DXY Weekly ForecastDXY Weekly Forecast

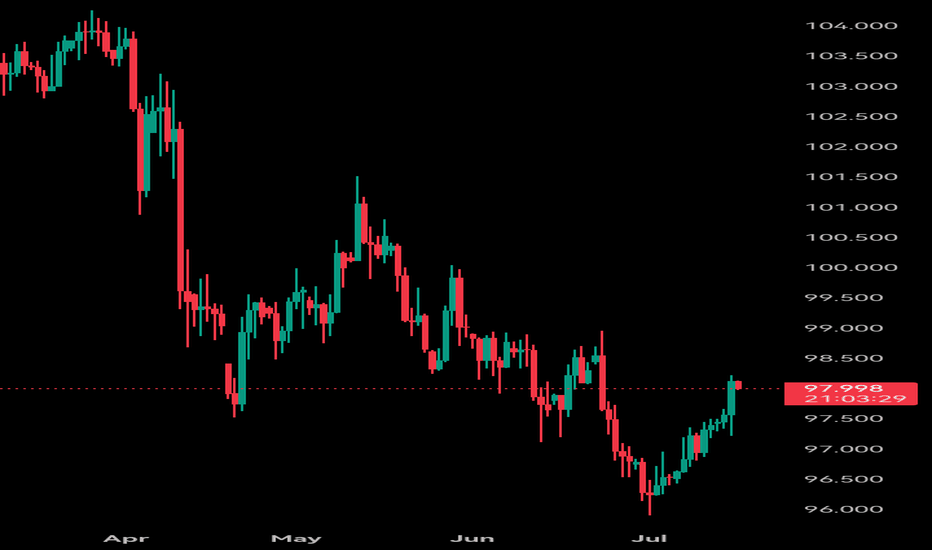

- look for down move when reaching 98.00 level

A Message To Traders:

I’ll be sharing high-quality trade setups for a period time. No bullshit, no fluff, no complicated nonsense — just real, actionable forecast the algorithm is executing. If you’re struggling with trading and desperate for better results, follow my posts closely.

Check out my previously posted setups and forecasts — you’ll be amazed by the high accuracy of the results.

USDX trade ideas

We can expect such a move if the event I mentioned in the captioHello friends..

In the analysis we had previously told you about the dollar index on this page, it started a downward trend right from the specified area (you can visit the page)

Now, after a long time has passed since that analysis, we are now in a suitable range in the dollar index.

See, on the weekly time frame, the index number has hit a strong support area, but we should not make a trading decision by seeing this support unit.

As you can see in the image, if the index number suffers in this range, we can expect a turn in the index.

You can change the trading decisions you have had so far in the event of a turn in the index.

This is just a view from our team, do not attach it to your trades.

.

.

Follow our page to see more analyses.

DXY July 6 AnalysisDXY

July 6

Parent Bias Bear

WEEKLY ANALYSIS

*Good example to witness price trend for the second week-the pull back I was anticipating did occur just not to the level I had suggested in last Sundays journal

*Note Price wicked to the .70 level on the monthly

*Price took key equal lows and rebalanced a FVG from Feb 22

*Monday/Tuesday Price seek lower prices

*Mid week consolidation-expected

*Thursday price took equal highs I was anticipating

*Friday Asia

*PM session of NY price retraced to close in consolidation

*Thursday expansion to buy side then on Friday reversal

WEEK AHEAD IDEAS

*Price closes in a consolidation on the previous days range 50%

*I suspect that price could seek the minor equal highs/FVG potentially reach for the gap from Thursday possible target should it really expand - this could be Sundays delivery

*could price expand for higher prices beginning of the week

*No news until Wednesday

*Sundays delivery can affect my ideas stay open

DXY Potential Bullish Reversal – Target 99.456 DXY Potential Bullish Reversal – Target 99.456 🎯

Technical Analysis Overview:

🔹 Trend Structure:

The chart illustrates a recent downtrend, which has been broken as price moved above the descending trendline, signaling a potential trend reversal.

🔹 Pattern Insight:

A bullish harmonic pattern is visible (possibly a bullish Bat or Gartley), with the price reacting from the PRZ (Potential Reversal Zone), aligning with key support near 96.500. The market has respected this zone multiple times, evident from the orange highlighted circles showing price rejections.

🔹 Support & Resistance:

Support Zone: ~96.500

Breakout Zone: ~96.985 (current consolidation near this resistance)

Target Zone: Marked at 99.456, which aligns with previous structure and fib projection.

