185 trade ideas

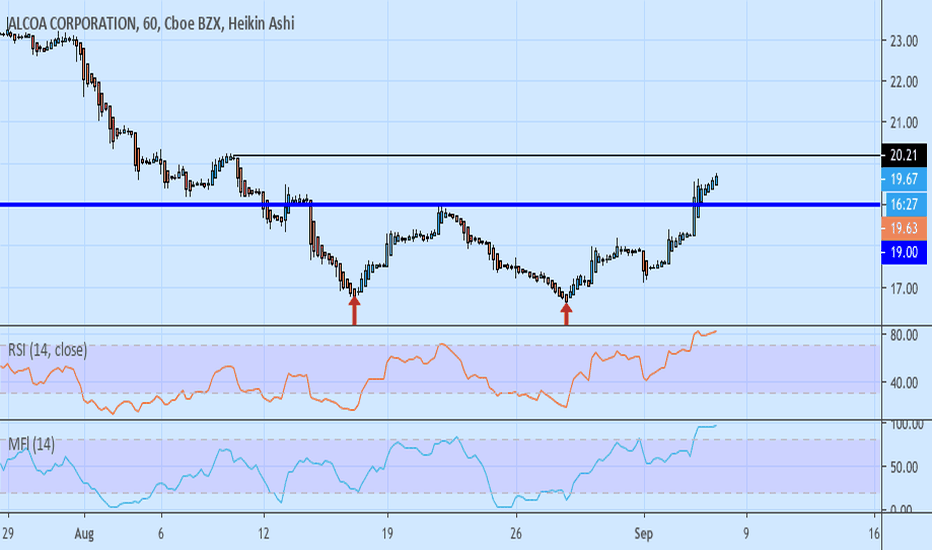

$AA Alcoa Corp a good Risk - Reward into earnings Strong support below, limited downside. Huge upside potential.

Bullish reversal on very high volume, pre earnings.

Analysts upgrade on Oct 10th

J.P. Morgan analyst Michael Gambardella maintained a Buy rating on Alcoa Corp (AA) today and set a price target of $26.00.

Company profile

Alcoa Corp. engages in the production of bauxite, alumina and aluminum products. It operates through the following segments: Bauxite, Alumina, Aluminum, Cast Products, Energy and Rolled Products. The Bauxite segment portfolio represents its bauxite mining assets and it is mined and sold primarily to internal customers within the Alumina segment, who then process it into alumina. The Alumina segment represents its worldwide refining system, which processes bauxite into alumina, which is mainly sold directly to internal and external smelter customers worldwide. The Aluminum segment represents its worldwide smelter system, which receives alumina, mostly from the Alumina segment, and produces molten primary aluminum. The Cast Products segment represents its worldwide cast house system, which are made from molten aluminum, purchased primarily from its Aluminum segment, which is then formed into various value-added ingot products, including billet and slab, for use in fabrication operations in a variety of industries. The Energy segment represents portfolio of energy assets. The Rolled Products segment represents its rolling mill in Warrick, Indiana, which produces aluminum sheet primarily sold directly to customers in the packaging end market for the production of aluminum cans. Alcoa Corporation began operation as a separate company on November 1, 2016 and was formed by Alcoa Inc. (now named Arconic Inc.) via a distribution of shares (spinoff) to existing Alcoa Inc. stockholders. The company is headquartered in New York, NY.

Full Analysis + Trade Idea on ALCOA by ThinkingAntsOkUse this as an idea to develop your own setup:

Main items we can see on the Daily Chart:

a)Price is against a major Support zone

b)We can see how the Bearish Movement have been decelerating

c)This on context is a good signal for thinking on Reversal movements coming soon

d)On the weekly chart, we can see a huge bullish Divergence

e)Our idea is to wait for a fake-out on the mentioned area + consolidation structure

f)If those items are accomplished we will set our orders on the explained areas on the chart.

Weekly Vision:

Trade Wars are NOT good. Trade Wars are NOT easy to win.@realDonaldTrump $X $AA Since the trade wars started the markets that were supposed to be benefited by this policies happened to have the complete opposite effect.

$AA had a loss of $7.6 B in market cap going from the 60's to the 20's level, 65% loss from the top to date. $X took a hit of $5.5 B in market cap, going from the 45's to the 15's levels and a 75% loss from the top to date. This is something that the market didn't take well. The market is always right, and it already spoke. Donald Trump, this market has made its point loud and clear. This trade war is of no benefit and it only scared away the investors. We want to step it and open investing lines in this. Enough ! Correct the policy, do something so we can see a turnaround and we can go back to profit of the aluminum and steel markets.

You're welcome !

The Market is always right.Trade wars are not good, trade wars are not easy to win. The market has shown us that it is always right, both $AA and $X wiped off billions in market cap since these trade wars started. The market is telling us loud and clear, Stop it!. Trying to manipulate the market creates artificial overextended conditions that sooner rather than later snap back. Let the markets do what they have to do, focus on being productive and take a competitive advantage.

At this time the technical indicators show a pretty big positive momentum divergence in the weekly, which signals an important reversal to the upside. As long as “he” lets the market do what it has to do $AA has a good chance to stop the bleeding and look to pick up the increasing momentum and become bullish.

The market has proven wrong the trade wars, how much lower it has to go before this becomes a systemic problem that takes the economy into a recession? I can hope for the best, but just like $X my position is neutral leaned towards the bullish side.

$ALCOA CORP could reward the brave. Bullish indicators.It may have some bullish technicals but the fundamentals remain very risky, although the earnings beat estimates by a penny, revenue was $60 million short of estimates. The commentary from management on the earnings call was far from Bullish also, as they blamed trade tensions and macroeconomic headwinds for declines in demand, in turn cutting their demand forecast for the remainder of the year.

Although the chart has shown some bullish signs it must be remembered that the stock is in as serious downtrend that must be respected.

AVERAGE ANALYSTS PRICE TARGET $30

AVERAGE ANALYSTS RECOMMENDATION overweight

SHORT INTEREST 3.2%

COMPANY PROFILE

Alcoa Corp. engages in the production of bauxite, alumina and aluminum products. It operates through the following segments: Bauxite, Alumina, Aluminum, Cast Products, Energy and Rolled Products. The Bauxite segment portfolio represents its bauxite mining assets and it is mined and sold primarily to internal customers within the Alumina segment, who then process it into alumina. The Alumina segment represents its worldwide refining system, which processes bauxite into alumina, which is mainly sold directly to internal and external smelter customers worldwide. The Aluminum segment represents its worldwide smelter system, which receives alumina, mostly from the Alumina segment, and produces molten primary aluminum. The Cast Products segment represents its worldwide cast house system, which are made from molten aluminum, purchased primarily from its Aluminum segment, which is then formed into various value-added ingot products, including billet and slab, for use in fabrication operations in a variety of industries. The Energy segment represents portfolio of energy assets. The Rolled Products segment represents its rolling mill in Warrick, Indiana, which produces aluminum sheet primarily sold directly to customers in the packaging end market for the production of aluminum cans. Alcoa Corporation began operation as a separate company on November 1, 2016 and was formed by Alcoa Inc. (now named Arconic Inc.) via a distribution of shares (spinoff) to existing Alcoa Inc. stockholders. The company is headquartered in New York, NY.

$AA ALCOA IS A SELL INTO EARNINGS.In last quarters earnings report we got a nice pop but that quickly reversed which is not a good sign. While other companies in this sector have risen AA has had terrible price action and we can see nothing other than a drop in price post earnings. Indicators are all quite negative which confirms our sell bias.