Beware

USDX Dollar Basket Index DXU5 Exp 03/09/2025 23:59 forum

Beware

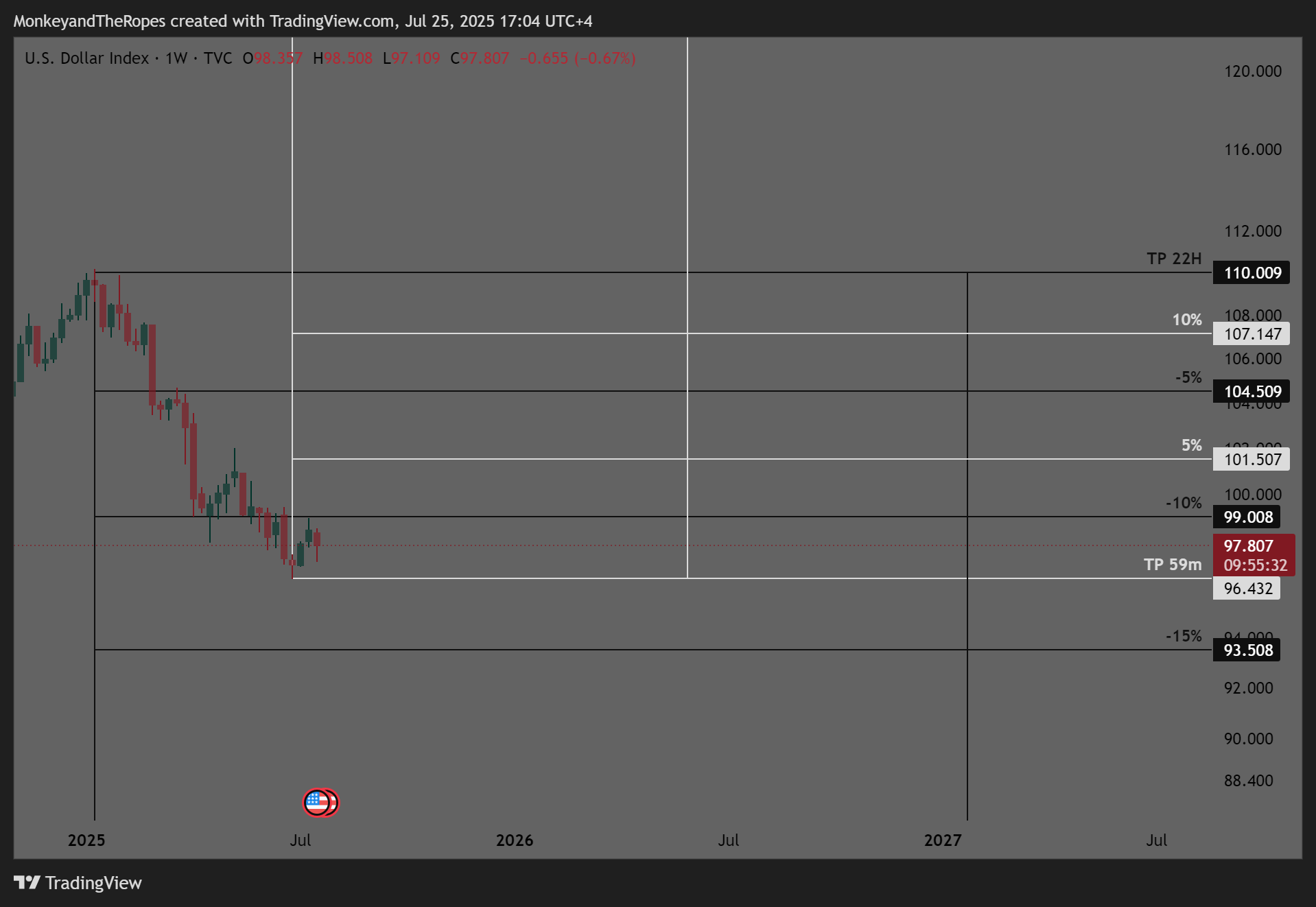

1- long term buy cycle (black lines)

2- midterm sell cycle (white lines)

% bubble ratio

As global markets show signs of overheating, the US Dollar Index (DXY) may be gearing up for its next big breakout — just like in past crises.

📈 DXY breakout likely above 106, targeting 110–112 in Aug–Oct 2025, driven by:

🔁 Historical Parallels:

2008: Global Financial Crisis → DXY +25%

2015: China slowdown + Fed hike → DXY +16%

2020: COVID panic → DXY surged short-term

2022: Inflation + war in Ukraine → DXY hit 20-year high (~114)

📊 Current Drivers (2025):

Fed holding rates steady while others prepare to cut

Trump-era tariff fears returning → inflation risk

Global equities & crypto topping → flight to safety

Capital flowing into USD as the global reserve

🎯 Strategy:

Long bias above 106

Target: 110+

Hedge against equity/FX volatility

The dollar rises when the world panics — and August–October has a history of fear.

Forgot to attach chart:

I was waiting to see if we would get a bullish response after correcting the daily imbalance (orange). Sure enough, now we go up to correct the bearish imbalances (purple) I guess