5ZM trade ideas

$ZM Long Setup (Probabilistic Bias: Bullish)Chart: 1H | Framework: Smart Money Concepts + Fibonacci + ORB | Date: July 8, 2025

🧠 Technical Insight:

Zoom ( NASDAQ:ZM ) has reclaimed its Equilibrium Zone (around $78) after sweeping liquidity into the Discount Area and tapping a bullish Order Block near $76. A clear CHoCH (Change of Character) signals a potential structural reversal.

🔍 Key Levels:

Support Zone (Discount Area): $75.80–76.50

Equilibrium/POI Zone: $78.00

Target 1 (Fibonacci 0.786): $80.65

Target 2 (Fair Value Gap / 0.886): $82.71

Target 3 (Strong High / Supply): $84.00–85.00

Invalidation: Below $75.30

📊 Volume Spike on July 5-8 confirms active participation near lows—suggesting possible accumulation.

🌐 Macro Context:

Recent Fed comments hint at rate pause or mild easing, boosting tech sentiment.

AI adoption remains a long-term catalyst for enterprise SaaS solutions—beneficial to Zoom’s growth narrative.

Nasdaq leadership rotation may favor ZM’s mean reversion after underperformance.

🔥 Catalyst Watch:

Earnings expected late July—option flow may front-run results.

Monitor implied volatility and ORB breakout ranges (15-min 0930–0945) for intraday confirmation.

📌 Summary (VolanX Signal Score):

Trend Reversal Probability: 67%

Risk-to-Reward: 2.8R

Bias: LONG

Conviction: Moderate to High

📉 Not Financial Advice — For Research Purposes Only

#ZM #SmartMoneyConcepts #WaverVanir #VolanX #OrderBlocks #Equilibrium #TechStocks #Fibonacci #Liquidity #OptionsFlow #MacroUpdate #TradingView #EarningsPlay #ORBStrategy #CHoCH

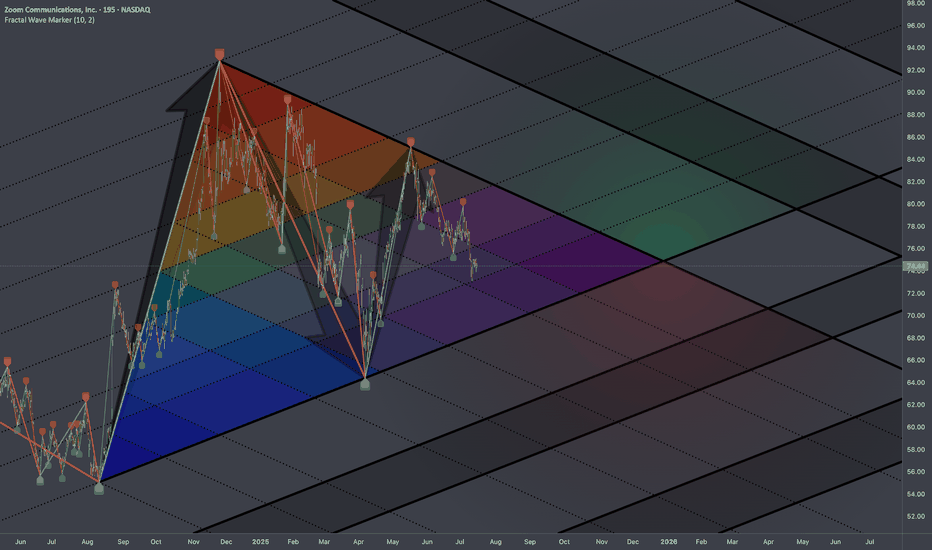

$ZM Ready to Fly — Macro Reversal in Play📈 NASDAQ:ZM Ready to Fly — Macro Reversal in Play

Timeframe: 1D | Date: July 8, 2025 | Powered by WaverVanir DSS + SMC + Fibonacci

Zoom ( NASDAQ:ZM ) is coiled at equilibrium after reclaiming key structure and defending the $75.58 level. We’re now positioned for a potential macro reversal targeting a multi-leg rally into the $97.84 zone (1.618 extension).

