25M trade ideas

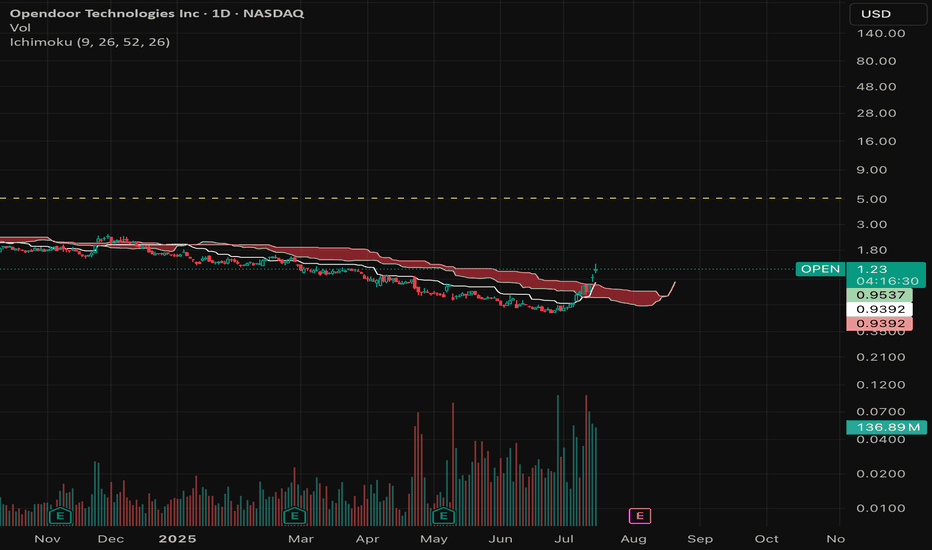

Trump firing Jerome is bullish for $OPEN - Trump firing Jerome is bullish for physical assets like real estate, gold, materials.

- Trump would most likely appoint a FED chair which will lead to lower interest rates.

- Lower Interest rates (Macro tailwinds) + Improving business model (fundamentals) + technical breakout = 🚀

Opendoor Technologies | OPEN | Long at $0.60Opendoor Technologies $NASDAQ:OPEN. This is purely a swing trade for a company that has been posting declining earnings and revenue since 2022 and does not anticipate becoming profitable in the next 3 years. Since the stock is now under $1, it's at-risk of being delisted from the Nasdaq. I am entering this play because there is a chance the recent price hit near $0.50 may be a temporary bottom and there is enough short interest (near 18%) for a spike near its book value of $1.00. Quick ratio is 0.75 (i.e. company may have difficulty meeting its short-term obligations without selling inventory or acquiring additional financing). While the company may be forced to do a split (a major risk for this purchase), I can see other eyes viewing this as a potential "quick play" for a reversal near its book value.

At $0.60, NASDAQ:OPEN is in a personal buy zone for a swing trade.

Targets:

$0.87 (+45%)

$1.00 (+66.7%)

OPEN BUYBUY OPEN at .45 to .40, riding it back up to 2.45 to 5.40 as Profit Targets, Stop Loss is at .20!

If anyone likes mumbo jumbo long useless analysis, than this is NOT for you.

Also, if you are afraid of risk, failure, and want only a 100% sure thing, than

run as fast as you can from here and from the markets,

because it is definitely NOT for you.

WARNING: This is just my opinion of the market and its only for journaling purpose. This information and any publication here are NOT meant to be, and do NOT constitute, financial, investment, trading, or other types of advice or recommendations. Trading any market instrument is a risky business, so do your own due diligence, and trade at your own risk. You can loose all of your money and much more.

$OPEN ready to go bananasNASDAQ:OPEN

Looks killer across time frames. Bottomed out and sitting in the weekly buy zone w/ the 10/20 hma curling. Daily 10/20 a nubbin' away from flipping. TSI positive as well. Bullish daily divergence on 1/28. Algo can't stop spitting purple buy diamonds.

