### **Bearish Analysis of DXY (U.S. Dollar Index)**### **Bearish Analysis of DXY (U.S. Dollar Index)**

The U.S. Dollar Index (DXY) has recently shown a weak trend, with a prevailing bearish sentiment in the market. The primary factors driving this outlook include:

### **1. Rising Expectations of Fed Rate Cuts**

- Recent weak U.S. inflation data (such as May's PPI and CPI) have reinforced market expectations that the Fed may cut rates as early as September.

- Morgan Stanley predicts the Fed could implement a cumulative 175 basis points in rate cuts by 2025, further reducing the dollar's appeal.

### **2. Trade Policy Uncertainty**

- The Trump administration has recently threatened new tariffs (e.g., 30% on imports) against the EU, Mexico, and other nations, escalating global trade tensions.

- Wall Street institutions warn that Trump’s tariff policies could trigger capital outflows, putting additional pressure on the dollar.

### **3. Growing Recession Concerns**

- Fears of a U.S. economic "hard landing" are intensifying, particularly due to deteriorating corporate orders, earnings forecasts, and capital expenditure plans, which could weaken the dollar’s safe-haven status.

- The expanding U.S. fiscal deficit (reaching $1.36 trillion this fiscal year) is further eroding confidence in the dollar.

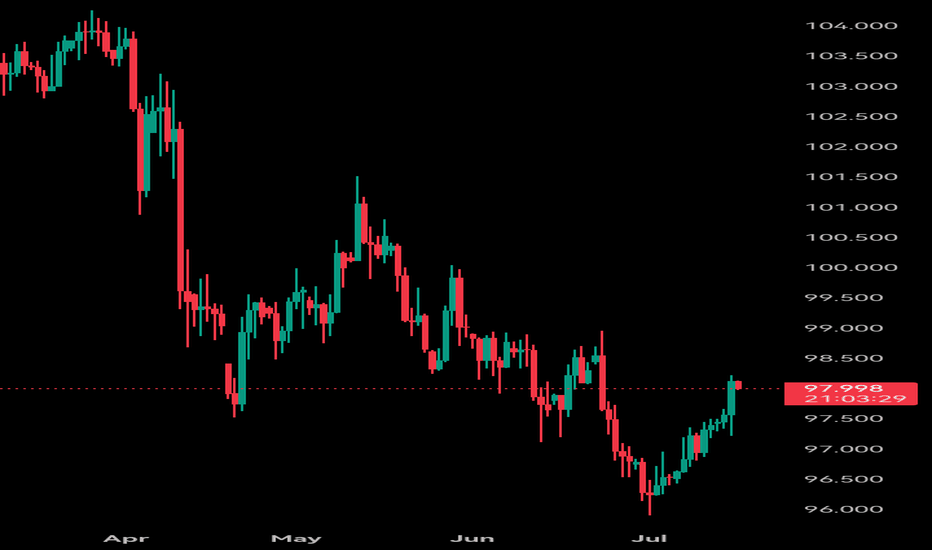

### **4. Technical Weakness**

- Since the beginning of 2025, DXY has fallen by approximately **8.4%**, marking its worst annual start on record.

- The index currently faces key resistance at the **97.80-98.00** range. A failure to break above this level could lead to further declines toward **96.50** or lower.

- RSI and MACD indicators suggest weak short-term rebound momentum, maintaining a bearish bias.

### **5. Risk of Capital Outflows**

- The U.S. "**899 Asset Tax**" proposal could increase costs for foreign investors holding dollar-denominated assets, potentially accelerating global divestment from the dollar.

- Goldman Sachs estimates that the dollar remains **overvalued by ~15%**, leaving room for further depreciation.

### **Outlook**

In the near term, DXY’s movement will depend on:

- **June CPI Data** (A lower-than-expected reading could reinforce rate cut expectations, further weakening the dollar).

- **Trade Negotiation Developments** (Escalating tensions may trigger risk-off sentiment, while easing could relieve dollar pressure).

- **Fed Policy Signals** (More explicit dovish guidance could extend the dollar’s downtrend).

**Conclusion:** Given multiple bearish factors, the U.S. Dollar Index is likely to remain weak in the short term. Traders should closely monitor key economic data and policy shifts.

