BCY trade ideas

Barclays Bank - Crash V.2Never recovered from 2008 crisis, fake money has just delayed the inevitable, Wants to go lower, 4th retest of 140p-150p, each test gets a weaker reaction until support breaks, good buy opportunity at 80p, although widespread panic will be flooding the market at this point and price could go much closer to zero , Barc won't be allowed to fail or its the end, Deutsche Bank could be the catalyst for the crash (already close to zero!)

Big Flag PatternBig because it takes eleven months for take shape of a flag and breakout the resistance line, and the resistance line was broken from a weekly chart perspective for avoid false breakouts or whipsaws now I need to wait for some pullback or consolidation around 10.80 and 10.40 approximately

By the way look the small gap five weeks ago and the price is showing that the bulls are in control combined with a strong financial sector with a rising interest rates and you have one more stock for the portfolio trading at cheaper price.

In my past idea I shared a stock with a low Avg. Volume but this is not the case for this company because the Shares Outstanding are 4,261.11 Mil and the Avg. Volume 2,835,728 this means this is a very liquid stock with a favorable spread

I cant not predict how will the price behave when arrive at the 14.00 area If arrives

because there is no math to get you out of having to experience uncertainty.

Patience, humility and weekly charts :(

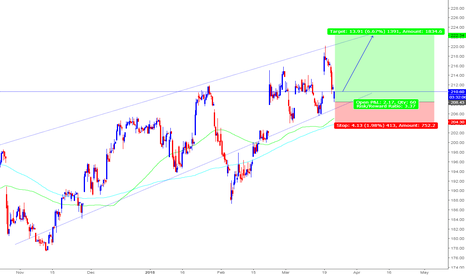

BARClAYS PLC STOCK ANAlYSIS (BARCL)Price bounced off the support zone and also a trendline giving us a good opportunity to enter a buy. Market retraced at the 0.63% of the Fibonacci Level given another indicator to enter for bullish and also based on the two Harmonic patterns we have on the chart (one completed and the other is forecast) they are both indicating a bullish trend (Buy).

Trade Setup: Buy

Target 1: 244.74

Target 2: 257.05

Target 3: 292.96