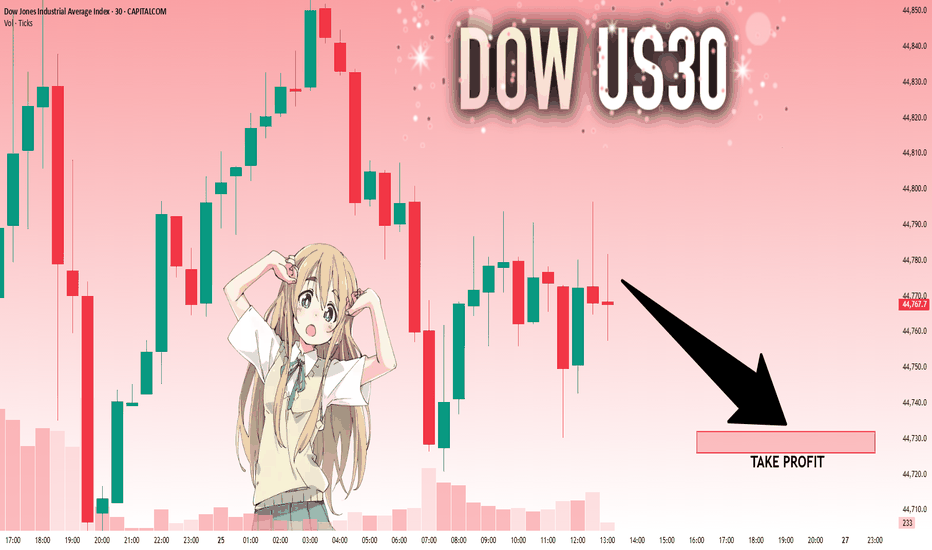

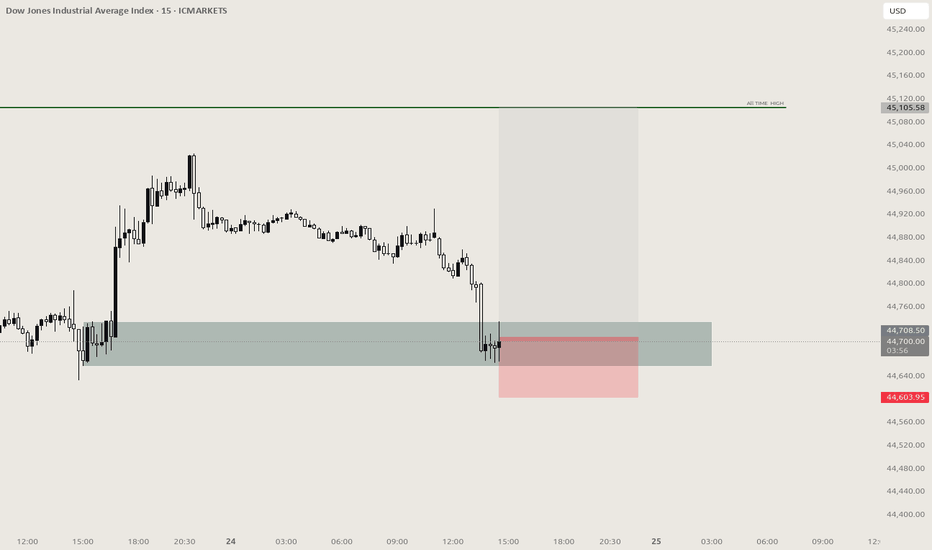

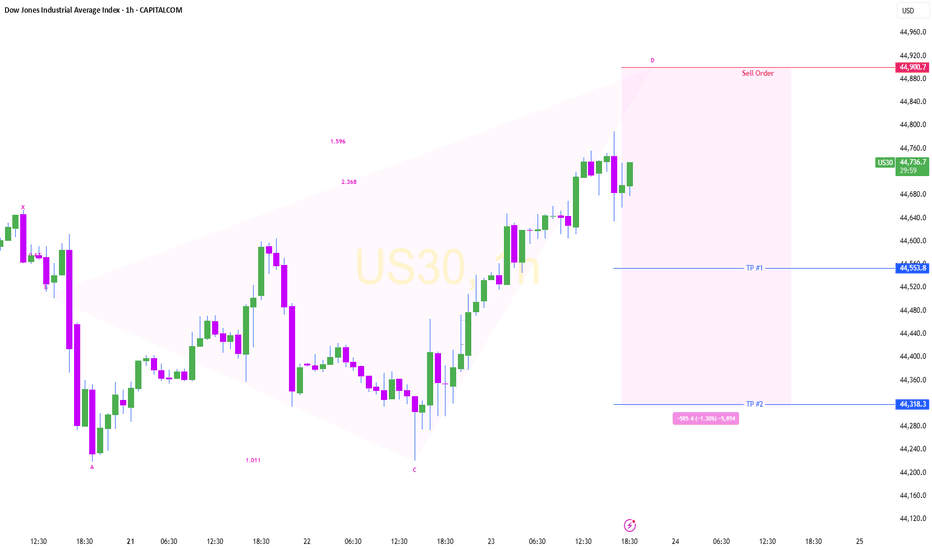

US30: Local Bearish Bias! Short!

