CAC40 Bullish breakout retestThe CAC 40 index continues to display a bullish bias, underpinned by a well-established rising trend. Recent intraday price action indicates a breakout from consolidation, suggesting renewed upward momentum.

Key Technical Levels:

Support:

7770 – This level marks the prior consolidation zone and n

About CAC 40 Index

The CAC 40 (CFD ticker: FRA40) is the benchmark index for the stock market in France. This index represents the top 40 stocks in the Euronext Paris stock market previously called "Bourse de Paris"; the total market capitalization of this index in 2015 was €1.03 Trillion. The Euronext trading hours begin at 9 a.m. and run to 5:35 p.m. CET for the fixing, Monday-Friday. This index was created back in December of 1987 and it started with a base value of 1,000. This index is of much help to investors that want to gain a perspective on how France"s stock market is performing and the economic implications that come along with the performance of this index. France represents one fifth of the total economy of Europe, therefore, it is of great importance to investors to follow the behavior of the French index in order to gain insight of where the European economy is heading. CAC 40 represents stocks from a broad range of sectors, with a total representation of 35 sectors. The sectors in this index range from the tires sector, automobiles, chemicals, cyber security, steel, aerospace, and insurance just to name a few. The CAC 40 is the French equivalent of the DAX 30. The sectors that have the most effect in the index are the pharmaceutical sector with a 10% of the total weight of the index, Banking 10%, and Oil equipment and services with a 9%.

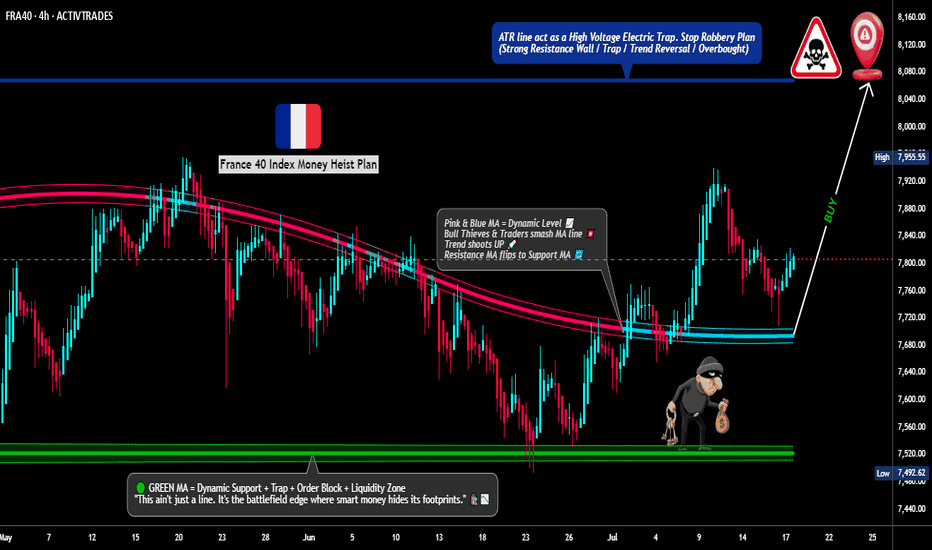

"FRA40/CAC40 HEIST! Bullish Loot Before Bear Trap – Act Fast!"💰 FRA40/CAC40 "FRANCE40" INDEX HEIST – THIEF TRADING STYLE MASTER PLAN 🏴☠️🚀

🔥 Steal the Market Like a Pro – Bullish Loot & Escape Before the Trap! 🔥

🤑 GREETINGS, FELLOW MONEY MAKERS & MARKET ROBBERS!

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

This is your VIP invite to the ultimate FRA40/CAC40 he

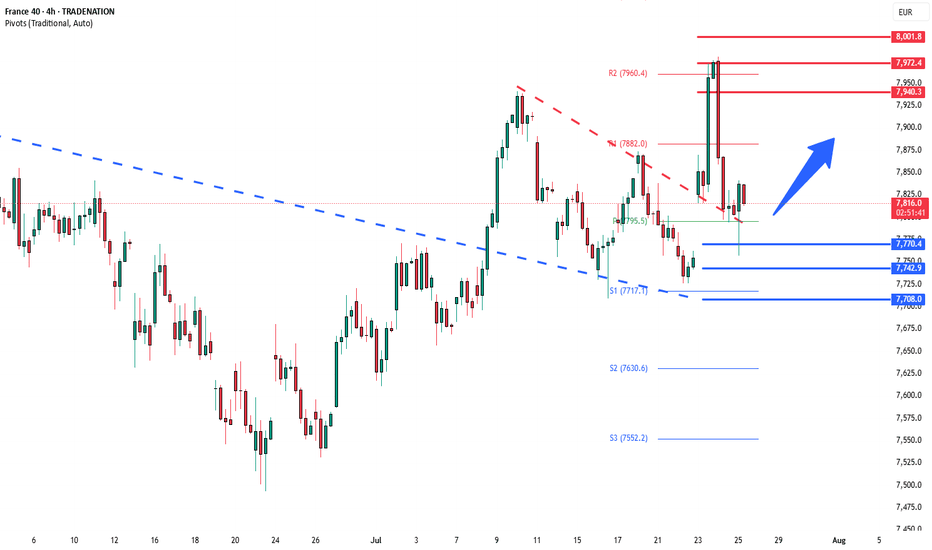

CAC breakout retest support at 7770The CAC 40 index continues to display a bullish bias, underpinned by a well-established rising trend. Recent intraday price action indicates a breakout from consolidation, suggesting renewed upward momentum.

