FEDFUNDS trade ideas

⚖️ 📊 Why Is The Fed Rate @ 5.33% ? - Here Is The Answer🛡️ Now in the last videos, i said

i was not going to teach you

--

Risk management

but I have changed my mind

--

in this video, i break down Risk management using

US Economy as an example take notes

--

Watch this video now before you trade

--

Disclaimer:

This is not financial advice

do your own research before you trade

--

Do not buy or sell anything

i recommend to you

--

🚫📊 **Trading Disclaimer** 🚫📊

The information provided is for

educational purposes

--

only and should not be considered

as financial advice.

--

Trading involves risk, and past performance

does not guarantee future results.

--

Always conduct thorough research and consider

consulting a qualified financial advisor

--

before making any investment decisions.

Remember to set appropriate

stop-loss levels to manage risk.

--

Rocket boost this content to learn more

Higher for LongerUS inflation data in July 2023 provided mixed signals. While Consumer Price Index (CPI) is moving in the right direction, producer price inflation suggest pipeline pressures are picking up. Core CPI, which excludes often-volatile food and energy costs, rose only 0.2% for a second month in a row . However, US producer prices picked up in July, owing to increases in certain service categories. This likely buys more time for the Federal Reserve (Fed) to deliberate on the future path of monetary policy.

The flows into bond exchange traded funds (ETFs) have been volatile. Over the past year, investors were starting to embrace duration. Investors were positioned for recession, inflation crash, and Fed cuts - evident from $31.7bn inflows to Treasury bond ETFs on pace for a record year2. However, investors are starting to pull out of the biggest bond ETFs devoted to Treasuries. More than $1.8 billion came out of the $39 billion iShares 20+ Year Treasury Bond ETF last week, the most since March 20203. Sentiment toward long-dated Treasuries has soured over the past month amid growing conviction that the Fed will keep interest rates at elevated levels for an extended period. We expect rates to remain higher for longer and are unlikely to see the Fed cut rates until the Q1 of next year amidst a stronger US economy.

Don’t celebrate on disinflation just yet

Overall, the US economy continues to show extraordinary resilience despite monetary constraints and credit tightening. While inflation has shown encouraging signs of decline, we caution that the level remains high. Strong July retail sales raise the risk of a re-acceleration in inflation. The four biggest categories of the ex-auto’s component saw outsized gains: non-store retailers, restaurants & bars, groceries, and general merchandise. Amidst a tight US labour market, with unemployment at historic lows and wages continuing to rise, the downward pricing momentum in the service sector is likely to be at a slower rate. Commodity prices are also beginning to rebound from the weakness seen in Q2 2023. Energy prices have been rising on the back of Organisation of Petroleum Exporting Countries and its allies (OPEC+) production cuts. If commodity prices extend their recent momentum, it could pose upside risks to inflation.

Fed Officials remain divided

Messaging on a somewhat mixed inflation outlook from the Fed Officials remains a mixed bag. One faction remains of the view that rates hikes over the past year and a half has done its job while another group contends that pausing too soon could risk inflation re-accelerating. Fed governor’s Michelle Bowman and Christopher Waller remain in the hawkish camp, hinting at more rate increases being needed to get inflation on a path down to the 2% target.

Futures markets are assigning about a 11% chance of a 25-basis-point rate hike when the Fed next meets on 19 and 20 September4. Additionally, rate cuts have now been completely taken off the table until perhaps later in the Q1 2024. The latest Fed minutes reveal commentary from officials, including the hawks, such as Neel Kashkari, suggest a willingness to pause again in September, but to leave the door open for further hikes at the upcoming meetings5.

Opportunity for a yield seeking investor

It’s been an impressive turnaround since the pandemic when negative real yields became the norm. TINA- ‘There Is No Alternative’ to equities, is over now that evidence of the shift to a 5% world appears stronger than ever. Today investors have the opportunity to lock in one of the highest yields in decades, with US two-year yields paying close to 5% exceeding the yields at longer maturities without the volatility witnessed in the 10-year sector. A resilient US economy is likely to keep interest rates and bond yields higher for longer.

Sources

1 Bureau of Labour Statistics as of 10 July 2023

2 BofA ETF Research, Bloomberg as of 9 August 2022 - 9 August 2023

3 Bloomberg as of 14 August 2023

4 Bloomberg as of 17 August 2023

5 federalreserve.gov as of 16 August 2023

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

long duration treasury bondsThe federal funds rate has never gone up this high and this steep before in history. the worse the conditions become apparent the faster they cut rates. with delayed effects of high funds rate just now showing themselves and markets/ credit contracting. Bonds are due for a guaranteed high rise that can be exited as soon as funds rate hits back to zero. I know nothing is guaranteed, but i feel this is the easiest risk adjusted return of the decade. tmf is 3x leveraged etf.