My dear friends,

Today we will analyse US30 together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 44,774.9 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

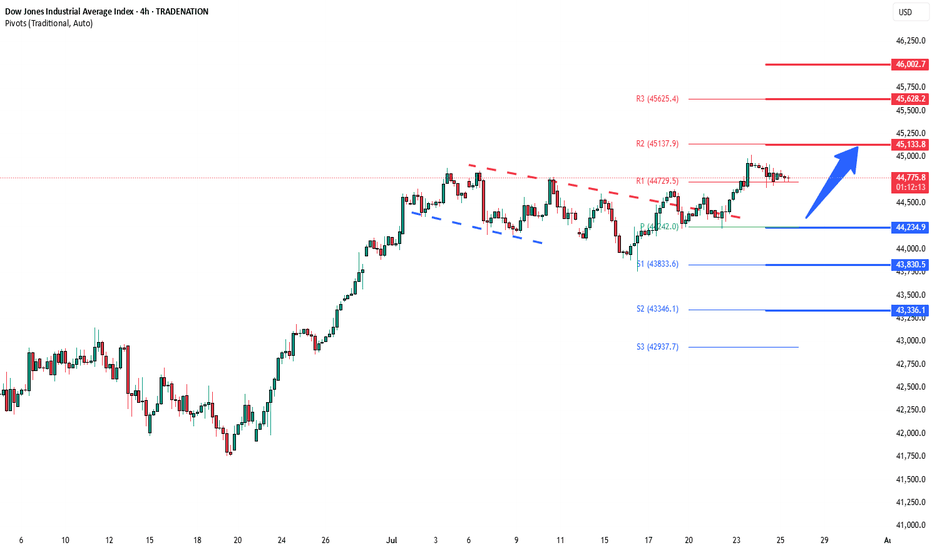

DJIA trade ideas

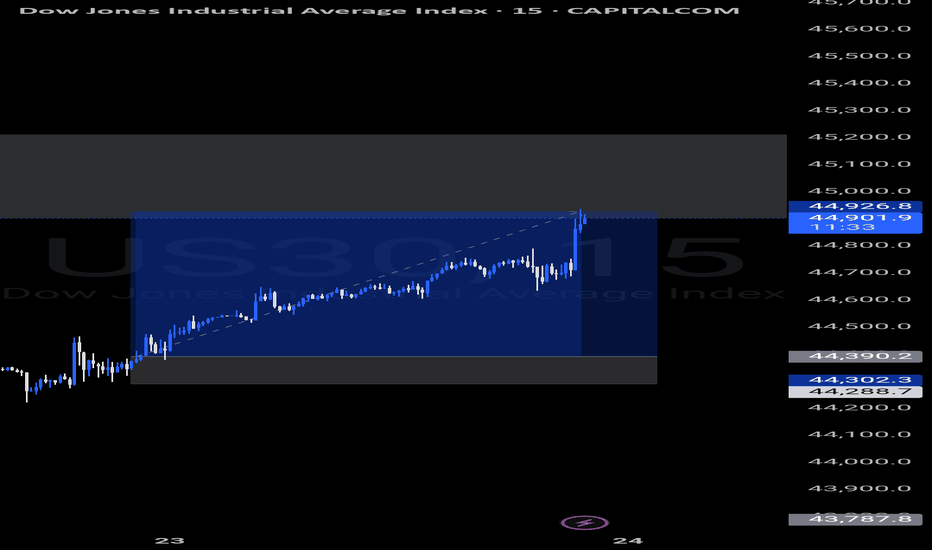

DowJones bullish breakout support at 44240Key Support and Resistance Levels

Resistance Level 1: 45135

Resistance Level 2: 45630

Resistance Level 3: 46000

Support Level 1: 44240

Support Level 2: 43830

Support Level 3: 43340

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

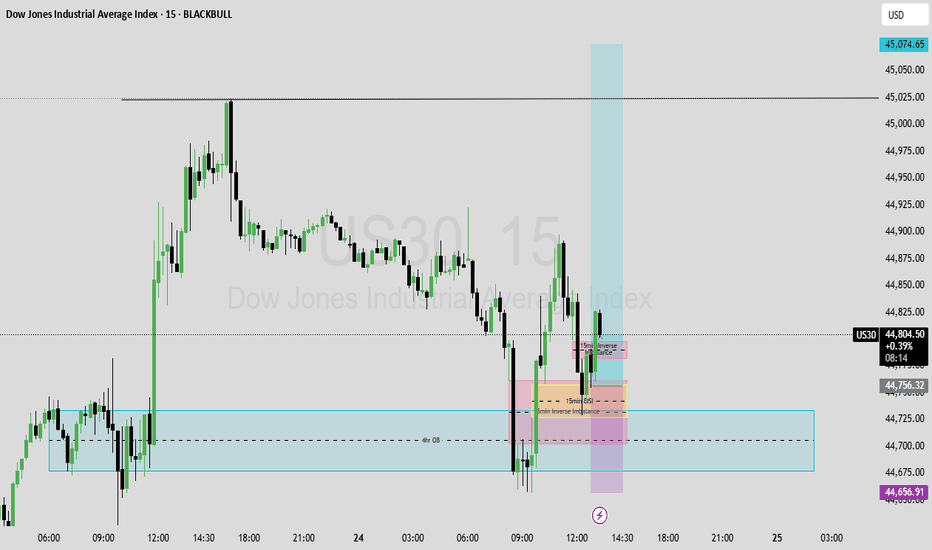

US30 Market Breakdown – 07/25/2025📍 US30 Market Breakdown – 07/25/2025

🕹️ After tagging the highs at 45,082, US30 has pulled back and is now hovering around 44,780. The market rejected the high and is consolidating below 44,931, forming a lower high — hinting at potential short-term weakness.

But don't get too bearish just yet. We’re still above the 9 & 21 EMAs on the 1H, and trend structure remains intact unless we lose key support.

Let’s break it down 👇

📊 Current Structure:

🔻 Rejection from 45,082

📉 Minor lower high forming

🔁 Consolidating between 44,700–44,900

📐 EMAs flattening = potential chop

