33L trade ideas

LULU - Q2 Earnings ExpectationLululemon had an incredible rally last week heading closer into earnings but sold off about 13% from the top. There was support found around the $346 level. We suspect that this is just a pullback.

We played the run up last week luckily took profit on our short term 2 day swing trade.

We are still bullish heading into Q2 earnings report.

WHY?

Ecommerce. Q2 was one of the best times for digital advertising. CPM on any major ad platforms were as low as 2017 and it was easy for many brands to scale their businesses online.

LULU as one of the leading retailers might surprise a lot of investors with an incredible earnings beat. We'll have to see if their online sales were able to overcome physical store closures.

Due to risk of volatility we're holding onto OTM calls expiring in OCT/NOV 2020.

Good luck traders.

*NOT A FINANCIAL ADVICE, THIS IS JUST OUR PERSPECTIVE AND WE DO NOT RECOMMEND ANY TRADES WE PUBLISH ON OUR CHANNEL. YOU WILL LOSE MONEY.

$LULU - Earnings on the 8th AMCSELL -1 IRON CONDOR LULU 100 (Weeklys) 11 SEP 20 387.5/397.5/387.5/377.5 CALL/PUT @9.20 LMT

Try to build it yourself. And keep the Risk less than $100.

For every $80 Risk. You have a potential to make to $150 (Realistic targets).

Another earning trade. Betting this wont have a severe move.

The Perfect IRC

Bull Flag Trying to break outLULU looks to be trading in a bull flag pattern with break out at 215.5 Has fallen out of rising wedge pattern which can be bearish..so I feel safer to trade it.

Target 1: 385 to 400

Target 2: 480 to 520

My stop would be under 284/we all have a different tolerance, then I would move it as she rolls.

Be safe and good luck!

LULU - 8.49% Potential Profit - Ascending TriangleClear uptrend Support with an Ascending Triangle formed within.

Target price set at a new potential resistance line.

I suggest entering with a Buy Limit order. If limit is not triggered, I wouldn't chase the run.

- Historical uptrend

- RSI + Stoch well above 50

- MACD above Signal.

Suggested Entry $332.94

Suggested Stop Loss $326.66

Target price $361.20

Note that I tend to adjust stop losses in order to secure profits early and preserve capital. This means that the target price is going to be achieved as long as there are no strong pullbacks that trigger my new adjusted stop loss.

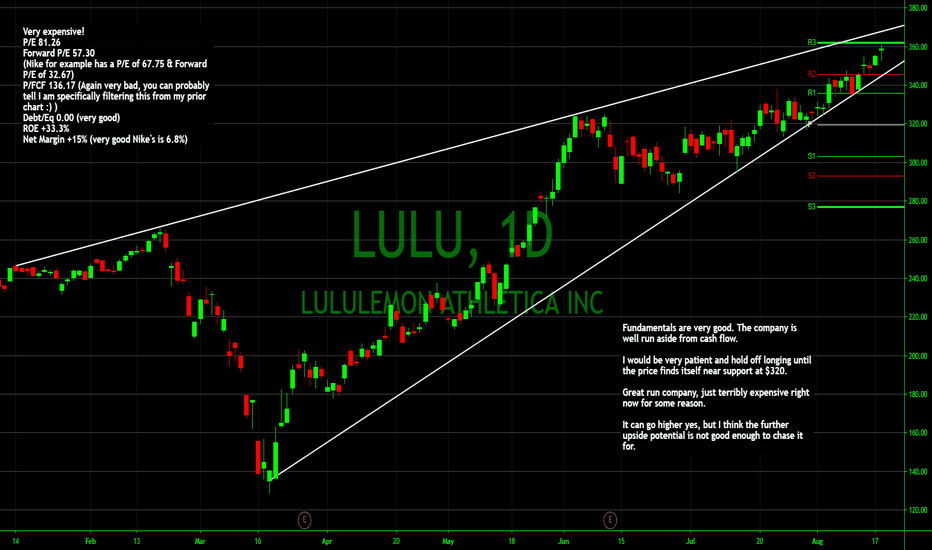

Analysis on Lululemon Athletica - a Canadian Retail CoFundamentals are very good. The company is well run aside from cash flow.

I would be very patient and hold off longing until the price finds itself near support at $320.

Great run company, just terribly expensive right now for some reason.

It can go higher yes, but I think the further upside potential is not good enough to chase it for.

Options trade LULU LULU has been on tear lately but a bit under analyst average price ratings.

It has had a double top and broke though it.

I did an options trade for expiry date of Dec 18th, 2020, 1 contract call option at strike price of $350.

If I watch the share price continue to rise, I will keep the option until such time that momentum dies down and it starts to dip. I am keeping an eye out for the earnings in August as well. I am thinking it will reach 340ish and start to dip a little bit.

LULU - Breakout$LULU

Flag and rectangle breakout.

I will place a buy above rectangle box around 326 for a 25 $ move minimum being height of box.

If results are good during this move then flag target possible. Another 50 to 25 $

on the whole a good setup.

Also check out ABT. similar looking chart setup.

LULU Potential Long SetupLULU longs fought hard to take out that 325 level, and their award is a new base of support. As LULU consolidates over 325, it could possibly see a strong upward move to confluency at 350. The moving averages are in consensus for an upside move.

Fundamentally, LULU is undervalued at current prices, with new analyst price targets showing a $355 estimate.

Bulls need to hold 325 for this move to sustain.