02M1 trade ideas

BSL.SGX_Range Breakout Trade_longENTRY: 1.47

SL: 1.38

TP: 1.62

- ADX>20

- RSI>50,RSI<30

- Daily RS +ve

- Daily FFI +ve

- Daily MACD +ve

- Weekly RS +ve

- Weekly FFI +ve

- Weekly MACD +ve

- Retraced to 38.2-50% fib level since breakout in Jul 2021 with lower volume.

- Breakout of range and HVN on 30 Sep 2021 and moving with higher volume since then.

- Today shows possible selling dry out with extremely low volume.

Raffles Medical (SGX counter)Updated View On Raffles Medical (25 Jan 2021)

This counter popped up in our scanner for the potential BEARish trade.

I expect 0.895 region shall be next.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you.

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

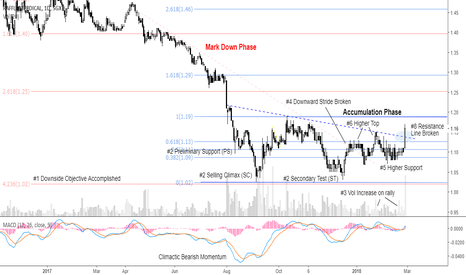

Raffles Medical (BSL) Expected to enter into Mark Up phaseI had some time this evening, thus, decided to conduct the Wyckoff Accumulation zone (Buying Tests) analysis on the stock. We expect the stock to mark up from here with target price at S$1.29. Stock's price action has passed 7 out of the 9 Wyckoff Method test as follows.

Buying Tests (Passed)

1. Downside price objective accomplished

2. Preliminary support, selling climax, secondary test established

3. Activity bullish (volume increases on rallies and decreases on reactions) Observed

4. Downward stride broken (that is, supply line penetrated)

5. higher supports observed

6. Higher tops observed

8. Base formed with horizontal price line broken

Buying Tests (Failed)

7. Stock not stronger than the market

9. Estimated upside profit potential is less than three times the possible loss