3HM trade ideas

$MSCI looks like stable growth is set to continue. The CEO appeared on CNBC today and discussed the fact that he has refused to sell any shares on the advice of his board, his reason for doing so that his belief that it will double or treble in value in the years to come. Of Course we can't dismiss the possibility of him talking up the stock but the company is very specialised and has good growth.

Currently sitting between its 200 & 50 day moving average a break up could be very rewarding with a march back to $250.

P/E ratio 33

Average analysts price target $244 | Overweight.

Company Profile

MSCI, Inc. engages in the provision of investment decision support tools, including indices, portfolio risk and performance analytics and corporate governance products and services. The company operates through the following business segments: Index; Analytics; Environmental, Social, and Governance (ESG); and Real Estate. The Index segment involves in the index-linked product creation and performance benchmarking, as well as portfolio construction and rebalancing, and asset allocation. The Analytics segment offers risk management, performance attribution and portfolio management content, applications and services. The ESG segment offers products and services that help institutional investors understand how ESG factors can impact the long-term risk of investments. The Real Estate segment includes research, reporting, market data and benchmarking offerings that provide real estate performance analysis for funds, investors and managers.. The company was founded by Andrew Thomas Rudd in 1998 and is headquartered in New York, NY.

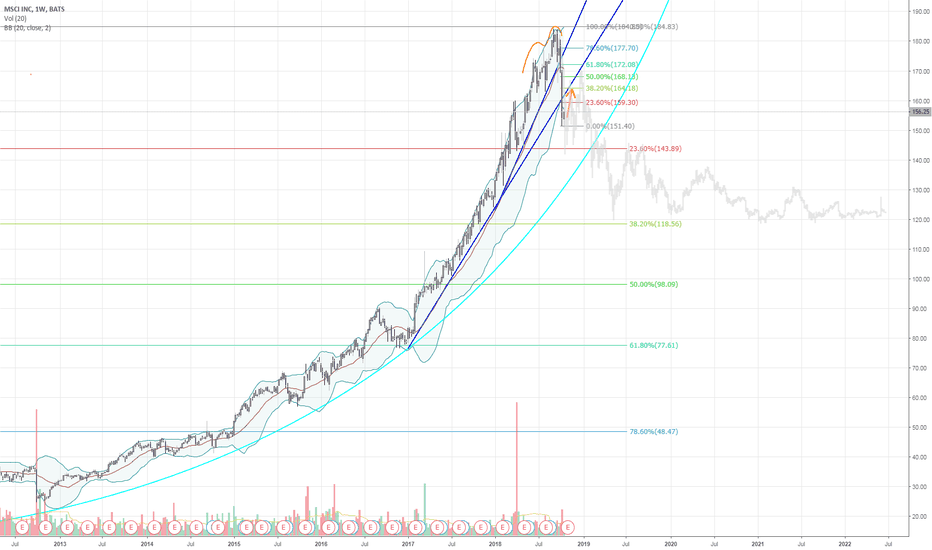

Parabolic Advance BrokenParabolic advance with a broken hypodermic trendline, much like whats been seen in Bitcoin, Gold, and other assets that have been through bubble cycles. Weekly Bollinger band M top, like the monthly ones we see on the DJI/S&P. Short above $160, expect a visit far lower maybe down to $120 first, the 38% macro bull retracement for starters. Good luck!

Real-Estate Not Looking Good? Buy $DRV (Elliott Wave Analysis)What is this chart? This is the Real-Estate Investment Trust (REIT) $MSCI it is the underlying asset for the 3xLeveraged Short Real-Estate ETF $DRV.

Why is it important? Because if you buy $DRV during a housing market crash you can make some pretty insane returns, and if you look at the Elliott Wave count (unconfirmed) you will see that $MSCI has possibly just completed Wave-c of an Extended Zigzag. Since it also ended with a terminal impulse it means that at a minimum Wave-c needs to be completely retraced but since we are completing an extended zigzag, and we are most likely in a triangle, it is highly unlikely that we'd retrace ALL of the entire zigzag because, based on my stock market count, we are in the 2nd "Three" of a major correction that started in 2000.

What does this mean? It means that if my chart is correct the Real-Estate market, and the US Economy, is about to collapse. The process will be slow and painful but this is a perfect starting point for it., the stock market is also reaching a nice high at this point it has basically triple topped. It seems like my related chart will probably continue to be right and the stock market growth will pretty much come to a halt and then the whole market will fall through the floor after about a year. I except there to be blood in the streets by the end of this. It will be at least as bad as 2007-09.

So how do we know if this chart is right? Well first of all it's still extremely speculative (lower probability), if you wait for it to first break the lower yellow line, and then to break the red and blue lines, it will have more or less confirmed the Wave-c impulse and also the entire Zigzag. If you wait until the blue line there is still plenty of profit left but you did miss out on quite a bit (especially on $DRV) so it may be a good idea to take the risk of being wrong and start moving capital into this trade now. Since Wave-c ends on a terminal it needs to retrace the terminal in 50% or less time it took, and typically its much faster than that. This means that if this chart does end up being right the housing market (and in particular $MSCI) is going to crash very fast and very hard within the next year.

How do we know if this chart is wrong? Well this would be the tippy top so if it moves up even a little bit from here it would be a good idea to stop-out and wait for a break down before taking this trade. That means that if you take the trade now on $DRV your R/R is over 1:1000. If you wait until there's a break down your R/R isn't quite as fantastic but the probability that this chart is correct increases substantially because it eliminates any other possibilities I may have overlooked.

Remember that $DRV is the big play here. The gains made from shorting $MSCI are nothing compared to what $DRV could be worth in a recession. The only reason we look at $MSCI is because it is the underlying asset for $DRV and because it's wave patterns are much more clear. Again this is a very speculative and risky trade at this point it's definitely not recommend that you get overly aggressive until this trade has more confirmations!

The clouds are definitely dark over Cyclical City, I would be seriously cautious about being invested in housing and anything that is cyclical in nature for the next couple of years. The market has had a good run for the last 7 years but now it looks like its time for the cycles to change and for the Economy to once again enter into a bearish period.

MSCI trending higher (earnings due later this week)MSCI has been a good preforming stock over the last few months. It broke the 2010 high ($40.79) in late 2013 but retested this zone three times before beginning its latest trend up.

It was not until the break of the 2014 high (in early 2015) that it became of interest - which coincided with a break above the $50 half figure. The March pullback (to the 50sma) was not too deep and now we see price moving higher and further away from this moving average.

More recently we saw a double bottom formation on the daily chart (using $60 as support) then, two days ago, a bullish breakout bar. Both suggest further strength to the upside. However, with earnings due out on Thursday it is worth standing aside until after this event before considering a buy position.