🔍 Technical Thesis

CHoCH Confirmed: Bullish shift in character post-accumulation

Order Block + BOS Alignment: Clear structure build from May’s low

Equilibrium Compression: Price consolidating at premium/discount boundary

Volume: Compressed + reset after post-earnings fade; volume profile supportive

Target Zones:

⚡️TP1: $80.65 (0.786)

⚡️TP2: $85.07 (1.000)

⚡️TP3: $97.84 (1.618 Extension)

Invalidation: Close below $75.58 = reassessment

🧠 Macro Context

Rates stabilizing, improving sentiment for beaten-down tech

Zoom potentially re-entering institutional rotation cycle

Options flow shifting bullish (see recent block activity on NASDAQ:ZM )

🚀 Bias: LONG

VolanX Signal Score: 73%

RR Potential: 4.1R

Conviction: High (on close > $77.50 with momentum)

This is not a trade—it’s a blueprint. We let structure lead, probabilities guide, and risk define our edge.

📛 Not Financial Advice – For Research and Strategic Education Only

#ZM #Zoom #SMC #OrderBlock #Fibonacci #BullishBias #VolanX #WaverVanir #TechnicalAnalysis #SmartMoney #LiquidityZones #BreakoutTrade #PredictiveSystems #TradingView

$ZM Bullish Setup — VolanX DSS ProjectionZoom ( NASDAQ:ZM ) has broken above structure with momentum and now retracing to equilibrium zones.

📈 Projected Wave Structure:

Targeting $88.35 (Fib 0.382 + SMC Premium Zone)

Potential pullbacks to $80.42 / $78.60 before continuation

Strong volume at lows signals accumulation

Liquidity sweep under CHoCH confirmed breakout leg

🔍 Key Levels:

⚡ Bullish re-entry: $77.50–$78.00 (Discount range)

🎯 Mid targets: $83.60 / $85.82

🚀 Final target zone: $88.35

📅 Timeline: Now through July 22nd, 2025

🔐 DSS + SMC alignment confirms this as a high-probability wave forecast

💡 Strategy: Long calls or butterfly lotto up to $85–88

#WaverVanir #VolanX #ZM #OptionsFlow #SmartMoney #TradingView #SMC

$ZM Swing Setup – Fib Expansion + Recovery Arc🔍 NASDAQ:ZM Swing Setup – Fib Expansion + Recovery Arc

Zoom is entering a Fibonacci golden arc setup, bouncing off key support ($75.60) and aiming for a multi-leg move back toward structural targets.

Trade Thesis: A successful reclaim of $85–88 range can propel NASDAQ:ZM to $105–109 with a final fib target of $122 if volume confirms.

Risk: Break below $72 invalidates the recovery arc.

🧠 WaverVanir DSS Score: 7.4/10

📌 Targets:

TP1: $85.00 (safe swing exit)

TP2: $96.24 (measured move)

TP3: $108.99–$122.53 (macro extension targets)

⚠️ SL: $72.30 | RR: 3.5:1 | Timeline: 30–60 days

#Zoom #ZM #Fibonacci #WaverVanir #Options #SwingTrade #AIQuant #TradingView

🔍 Chart Overview

Ticker: ZM (Zoom Video Communications, Inc.)

Timeframe: Daily

Chart Tools: Fibonacci retracement & extension levels, projected Elliott-style wave structure

📊 Current Price

Current Price: $77.57

Key Support:

$75.60 → Previous pivot low (likely acting as short-term support)

$72.30 → Golden Pocket zone (high probability bounce area)

Key Resistance Zones:

$85.00 → 1.0 Fib retracement (former high)

$88.35 → 61.8% retracement of previous drop

$96.24 → Full 100% retracement

$105.78 → 1.272 extension (strong resistance)

$109.01 → 1.618 Fib extension

🧠 Technical Structure & Path Forecast

A potential ABC impulse wave is drawn in red:

Leg A → Target ~$92–96 range (50–100% retracement zone)

Pullback (leg B) → ~$88–90 support retest

Leg C rally → Major resistance at $108.99, possibly extending to $116.91 or $122.53 in a blow-off top

Confluence Targets:

$105.78 (1.272 extension) aligns with a major Fib cluster and resistance zone

$109.01 (1.618 extension) also aligns with previous structural highs

Final target ~$122.53 (2.272 extension) is ambitious but possible under bullish macro conditions

⚠️ Risk Management

Stop-Loss (short-term): $72.30 (loss of this level invalidates the bullish thesis short-term)

Entry Zones:

Swing long: $75.60–$77.50 (ideal accumulation range)

Momentum entry: above $85.00 (break of structure)

Downside Risks:

Break below $72.30 opens the path to $67.00 and possibly lower

📈 Probabilities (Based on WaverVanir DSS)

Target Level Type Probability

$85.00 Local resistance 80%

$96.24 Measured move 100% 68%

$105.78 1.272 Fib extension 55%

$109.01 1.618 Fib extension 45%

$122.53 2.272 Fib extension 25%

ZM: Uncanny Feeling this is going to explodeStrategy Type: Debit Call Spread (defined risk, favorable skew)

Thesis: Price moving from $77 toward the $85–$93 liquidity zone

🧾 Setup Details (as of $77.76 spot)

📅 Expiry:

August 16, 2025 (standard monthly expiration – gives time for move to unfold post-earnings and macro catalysts)

⚙️ Structure:

Buy 80 Call @ ~$3.70

Sell 90 Call @ ~$1.10

Net Debit (Cost): ≈ $2.60 per spread

Max Profit: $10 spread - $2.60 cost = $7.40

Max Loss: $2.60

Break-Even: $82.60

📈 Profit Scenario

Stock Price @ Expiry P&L per spread

≤ $80 -100% loss (-$260)

$82.60 Break-even

$90 Max gain ($740 profit)

≥ $93.05 Full liquidity sweep – still capped at $90

🧮 Risk-Reward

R:R Ratio: 2.85:1

Probability of Profit (est.): ~42% (based on delta skew + chart breakout zones)

Implied Volatility Rank: Neutral-high (useful for buying debit spreads)

🛡️ Why Debit Spread?

Controlled risk — limited to your premium paid ($260)

Aligns with structure shift and price roadmap toward $85–$93

Selling 90C offsets premium and reduces theta decay

🪛 Adjustments

If ZM breaks above $80.65 with volume, consider adding a second spread or switching to long calls for momentum

If ZM fails to hold $75.72 key level, cut or hedge with short-dated puts (70P)

🔁 Alternate (More Aggressive) Play:

Buy August 85C outright

Cost ≈ $1.30

Break-even ≈ $86.30

Max reward: unlimited

Use if expecting strong earnings surprise or short squeeze

Zoom Communications ($ZM) – Discount Demand Zone Reversal in ProAfter an extended corrective move, NASDAQ:ZM has tapped into the 0.618–0.786 discount Fib zone around $75.72, aligned with BOS (Break of Structure) and CHoCH (Change of Character) signals. Price structure suggests a bullish reversal with upside targets of $87–$93 over the coming weeks.

🔍 Technical Overview (1H):

📉 CHoCH > BOS confirms early accumulation

🧊 Price swept weak low, reclaimed equilibrium

🟦 Demand zone defended at $75.72

🎯 Targets:

TP1: $82.71 (0.886 Fib)

TP2: $85.07 (1.0 Fib)

TP3: $89.95–93.05 (1.236–1.382 extension)

🤖 WaverVanir DSS Forecast (AI-Powered):

📈 15-Day Prediction: $79.99 (+3.9%)

🚀 30-Day Prediction: $87.35 (+13.5%)

🔵 Sentiment Score: 38/100 (recovering from bearish cycle)

🌐 Macro + Fundamental Catalysts:

Tech Rotation into Discounted SaaS Stocks: AI fatigue has redirected capital into cash-flow positive companies like Zoom.

Lower Treasury Yields: Easing yields support long-duration growth names.

Upcoming Earnings (Q2): Low expectations + short interest = potential squeeze on positive surprise.

Enterprise AI Integration: Zoom’s recent push into workplace AI could unlock new investor narratives.

Buyback Potential: Zoom has a strong balance sheet with buyback flexibility, increasing downside protection.

📌 Trade Plan:

🔹 Entry: $76.00–$77.80

🔻 Stop Loss: Below $75.00

🎯 Target: $87.00–$93.00

🛑 Invalidation: Loss of BOS and demand zone breach

✅ Bias: Bullish Recovery Setup

📆 Time Horizon: 15–30 days

📈 Style: Swing / Position

🧠 For educational purposes only – not financial advice.