Monetary Policy: Fed Funds & UnemploymentThe unemployment rate and the federal funds effective rate are two important economic indicators that provide insights into the health of an economy, but they represent different aspects of economic activity.

Unemployment Rate:

The unemployment rate is a measure of the percentage of the labor force that is unemployed and actively seeking employment. It is a key indicator of the overall health of the labor market and can provide insights into the level of economic activity. A low unemployment rate is generally considered a positive sign, as it suggests that a larger portion of the labor force is employed and contributing to economic growth. On the other hand, a high unemployment rate can indicate economic distress and underutilization of human resources.

Federal Funds Effective Rate:

The federal funds effective rate, often referred to as the "federal funds rate," is the interest rate at which depository institutions (such as banks and credit unions) lend reserve balances to other depository institutions overnight on an uncollateralized basis. It is a key tool used by the central bank (in the United States, the Federal Reserve) to influence and control the country's monetary policy. The Federal Reserve sets a target range for the federal funds rate, and it is adjusted as a means to control inflation, stabilize the economy, and influence borrowing and spending by businesses and consumers.

Relationship Between the Two:

While the unemployment rate and the federal funds effective rate are not directly linked, they can influence each other indirectly through broader economic dynamics:

Monetary Policy Influence: The Federal Reserve uses changes in the federal funds rate to impact borrowing costs and, subsequently, economic activity. When the economy is sluggish and unemployment is high, the Fed might lower the federal funds rate to encourage borrowing and spending, which can help stimulate economic growth and job creation. Conversely, if the economy is overheating and inflation is a concern, the Fed might raise the federal funds rate to cool down economic activity and prevent excessive inflation.

Economic Conditions: Changes in the federal funds rate can affect overall economic conditions. Lowering the rate can potentially lead to increased borrowing, investment, and spending, which could contribute to job creation and, in turn, reduce the unemployment rate. Conversely, raising the rate can lead to reduced borrowing and spending, potentially impacting job creation and leading to changes in the unemployment rate.

In summary, the unemployment rate and the federal funds effective rate are distinct indicators that provide information about different aspects of the economy. While they are not directly correlated, they both play roles in shaping and reflecting the overall economic environment.

Central banks navigate the last stretch of the tightening cycleThis week we learnt how vital Central Bank communication is to global financial markets. The trio of central banks – The Federal Reserve (Fed), European Central Bank (ECB) and the Bank of Japan (BOJ) held their respective meetings. Each of the central banks tried to convey how they will navigate monetary policy amidst a slowing economy and avoid a hard landing.

China takes small steps to shore up the recovery

Even the People’s Bank of China (PBOC) surprised the markets this week, by announcing a cut in the 7-day Open Market Operations (OMO) by 10Bps to 1.9%1 which paved the way for another cut to the one-year medium term lending facility rate by 10Bps to 2.65%2. These recent developments mark a more proactive stance by Chinese policy makers in trying to tackle the Chinese slowdown in activity since the re-opening. Clearly more is needed. Policymakers are soliciting opinions from business leaders and economists on how to revitalise the economy in a number of urgent meetings3. While the Fed and ECB are trying to tame inflation, China has the opposite problem as inflation remains low. Manufacturing remains weak, exports are slowing, and credit growth is cooling. This is why it’s no surprise that the markets are prepping for a broader package of stimulus targeted towards the ailing property sector.

A hawkish skip for the Fed

The recent flurry of economic reports continues to show the US economy is holding up but losing steam, supporting the Fed’s approach of changing the pace of its policy tightening. The Fed kept the fed funds rate in range of 5-5.25%, by unanimous vote, in line with market expectations after 10 straight hikes dating back to March 2022.

The Fed’s dot plot showed the median rate at 5.6% versus 5.1% a month back. In the summary of economic projections, the median unemployment rate forecast was revised lower from 4.5% to 4.1% by the end of 2023 while the core inflation rate was revised higher from 3.6% to 3.9% making the case for more hikes this year. This clearly was a hawkish skip.

Fed Chairman Jerome Powell was careful to point out that no decision was made on a July hike, but he did say it is a live meeting, leading the market to increase the probability of a move. What surprised me the most, was that Powell said rate cuts would be a couple of years out which is at odds with the dot plot forecast of 100Bps of cuts in 2024.