Key Technical Levels:

Support:

7770 – This level marks the prior consolidation zone and n

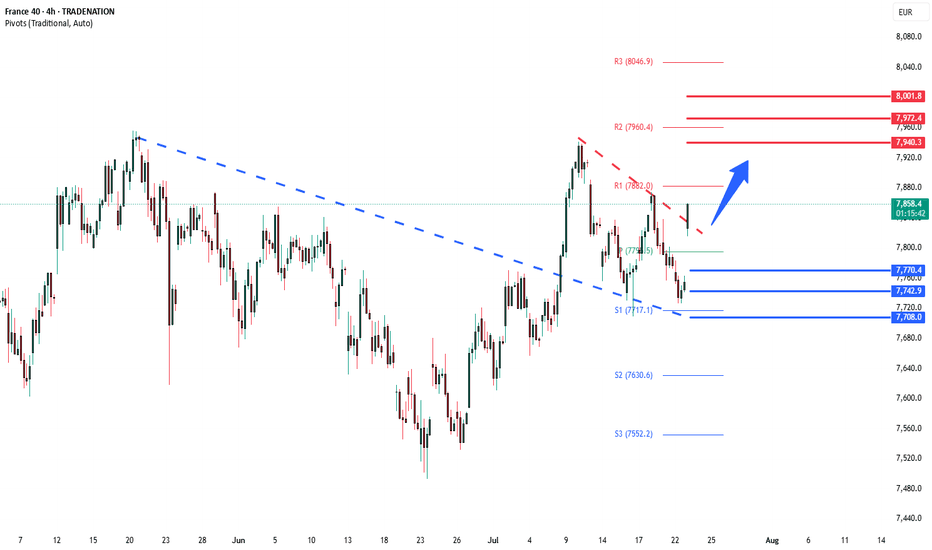

CAC40 Bullish consolidation breakout The CAC40 price action sentiment appears Bullish, supported by the current rising trend. The recent intraday price action appears to be a consolidation breakout.

The key trading level is at the 7770 level, the previous consolidation price range. A corrective pullback from current levels and a bulli

CAC40 Bullish breakout retest support at 7770The CAC40 price action sentiment appears Bullish, supported by the current rising trend. The recent intraday price action appears to be a consolidation breakout.

The key trading level is at the 7770 level, the previous consolidation price range. A corrective pullback from current levels and a bul

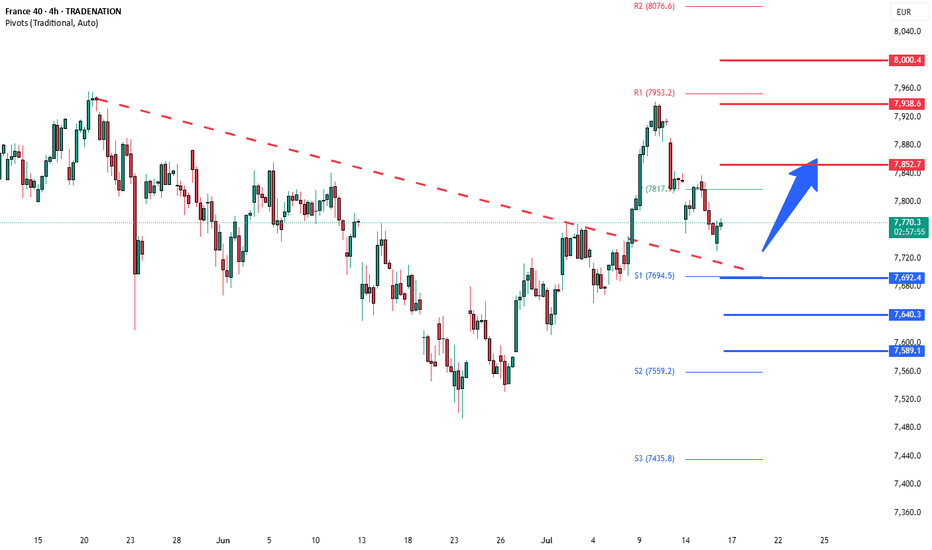

CAC40 Bullish breakout retest support at 7690The CAC40 remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 7960 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 7690 would confirm ongoing up

FRANCE 40 Heist in Progress | Bullish Reversal Zone Spotted.💼 CAC40 Market Heist: Thief Trading Blueprint for Smart Traders (Swing/Day Trade Edition) 💼

🌍 Bonjour, Hola, Hallo, Marhaba, Ola, Hello! 🌍

Welcome to all Market Hustlers, Silent Snipers, and Profit Seekers! 🤑💸🎯

We're back with a precision-built Thief Trading Plan — this time targeting the FRANCE40

France 40 is priming up for strong upside to 8,673France is definitely setting itself for upside to come.

We have positive data from the love country including:

📈 Oversold Conditions

The CAC 40 was heavily sold off — now it’s ripe for a bounce.

🏦 ECB Rate Cuts

Lower interest rates fuel investor appetite for European equities.

💼 Strong Cor

CAC40 Bullish breakout supported at 7560Key Support and Resistance Levels

Resistance Level 1: 7850

Resistance Level 2: 7930

Resistance Level 3: 7995

Support Level 1: 7560

Support Level 2: 7490

Support Level 3: 7410

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a p

France 40: A short/medium term buyHello,

The France 40 Index is currently forming a compelling bullish setup, characterized by a contracting triangle pattern—typically a continuation structure that signals the potential for further upward movement. Price action is consolidating within this triangle, indicating that a breakout could

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

CAC 40 Index reached its highest quote on Mar 6, 2025 — 8,297.48 EUR. See more data on the CAC 40 Index chart.

The lowest ever quote of CAC 40 Index is 3,337.20 EUR. It was reached on Oct 9, 2012. See more data on the CAC 40 Index chart.

CAC 40 Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy CAC 40 Index futures or funds or invest in its components.