🔹 Market Sentiment:

Price is consolidating after breaking the downtrend, forming a bullish rectangle (accumulation). The green arrows indicate bullish intent from buyers defending support levels.

🔹 Price Action Signal:

Formation of higher lows.

Break of structure and close above previous highs.

Possible breakout pending above consolidation box.

📊 Conclusion:

DXY shows bullish potential as it builds a base around strong support. A confirmed breakout above the rectangle could fuel a rally toward 99.456. Keep an eye on volume and confirmation candles for entry. ✅

#Dollar / #Bitcoin correlation I've previously described the correlation, and it's clear to everyone: a weaker DXY is positive for BTC.

📝Recently, the dollar has grown significantly and seems close to a local maximum (the chart is inverted). This demonstrates the strength of Bitcoin, as it was able to rise even against a strengthening dollar.

💡Imagine its movement when the new administration plans to lower the dollar price like they did last time. I think we will see a similar scenario as in 2017, when the dollar, from a local maximum, begins to provide a tailwind to the movement of assets that trade against it.

DXY Is Bearish - But A Retest is Highly ProbableThere is no denying that the overall trend is still bearish. However, price is currently respecting an H4 demand zone - which might continue to apply pressure to the upside for a minor correction.

Of course, if this correction does not happen and the H4 demand zone breaks, then we continue to ride the trend to the downside and all the way to the next weekly TF demand zone.

#TheTrendIsYourFriend

Relation between DXY BTC TOTAL#📄 Analysis of three price charts and comparison between dates and movement

◀️ So far, the anticipated rise in alternative currencies has not occurred, and the rise that has happened is considered small and weak since the bottom of 2022

📄 In the first price chart, we see the movement of the US Dollar Index (DXY)

🔽 Each time the index breaks below the 100.00 level, it has a path to test 90.00, and this path has been achieved twice before during the periods of 2017 - 2018 and 2020 - 2021, with each time lasting approximately 320 days

◀️ At the moment we are in, there has been a break below the 100.00 level in DXY, and we are currently on day 84 of this break

⭕️ In the first break between 2017 - 2018, Bitcoin moved up by 2128%, and alternative currencies moved up by 3030%

⭕️ In the second break between 2020 - 2021, Bitcoin moved up by 608%, and alternative currencies moved up by 1668%

⭕️ In the current third break, which is still in its early stages, Bitcoin has moved up by 48%, and alternative currencies have moved up by 23%

⌛️ This period may extend into the first quarter of 2026, and it is essential to monitor developments closely with daily and weekly follow-ups

WHy is everyone Freaking out over the DXY !?!?!Here is a chart of the DXY. with a linear regression channel plotted over it. Yes, we are close to the bottom of the channel. But we are no where near an all time low. Far from it. The DXY may be due for a push, but even if it was to drop more it would not be that big of a deal relative to historical patterns.

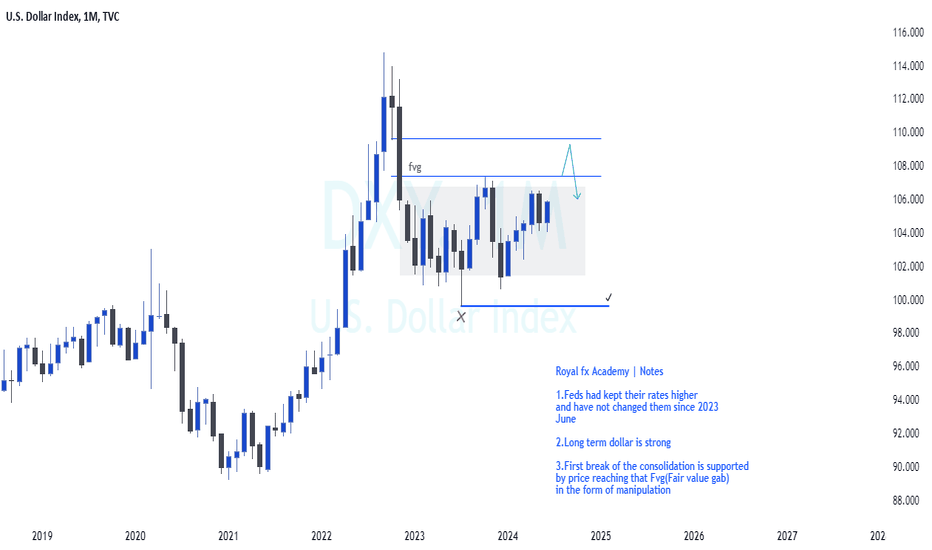

Dollar Index Macro analysisCurrently the Fed's Dollar is kept at 5.50% which is higher than any other currency except for the Kiwi , As we all know interest have high impact on currency prices. We are currently in a consolidation market profile. Therefore my interest is where the next expansion will be at, Clearly defined on my analysis it should be on the upside.