🔗 Posted by WaverVanir_International_LLC

(APA7: TradingView, 2025)

Zoom (ZM) – Is There Upside Ahead?🔹 Analyst Expectations:

- Low Target: $75.00 (current price)

- Average Target: $91.64

- High Target: $115.00

🔹 Fundamental View:

- Zoom posted stronger-than-expected earnings, but the stock pulled back due to cautious revenue guidance.

- Financial health remains solid, and long-term demand for remote communication tools is stable.

- Analysts see potential upside, but the stock needs to regain momentum.

🔹 Technical Setup:

- Zoom is trading near strong support at ~$75.

- A break above $88-$92 could trigger more upside toward analyst targets.

- If support holds, there’s room for a 17-21% move up in the coming months.

💡 My personal target for Zoom is $88.50 which is the previous high, right before the earnings report, which as mentioned above, was positive! This represents a 17% growth opportunity in the short term.

Time to "ZOOM" back to winnings ways?On Thursday afternoon, the King Trading Momentum Strategy triggered alongside eleven other alerts, followed by five more on Friday. This flurry of signals doesn’t exactly indicate a “bearish” sentiment, but as always, the market has its unpredictable ways! With markets approaching all-time highs, I’ve been cautious, limiting my positions to just a few with low allocations in TNA, ADBE, PYPL, and XYZ.

When I analyzed Zoom (ZM), I noticed that it experienced a strong rally from July through the end of the year, gaining over 50%. Now, the key question is: has it finished consolidating, or is there more downside ahead?

Looking back to July, ZM’s performance suggests a classic bull flag pattern. It’s retraced to the 38% Fibonacci level, and during a two-hour window when the signal fired, the impressive “wick” formed caught my attention. Now, after a short-term pump, it’s retracing again, and I’m eyeing the 50% Fibonacci level as a potential entry point.

Unless Monday brings a major selloff due to concerns over the Fed meeting on Wednesday or the PCE data on Friday, I’ll likely use the usual morning volatility to position myself in this trade. Let’s see how this one unfolds!

The King Trading Momentum Strategy employs a robust combination of indicators: the 5 EMA crossing above the 13 EMA, RSI strength, favorable momentum measured by ADX+, and MACD confirmation. ZM, along with over 100 other equities, is integrated into this script with optimized backtested take-profit and stop-loss levels. Activating these parameters is as simple as checking a box (they’re off by default), making this strategy both powerful and user-friendly.

ZM - Looking for DirectionNASDAQ:ZM is currently trading below its 20-day MA and can enter the Ichimoku cloud. The volume is drying up. the next 10% upside is going to be a hard grind with supply zone in the range from 89-92. Its a tough trade and for the patient ones only. The fundamentals are strong. The technicals are now subject to market volatility. Enter if you are long; OR enter once it breaks the supply zone at 92.

Zoom Video Communications, Inc. - Bullish divergence*investment opportunity*

A 90% correction since late 2020 on the above 4 day chart. There now exists an excellent opportunity on this stock. Why?

1) Price action and RSI resistance breakouts.

2) Support and resistance, look left. Price action is on past support. Terrific.

3) Bullish divergence. Lots of it, as measured over a 100 day period.

Is it possible price action falls further? Sure.

Is it probable? No

Ww

Type: Investment

Risk: <=6% of portfolio

Timeframe: Act now

Return: Rather awesome. Will say elsewhere.

Stop loss: Will say elsewhere.

ZM Zoom Video Communications Potential BreakoutIf you haven`t bought ZM at the end of the giant falling wedge:

Now Zoom Video Communications (ZM) is currently showing a bullish pennant pattern, which is often a precursor to an upward breakout.

With the stock approaching the $72 level, a breakout could lead to a swift move higher, given the strong technical setup.

For speculative traders, buying the $72 strike price calls expiring this Friday at a $0.12 premium offers an appealing risk-reward ratio.

If ZM breaks above the resistance, these calls could rapidly gain value.

$ZM Looking to keep going strong in AI GameGonna let it come back down to cool off as its been on a tear for the month.

65 area or high 64ish and hold of it. I'll be looking to add a long position and run up for ER. It may even keep going as its already broke out of its trend.

Keep it on watch. Stay Dicspine.

ZOOM (ZM) bullish consolidation on weekly chartAfter its huge rally, Zoom has been hovering at around the same price rage for the past few weeks. When looking at the weekly chart, you can see a bull flag (inside bar) patter forming. The resulting move would take the stock roughly eleven dollars to the upside should it play out.