USDX trade ideas

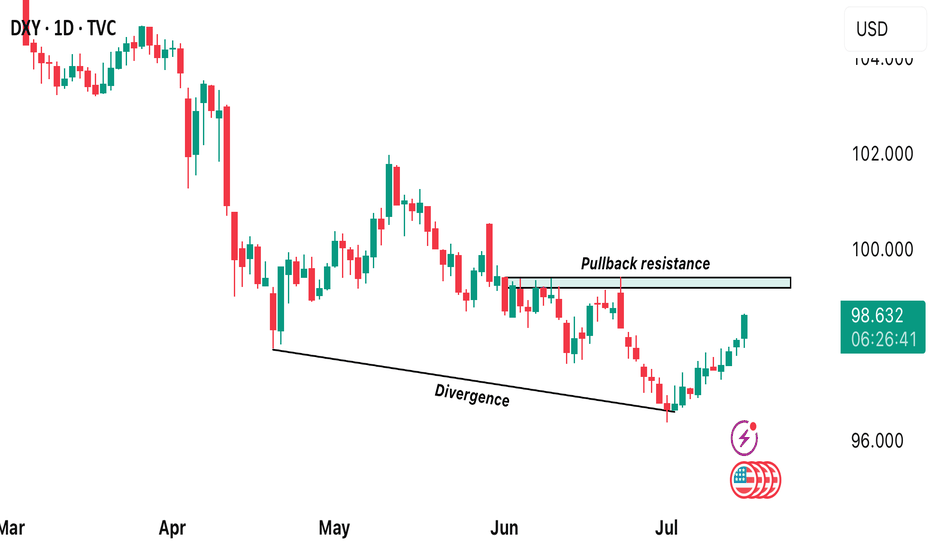

DXY REBOUNDS AFTER FORMING A DIVERGENCE!DXY rebounds after forming a divergence! Technically, we approach a pullback resistance level. What do we expect next from DXY? Is this gonna be a new era of dollar strength? From the technical standpoint, if we get a break above 99.202 we’re likely to see more bullish strength development away from this market.

deepseek→→U.S. Dollar Index (DXY) Recent Analysis and Outlookchina deepseek↓↓

### **U.S. Dollar Index (DXY) Recent Analysis and Outlook**

#### **1. Current Market Trends and Driving Factors**

- **Trade Policies Boost the Dollar**: U.S. President Trump recently announced new tariffs on Canada (35%), the EU, and Mexico (30%), triggering risk-off sentiment and pushing the Dollar Index (DXY) from 97.20 to around 98.00.

- **CPI Data as a Key Variable**: The U.S. June CPI data, released today (July 15), will influence market expectations for Fed rate cuts. Stronger-than-expected inflation could reinforce the dollar's rally, while weak data may weaken it.

- **Shift in Market Sentiment**: Unlike the "dollar sell-off" trend in early 2025, recent market reactions have leaned toward treating the dollar as a "safe-haven asset" rather than selling it solely due to trade war concerns.

#### **2. Technical Analysis**

- **Key Resistance and Support Levels**:

- **Resistance**: 97.80-98.00 (short-term critical range). A breakout could test 98.50 or even 99.00.

- **Support**: 97.50 (50-day moving average). A drop below may target 96.38 (June low).

- **Technical Indicators**:

- **MACD**: A golden cross has formed on the daily chart, but it remains below the zero line, suggesting the current rebound may still be corrective.

- **RSI**: Near the 50 neutral zone, not yet overbought, indicating room for further upside.

#### **3. Short-Term and Long-Term Outlook**

- **Short-Term (1-2 Weeks)**:

- **Bullish Scenario**: If CPI data is strong and DXY breaks above 98.20, it could challenge 98.50-99.00.

- **Bearish Scenario**: Weak CPI data or progress in trade talks may push DXY back to 97.30-96.50.

- **Long-Term (Second Half of 2025)**:

- **Structural Pressures Remain**: Despite the short-term rebound, the dollar still faces long-term challenges, including widening U.S. fiscal deficits, de-dollarization trends, and concerns over Fed independence.

- **Historical Trend**: After falling over 10% in the first half of 2025, DXY may continue its downtrend in the second half, though the pace of decline could slow.

#### **4. Key Risk Factors**

- **Fed Policy**: If CPI data reinforces a "higher-for-longer" rate outlook, the dollar may strengthen further. Conversely, rising rate-cut expectations could weigh on the dollar.

- **Geopolitics and Trade Talks**: Compromises from the EU or Mexico could reduce safe-haven demand, while failed negotiations may fuel further dollar gains due to risk aversion.

### **Conclusion**

The DXY is at a critical juncture, with short-term direction hinging on CPI data and trade policy developments. Technicals lean bullish, but long-term fundamentals remain challenging. Traders should closely monitor the 98.00 breakout and today’s CPI data impact.

DXY Weekly Update — July 14, 2025⌛ Timeframe:

.

📆 Analysis Date: July 14, 2025

.

🎯 Weekly Bias: Bearish-to-Neutral (Potential for retracement or reversal)

🔎 Market Overview:

⬇️ Persistent USD Weakness:

DXY has dropped nearly 10% YTD, marking the steepest half-year decline since 1986.

