DJTA trade ideas

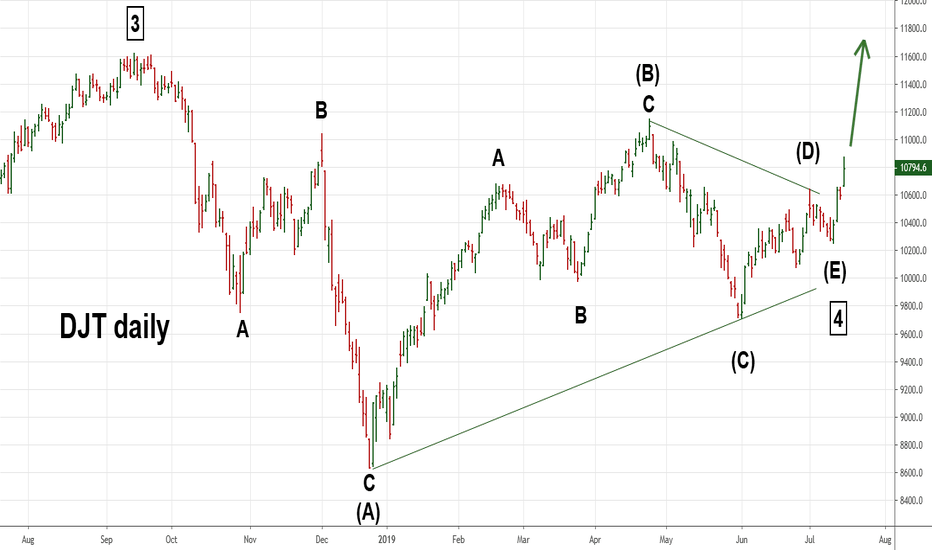

Long Term DJT Elliott Wave Forecast - Target 12000This is a follow up to my prior DJT daily post.

From the DJT major bottom made in 2009 appears to be in the early part of the Primary wave "5" - boxed. If so,after completion it implies a multi - year bear market.

There's usually a relationship between waves "five" and "one". Using a Fib ratio of .236 of the percentage growth of Primary wave "1" -boxed

1.637 growth rate x .236 = .386

A growth rate of .386 + 1.00 = 1.386 x 8636 Primary wave "4" bottom targets DJT 11973.

The rising trendline connecting the January and September 2018 peaks cross 12000 in the first quarter of 2020.

Broad price target zone 11960 to 12070

Broad time target January to May 2020

Mark

DJT Has the Clearest Elliott Wave PatternToday 11/5/19 was a very important day for the DJT. It broke above important resistance at 11148 made on 4/24/19 labeled as (B).

My 7/16/19 DJT post speculated that the DJT may have completed an Elliott wave - Horizontal Triangle. As it turned out the Triangle appears to have been still under construction.

The current H - Triangle has 50% Fib relationships between wave (D)/(B) and (C)/(A).

Daily Stochastic has a bullish crossover, and room to run on the upside.

If this count is correct the DJT is in a post triangle trust up that could move it well above the all-time.

IMPORTANT - Even if you don't trade DJT you need to watch the index because it has the clearest US stock index and can act as a road map for other indices.

My next DJT post will examine the long term DJT Elliott wave pattern and upside target.

Mark

DJT and KNX Comparison 1 Week timeframe ---Composed this for a friend---

A comparison of a large trucking company and the DOW Jones Transportation Index. Using the DOW index to look for early signs that can affect the smaller logistics components.

I am bearish (negative) on Industrials. Why? At the most Macro -- President Trump does not want war, but, Congress is too divided for comprehensive infrastructure rebuilding.

Also at the macro level I'm very bearish on many mainstream stocks, at both DOW and S&P500 exhibit multi-year topping pattern - and, my opinion only stay afloat with accounting tricks.

other factors:

Overland transportation is (to a degree) dependent on vehicle sales - and I believe sales of new cars and light trucks have topped.

American consumer appears to be maxed out, and topping as well. Less need for movement of consumer purchases.

Long term - some (National) moves to grow food locally - and have less of the "2000 mile salad".

Trade war - less movement - more tariffs/ higher costs for non necessities.

What would make me bullish?:

a huge war

a huge natural disaster of an entire region - necessitating a national effort to keep that region supplied.

Cost cutting with new technology (no drivers?)...? not sure about this one...

DJT looking heavier and HEAVIERThe chart says it all. Continuously watching DJT and RTY for economic indicators pointing towards overall slowdown.

Both -Nas and SP500- made new ATH's, while the latter RTY and DJT (DowJonesTranspo) lagged and were unable to re-capture ATH's.

-------RTY and DJT appear to be spilling over. ------

Watch the levels, trade accordingly and most importantly.

We are market AGNOSTIC. We move with , NOT against.

Dow theory in play and it suggest a gloomy outlookClassic Dow theory suggest a downtrend ahead and the outlook may look gloomy as the Transportation has not been making new highs and instead it makes new low. Beside that, there is a high probability that the transportation will break the diamond top pattern.

Dow Transports are Surging UpThe Dow Jones Transportation Average (DJT) looks like it has completed a multi- month Elliott Wave Horizontal Triangle, if so it could now be in the early phase of a post triangle thrust up. A thrust is usually measured by the widest length of the triangle which in this case is wave (A) = 2986.80 points. This is added to the termination point of the triangle - the bottom of wave (E) 10260.30 + 2986.80 = 13247.10 as a possible bull market top.

For confirmation,all that is needed is to exceed Primary wave "3" boxed at 11623.60 top.

An alternate bull market top can be calculated by taking wave (A) length of 2986.80 x .618 = 1845.80 + 10260.30 = 12106.10 alternate bull market peak.

Time target late August early September 2019.

Mark