ETN - Break Previous HighHello Everyone,

This is the 3rd one that i would like to mention.

What they do?

Eaton Corporation focuses on solving challenges in electrical, aerospace, hydraulic, and vehicle products (including eMobility) through its power services. These products promote efficiency and safety for industry usag

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

9.20 EUR

3.66 B EUR

24.03 B EUR

390.46 M

About Eaton Corporation, PLC

Sector

Industry

CEO

Paulo Ruiz

Website

Headquarters

Dublin

Founded

2012

ISIN

IE00B8KQN827

FIGI

BBG000F51MS1

Eaton Corp. Plc is a power management company, which provides energy-efficient solutions for electrical, hydraulic, and mechanical power. It operates through the following segments: Electrical Americas and Electrical Global; Aerospace, Vehicle, and eMobility. The Electrical Americas and Electrical Global segments engage in sales contracts for electrical components, industrial components, power distribution and assemblies, residential products, single and three phase power quality, wiring devices, circuit protection, utility power distribution, power reliability equipment, and service. The Aerospace segment supplies aerospace fuel, hydraulics, and pneumatic systems for commercial and military use. The Vehicle segment deals with the design, manufacture, marketing, and supply of drivetrain and powertrain systems and critical components that reduce emissions and improve fuel economy, stability, performance and safety of cars, light trucks and commercial vehicles. The eMobility segment designs, manufactures, markets, and supplies electrical and electronic components and systems that improve the power management and performance of both on-road and off-road vehicles. The company was founded in 1911 and is headquartered in Dublin, Ireland.

Related stocks

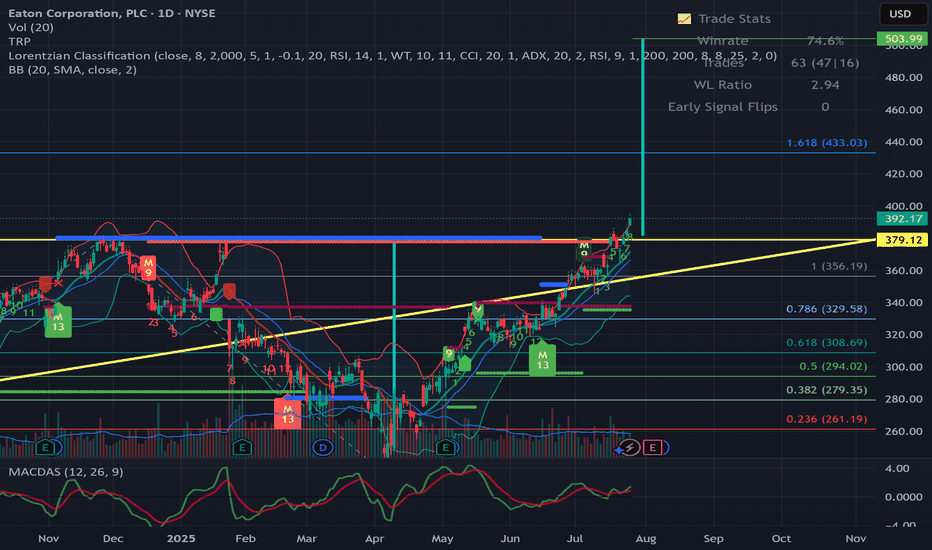

Eaton Corporation ($ETN) – Strong High in Sight, Structural ExpaNYSE:ETN has officially broken out of its multi-month compression range, reclaiming key BOS zones and leaving behind a clear discount-to-premium trajectory. With demand reestablished near equilibrium and strong follow-through volume, we’re now eyeing a run toward the structural high at $422.46.

🔍

Trade Idea: ETN (Eaton Corporation) - Breakout OpportunityTicker: ETN (NYSE) | Sector: Industrial/Energy Infrastructure

📈 Trade Setup

Entry: $340.5 (Current price near breakout level)

Stop Loss: $315 (-7.5% from entry)

Take Profit: $391.68 (+15% upside)

Risk/Reward Ratio: 1:2

🔍 Technical Analysis

Trend & Momentum:

Daily Chart: Strong uptrend (Higher

ETN: Bullish Cup & Handle Pattern Targets All-Time HighsOverview:

On the daily timeframe (D TIMEFRAME), ETN appears to be forming a well-defined Cup and Handle chart pattern, a classic bullish reversal and continuation pattern. The price has recently completed the "cup" formation and is currently consolidating within what appears to be the "handle," rig

ETN - Increased Probability of AppreciationThe Fibocloud configuration indicates an increased probability of appreciation towards the first target. The final target should be tested, provided the stop loss is properly repositioned at the time of the first partial realization.