Senior Economist to WisdomTree Jeremy Siegel believes the Fed is done hiking and that alternative inflation metrics which incorporate real time housing inputs show inflation running at 1.4% instead of 4.1%. This is based on alternative shelter inflation calculations using Case Shiller Housing and Zillow rent annualized at 0.5% instead of the 8% that is biasing Bureau of Labor Statistics (BLS) CPI higher.

ECB’s revised inflation forecasts remain at odds

After raising the deposit rate by 25Bps to 3.5%, the ECB was a lot clearer than the Fed in signalling that rate hikes are almost certain next month on July 27. The ECB remains too optimistic on growth, reducing their projection for 2023 real GDP to only 0.9% (from 1% in its March projections).

While I would agree with the ECB’s view that (1) mostly labour-intensive services will support economic growth over the next two years and (2) the current hump in wage inflation will show up via higher prices for these services, I remain sceptical amidst the global headwinds for manufacturing, and a slower pace of overall growth could keep inflation as high as the ECB now projects. While wages are likely to accelerate slightly above 5% in 2023, they should begin declining to 4% yoy by late 2024. We believe, if core inflation continues to recede in the coming months and the real economy grows at 0.4% in 2023, the ECB will stay put in September after a final move next month.

As expected, the ECB confirmed that it will stop to reinvest proceeds from maturing bonds under its standard Asset Purchase Programme (APP) from July onwards. It won’t offer new long term liquidity injections upon the expiry of the €477Bn of a TLTRO III liquidity measure on 28 June 2023.

BOJ sits tight

As expected, the BOJ kept all key policy settings unchanged, including the +/-50Bps band around the zero% Japanese Government Bond JGB yield target. Since taking the helm in April 2023, BOJ Governor Kazuo Ueda has stressed the high cost of premature tightening as the economy is finally seeing green shoots toward sustainable inflation.

In contrast to the ECB, the BoJ's latest assessment and outlook for the economy and inflation were also largely unchanged from their update in the April Outlook Report. The BoJ continues to note "extremely high uncertainties" surrounding economies and financial markets at home and abroad." Japanese equity markets reacted positively to the BOJ’s status quo stance on monetary policy. Looking ahead, the Fed’s potential pivot back to a hawkish mode versus the BOJ’s dovish perseverance could pave the way for further upside for Japanese equities owing to the underlying weakness in the Yen versus the US dollar.

Sources

1 Bloomberg on June 13, 2023

2 Bloomberg on June 15, 2023

3 Bloomberg on June 14, 2023

The Ten Fundamental Objectives of the Federal ReserveIntroduction

The Federal Reserve System, often referred to as "the Fed," was established in 1913 in response to a series of banking panics. As the central banking institution of the United States, it plays a crucial role in maintaining the stability and integrity of the nation's monetary and financial systems. This essay explores the ten fundamental objectives of the Federal Reserve, which include maintaining price stability, promoting full employment, and ensuring a stable financial system, among others.

1. Price Stability

The primary objective of the Federal Reserve is to maintain price stability, which refers to a low and stable rate of inflation. By managing inflation, the Fed helps to preserve the purchasing power of money, ensuring that consumers and businesses can make informed decisions regarding spending, saving, and investment.

2. Maximum Sustainable Employment

Another key objective of the Federal Reserve is to promote maximum sustainable employment, also known as full employment. This means providing enough job opportunities for all individuals who are willing and able to work, while minimizing the rate of unemployment. By promoting full employment, the Fed contributes to overall economic growth and well-being.

3. Moderate Long-Term Interest Rates

The Federal Reserve aims to maintain moderate long-term interest rates, which are essential for economic growth and stability. By controlling short-term interest rates, the Fed can indirectly influence long-term rates, thereby encouraging borrowing, investment, and consumption.

4. Financial System Stability

One of the most critical objectives of the Federal Reserve is ensuring the stability of the financial system, which involves monitoring and regulating financial institutions, as well as identifying and addressing potential risks. By maintaining a stable financial system, the Fed helps to prevent crises and protect the economy from shocks.

5. Efficient Payment and Settlement System

The Federal Reserve is responsible for managing the nation's payment and settlement systems, which include check clearing, electronic funds transfers, and automated clearinghouse operations. By providing these services efficiently and securely, the Fed ensures that financial transactions occur smoothly, promoting confidence in the banking system.