EURUSD heading for a bearish dropThere is a valid supply zone having a financial move that broke structure. looking properly at the left hand side of the supply zone there is no structural liquidity, so the supply zone is expected to fail before the sells, or create some form of liquidity around the supply zone.

Kindly follow Structure, POI, liquidity and can scale down to m5 for sniper entry and apply proper risk management.

### **Bearish Analysis of DXY (U.S. Dollar Index)**### **Bearish Analysis of DXY (U.S. Dollar Index)**

The U.S. Dollar Index (DXY) has recently shown a weak trend, with a prevailing bearish sentiment in the market. The primary factors driving this outlook include:

### **1. Rising Expectations of Fed Rate Cuts**

- Recent weak U.S. inflation data (such as May's PPI and CPI) have reinforced market expectations that the Fed may cut rates as early as September.

- Morgan Stanley predicts the Fed could implement a cumulative 175 basis points in rate cuts by 2025, further reducing the dollar's appeal.

### **2. Trade Policy Uncertainty**

- The Trump administration has recently threatened new tariffs (e.g., 30% on imports) against the EU, Mexico, and other nations, escalating global trade tensions.

- Wall Street institutions warn that Trump’s tariff policies could trigger capital outflows, putting additional pressure on the dollar.

### **3. Growing Recession Concerns**

- Fears of a U.S. economic "hard landing" are intensifying, particularly due to deteriorating corporate orders, earnings forecasts, and capital expenditure plans, which could weaken the dollar’s safe-haven status.

- The expanding U.S. fiscal deficit (reaching $1.36 trillion this fiscal year) is further eroding confidence in the dollar.

### **4. Technical Weakness**

- Since the beginning of 2025, DXY has fallen by approximately **8.4%**, marking its worst annual start on record.

- The index currently faces key resistance at the **97.80-98.00** range. A failure to break above this level could lead to further declines toward **96.50** or lower.

- RSI and MACD indicators suggest weak short-term rebound momentum, maintaining a bearish bias.

### **5. Risk of Capital Outflows**

- The U.S. "**899 Asset Tax**" proposal could increase costs for foreign investors holding dollar-denominated assets, potentially accelerating global divestment from the dollar.

- Goldman Sachs estimates that the dollar remains **overvalued by ~15%**, leaving room for further depreciation.

### **Outlook**

In the near term, DXY’s movement will depend on:

- **June CPI Data** (A lower-than-expected reading could reinforce rate cut expectations, further weakening the dollar).

- **Trade Negotiation Developments** (Escalating tensions may trigger risk-off sentiment, while easing could relieve dollar pressure).

- **Fed Policy Signals** (More explicit dovish guidance could extend the dollar’s downtrend).

**Conclusion:** Given multiple bearish factors, the U.S. Dollar Index is likely to remain weak in the short term. Traders should closely monitor key economic data and policy shifts.

DXY Weekly Update — July 14, 2025⌛ Timeframe:

.

📆 Analysis Date: July 14, 2025

.

🎯 Weekly Bias: Bearish-to-Neutral (Potential for retracement or reversal)

🔎 Market Overview:

⬇️ Persistent USD Weakness:

DXY has dropped nearly 10% YTD, marking the steepest half-year decline since 1986.

📉 Rate Cut Expectations:

Markets are pricing in a potential 75bps rate cut by the Fed in H2 2025, pushing yields and the dollar lower.

📦 Trade War Fears:

Renewed tariff risks (targeting EU, Japan, Mexico, South Korea) aren't boosting demand for USD — a signal of lost safe-haven appeal.

⚖️ Central Bank Diversification:

Global reserve managers are rotating into gold and away from USD, weakening long-term structural demand.

🌀 Sentiment & Risk Appetite:

💸 Liquidity Demand is Soft:

DXY is retesting a 4H fair value gap (97.10–97.30), suggesting potential short-term consolidation or correction.