Macro: Worst housing market since the 90s. Trump has aways been a real estate guy, there's no way he won't pump the housing market at some point. He'll be relentless in pushing the Fed to lower rates. All wins for OPEN.

www.tradingview.com

Open Door Potential POPOpendoor is publicly traded on the NASDAQ under the symbol OPEN. Its stock performance often reflects factors such as housing market trends, interest rates, and competition within the proptech and real estate industries.

The company has experienced volatility, particularly due to the cyclical nature of the real estate market and external economic factors like inflation and mortgage rate changes. Investors view Opendoor as a disruptive player in the real estate space with significant growth potential, albeit with risks tied to market conditions.

Currently, price has broken out of a year long consolidation falling wedge pattern, which can signal a bullish breakout if we manage to hold price above $2.

Additionally, Open Door could potentially rally in the near future due to several factors, including:

1. Recovery in the Housing Market

If the real estate market stabilizes or improves, Opendoor could benefit from increased transaction volumes and home price appreciation. Lower mortgage rates or government policies that boost housing demand might also drive a rebound.

Here are additional reasons why Opendoor (OPEN) stock could potentially rally:

2. Improved Financial Performance

If Opendoor demonstrates better-than-expected earnings, reduced losses, or achieves profitability sooner than anticipated, investor confidence could drive the stock higher. Cost-cutting measures or increased operational efficiency may also contribute.

3. Expansion of Market Share

Opendoor's ability to capture a larger share of the real estate market by expanding into new cities or increasing its customer base can be a catalyst for growth. Enhanced marketing or improved user experience might help attract more buyers and sellers.

4. Partnerships and Innovation

Strategic partnerships, such as integrations with other proptech companies, lenders, or real estate agencies, could bolster its platform's value. Innovations in its technology or services, such as enhanced AI for pricing accuracy, may also attract more users.

5. Positive Economic Data

Macroeconomic factors like declining interest rates, increased consumer confidence, or higher housing demand could positively impact Opendoor’s business and outlook.

6. Regulatory Changes Favoring Proptech

If regulatory changes make real estate transactions easier or more digital-friendly, Opendoor could benefit from accelerated adoption of its platform.

7. Short Squeeze Potential

Opendoor has occasionally been a target of high short interest. A strong earnings report or other positive news could trigger a short squeeze, pushing the stock price up sharply.

8. Acquisition Speculation

The company’s unique position in the iBuyer space could make it an attractive acquisition target for larger tech companies or real estate players looking to expand their digital footprint.

9. Investor Sentiment and Momentum

Positive analyst upgrades, increased institutional buying, or heightened retail investor interest (e.g., via social media platforms) could contribute to a rally.

I will be taking a long trade entry here on this stock with a stop below the gap zone under $2.

Only time will tell how this one trends.

OPEN - Possible Cup & Handle Pattern Forming?OPEN ( NASDAQ:OPEN Opendoor) Looks to Print a Possible Cup & Handle Pattern which is Bullish.

Should this pattern execute, I have plotted the potential Price Value Area Targets and shown the Upside.

Remains a Risky Trade or Investment, however the Macro Factors of a Lower Prime Rate % should support this Strategy.

As always, please get a few outside Expert's Advice before taking Trade or Investment Decisions.

Should you appreciate my Chart Studies, Smash That Rocket Boost Button. It's Just a Click away.

Regards Graham.

OPEN - Falling Wedge on the Daily ChartThe price has been fluctuating within a broad range but shows a general downward trajectory as indicated by FALLING WEDGE. There's a noticeable struggle to break above the supply zone, suggesting that any rally towards this zone might be met with selling pressure.

OPEN - OPENDOOR - come back of real estate namesAs we gear towards the rate cuts, I think some of the worst impacted companies from high interest environment finally do a turn around and comeback. Barring a recession, a soft landing and signalling data, could make OPENDOOR an interesting play.

Price is moving down inside a very clear channel. We took out previous low, sweeping the liquidity and sell side stops. A good NFP and CPI data, can push easily OPEN to 2. And if Fed signals end of the month rate cuts, easily 3-4 in a couple of months before election worries settle in.