6. Consumer Protection

Another important objective of the Federal Reserve is to protect consumers by enforcing federal consumer protection laws and regulations. This includes monitoring financial institutions for compliance, addressing consumer complaints, and providing education and resources to help consumers make informed financial decisions.

7. Supervision and Regulation

The Federal Reserve plays a vital role in supervising and regulating financial institutions to ensure their safety, soundness, and compliance with laws and regulations. This oversight helps to maintain a stable and resilient financial system, while also protecting consumers and investors.

8. Community Development

The Federal Reserve is committed to promoting community development by supporting initiatives that address issues such as affordable housing, small business development, and workforce development. This objective aims to foster economic growth and improve the quality of life in communities across the country.

9. Economic Research and Analysis

The Federal Reserve conducts extensive research and analysis to better understand the U.S. economy, as well as the global economy. This research informs the Fed's monetary policy decisions and helps it to fulfill its other objectives, such as promoting maximum employment and maintaining stable prices.

10. International Financial Cooperation

Finally, the Federal Reserve cooperates with other central banks and international financial institutions to promote global economic stability and financial system resilience. This collaboration allows the Fed to share information, resources, and expertise, ultimately benefiting the U.S. economy.

Conclusion

The Federal Reserve plays a pivotal role in the U.S. economy by pursuing ten fundamental objectives, which range from maintaining price stability to promoting international financial cooperation. By fulfilling these objectives, the Fed ensures the stability and growth of the U.S. economy, while also fostering a resilient and efficient global financial system.

Trade with care.

If you like our content, please feel free to support our page with a like, comment & subscribe for future educational ideas and trading setups.

Inflation dominates financial stability risks for central banksDespite the banking industry turmoil, central banks continued to raise rates last week. This marked moves from the European Central Bank (ECB) by 50Bps, Federal Reserve (Fed) by 25Bps, Bank of England by 25Bps, Swiss National Bank by 50Bps, Norway by 25Bps, the Philippines by 25Bps, and Taiwan by 12.5Bps. Central banks appear determined to show they have the tools in place to nip financial stability issues in the bud and so monetary policy is free to deal with inflation.

The Fed is likely nearly done

The March Federal Open Market Committee (FOMC) turned out to be on the dovish side. This was evident in the written statement in which the FOMC anticipates – “some additional policy firming may be appropriate” from “ongoing increases in the target range will be appropriate”. There was a risk that if the Fed chose not to hike rates, it would raise concerns about further financial system weakness. The reason given was that financial instability was "likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation”.

The Fed has clearly signalled to the markets that it can control financial contagion from spreading by providing large amounts of liquidity. Over the past weeks we have seen a combination of measures to stabilise the market turmoil, including 1) The Fed’s proposal to provide immediate deposit protection and emergency lending 2) the intervention by Swiss Authorities to merge Switzerland’s two biggest banks and 3) the resumption of a dollar swap facility among central banks.

If the banking crisis calms down and the economic data looks anything similar to the January/February reports, another rate hike at the May FOMC meeting should not be ruled out. Conversely, ongoing market dislocations could outweigh the data and push the Fed into pause mode. Currently the implied probability for Fed Funds Futures looks for a rate cut during the summer. That scenario can only materialise if the risks emanating from the banking system continue to deteriorate from a market and/or economic perspective.

Gold offers a potential investment solution

There is no doubt that the investment landscape is fraught with elevated uncertainty and, of course, the volatility that comes with it. Gold is benefitting twofold from its safe haven status alongside the earlier than expected pivot in monetary policy by the Fed. While the Fed does not currently see rate cuts this year, in contrast to market expectations, its projections raise the prospect of rate cuts for 2024 which remains price supportive for gold.

The Commodity Futures Trading Commission (CFTC) has now largely caught up with publishing futures positioning data for gold following the disruption in February due to a ransomware attack on ION Trading. We now know there was a slump in positioning during February, but net longs in gold futures rose back above 154k contracts on 14 March 2023 as the banking crisis was unfolding.

Laying an emphasis on quality stocks

Rising concerns about financial stability tends to cause negative feedback on the real economy. Quality has stood the test of time, displaying the steadiest outperformance over 10-year periods. Dating back to the 1970s, quality has displayed the highest percentage 89% of outperforming periods in comparison to other well-known factors.