🧱 Resistance Zones:

45,049 → 45,082 (double rejection)

44,931 (current ceiling)

📉 Support Zones:

44,750 (minor intraday demand)

44,700 = EMA confluence

44,600–44,500 (next strong base)

⚠️ If price breaks under 44,700, we could see a retest of 44,450 and even 44,171.

🧠 Bias:

🟡 Neutral to slightly bearish intraday

Below 44,900 = short setups favored

Watch for bounce at 44,700 or breakdown toward 44,600

Still in uptrend overall unless 44,171 breaks

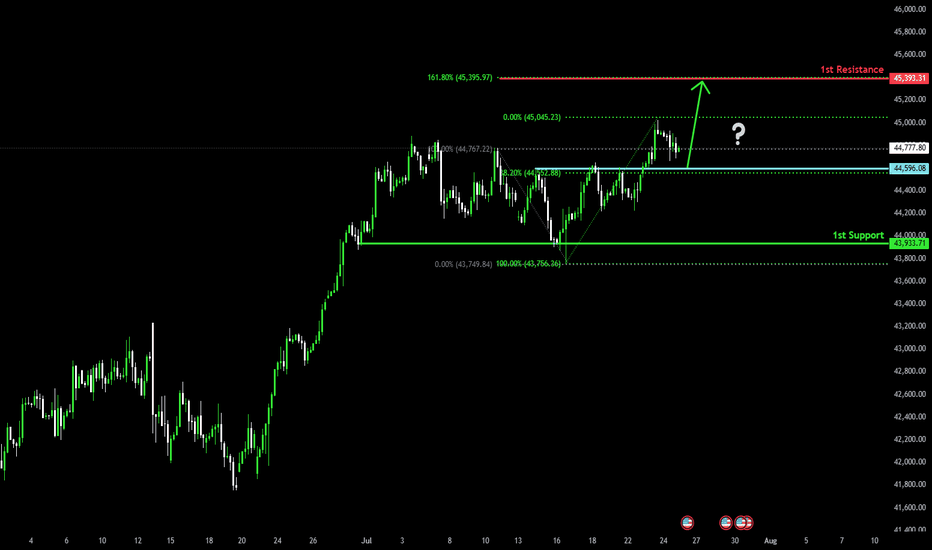

Bullish bounce off pullback support?Dow Jones (US30) is falling towards the pivot and could bounce to the 161.8% Fibonacci resistance.

Pivot: 44,596.08

1st Support: 43,933.71

1st Resistance: 45,393.31

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

#DJI - 5000 Pts already moved out of 8000 points..Date: 27-06-2025

#DJI - 5000 Pts already moved out of 8000 points as posted on 22nd April. Another 3000 points to cover. we have different pivot for the next level up and it will be shared soon.

Old levels are as follows.

#DJI Upside Targets: 41240.49, 43084.22, 45025.94 and 46967.67

#DJI Downside Targets: 34578.53, 32728.34, 30786.61 and 28844.88

Current price is around 43,870 at the time of this post.

