ACB retest 5dllsI think ACB will go down to 4 ~ 5 dlls,

Last time ACB touches a strong support around 7dlls, it went up but it couldnt break for multiple days the resistance at in the area of 10.3, it also already went back to the new support at 9dlls and doesnt look 9dlls will hold it, MACD doesnt send me a signal is time to buy and RSI is going down but still the oversold signal is far from come.

Let me know your toughs guys, this is my first post, I bough put options.

21P trade ideas

Aurora'ing back to life..will ACB burn one to get a yearly HIGH?EMA cross (50/200) on the 2hr chart, maybe back testing the 200 EMA now. Bresserts crossover on the weekly chart in oversold territory (last time this happened, it pumped $10 in the following 2 weeks - past performance not necessarily indicative of future results).

CMF shows money flow is in positive territory, relative strength hovering just under 50 RSI. I'd like to see the price touch the $8.80-9.00 ideally, but the downside can be complete here. Semi-worst case it should hold $8.00 but still would not invalidate until major support is breached. Good R:R IMO... this one can be a volatile beast. It is possible we see a pump to the $10.90 region and a retrace to these levels again ($8.50-$9.50) before moving higher. Placing major support at $7.20, soon to move up to $7.60. Keep in mind this is the one traded on the NASDAQ in USD, so you'd have to convert support regions accordingly if trading on the TSX exchange chart. Inverted H&S formation points to $21-$23 region... but should go 'HIGH'er long term.

ACB; An Underdog on the quest to getting highRepost from

DISCLAIMER

This is in no way, shape or form, fluid and function, an analytical, qualitative or intelligent compte rendu. I am obviously not rich, so obviously I haven't made it with my own thinking, so definitely don't put faith in me. But maybe read and learn some things about a company that might just lift themselves to new highs.

Further disclaimer: I believe a major market incident is imminent, the nature of which is in major media. Thus my outlook of long on this stock is truly that, I believe it is a stock worth looking at investing in the long term.

Thesis

I will start this analysis off stating I walked into this expecting to give a poor outlook, but come here to you with a fresher story. There is absolutely no way around it, ACB was completely mismanaged, sloppy, gluttonous and dying. Now it feels streamlined and organic. While I cannot and will not go into the history of the failures or successes of ACB, what I can tell you is they have been cutting costs, building brands, carefully entering markets and growing at a modest and sustainable pace over the last year. All while maintaining the same share price, which means this might be an unnoticed asset right now for those looking to step in to the field of cannabis stocks.

It is quite clear that short-heavy hedge funds have gone after ACB in the past, spilling more hit pieces in financial "news" groups like Motley fool and benzinga. And rightfully so! ACB was bleeding money, it was making mistake after mistake trying to grow too big too quickly and throwing nearly a billion dollars down the drain (which the new CEO joked about comfortably, signaling a lesson learnt). Since then, they have taken a much more modest and slow approach, carefully treading water in the US waiting for regulations to break, and perfectly placing themselves on the CBD platform until then. Without including any market potentiation, without including any brand name strength or platform foundation, ACB earns it's price tag, and possibly more. Furthering this, after acquiring Reliva CBD in Massachusetts, USA, they gave themselves a perfect opening into American markets. With over $400 million cash on hand, they could quickly pave roads to distribute once given the go-ahead from regulators. While competing with major American company developments, I would not underestimate the strength of ACB brand name in the Northeast corridor. Adding to the strengths of the Reliva acquisition compared to it's rivals Cronos, et al., there was neither sham nor shame in the deal, in which ACB acquired a foothold on American CBD and THC consumption, but also a possible super star CEO.

While some might view the Tilray-Aphria merger as a threat to Aurora's market share, I view consolidation as a healthy component. A less crowded field means more visible players, making Tilray a goliath only ever makes Aurora a possible David. And as unfortunate as it is, trading in the shares of a company is trading in the societal view of that company, which means an underdog bite can hurt more than a higher quarterly revenue report. Furthermore, approaching 52-week lows, and a P/E ratio of 6.15 (8.7$/share/$280 mil revenue /197.98 million shares), this is nearly 3x lower than the market ratio of 20xP/E's, which is absolutely insane. While I cannot make a personal product recommendation, I can say that Aurora Cannabis seems undervalued.