🌍 Risk-On Mood Returns:

According to Goldman Sachs, the USD is trading more like a "risk asset" than a haven, aligning with rising equity appetite.

📉 Technical Landscape:

🟠 4H Structure:

If DXY breaks below 97.00, next support lies at 96.37, followed by 95.50–96.00.

Consolidation expected if price remains within the FVG.

🔻 Key Resistance:

97.70–98.20 zone. A break above this area could change the tone to bullish.

📌 Summary:

🔷 Fundamentals show long-term dollar weakening (rates, trade tension, reserve shifts)

🔷 Sentiment aligns with risk-on appetite and reduced USD demand

🔷 Technicals at critical level; break below 97.00 opens room for correction, break above 97.70 shifts bias bullish

.

.

.

.

🟠 Bias: Bearish to Neutral

Watch Levels: 97.00 support, 97.70–98.20 resistance

⚠️ Note: This analysis is for educational purposes only and is not financial advice. Always apply risk management.

✅ If you like this analysis, don't forget to like 👍, follow 🧠, and share your thoughts below 💬!

DXY: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse DXY together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 97.370 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

DXY Bearish Bias

Institutions are currently holding a net short position on the Dollar, indicating bearish sentiment. With a net position of -4,282, we may expect continued weakness in the DXY, especially if price reacts from key supply zones. Swing traders should remain cautious with long setups and prioritize opportunities aligned with USD weakness across major pairs.

Bold analysis for the most powerful currency in the world (DXY)Orange range: entering in several steps .

Green area: important support and exit point .

Important note: The gray line is the liquidity range

Watch the dance around this line carefully (bank positions are settled around this line)

And in my opinion, by increasing the price, they are emptying it on the buyers, so buy cautiously, but sell boldly.

GL

DXY Bearish Setup

Entry: 97.50 (current price)

Target (TP): 96.500 or below

Stop Loss (SL): ~97.80 (above recent swing high or resistance)

Risk Management: Essential — position size based on SL distance and account size

🔍 Trade Rationale:

Technical View: Price may be forming a lower high, suggesting possible downside continuation.

Fundamental Pressure:

Market cautious on Fed rate path

Tariff uncertainty could weaken USD

Upcoming FOMC minutes may add pressure if dovish signals emerge

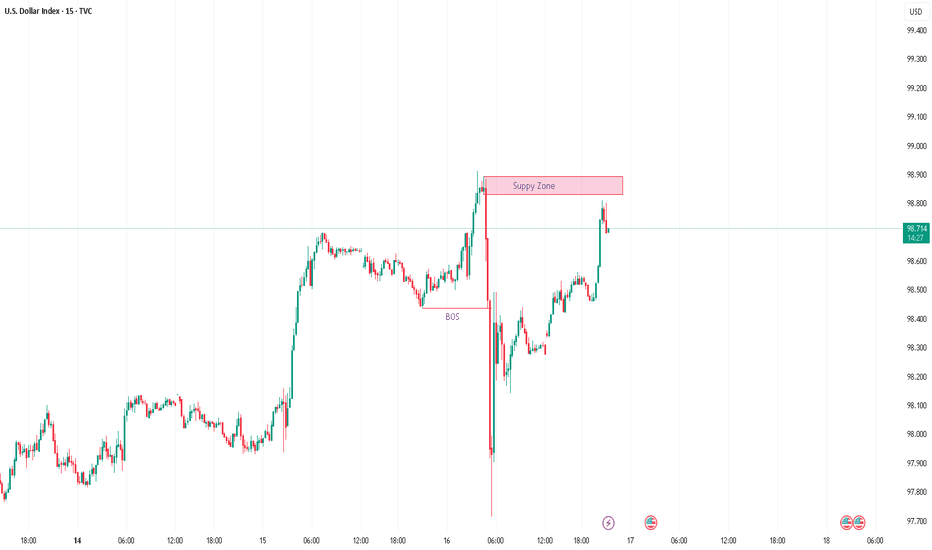

DXY LOCAL SHORT|

✅DXY is about to retest a key structure level of 98.000

Which implies a high likelihood of a move down

As some market participants will be taking profit from long positions

While others will find this price level to be good for selling

So as usual we will have a chance to ride the wave of a bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Check the trend It is expected that a trend change will form at the current resistance level and a continuation of the downtrend will form. Otherwise, the continuation of the uptrend to the specified resistance levels will be possible and then there will be a possibility of a trend change at the specified resistance levels.