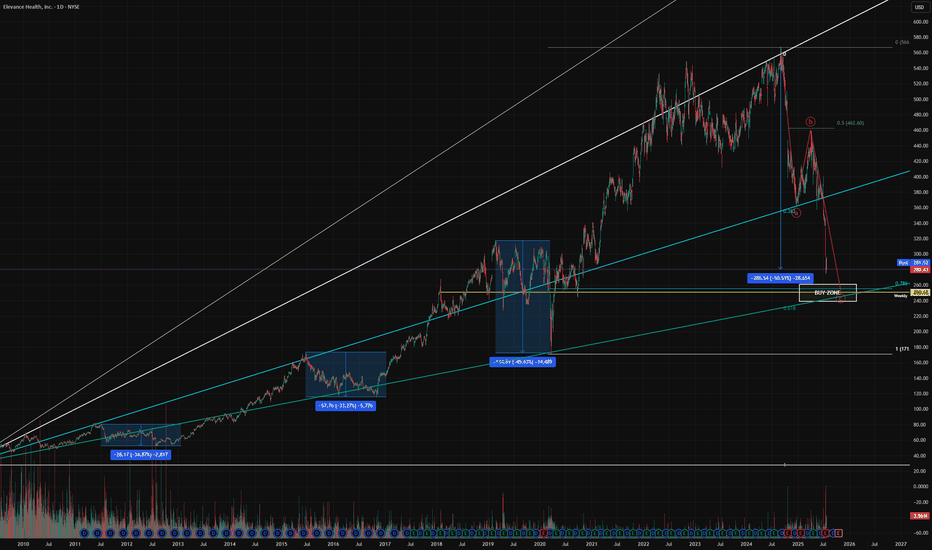

Potential 33% gain in ELVELV has a potential for a reversal for potentially 33% gain.

Using the Data Distribution with Extreme Clusters custom indicator, we can see that the stock is overextended on both the 5D chart (longer term) and 1D (shorter term) chart.

The last weekly bar ended up on a very high volume. Looking a

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

20.0 EUR

5.78 B EUR

170.79 B EUR

224.79 M

About Elevance Health, Inc.

Sector

Industry

CEO

Gail Koziara Boudreaux

Website

Headquarters

Indianapolis

Founded

1944

FIGI

BBG000BHX743

Elevance Health, Inc. operates as a health company, which engages in improving lives and communities, and making healthcare simpler. It operates through the following segments: Health Benefits, CarelonRx, Carelon Services, and Corporate and Other. The Health Benefits segment offers a comprehensive suite of health plans and services to different customers. The CarelonRx segment markets and offers pharmacy services to affiliated health plan customers, as well as to external customers. The Carelon Services segment integrates physical, behavioral, pharmacy, and social services with the aim of delivering whole health affordably by offering a broad array of healthcare related services. The Corporate & Other segment includes businesses that do not individually meet the quantitative threshold for an operating segment. The company was founded in 1944 and is headquartered in Indianapolis, IN.

Related stocks

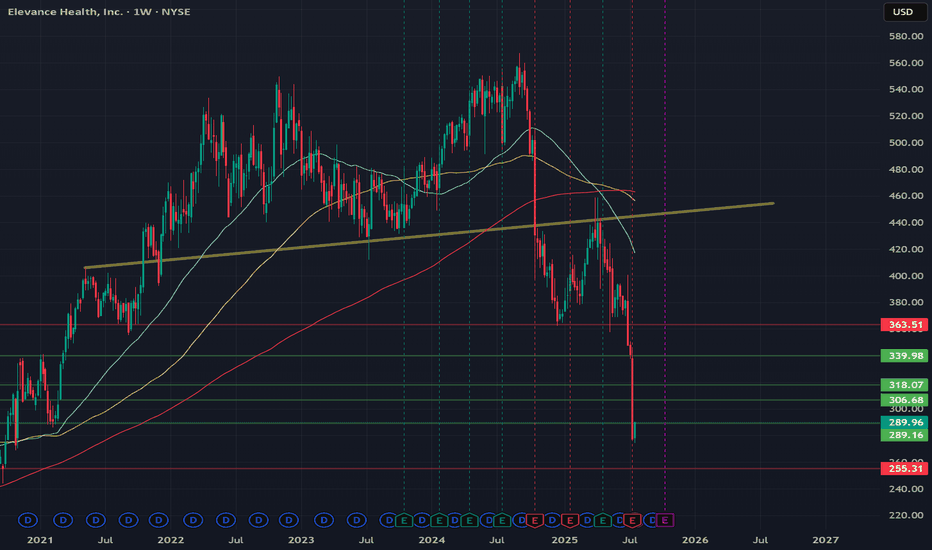

Elevance is losing the long term trendlineLosing such a large trendline is always a bad signal for a company.

The price can easily fall from 15 to 25% in the upcoming weeks or months, take care with this stock unless you are shorting.