Fundamentals Analysis

I use multiple sites for finance breakdowns annually and quarterly, but this is more accounting, which isn't what I do or know about. But via www.macrotrends.net we see a major improvement in almost all financial aspects through the quarters. It is easy to talk about how poorly managed the company has been, but right now it has everything in line to take off. It has decreased R&D costs, it has reduced all debt and expenses, continuously organically raising profits, product and market. It has reached an absolutely sustainable point with only room to go up from here, and if the floor is bankruptcy, with 430 million cash in hand, I just don't see that happening anytime soon.

Furthermore, according to their most recent Quarter results found here: investor.auroramj.com

They had net revenue of $70 mil, 11% growth from 2020. IF market capitalization valuations are supposed to be 5x yearly revenue, and they maintain their modest $70m/quarter, they are at perfect valuation right now at 1.25-1.75 billion. So removing any other positives from the company, it is perfectly valued.

With $430 mil on hand, they could easily pay off some or all debt, increase market potentiation via branding and commercialization across applicable markets, or, via a partnership with another distribution company, build infrastructure to increase grow capacity and product manufacturing. Having a partnership in Massachusetts with Reliva gives them a platform to go from CBD to THC very, very quickly. 430 million dollars is a very quick way to open distribution and market capacity.

The Board

Starting with the CEO, Miguel Martin, hired September 2020 and it shows. While I don't think the transformation can be blamed solely on Miguel, he serves as a perfect representation of it. Interviews great, speaks clearly, he gets the job done well. Honestly, he feels organic himself. Watching a few interviews, reading a few articles by him, and I genuinely believe they are by him (www.linkedin.com), the guy seems like a cool dude who loves marijuana and wants you to try his bud. If I have to ask my intuition, I would give this guy the benefit of the doubt. Psychologically speaking, he's handsome, tall, great voice, charismatic, smooth; he is the perfect trap. So ignoring him and looking at what he has done, prior to cleaning up Aurora. He worked at Altria (big tobacco) as a manager and worked his way up management, to Logic an e-cig company and built that up as President, to Reliva, building that into his role at Aurora. It is absolutely clear this guy is a salesman and a manager. I am torn between wanting to fall for the honeypot CEO, or just appreciating his strong work history; either way I am all in on him spearheading a steady and strong market growth.

The rest of the board fill the holes; a steady list of directors with backgrounds fitting their roles. The lack of an investor emphasis on any of them is always of note, and the fact that many of these directors hail back to less savory company straits, leaves me at odds. From the outside, Aurora looks very closeted, their investor site is barebones. Sure it has all the pages and pictures, and sometimes more information than you'd expect on rarer aspects (most likely put there in response to short attacks). But their management and directors have no profile, and their investor presentation leaves much to be desired in a concrete plan or a preface on their interactions with various local and international elements concerning important aspects such as banking needs or regulation pushes and measuring up to fill that. What we get is a page with Reliva and little information on how it correlates to ACB or it's true pivot into America. Reliva is gaining ground as a CBD product brand in the USA, but how much longer can ACB be starved out of the American markets before its too late and there is no room for them? Probably not ever. The market has not developed in Massachusetts or the US. Brand awareness is negligent and while sales are impressive, they shadow their true potential as Marijuana use becomes more supported and socially acceptable in the world. How would you, the reader, react if I told you I researched and wrote this while smoking a blunt? How would you react if I told you I was drinking a fine scotch or a glass of pinot? There is still a massive bias against CBD and THC in the states, myself included at times, and as this resolves, the market will grow tremendously. Keeping itself weighted now, with the ability to expand as a potentiation, gives ACB the ability to wait out legal battles and delays of enforcement.

Share Pool/Float Analysis

With a massive float, but little institutional ownership, the room for a pump and dump is slim. However, I do believe an attempt at one is imminent. The twitter followers and r/wsb mentions has drastically increased in the past few months with a spike beginning recently. Additionally, Susquehanna has reported a massive amount of calls and puts 3.31.21 and general puts heavily outweighing calls. (whalewisdom.com ). ACB has a high rate of FTDs which would indicate a drying pool with hard to find shares. It is entirely possible a massive amount of retail investors own a significant part of the float from the 2018-2019 Robinhood era and its previous seat on the meme-stock council.

www.quiverquant.com

Super interesting, check out the fintel institutional ownership page with the shares changed: fintel.io

It looks like every hedge fund/investment firm has exited their position on ACB, which might explain the lack of a proper price raise as the company outlook has increased. This might have nothing to do with ACB having a poor outlook, but rather liquidation of assets for margin requirements, but that is just my hypothesis.