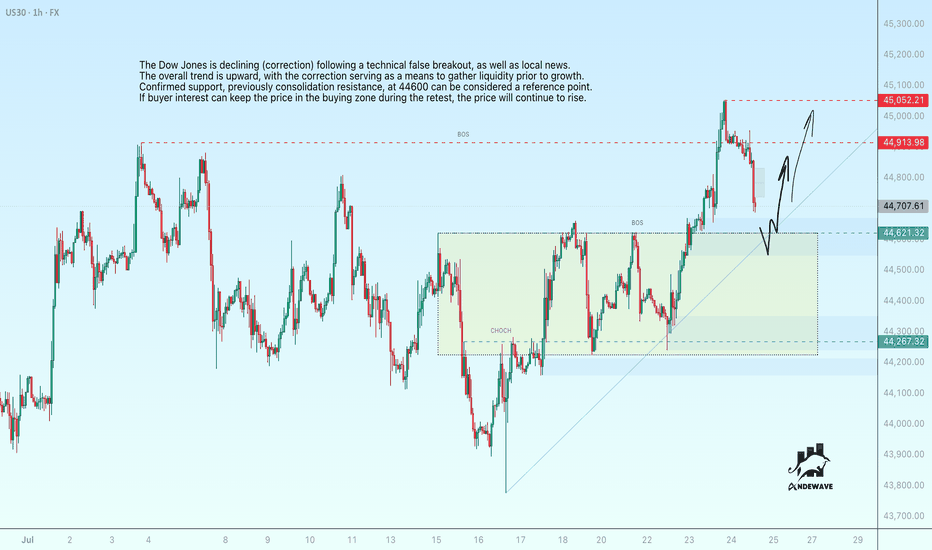

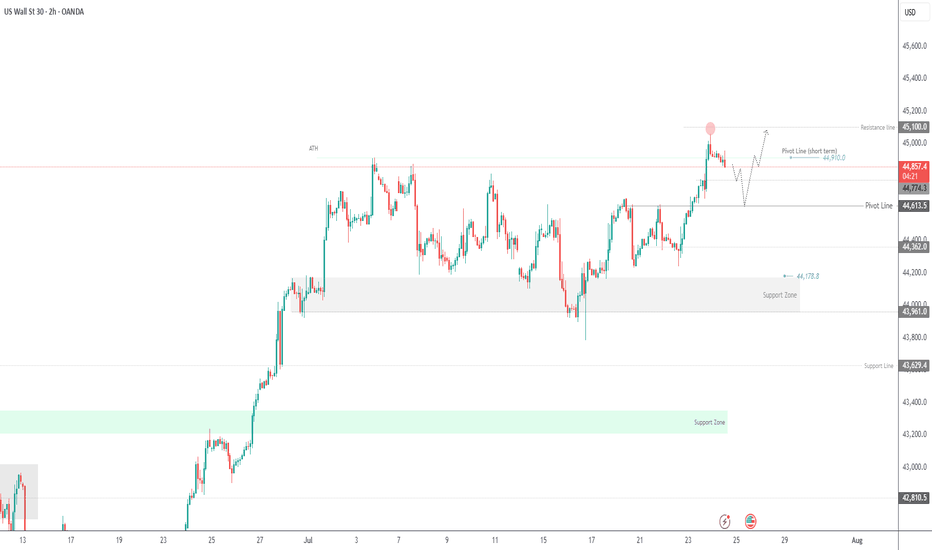

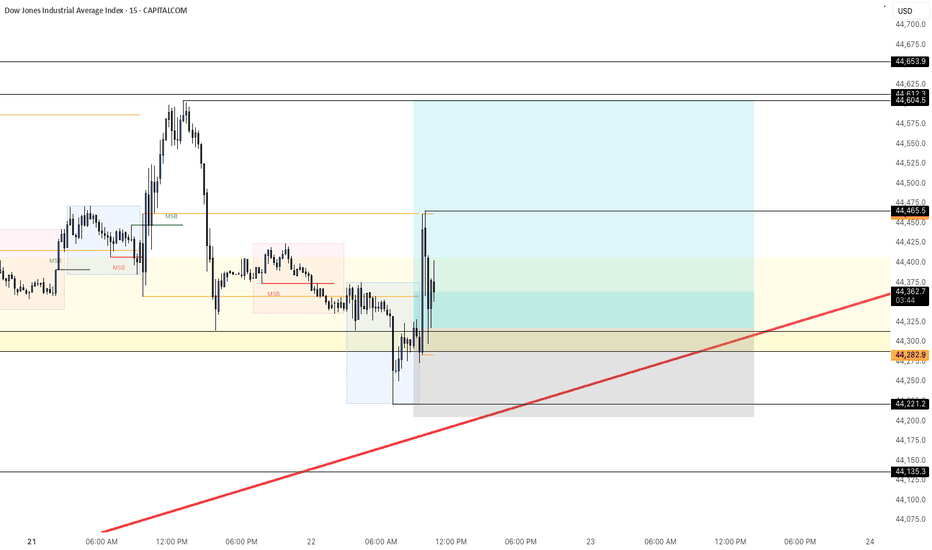

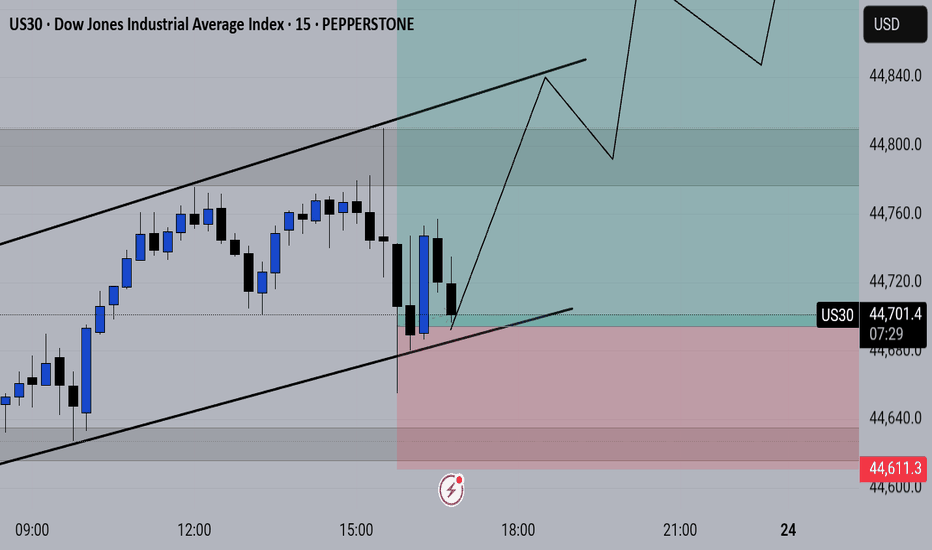

US30 (Dow Jones) may return to growthThe Dow Jones is declining (correction) following a technical false breakout, as well as local news. The overall trend is upward, with the correction serving as a means to gather liquidity prior to growth. Confirmed support, previously consolidation resistance, at 44600 can be considered a reference point. If buyer interest can keep the price in the buying zone during the retest, the price will continue to rise.

