2BH trade ideas

HCA Please excuse the sloppiness of my chart. Doing this off my phone so not the ideal situation. An interesting chart. HCA, the largest for-profit hospital system in the US. You can see since COVID-19 the price has shot up over 300%. Currently looks to be consolidating and breaking this rather steep uptrend. Hasn't quite reached the 1.618 fib but very close. RSI also losing strength. I can see it pushing higher to 290 or $300 but wouldn't expect much past that. Possibly heading towards a very nasty correction. Overall, if it does break down I could see over a 50% decrease back down near the $130 range. Some interesting news as well with I believe the VP having sold a large amount of stock recently...

HCA pressuring to break all-time-highHCA is consolidating after a large move up.

Buying pressure came in on 25th of June 2021 and set $204 as support. Since then buying volume has decreased but not by a lot. That's why HCA is positioning it self for a breakout.

Looking at the longer time-frames, it's showing a clear up trend and it's also expected to grow its earnings-per-share over the coming year.

Looking at the price-action HCA may come back to retest the $212.50 to $214.30 region before making a move higher.

A break below $212.50 could send the price to retest the support of $200.

Final Thoughts:

* Good long term hold

* Pays dividends

* Buying pressure from June 25th, 2021 set $204 as a solid support pushing the price higher

Two things you can do from here if you want to trade this

* Look for buying opportunities around $212.50 and $214.30

* Wait for a clear break of $217.36

* A break and close below $212.50 may negate the immediate bullish outlook

HCA to buy after a retracement? HCA is one of the stocks to look at after the Biden election. Indeed, one of the strengths of his program is the healthcare policy proposals that aim to create a Medicare-like public healthcare option.

The price has tested the resistance at 152$ and looking at Bollinger bands it went out of the channel. Furthermore, RSI is about to reach the overbought zone (also Stochastic). Therefore, I think that it is appropriate to wait before opening a long position. A good price to buy HCA stocks would be between 133 $ and 140 $ that is between Fib retracement of 0.3 and 0.6. The price here should also be supported by the SMA 50.

Moreover, looking at the last week's volumes ( 2h or 4h), it is possible to notice that they decreased. That can increase the probability of a retracement in the short term.

Another more conservative strategy may be to wait for a candle that strongly breaks the resistance.

what's your thought

My HCA HEALTHCARE INC VisionHello traders, HCA HEALTHCARE INC gives a bearish signal, buyers reject a large volume of sales and we are on an upward trend support. We will break the trend to look for the last precedent lower, to start again on the rise.

Buyers have a great likelihood of breaking out of the equilibrium zone, as we are going to be in more than half of the zone, if the buyers are ready to pay we can reach the top of the new equilibrium zone.

Please LIKE & FOLLOW, thank you!

HCA Daily Range PlayHCA is giving us some simple stops and profit taking levels. We're nearing a resistance at ~145, which is followed by another at 147. Giving us a clear line to short with an easy stop to place. Coming down, we have 3 major support levels we have to pass/hit. The POC, 119 and lastly 116. A potential play would be shorting until the POC, exiting and securing profits. Watching for a break on the POC, re-enter and set your stop above the POC and ride it to the next support level. Obviously holding and riding through POC will yield greater profit, but comes with a risk of a bounce back to resistance.

HCA: HCA Healthcare Swing 6/7% (or long term investment)Happy Fourth of July, the most American way to celebrate is profiting off healthcare.

HCA Healthcare is the largest publicly traded healthcare system in the United States.

Has the scale to swallow non-profits and small scale hospitals across the United States.

Limits loss caused by Medicare and Medicaid patients by operating hospitals only in economically sound urban areas.

Focused on regions with higher median age such as Florida.

Combatting nursing shortage with a majority stake in Galen Nursing College.

Lots of debt but high cashflow limits the risk.