The WisdomTree Global Developed Quality Dividend Index (Ticker: WTDDGTR Index) offers investors an exposure to dividend paying stocks in developed markets with a quality tilt. The WisdomTree Global Developed Quality Dividend Index has outperformed the MSCI World Index (Ticker: MXWO Index) by 1.54% over the past five years. The emphasis on quality, by tilting the portfolio exposure to stocks with a high return on equity has played an important role in its outperformance versus the benchmark.

Over the past five years, we also observed the allocation and selection of stocks within the information technology, financial and healthcare sectors contributed meaningfully to the 1.54% outperformance versus the MSCI World Index as highlighted below.

US Federal Funds RateFed saying the peak rate 5% next year. imo this news -had- to accompany a 50bp hike or apes would have prematurely partied. I think the 4000% climb up to now was worse.

They want to raise as much across 2023 as they rose in November 2022 alone. Of course there are layers of complexity here, but looking at the topical move here, I don't think its thats bad and the. The question now is how long they maintain the peak rate. Could be through H1 2023 or longer if inflation is stubborn.

In summary I think we are approaching the range where markets offer an increasingly attractive risk/reward for averaging into positions over the next six months to year.

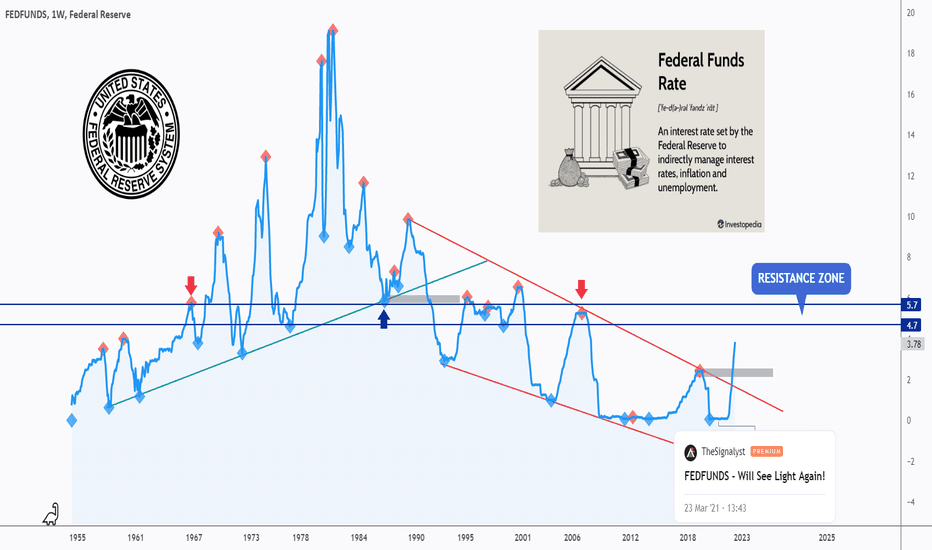

All Eyes On Fed Funds Rate 🏛Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

I am not a fundamental expert (nor an economist) but I found FEDFUNDS chart really interesting!

I never thought that basic technical analysis tools can also be applied to such economic instruments!

As per my last analysis (attached on the chart) FEDFUNDS traded higher and broke the red wedge pattern upward.

Now we are technically bullish, expecting big impulse movements to push price higher, and small bearish correction movements.

We all know that Federal Reserve will most probably increase the interest rates by another 50 basis points (0.5%) next week (on Wednesday)

By adding another 0.5% , FEDFUNDS will be approaching a strong resistance zone in blue (4.7% - 5.7%) which might hold the price down for a bearish correction to start and push price lower till the previous high in gray again.

It would be interesting to hear your thoughts on this one.

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Crash Incoming 13?Another simple, without noise chart: Effective Federal Funds Rate (blue) and the S&P 500 (dark yellow).

Since March, with a macro perspective, almost all my 'crash' ideas are showing that the probability of a major crash is in place; the truth be told, with a boring pattern that keeps repeating itself. I don't know if this time will be different, what I know is that this research, that I am sharing with you disinterestedly, is helping me to build a strategy to protect my wealth. Stay well, stay safe.

Fed pivot indicatorThis chart is essentially proxy for the acceleration rate of interest expense for the US government, and has been a reliable indicator of fed pivot for 30+ years as the fed has ensured the US doesn't enter a debt death spiral.

To keep this line 'inbounds' they need the middle of the curve to fall ~75bp between now and the 24th

Or maybe they'll allow a brief spike above, and given the length of that chart, maybe 'brief' can be a number of months

But as far as what would be normal fed behavior, we're at the tightening limit for interest rates

twitter.com