This is especially significant while we are seeing Indexs, BTC and more doing new all time highs.

A SL

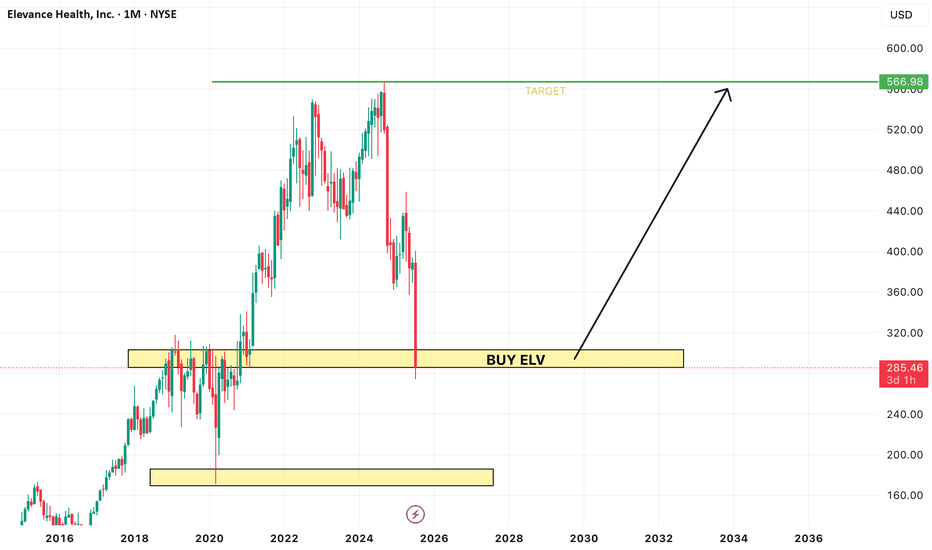

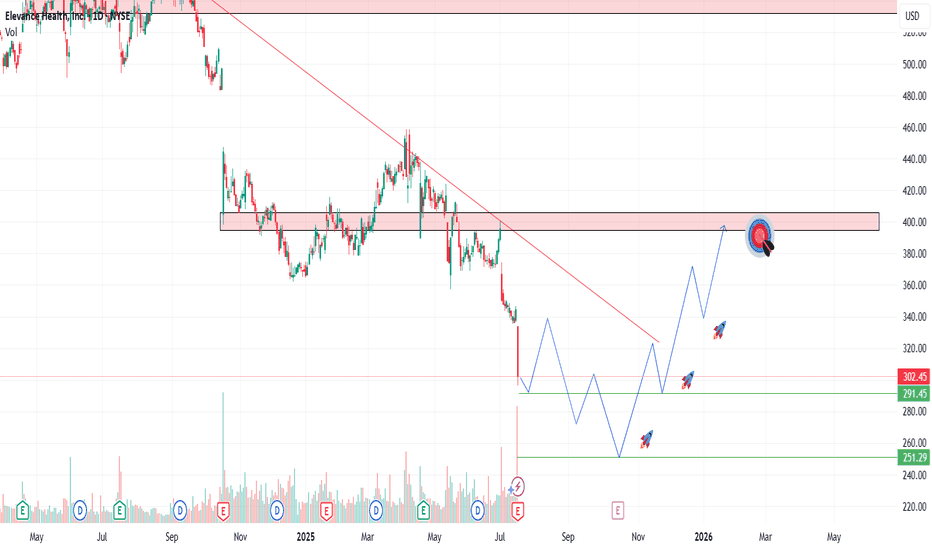

Support Levels approaching$250 could potentially be a good opportunity to pick up Elevance. We are moving towards that level and I will be patient here as the downtrend is strong. The stock is representing deep value here and insiders agree as the CEO is been acquiring shares.

The stock has dropped 50% since it's recent hi

Elevance Health | ELV | Long at $286.00What are seeing in the healthcare and health insurance provider industry right now is destruction before a once-in-a-lifetime boom. The baby boomer generation is between 60 and 79 right now and the amount of healthcare service that will be needed to serve that population is staggering. Institutions

ELV (Elevance Health) – Catching the Knife or Catching Value?Elevance (ELV) just took a 12% hit after Q2 earnings missed estimates and full-year guidance was cut significantly. But here's the thing—the selloff may be overdone. The stock now trades at a forward P/E of ~10, well below industry peers, and is approaching multi-year support levels.

📥 Entry Plan

ELV Swing Trade Setup - May 2025Fundamentally undervalued with a strong balance sheet, consistent earnings beats, and a low P/E ratio. Recent drop (~33% from 52-week highs) appears overdone relative to earnings strength likely due to short-term Medicaid cost concerns, not long-term deterioration.

