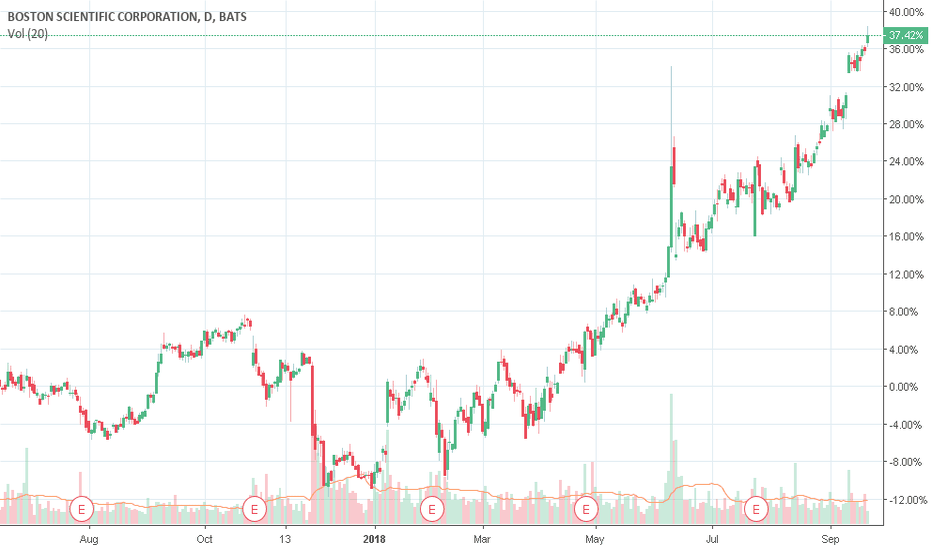

BSX trade ideas

Update: $BSX shenangianthis is the most scary kind of move- going back above the upper pivot again after the shenanigan. MFI looks strong.

If this close above the red pivot today, I will get into the game again with a very small call position, but if anyone behind the shenanigan decides to take my money away, he/she gets my applaud for outplaying me.

BSX - Upward channel breakdown short from $27.60 to $24.67 BSX hit its speculative entry as it broken below $29 label, and now it seems breaking down its Upward channel formation. We would consider a secondary entry at the confirmation break of upward channel around $27.60

* Trade Criteria *

Date First Found- October 25, 2017

Pattern/Why- Upward channel breakdown short

Entry Target Criteria- Break of $29 (Speculative entry); Confirmed Entry $27.60

Exit Target Criteria- $24.67 & Lower

Stop Loss Criteria- N/A

Please check back for Trade updates. (Note: Trade update is little delayed here.)

BSX_ as it retest overhead resistance at $21.47BSX

Date First Found - November 15, 2016

Pattern/Why- breakdown of trend line and up channel

Entry Target Criteria- Retest overhead resistance at $21.47

Exit Target Criteria- $17.13

Stop Loss Criteria- $22.13

Indicator Notes- huge drop in Twiggs Money Flow

Special Note- we would consider February $20.00 Puts currently @ $0.68