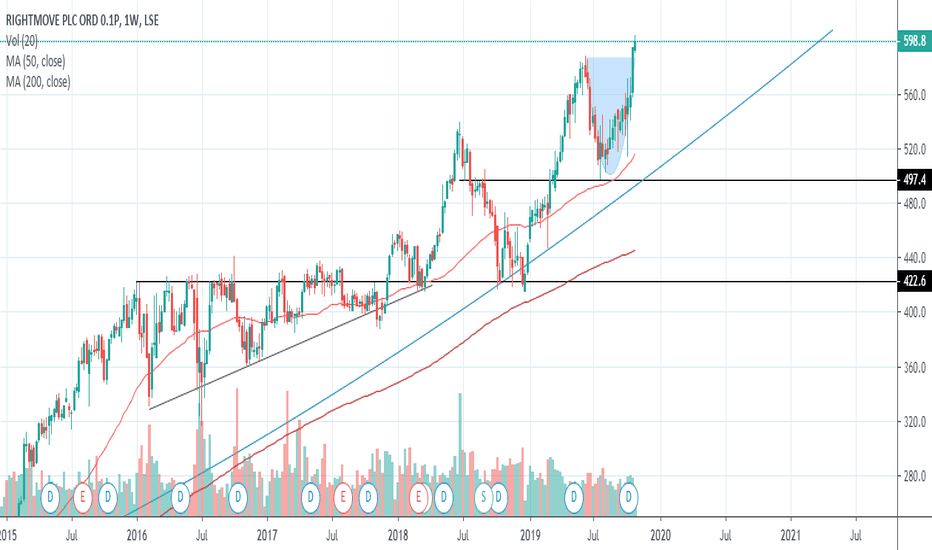

Rightmove Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Rightmove Stock Quote

- Double Formation

* A+ Set Up)) | Completed Survey | Subdivision 1

* 012345 | Valid Wave Count Configuration

- Triple Formation

* Retracement | Not Numbered | Subdivision 2

* Cup & Handle | Pattern Condition | Subdivision 3

* Daily Time Frame | Behavioural Settings Indication

Active Sessions On Relevant Range & Elemented Probabilities;

European Session(Upwards) - US-Session(Downwards) - Asian Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

3JDA trade ideas

Rightmove Long to Gap Fill #RMV Rightmove

Recent Trades :-

Date Time Trade Prc Volume Buy/Sell Bid Ask Value

14-Aug-20 18:45:01 617.11 25,000 Sell* 620.00 620.80 154.28k O

14-Aug-20 17:48:31 621.284 143 Buy* 620.00 620.80 888.44 O

14-Aug-20 17:18:55 621.40 1,934 Buy* 620.00 620.80 12.02k O

14-Aug-20 17:18:43 621.40 1,934 Buy* 620.00 620.80 12.02k O

14-Aug-20 17:14:28 619.752 930 Sell* 620.00 620.80 5,764 O

14-Aug-20 17:07:01 620.238 32,201 Sell* 620.00 620.80 199.72k O

14-Aug-20 17:06:55 619.884 9,389 Sell* 620.00 620.80 58.20k O

14-Aug-20 17:04:18 619.539 1,228 Sell* 620.00 620.80 7,608 O

14-Aug-20 16:47:32 620.374 39,179 Sell* 620.00 620.80 243.06k O

14-Aug-20 16:35:24 621.40 541,587 Buy* 620.60 621.40 3m UT

Currency GBX

Issue Country GB

Shares in Issue 873m

Market Capitalisation £5,425m

Market Size 3,000

52 Week High 708.00

52 Week High Date 11-Feb-2020

52 Week Low 373.10

52 Week Low Date 23-Mar-2020

Rightmove Stock Analysis - London Market PlaceBased on the below fundamental analysis and technical analysis (breakout of resistance) the idea is to go long

Good news for property owners from the Halifax Index meant investor confidence grew in the market.

Shares in property portal Rightmove (RMV.L) surged on Friday as investors looked past a fall in half-year revenue and instead focused on signs the housing market was coming back to life.

The half-year report showed revenue declined by 34% to £94.8m in the first six months of the year. Operating profit dropped 43% to £61.7m ($81m).

However, the stock jumped over 7% as chief executive Peter Brooks-Johnson flagged “record levels” of activity in the housing market since it reopened in mid-May.

Rightmove PLC 6 RRR shortTrading Methodology:

1. An asymmetric bullish/bearish pennant is drawn using ascending and descending curved trend lines with a minimum of three price action touche points per line. The direction is determined by the previous trend.

2. The angle tool is applied from the earliest two trend touch points, beginning at the earliest touch point.

3. A trend-based Fibonacci retracement triangle is drawn starting from the earliest trend touch point and ending at the earliest touch point of the opposite trend line .

4. Based on the degree, of the earlier defined angle, the appropriate (and secret) levels are selected for the fibonacci retracement ; two levels for stop-loss and two levels for take-profit. The closest stop-loss level to the current price level is the top priority stop-loss. Though the secondary stop-loss level is often chosen for some markets such as FX and some equities in order to account for seldom unexpected resistance breaks. The greater target level is the top priority, and where majority of the shares are sold, though some may choose to close part of the position at the first target level or set it to be the stop-loss once price exceeds it. Entries should be laddered in around the levels closest of the yellow line.

This trading strategy can be applied to any market and time frame, and positions most often garner the greatest risk-to-reward ratio with the highest success rate. What more can you ask for? I will only be posting my unique trading strategy until EOY. I work solely with price action to identify pennants and apply unique trend-based fibonacci retracement levels for SL and TP levels. Reach out to me if you have any questions.

Rightmove Making The Right MovesLast post: June 14th. See chart .

Review: Price had started trending strong after breaking through resistance.

Update: Price continues to trend to the upside and still looks strong.

Conclusion: We will be looking for long opportunities following the next breakout.

Any comments or questions, do not hesitate to leave them below. Give us the thumbs up if you share our sentiments!

Sublime Trading

Rightmove Still TrendingLast post: May 27th. See chart .

Review: Price had broken the resistance level and was approaching the £50.00 round number.

Update: Price eventually broke through £50.00 and has gained momentum.

Conclusion: We can look for entry opportunities after a breakout of a previous high on the daily timeframe.

Any comments or questions, do not hesitate to leave them below. Give us the thumbs up if you share our sentiments!

Sublime Trading

Right Move Is Making MovesThis stock is featuring for the first time on our TradingView blogs.

Current setup: Price is currently making new all-time highs but the £50.00 round could cause a bit of resistance for price.

Conclusion: We will be waiting for price to move above the £50.00 round number before looking for trading opportunities here

Any comments or questions, do not hesitate to leave them below. Hit agree if you share our sentiments!

Sublime Trading