TA:

Weekly MACD Cross

Weekly 50ma

Fell in April due to UNH earnings concerns (nothing changed fundamentally)

Trading within a channel since December

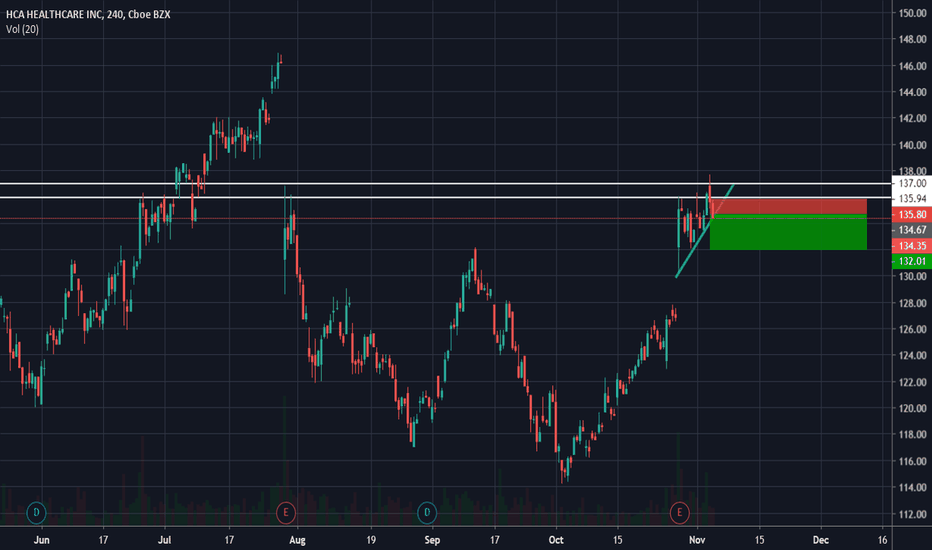

Took an initial position April 23rd added more at 135.15. Looking to sell some at 144.00 and hold the rest for long term investment

Finally Happening! It took a long time to start, but it finally did. The market sharply raised after we had a severe decline in late 2018. I was and I am still concerned that this sharp upwards move might be an empty one, meaning nothing fundamentally has changed about the market. Here we have one of the early tickers that has started its downward journey. The price has formed a Broadening Top pattern. Not being able to make any further upwards progress, the price forms another pattern, Multiple Tops, that indicates exhaustion in buys. And this happens today; the price dives down by 10%. If we close around the same price level today, the price has finally broken the Broadening Top pattern from the downside. I will keep watching it until the end of this trading session. I will go short if the price remained below ~$115.00. My best guess is that the price continues down to ~$90.00, but I will use trailing stops in case I was wrong...

Stay profitable!

Long HCA following expanded flat correctionHCA broke higher out of a parallel trend channel in early 2018, rallying from $100 to $140 before entering a correction. The price action from the October 2018 high appears to be a flat correction, which is a common Elliott Wave pattern following strong impulsive moves.

In this type of correction, Wave A is a three wave counter-trend move followed by a three wave rally in Wave B. It is referred to as an "expanded flat" when Wave B makes a new high, as it has done in this case. The final leg of the correction is a five wave move lower in Wave C, which is often confused for the start of a new impulsive sell-off.

From the Wave C low, we can clearly see a five wave rally higher into the previous high. We're considering this a resumption of the long-term trend, which presents an opportunity to get long on a pullback into Fibonacci support between $130 and $135. Initiating a long position at market and looking for price to make new highs in coming weeks.

The trading system Equity Trend to go long in HCA stockThe equity trading system Equity Trend will open a long position in HCA Healthcare (ticker: HCA) today at the market open - December 3

Stock:

- Long - HCA Healthcare - Ticker: HCA

Each day, the system scans around 10,000 stocks to find just 1 or 2 which are ready to move immediately.

The system combines elements of breakout trading, trend following and risk management from Turtle trading.

System: bit.ly