Ideal entry in FVG shaded area, 1st entry, add to the position when channel is broken to the upside. 2 Buyside are targets, 1st to take partial profit, 2nd to close position. Do not forget trailing stop.

Opendoor TechnologiesHello dear traders!

Today, I want us to analyze Opendoor Technologies on a weekly timeframe, which shows a beautiful ascending pattern indicating its goal of completing the liquidity sale, followed by a spectacular upward movement. It is a simple and fluid analysis. Thank you for your collaboration.

#SmartMoneyConcepts

#Liquidity

#Hunter

OPENDOOR bounceThe stock seems to be in a channel that is ascending. The STC Indicator shows that the market is in oversold conditions. A buy signal was detected using harmonics. The momentum appears to still be on the short side, but a bounce may occur to bring the stock back up into the channel. The stock is currently at the fib 50% ratio and may bounce from this support level. If bad news breaks out, OPEN can fall with the rest of the market and breakout from the channel to reach lower lows.

OPENDOOR - CHANCE FOR A BOUNCE The STC Indicator shows signs of this stock being oversold. The graph shows a channel that the stock may have fallen into. The overall trend currently is still on the downside but a harmonic pattern printed as a buy signal. The Fibonacci retracement tool indicates this stock has retraced to the 50th percentile and bounces can occur at such levels. If bad news happens and stocks plummet, generally, we can expect OPENDOOR to follow market trends as well.

RiskMastery's Breakout Stocks - OPEN EditionWelcome to RiskMastery's Breakout Stocks - Stocks with breakout potential.

In this edition, we'll be looking at NASDAQ:OPEN ...

I believe this code is at a point of potential volatility.

If price can hold above $3.56 ... Bullish potential may be unlocked.

My key upside targets include:

- $4.21 (Conservative)

- $5.05 (Medium)

- $6.52 (Aggressive)

If however price falls below $2.87 ... Bearish risk potential may be unlocked.

(My key risk targets - C, M,& A - are as noted on the chart)

Enjoy, and I look forward to being of further service into the future.

If you'd like to connect, feel free to reach out and comment below.

Mr RM | Risk Mastery

Disclaimer:

This post is intended for educational purposes only - Publicly available RiskMastery information & content is not intended to be financial advice in any shape or form. Please do your own research and seek advice from a licensed professional before acting on any of the information contained within this post. This post is not a solicitation or recommendation to buy, sell or hold any positions in any financial instrument. All demonstrated trades are merely incidental to the educational training RiskMastery aims to provide. You are solely responsible for your own investment and trading decisions, of which should be made only according to your own opinion, knowledge and experience. You should not rely on any of the information contained on this site or contained in any RiskMastery material on any website or platform. You assume the sole risk of any trade or investment you elect to make. RiskMastery and affiliates shall not be liable to you for any monetary losses or any other damages incurred directly or indirectly, from your use, reliance or reference of RiskMastery materials, content and educational information. Thank you for your understanding and cooperation - We look forward to working with you into the future to navigate the fine line of trading and investment success.

$OPEN Approaching Resistance at $5.30Opendoor Technologies has broken the falling trend channel in the medium long term and reacted strongly up. NASDAQ:OPEN is approaching resistance at 5.30 dollar, which may give a negative reaction. However, a break upwards through 5.30 dollar will be a positive signal.

The short term momentum of the stock is strongly positive, This indicates increasing optimism among investors and further price increase for Opendoor Technologies.

OPEN Opendoor Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of OPEN Opendoor Technologies prior to the earnings report this week,

I would consider purchasing the 2usd strike price Calls with

an expiration date of 2023-11-10,

for a premium of approximately $0.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Open door Technology Inc: unravel the hidden gemOpendoor is one of the most prominent companies, leveraging technology to streamline the home buying and selling process.

Opendoor has several growth opportunities that it could pursue to drive future revenue and earnings growth. One such opportunity is to expand its geographic footprint by entering new markets. The company operates in over 40 markets across the United States and plans to expand into additional markets in the coming years. This could help the company increase its revenue base and market share in new regions.