A false break of 44600 - 44620 and consolidation of the price above this level will confirm readiness for growth...

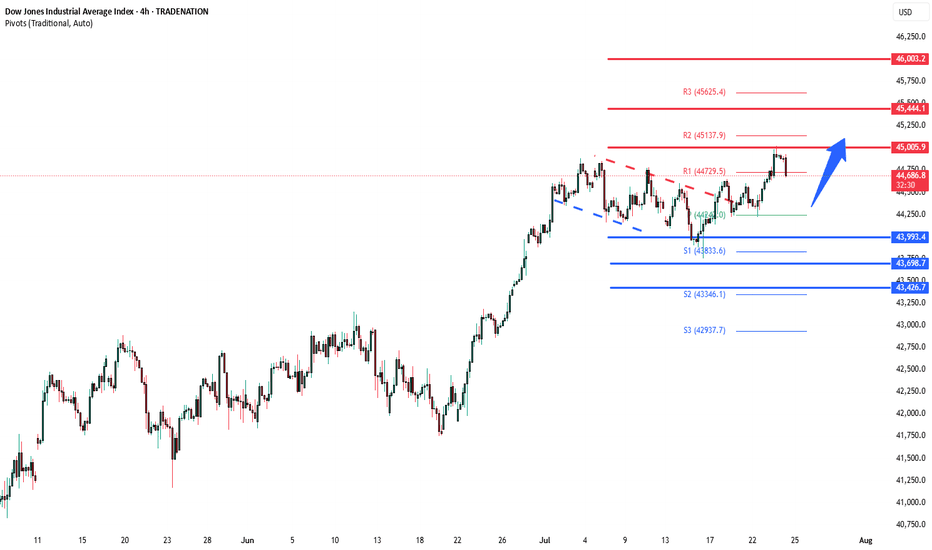

DowJones uptrend support at 43990Key Support and Resistance Levels

Resistance Level 1: 45000

Resistance Level 2: 45444

Resistance Level 3: 46000

Support Level 1: 43990

Support Level 2: 43700

Support Level 3: 43426

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

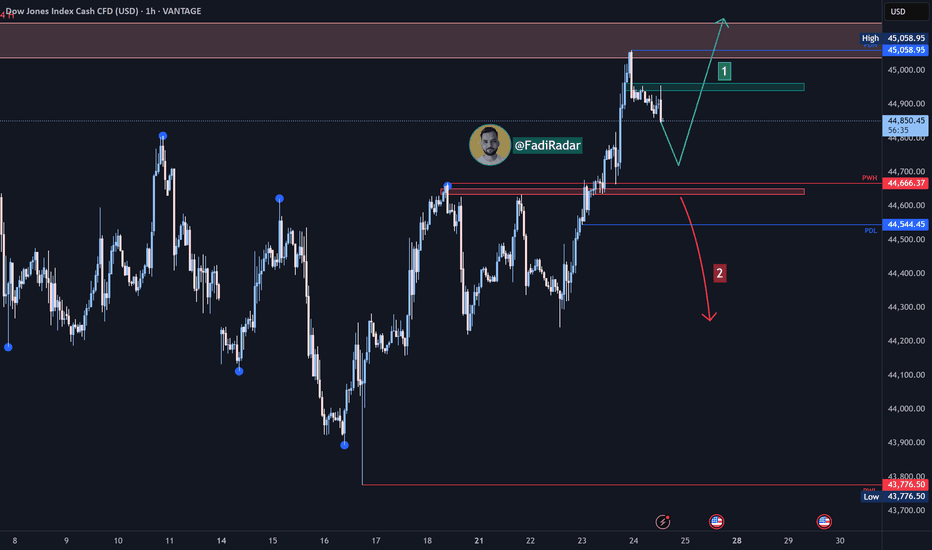

Dow Jones Index Analysis (US30 / Dow Jones):🔹 The index is trading near 44,900 USD and showing short-term bullish momentum, with a potential pullback to retest the 44,700 USD zone.

