could be underway: after a bearish phase, a period of consolidation may follow. If this scenario plays out, we could see DXY oscillating between the 97.65 and 99.30 levels – both of which show signs of acting as support and resistance (as indicated by the arrows).

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

DXY SHORT?

## 📉 **DXY Bearish Setup for 2025 – Fed Cuts, Fiscal Strain, Technical Breakdown**

### 🧠 Thesis

The U.S. Dollar Index (DXY) is poised to remain under pressure through the rest of 2025 due to macro, policy, and technical headwinds. With the Fed preparing for multiple rate cuts, rising fiscal imbalances, and a strong global diversification away from USD, the broader trend points **downward**.

---

### 🔍 Fundamentals Driving USD Weakness

* **Federal Reserve Pivot**: 2–3 rate cuts expected in 2025 → erodes USD yield advantage.

* **Surging U.S. Deficits**: Debt-to-GDP nearing 130%, undermining investor confidence.

* **De-dollarization Trend**: Central banks diversifying reserves (yuan, gold, euro).

* **Political Noise**: Tariff risk + weak-dollar narrative from Trump camp adds pressure.

---

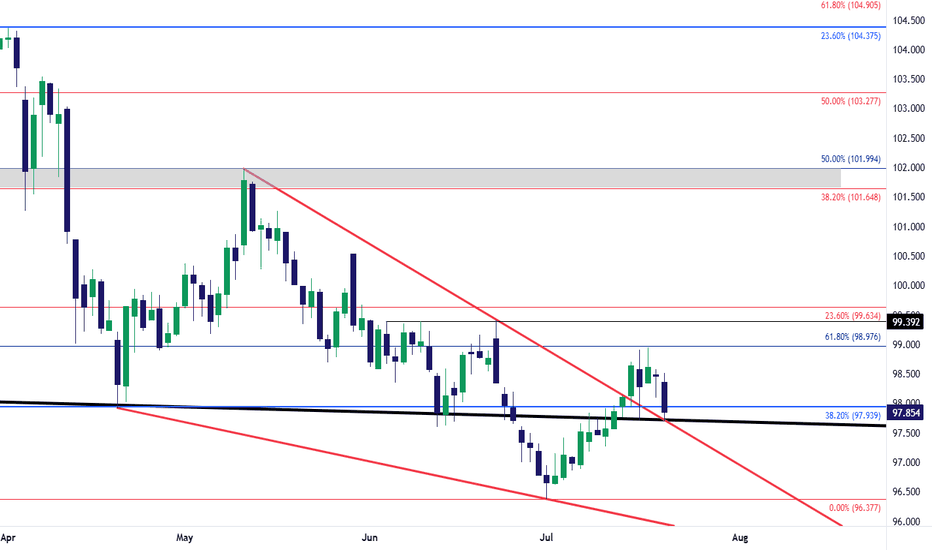

### 📊 Technical Outlook (1D/1W Charts)

* DXY is trading below **9/20/50 EMA**.

* RSI \~43 with hidden bearish divergence.

* Clear **descending channel** since mid-2024.

* Key **support zone: 97.90 – 96.40**.

* Below 97.90 opens path toward 96.00–95.00.

---

### 🛠️ Trade Setup

| Type | Short (swing/position) |

| -------- | ---------------------- |

| Entry | Break below 98.00 |

| Target 1 | 96.40 |

| Target 2 | 95.00 |

| SL | Above 99.50 |

| R\:R | \~2.5:1 |

---

### ⚠️ Risks

* Surprise inflation → Fed pauses cuts

* Safe haven bid from geopolitical shocks

* Strong upside breakout >101.00 = trend invalidation

---

### 💬 Final Note

As long as DXY remains below 99.50, rallies are selling opportunities. Watch the 97.90–98.00 level — a confirmed breakdown could mark a fresh leg lower toward 95.00 by year-end.

---

### 🏷️ Tags

`#DXY` `#USD` `#DollarIndex` `#Forex` `#Macro` `#Bearish` `#TradingSetup` `#ShortUSD`

---

Fundamentals Support Dollar’s Potential Trend ReversalThe dollar appears to be reversing its direction on the 4-hour timeframe. The trendline has been broken and retested twice, but the dollar has held above it, signaling a potential shift in momentum.

Despite intense pressure from the White House on the Federal Reserve, the data is likely to prevent the Fed from cutting rates at the upcoming meeting and possibly at the one after that. A potential rate cut in September will largely depend on incoming inflation and labor market data.

The inflation impact of tariffs became more visible in the latest CPI report, but the effect is still relatively modest. This aligns with our theory that tariff-driven inflation will build gradually and persist over a longer period, rather than cause an immediate spike.

Meanwhile, the labor market has not shown clear signs of rapid weakening, so there is no strong case for a rate cut from that side either. The Financial Conditions Index also indicates that monetary policy remains on the accommodative side. Bloomberg financial conditions index is at highest level since March.

As markets increasingly recognize that no rate cuts are likely in the near term, and with the August 1 tariff deadline approaching amid potential rising risks of trade tensions between the U.S. and the EU, the dollar may gain further support. The U.S.–EU bond market spread also does not favor a stronger euro at the moment, adding to the dollar's upside potential.

In the short term, 98.10 and 98.53 are immediate support and resistance levels. If the dollar breaks above 98.53 again, upward momentum may strengthen and open the path toward the 100 level.

TCB Strategy Application on DXY 4H✅ TCB Strategy Application on DXY 4H

🔹 Trend → Countertrend → Breakout Structure:

• Trend: We’ve had a bullish recovery from the 97.00 zone (bottom demand), moving within an ascending channel.

• Countertrend Zone: Price has now pulled back from the 99.00–99.200 supply area.

• Breakout Watch:

o A break below the ascending channel (support line) + 98.00 zone would signal countertrend breakout → opens potential for 97.000 retest.

o A break above 99.200 would be a bullish breakout targeting the 100.500–101.000 macro supply zone.

________________________________________

🔄 What This Means for Dollar Pairs (Especially XAUUSD):

🟥 Scenario 1: Bearish DXY Breakout (98.00 loss)

• Expect XAUUSD bullish continuation, possibly reclaiming upside zones (especially if DXY targets 97.00).

• GBPUSD, EURUSD, etc., likely to gain against USD.

🟩 Scenario 2: Bullish DXY Breakout (Above 99.200)

• XAUUSD may reject from resistance or fall back toward support zones.

• USD strength will put pressure on GBPUSD, EURUSD, and other majors.

________________________________________

🧠 TCB Notes:

• Checklist Score (Pre-Breakout): ~75%

o ✔ Structure zones marked

o ✔ Channel support tested

o ✔ Reaction to supply zone

o ✖ Awaiting breakout candle + NY session confirmation

________________________________________

🔔 Suggested Alerts (Set in TradingView):

• DXY Breakout Alert: 98.00 (bearish trigger)

• DXY Bullish Trigger Alert: 99.20 or trendline breakout

• Match these alerts with corresponding TCB setups on XAUUSD, GBPUSD, etc.