ACB surges on Jeff Sessions' ResignationBig move today following a tweet buy President Trump that he has accepted the resignation of Attorney General Jeff Sessions

twitter.com

This came after a clear hourly bear break across the sector singling some daily consolidation was coming, but this breaking news clearly sidetracked that plan and delayed consolidation for at least a little while. I am closely watching for the hourly trend to change as the daily chart is very over extended right now

Key levels for tomorrow:

S: 9.59

R: 10.75, 11.29

21P trade ideas

ACB sticking to my previous calls!Good morning everyone!

The stock market has never been so exciting! With the elections going in our favour of legalizing cannabis in the federal level for the US, I speculate that the bullrun for this year is not yet over.

On to the technicals, I still stick to my previous chart patterns and previous lay out from my Aug/Sept post. We just bounced off the 70% fib retracement and on our way back up. With the elections acting as our main catalyst(co-incidence? I think not... nothing is a co-incidence in stock markets), Volume has remained strong and support the price movement going up. It has been bullish candles ever since the bounce off. I still truly believe (in my own speculation) that we are not done with our bull run. Based on historical events back in 2014 when we had one of the states in the US legalize MJ, the first bull run was just a way of getting the attention of the public to participate in this market. Now that the institutional investors(and us who knows how the market psychology/technical works) have taken profits, the bounce has been created. I think we will still hit that 17 CAD mark! It needs to beat the previous high (no pun intended) from early 2017. In the technical sense, the Oct 2017 high does not co-relate with the momentum of the market. We need to beat that high. ACB is a strong company. WEED has doubled its Jan 2017 high. ACB is only bound to do so and this would be the price target that I would have if we are to beat the previous highs. If ACB does not the previous high, the chart would form a double top, which indicates a bearish pattern.

I am Balanar. I stalk these charts day and night.

Happy trading.

ACB Aurora Cannabis moving up. Very Bullish November a month that markets are bullish are really powering ACB back from the lows of Octobers Market Correction.

ACB price movement now showing very strong upward trend. Company earnings report due Wednesday November 07

$11 for tomorrows target. Red Pin on 30 min chart. Bullish Signal

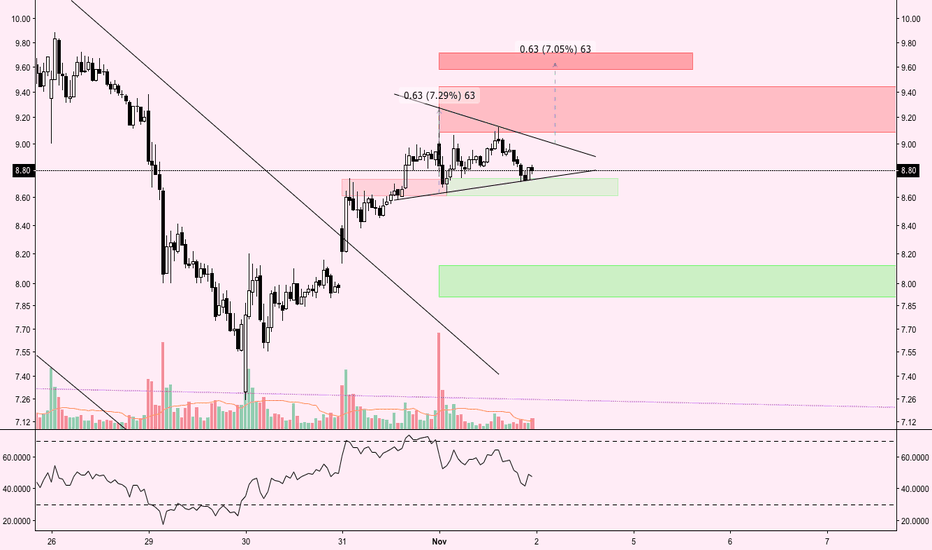

ACB hourly equilibrium on watchThe oversold bounce is starting to feel toppy with a bearish reversal candle on the daily and declining volume. The high of the day rejected from the 100MA and we're in an hourly equilibrium now to determine if we're going to see bounce continuation or set a higher low on the daily chart.

I would also look towards Canopy for clues on how the sector leader breaks.

Key levels for hourly eq:

S: 8.63

R: 9.12

_____

For anybody looking at any individual stock it is imperative to keep an eye on the overall market and the analysis I do on SPY. The correlation of every individual name and sector to the market is very real and affects every stock you own.

ACB - Time for a reversal ?Dear Traders,

ACB took a huge hit, but i'm happy that thanks to my previous TA I expected a big drop. I saw a Bearish Divergence and I stayed far away from ACB, WEED, TGOD and APH.

But i decided to have a look because a reversal in imminent at this price.

On the 1hr chart I see a Kangaroo Tail which is a bullish pattern, and I also see that my histogram is showing a Divergence, a bullish one.