📉 Rate Cut Expectations:

Markets are pricing in a potential 75bps rate cut by the Fed in H2 2025, pushing yields and the dollar lower.

📦 Trade War Fears:

Renewed tariff risks (targeting EU, Japan, Mexico, South Korea) aren't boosting demand for USD — a signal of lost safe-haven appeal.

⚖️ Central Bank Diversification:

Global reserve managers are rotating into gold and away from USD, weakening long-term structural demand.

🌀 Sentiment & Risk Appetite:

💸 Liquidity Demand is Soft:

DXY is retesting a 4H fair value gap (97.10–97.30), suggesting potential short-term consolidation or correction.

🌍 Risk-On Mood Returns:

According to Goldman Sachs, the USD is trading more like a "risk asset" than a haven, aligning with rising equity appetite.

📉 Technical Landscape:

🟠 4H Structure:

If DXY breaks below 97.00, next support lies at 96.37, followed by 95.50–96.00.

Consolidation expected if price remains within the FVG.

🔻 Key Resistance:

97.70–98.20 zone. A break above this area could change the tone to bullish.

📌 Summary:

🔷 Fundamentals show long-term dollar weakening (rates, trade tension, reserve shifts)

🔷 Sentiment aligns with risk-on appetite and reduced USD demand

🔷 Technicals at critical level; break below 97.00 opens room for correction, break above 97.70 shifts bias bullish

.

.

.

.

🟠 Bias: Bearish to Neutral

Watch Levels: 97.00 support, 97.70–98.20 resistance

⚠️ Note: This analysis is for educational purposes only and is not financial advice. Always apply risk management.

✅ If you like this analysis, don't forget to like 👍, follow 🧠, and share your thoughts below 💬!

DXY Previous weeks analysis and July 13 week ahead ideasDXY

July 13

July 7 to 11 DELIVERY NOTES

I suspected that price would gravitate for higher prices in last Sundays analysis, celebrate on

*up closed candle on the weekly, rebalancing SIBI from June 23 week

*Price retraced to close on equilibrium on the current range

*Monday delivered an expansion

*Tuesday retraced to Monday CE of the daily candle

*Wednesday consolidation

*Thursday retraced to a discount then reversed to take Mondays buy stops

*Friday expansion to make the high of the week closing on the CE of the FVG from Wed June 25

July 14 to 18 Ideas

Bear bias

*Since July 2 Price has been seeking higher prices, further example of trending market

*Price reaching equilibrium on the HTF range and buy side taken last week

*I suspect that price will retrace for sell side liquidity this week

*I anticipate for Price to gravitate towards the EV at 97.430 for the low target this week, possibly the noted equal lows from Monday July 7

*Friday's delivery was a in consolidation pattern

*Sundays delivery could gravitate to the noted equal highs and noted FVG

*I suspect that Price will expand to seek lower Prices for Mondays delivery

*Price expand higher in Sundays delivery, we could see Price retrace Fridays in FVG

No News Monday and Friday

DXY Targeting Liquidity Zones & Gap Fill Before Potential ReversThe U.S. Dollar Index (DXY) is showing a strong bullish push, climbing steadily along an ascending trendline. Price appears to be heading toward key liquidity levels and a visible Fair Value Gap (FVG) near the previous New York high. The chart also highlights an unfilled gap above, which aligns with a potential liquidity sweep scenario.

Once these upper zones are tapped — including the liquidity and imbalance areas — a significant rejection could follow, especially considering ongoing strength in the Euro (EUR). This setup suggests a high-probability reversal opportunity after the liquidity grab

DXY: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse DXY together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 97.370 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

DXY strengthens but can it break THIS key level?The US dollar has gained ground this week, with the Dollar Index rising to retest the previously broken April low near the 97.92 level—an important technical zone. The short-term bias would flip to being bullish if this area breaks.

The greenback’s strength has been underpinned in part by unexpectedly strong economic data. For instance, Thursday’s weekly jobless claims came in at 227,000, below the forecast of 235,000. This marks the fourth consecutive weekly decline and the lowest reading in seven weeks, reinforcing the view that the US labour market remains tighter than anticipated.

Adding to this backdrop are President Trump’s threats of higher tariffs and expansive fiscal plans—described as “big, beautiful” spending and tax initiatives. These factors increase the risk of more persistent inflation.

While the Federal Reserve is still widely expected to initiate rate cuts in September, the rising inflationary pressures could slow the pace of easing thereafter. This shift would likely provide support for the dollar so long as investors don't lose trust in US monetary policy.