Nasdaq lists institutional ownership at 21.5 million shares and Yahoo at 19.4% of the float owned by institutions. Which always makes me beg the question where is the other 80% of the float, and what is it doing. Is it long retail? Small institutions? Maybe when America adopts blockchain we can know these things and fairly discover the price. Maybe ACB doesn't deserve a market capitalization similar to Tilray, but certainly it deserves more than Sundial?

Current Price movement and a crazy hypothesis

It is possible that ACB was a major short squeeze in 2018, with its reign as the highest held stock on Robinhood for a number of months, it is quite possible this was a prelude to the GME saga. This is one of those times where history really matters, and where we as investors need to create a solution for these moments. Relying on google to sort through this spike, what I can tell from Benzinga and Motley Fool articles is that they, and other hedge funds, took massive short positions on ACB, and other Canadian weed stocks, and got squeezed. After that, it looks like a mix of loss of interest, ACB share splits and dilution, the stock came down to a much more modest valuation. By all rights and standards, it has the fairest EPS of the weed stocks, has a relatively new story with a growing old but gold story among its previous investors, and an undervalued underdog in newer circles.

I would not be surprised if retail ownership is ever revealed, retail owned, or owns at this time, a major position in the float, with recent buyers hailing from institutions on positive company outlook news.

Disclaimer

I am going to be real honest with you; congratulations for getting to the end. Thank you for your time, I hope it was worth it. If you have any suggestions, I would love to hear it. Please don’t make an investment decision on my information alone, always double check. I am not a financial analyst, I do not get paid to write any of this, and I do not currently (5/5/21) have an investment in ACB or it's stock price. Thanks.

P.S., I have recently (5/5/21) placed and completely paid for an order for Reliva's CBD tincture for my arthritic 7.5y/o guinea pig. I will update this article with results after a period of treatment.

$ACB Target 13.85 for 29.927% $ACB Target 13.85 for 29.927%

Or next add level is at 7.47

Aurora moved to Nasdaq so I'm just updating my chart here. No add just chart.

—

On the far right of the chart is my Average (Grey) Current Target (Green), and Next Level to add (Red) Percentage to target is from my average.

I start every position with 1% of my account and build from there as needed and as possible.

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

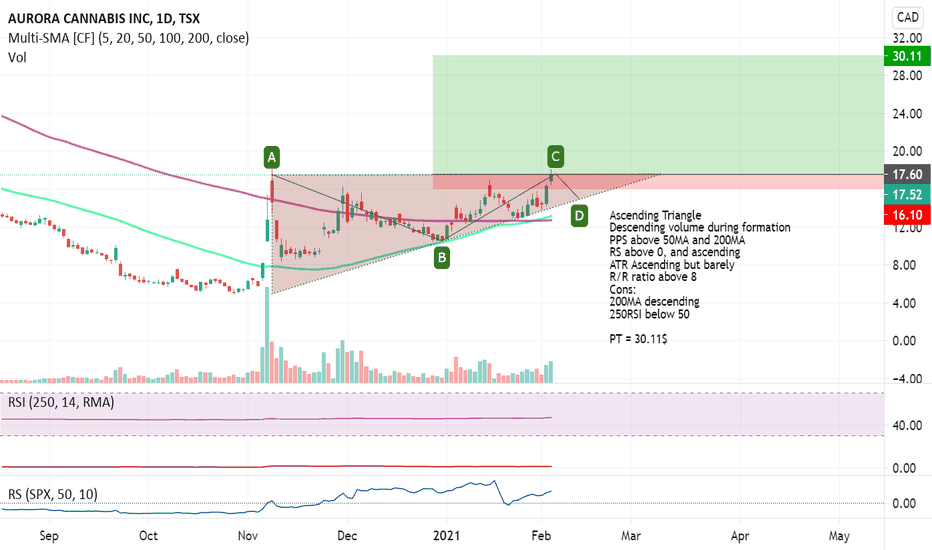

ACB Possible Long OpportunityPossible long entry here.

Critical Support level at the .618, historically a great and proven buy/sell level with this particular stock.

A daily candle close above $13.54 would be an even stronger indication of strength.

A move up will help complete the golden cross for further confirmation.