I think we might see a little uptrend towards 8.90C$, which is our 21 ema (Resistance), if that breaks, we should see a run towards 10.25C$ which is the 55 ema.

Let's keep an eye on this one tomorrow.

Aurora bulls buy the gap down openQuick updates tonight.

ACB had a big gap down and giant bounce in the first 30 minutes of trading, and remained in an hourly equilibrium for the remainder of the day. Bulls made an attempt at a new high of day in late afternoon but came 4c shy of resistance.

The end of the day saw SPY with big bull move finishing up near the high of the day on the strength of both the tech sector and financial sector, while Canadian MJ was unable to derive any momentum from the this move. That does give some reason for concern with bulls being so close to resistance but unable to break it.

Tomorrow first thing the bulls want to break our two hourly resistances in order to see bounce continuation. Failure to do so a second time would be a red flag.

Key levels:

Support: 7.55

Resistance: 8.16, 8.20

If the bulls find the momentum to break this range and see continuation on the hourly bounce, we would look for a 4hr lower high compared to 11.29. There are numerous hourly resistances on the way up to that level, giving Aurora several more hurdles that Canopy and Aphria don't have to deal with.

_____

For anybody looking at any individual stock it is imperative to keep an eye on the overall market and the analysis I do on SPY. The correlation of every individual name and sector to the market is very real and the market has been showing significant weakness over the past four weeks. This correlation affects every stock you own.

Aurora nears daily oversoldACB continued its recent pattern of lower lows, dumping the whole day and closing down over 16% in one of the most stand-out bearish days this sector has seen. There is no doubt in my mind this weakness is in large part to the overall stock market dumping for the past four weeks, so be sure to keep an eye on the correlation to SPY. We've now given back 80% of the run up from August 14th to all time high over the past 10 trading days.

Where we stand, Aurora has a lack of support here. Regular readers know I anticipated a bounce before our key weekly level 7.65, which we broke today by 10 cents. This was very unlikely to happen, which speaks to just how weak this chart is. The daily RSI is approaching oversold, and is the lowest level it's been since August 14th. I'm now anticipating an oversold bounce.

Why do I anticipate a bounce in the very near future?

RSI levels on multiple timeframes are currently at or near historical bounce levels:

Daily - 30

4hr - 21

1hr - 21

If you did not stop out on one of the bear breaks over the past two weeks, now isn't the time you want to sell your position. Instead, you probably want to wait for a bounce to get underway, as we are likely to see at least a couple days of follow-through. Of course, if your mindset is to hold your position for years, then stop checking the price every day or you will drive yourself crazy. In my opinion, the bounce will not start until the CGC bounce starts....which will not start until the S&P bounce starts.

If you are one of the people who have asked me over the past couple months about a good time to buy Aurora, these conditions are ideal for starting to SLOWLY scale into a long term entry you plan to hold for years. Just be sure not to invest all your money at once. Keep in mind we have no more upcoming catalysts for the sector, and the correlation to the S&P500 could mean several months of continued downside for ACB.

I'm looking at the 1hr chart right now for our levels. We remain in a downtrend with clear lower highs and lower lows

Key levels to watch for trend change/continuation

Support: low of day 7.55, 6.67, 6.07

Resistance: 9.38, 9.88, 10.07

While Canopy and Aphria have a lack of resistance once they clear their two levels, Aurora has many more resistance levels to deal with.

_____

For anybody looking at any individual stock it is imperative to keep an eye on the overall market and the analysis I do on SPY. The correlation of every individual name and sector to the market is very real and the market has been showing significant weakness over the past four weeks. This correlation affects every stock you own.

ACB trying to hand on waiting for Canopy's breakAurora has a much weaker setup, and looks clearest to me on the hourly chart. Unlike Canopy, Aurora has broken down to lower lows although bulls are still buying the dip so far. Friday closed with weakness heading back down towards the end of the day. We remain in a clear hourly downtrend with lower highs of resistance on each little bounce.

The bear breaks on the hourly chart have so far been met with little followthrough as Canopy remains in its equilibrium. This correlation favours the Aurora bears; if Canopy breaks bearish, Aurora is well positioned for greater downside because of how much weaker the chart currently is.

ACB is also down close to the golden pocket retrace from the low of its August consolidation to new all time high, but has broken below the .65 unlike other names with stronger setups

Key levels for Monday

Support: 9.00

Resistance: 9.88

_____

For anybody looking at any individual stock it is imperative to keep an eye on the overall market. The correlation of every individual name and sector to the market is very real and the market is showing significant weakness over the past three weeks.

ACB In a Bullish patternAfter the new highs ACB fell out of the uptrend but I believe it was a bullish sell off to catch the shorts in a trap. The bullish ascending wedge is lining up perfectly for a bullish week in the sector. Other theory we broke the trend is to the TSX and SPX falling 1-2 percent a day and scared investors and bulls to hide out until the dust settles. anyways I see testing 12 next week I can see that if we hold 9 if not 8 is our long term support here.