📊 Position Type:

✅ Swing Trade t

$ELV Earnings Preview: Oversold Potential + Key Metrics AheadEarnings Estimates: Analysts forecast an EPS of $3.82 for the upcoming quarter, indicating a 32% year-over-year decline. Revenue is projected at $44.67 billion, a 5.2% increase from the same period last year.

Oversold Potential: With an oversold score of 59%, NYSE:ELV appears attractive for a

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ANTM4983288

Elevance Health, Inc. 3.125% 15-MAY-2050Yield to maturity

7.14%

Maturity date

May 15, 2050

US36752AS2

ELEVANCE HE. 21/51Yield to maturity

6.97%

Maturity date

Mar 15, 2051

ANTM4880736

Elevance Health, Inc. 3.7% 15-SEP-2049Yield to maturity

6.84%

Maturity date

Sep 15, 2049

ANTM5405192

Elevance Health, Inc. 4.55% 15-MAY-2052Yield to maturity

6.54%

Maturity date

May 15, 2052

AE1J

ELEVANCE HE. 17/47Yield to maturity

6.47%

Maturity date

Dec 1, 2047

ANTM4606236

Anthem, Inc. /Old/ 4.55% 01-MAR-2048Yield to maturity

6.46%

Maturity date

Mar 1, 2048

ANTM4153492

Elevance Health, Inc. 4.85% 15-AUG-2054Yield to maturity

6.33%

Maturity date

Aug 15, 2054

ELVH5534305

Elevance Health, Inc. 5.125% 15-FEB-2053Yield to maturity

6.26%

Maturity date

Feb 15, 2053

ANTM4153493

Elevance Health, Inc. 4.65% 15-AUG-2044Yield to maturity

6.21%

Maturity date

Aug 15, 2044

ANTM5923067

Elevance Health, Inc. 5.85% 01-NOV-2064Yield to maturity

6.17%

Maturity date

Nov 1, 2064

ANTM3851462

Elevance Health, Inc. 4.625% 15-MAY-2042Yield to maturity

6.15%

Maturity date

May 15, 2042

See all A58 bonds

Frequently Asked Questions

The current price of A58 is 246.6 EUR — it has decreased by −3.41% in the past 24 hours. Watch ELEVANCE HEALTH DL-,01 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange ELEVANCE HEALTH DL-,01 stocks are traded under the ticker A58.

A58 stock has risen by 2.66% compared to the previous week, the month change is a −22.18% fall, over the last year ELEVANCE HEALTH DL-,01 has showed a −49.84% decrease.

We've gathered analysts' opinions on ELEVANCE HEALTH DL-,01 future price: according to them, A58 price has a max estimate of 429.91 EUR and a min estimate of 252.84 EUR. Watch A58 chart and read a more detailed ELEVANCE HEALTH DL-,01 stock forecast: see what analysts think of ELEVANCE HEALTH DL-,01 and suggest that you do with its stocks.

A58 stock is 3.53% volatile and has beta coefficient of 0.25. Track ELEVANCE HEALTH DL-,01 stock price on the chart and check out the list of the most volatile stocks — is ELEVANCE HEALTH DL-,01 there?

Today ELEVANCE HEALTH DL-,01 has the market capitalization of 54.18 B, it has decreased by −10.52% over the last week.

Yes, you can track ELEVANCE HEALTH DL-,01 financials in yearly and quarterly reports right on TradingView.

ELEVANCE HEALTH DL-,01 is going to release the next earnings report on Oct 15, 2025. Keep track of upcoming events with our Earnings Calendar.

A58 earnings for the last quarter are 7.50 EUR per share, whereas the estimation was 7.56 EUR resulting in a −0.78% surprise. The estimated earnings for the next quarter are 4.95 EUR per share. See more details about ELEVANCE HEALTH DL-,01 earnings.

ELEVANCE HEALTH DL-,01 revenue for the last quarter amounts to 41.95 B EUR, despite the estimated figure of 40.91 B EUR. In the next quarter, revenue is expected to reach 43.15 B EUR.

A58 net income for the last quarter is 1.48 B EUR, while the quarter before that showed 2.02 B EUR of net income which accounts for −26.67% change. Track more ELEVANCE HEALTH DL-,01 financial stats to get the full picture.

Yes, A58 dividends are paid quarterly. The last dividend per share was 1.50 EUR. As of today, Dividend Yield (TTM)% is 2.43%. Tracking ELEVANCE HEALTH DL-,01 dividends might help you take more informed decisions.

ELEVANCE HEALTH DL-,01 dividend yield was 1.77% in 2024, and payout ratio reached 25.39%. The year before the numbers were 1.26% and 23.47% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 104.2 K employees. See our rating of the largest employees — is ELEVANCE HEALTH DL-,01 on this list?

Like other stocks, A58 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ELEVANCE HEALTH DL-,01 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ELEVANCE HEALTH DL-,01 technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ELEVANCE HEALTH DL-,01 stock shows the sell signal. See more of ELEVANCE HEALTH DL-,01 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.