1️⃣ If strong buying momentum leads to a break and close above 44,960 USD, this could push the price toward the 45,200 USD resistance.

2️⃣ However, if the price breaks below the 44,630 USD support and closes beneath it, we may see a decline toward 44,350 USD.

🔻 A confirmed break below this level could resume the bearish trend and open the path toward 43,900 USD.

⚠️ Disclaimer:

This analysis is not financial advice. Please monitor the markets carefully before making any investment decisions.

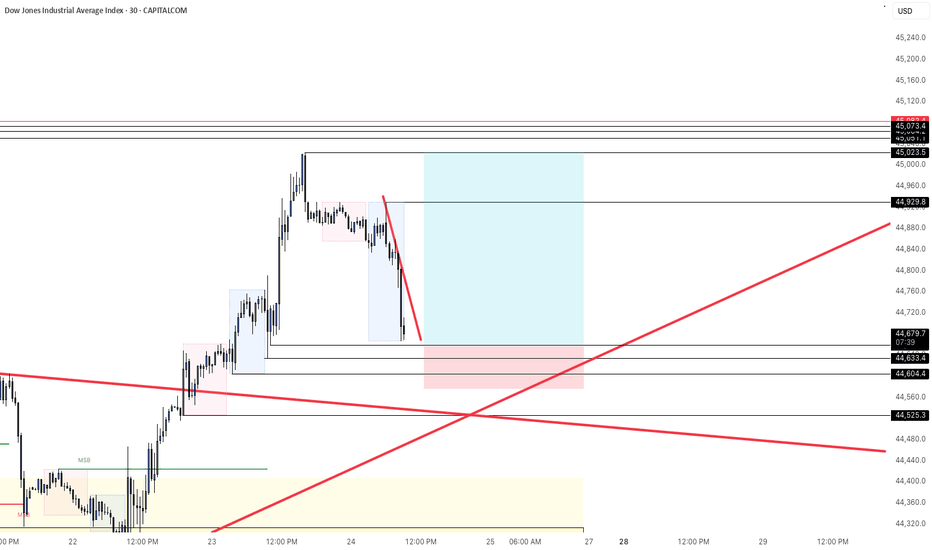

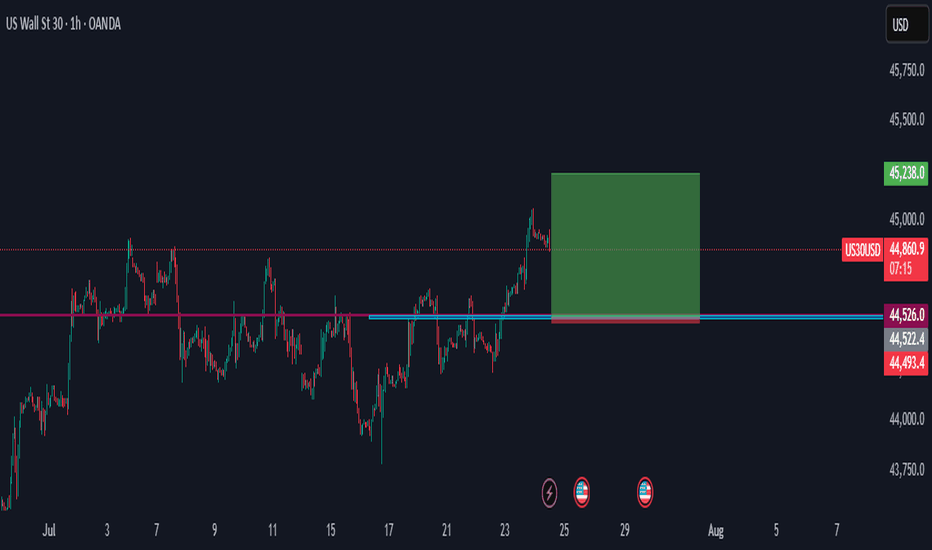

US30 Hits New All-Time High – What’s Next?US30 | OVERVIEW

The price has printed a new all-time high, exactly reaching our target at 45,090, as previously anticipated.

Today, we may see a correction toward 44,770 and 44,610. If the price stabilizes above these levels, another bullish leg is expected.

On the upside, a break above 44,910 would confirm a bullish continuation toward 45,090 and 45,250.

Key Levels:

Support: 44,770 · 44,610 · 44,370

Resistance: 45,090 · 45,250

previous idea:

US30 LONG US30 has recently broken out of a multi-session consolidation range and tapped into the 45,000 psychological resistance zone, forming a temporary high around 44,950. With this in mind, I’m seeing two opportunities based on the market structure:

Short-Term Sell Setup

Bias: Counter-trend (retracement)

Entry Zone: 44,850 – 44,950 (rejection at resistance / liquidity grab)

Target Zone:

TP1: 44,400

TP2: 43,950

Stop Loss: Above 45,050

Reason: Price is overextended; likely to pull back before continuing uptrend. This is a scalper/intraday short opportunity.