If this projection is confirmed and a partial realization occurs

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ETN4539190

Eaton Corporation 3.915% 15-SEP-2047Yield to maturity

6.04%

Maturity date

Sep 15, 2047

ETN5463662

Eaton Corporation 4.7% 23-AUG-2052Yield to maturity

5.69%

Maturity date

Aug 23, 2052

ETN4071733

Eaton Corporation 4.15% 02-NOV-2042Yield to maturity

5.69%

Maturity date

Nov 2, 2042

ETN.GW

Trinova Corp 7.875% 01-JUN-2026Yield to maturity

5.39%

Maturity date

Jun 1, 2026

ETN.HC

Eaton Corporation 5.8% 15-MAR-2037Yield to maturity

5.01%

Maturity date

Mar 15, 2037

ETN.GY

Eaton Corporation 5.45% 15-OCT-2034Yield to maturity

4.88%

Maturity date

Oct 15, 2034

ETN.GZ

Eaton Corporation 5.25% 15-JUN-2035Yield to maturity

4.66%

Maturity date

Jun 15, 2035

ETN5463660

Eaton Corporation 4.15% 15-MAR-2033Yield to maturity

4.57%

Maturity date

Mar 15, 2033

ETN4071735

Eaton Corporation 4.0% 02-NOV-2032Yield to maturity

4.54%

Maturity date

Nov 2, 2032

EV6071217

Eaton Capital Unlimited Company 4.45% 09-MAY-2030Yield to maturity

4.32%

Maturity date

May 9, 2030

ETN4539192

Eaton Corporation 3.103% 15-SEP-2027Yield to maturity

4.06%

Maturity date

Sep 15, 2027

See all 3EC bonds

Frequently Asked Questions

The current price of 3EC is 334.20 EUR — it has decreased by −2.45% in the past 24 hours. Watch EATON CORP.PLC DL -,01 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange EATON CORP.PLC DL -,01 stocks are traded under the ticker 3EC.

3EC stock has risen by 2.39% compared to the previous week, the month change is a 11.33% rise, over the last year EATON CORP.PLC DL -,01 has showed a 19.19% increase.

We've gathered analysts' opinions on EATON CORP.PLC DL -,01 future price: according to them, 3EC price has a max estimate of 374.08 EUR and a min estimate of 231.64 EUR. Watch 3EC chart and read a more detailed EATON CORP.PLC DL -,01 stock forecast: see what analysts think of EATON CORP.PLC DL -,01 and suggest that you do with its stocks.

3EC stock is 2.51% volatile and has beta coefficient of 1.47. Track EATON CORP.PLC DL -,01 stock price on the chart and check out the list of the most volatile stocks — is EATON CORP.PLC DL -,01 there?

Today EATON CORP.PLC DL -,01 has the market capitalization of 130.69 B, it has increased by 0.57% over the last week.

Yes, you can track EATON CORP.PLC DL -,01 financials in yearly and quarterly reports right on TradingView.

EATON CORP.PLC DL -,01 is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

3EC earnings for the last quarter are 2.51 EUR per share, whereas the estimation was 2.50 EUR resulting in a 0.53% surprise. The estimated earnings for the next quarter are 2.48 EUR per share. See more details about EATON CORP.PLC DL -,01 earnings.

EATON CORP.PLC DL -,01 revenue for the last quarter amounts to 5.89 B EUR, despite the estimated figure of 5.78 B EUR. In the next quarter, revenue is expected to reach 5.87 B EUR.

3EC net income for the last quarter is 891.07 M EUR, while the quarter before that showed 937.96 M EUR of net income which accounts for −5.00% change. Track more EATON CORP.PLC DL -,01 financial stats to get the full picture.

Yes, 3EC dividends are paid quarterly. The last dividend per share was 0.92 EUR. As of today, Dividend Yield (TTM)% is 1.04%. Tracking EATON CORP.PLC DL -,01 dividends might help you take more informed decisions.

EATON CORP.PLC DL -,01 dividend yield was 1.13% in 2024, and payout ratio reached 39.58%. The year before the numbers were 1.43% and 42.88% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 94 K employees. See our rating of the largest employees — is EATON CORP.PLC DL -,01 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. EATON CORP.PLC DL -,01 EBITDA is 5.49 B EUR, and current EBITDA margin is 23.26%. See more stats in EATON CORP.PLC DL -,01 financial statements.

Like other stocks, 3EC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade EATON CORP.PLC DL -,01 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So EATON CORP.PLC DL -,01 technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating EATON CORP.PLC DL -,01 stock shows the buy signal. See more of EATON CORP.PLC DL -,01 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.