By Fawad Razaqzada, market analyst with FOREX.com

DXY Bearish Bias

Institutions are currently holding a net short position on the Dollar, indicating bearish sentiment. With a net position of -4,282, we may expect continued weakness in the DXY, especially if price reacts from key supply zones. Swing traders should remain cautious with long setups and prioritize opportunities aligned with USD weakness across major pairs.

DXY (USD Basket) - 3 Month - Short Squeeze In Play?Technicals:

The last 3-month candle closed above the major resistance that tends to hold according to historic levels going back to the year 1967.

Golden Cross is almost complete (50 MA crossing the 200 MA).

Fundamentals:

The dollar has only been more shorted once in history (2018), setting things up for a potential "Short Squeeze" and triggering a "Risk Off" scenario. Tends to hurt risk assets quite hard—for example, tech stocks, crypto, and other leverage plays.

A rise in the DXY could potentially trigger a "Short Squeeze" for foreign countries, companies, and investors that borrow in USD, creating "economic panic" in other countries that get their currency devalued relative to their obligations.

Countries that need USD to service their debt. With the current tariffs, the flow of dollars in the world will change. The question is: what will the effect look like in August when these tariffs start to go live? Like I mentioned before, other countries need the dollars in order to service their debt. If it gets more expensive for US consumers to import (caused by the tariffs), the exporting countries won’t get those dollars—setting it up for a buying cycle that could potentially drive the USD (DXY) higher, even to all-time highs.

Current narrative:

The narrative right now is that the USD will get "worthless," setting the stage to take more risk and use more leverage, maybe without even hedging. A surprise variable to this narrative could be devastating to the financial markets—not just in the US, but even to the world. IF/When this happens, everyone will hunt the USD once again, creating a new bullish narrative for the USD, and everyone will be forced to return to the reserve currency.

Nothing in this post should be considered financial advice. Always do your own research and analysis before investing.

Dollar I Daily CLS I Model 1 I KL OB I Target TRCandleYo Market Warriors ⚔️

It's risky, re-entry, but scared money makes no money.

if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/day — banks, algos, central players.

📍Model 1:

HTF bias based on the daily and weekly candles closes,

Wait for CLS candle to be created and manipulated. Switch to correct LTF and spot CIOD. Enter and target 50% of the CLS candle.

For high probability include Dealing Ranges, Weekly Profiles and CLS Timing.

Trading is like a sport. If you consistently practice you can learn it.

“Adapt what is useful. Reject whats useless and add whats is specifically yours.”

David Perk aka Dave FX Hunter

💬 Don't hesitate to ask any questions or share your opinions

DXY Tests Key Support – What’s Next for the Dollar?

The U.S. Dollar Index (DXY), which tracks the dollar’s performance against a basket of major currencies, recently broke below its 50-month moving average based on the monthly chart —a significant technical signal. After this drop, the index is now bouncing off a key support zone near 96.50.

This area has acted as a pivot point in past cycles, and a sustained bounce could indicate the dollar regaining strength. If risk sentiment fades—due to weaker equity markets, geopolitical tensions, or stronger U.S. data—the dollar might find new momentum.

On the flip side, failure to hold 96.50 could open the door toward the 90.00 zone, a major long-term support level. Such a move would likely reflect expectations of looser U.S. monetary policy or further deterioration in economic confidence.

For now, price action near 96.50 will be decisive. A rebound could shift sentiment back in favor of the dollar, while a deeper decline may trigger broader adjustments in FX markets. Traders should closely monitor upcoming macro data and risk sentiment for cues on the next leg.

Bold analysis for the most powerful currency in the world (DXY)Orange range: entering in several steps .

Green area: important support and exit point .

Important note: The gray line is the liquidity range

Watch the dance around this line carefully (bank positions are settled around this line)

And in my opinion, by increasing the price, they are emptying it on the buyers, so buy cautiously, but sell boldly.

GL

US interest rate reduction?!As you can see, the US dollar index has completed a 5-wave uptrend and after touching the top of the uptrend channel and breaking the uptrend line, it is currently in the second correction wave. I expect to see the beginning of the third correction wave soon. This may coincide with the reduction of the US interest rate in next week!!

Dollar Index AnalysisTwo possibilities for the dollar index has been shown here. We can see that dollar index is showing a short term uptrend. Which is clearly visible from the chart.

1: Dxy can maintain this short term uptrend. Because it is a monthly pullback. As it has been

for last 5 months.

2: Dxy can change character and again touches to the monthly demand zone as shown in my

previous video.

Dollar Index Analysis [DXY]Market has show upper wicks for last 3 days which is the sign that there is still sell pressure. The daily candles for this week are range bound. 4H chart is showing short term uptrend which is maintaining higher highs and higher lows. We can use this range to have scalps in this range.