Long-Term Buy Setup

Bias: Trend continuation

Ideal Buy Zones (Fibonacci):

Zone 1: 44,400 (23.6%)

Zone 2: 43,775 – 43,550

Stop Loss: Below 43,400

Targets:

TP1: 45,250

TP2: 45,750

Reason: Market is in a bullish structure. A pullback to golden ratio (50%–61.8%) offers an ideal entry for a swing continuation. Watch for bullish confirmation at these zones.

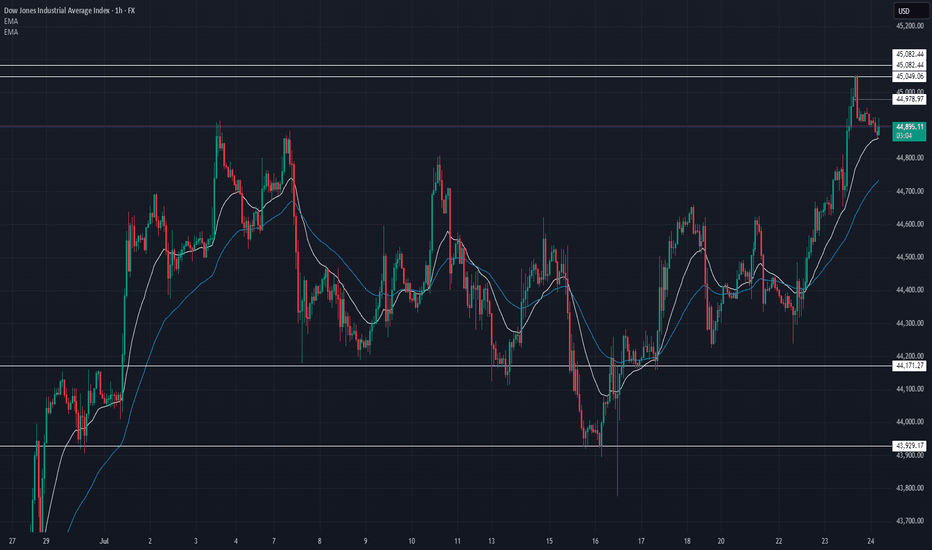

US30 Technical Breakdown – 07/24/2025📍 US30 Technical Breakdown – 07/24/2025

🔥 New highs achieved — bulls pushed straight through the 44,867 ceiling and tagged 45,082 before pulling back slightly. This is a key psychological level, and price is now consolidating just below.

We’ve officially shifted into breakout territory. Momentum is strong, and EMAs are fully bullish. But after such a run, we may be due for a retest or short-term correction. Let’s break it down 👇

📊 Current Market Structure:

✅ Series of higher highs & higher lows

✅ EMA 9 > EMA 21 > Price (bullish structure)

✅ Breakout from range: 44,867 → 45,082

🧱 Minor resistance at 45,050–45,082

⚠️ Watch for pullback to 44,750–44,800 zone

🔑 Key Levels:

🔼 Resistance:

45,050 → 45,082 (fresh supply zone)

45,200+ (blue sky if broken)

🔽 Support:

44,867 (former resistance turned support)

44,734 (EMA confluence)

44,450–44,600 (demand zone)

🧠 Market Bias:

📈 Still bullish, but extended.

Above 44,867 = continuation zone

Below 44,734 = momentum shift likely

Rejection at 45,082 could give scalpers a play short 🔄

💡 Potential Trade Setups:

📈 Breakout Buy (Momentum Entry):

Entry: Above 45,100

TP1: 45,200

TP2: 45,300

SL: Below 45,040

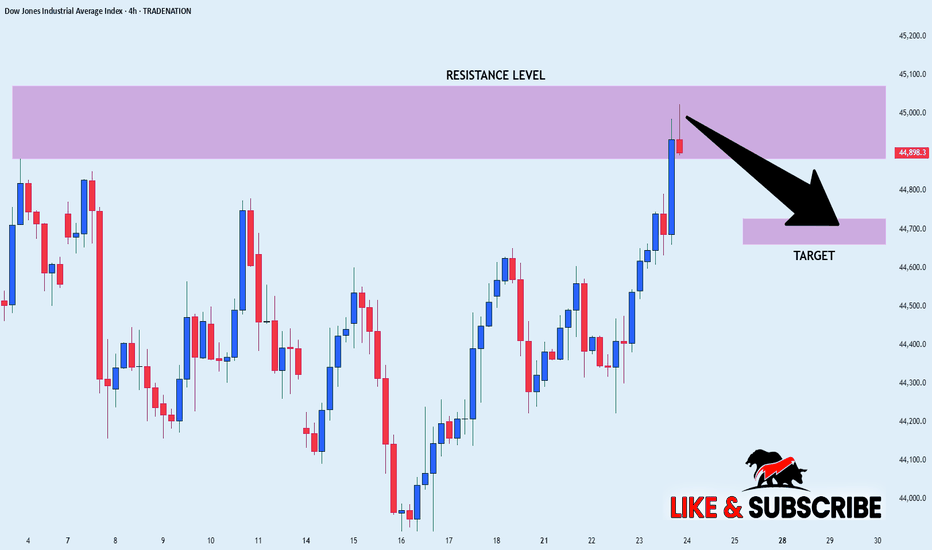

US30 SHORT FORM RESISTANCE|

✅DOW JONES index keeps

Growing in a strong uptrend

And we are bullish biased long-term

However the price has hit an all-time-high

Resistance level of 45,072(which can be seen

Further left you zoom out on higher TF)

So as we are already seeing a local

Bearish reaction we will be

Expecting a local bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

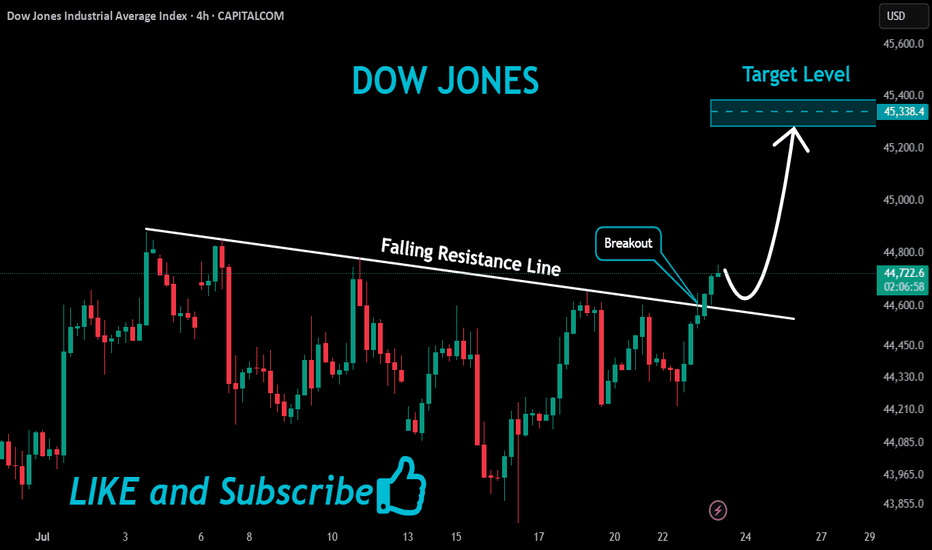

US30 Massive Bullish Breakout!

HI,Traders !

#US30 is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

KOG - US30US30

Looking at this we have a clean reversal in play suggesting we’re going to get lower order regions before a potential RIP. The red boxes have been added and may give us opportunities to capture the tap and bounces on the smaller TFs.

If we can support lower, we could very well see this push up into the ideal target level we have illustrated.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

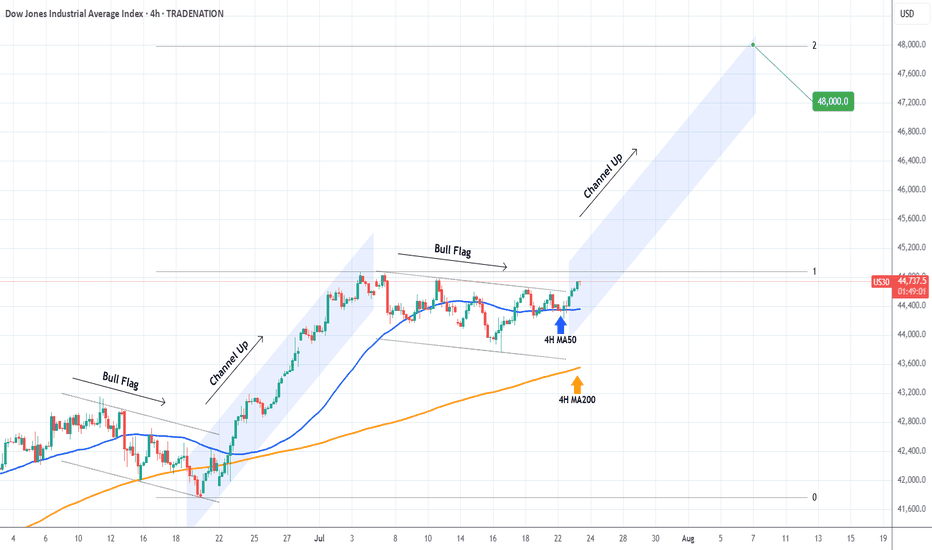

DOW JONES Strong rebound on its 4H MA50.Dow Jones (DJI) is having a strong rebound exactly on its 4H MA50 (blue trend-line). This is taking place just after the price broke above the Bull Flag that served as the accumulation pattern following the previous Channel Up.

This is a repetitive pattern and most likely we will now see the new Channel Up starting. The technical Target on such formations is the 2.0 Fibonacci extension at 48000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