CEXB trade ideas

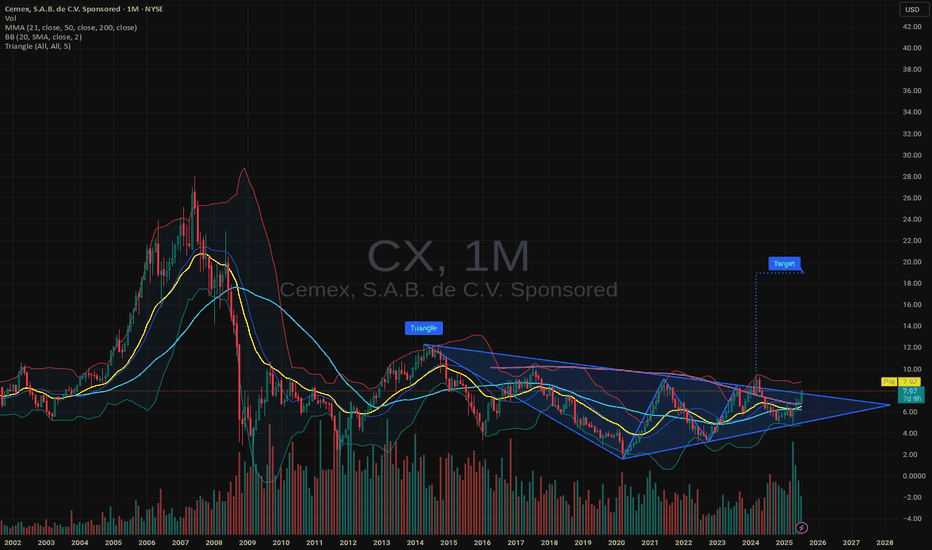

CX | Long | Triangle Breakout & Value Entry | (May 2025)CX | Long | Watching for Triangle Breakout & Value Entry | (May 2025)

1️⃣ Short Insight Summary:

CX has been stuck in a long-term consolidation pattern since 2008, but now it’s approaching a key decision point. We’re seeing signs of potential breakout movement, especially as price compresses within a triangle formation.

2️⃣ Trade Parameters:

Bias: Long

Entry: Watching for retracement into $5.95–$5.75 zone (near value area high)

Stop Loss: $5.33

TP1: $6.70

TP2: $7.91

Final TP: $9.00

3️⃣ Key Notes:

✅ Daily and 4H charts show upward momentum, but 1H and 2H charts suggest short-term selling pressure (money flowing out).

✅ Weekly timeframe shows money inflow—bullish signal.

❌ Monthly chart shows money flowing out, signaling caution for long-term holders.

📉 Fundamentals show mixed signals: strong free cash flow ($1.6B), low P/E (6.3), and solid market position—but future EPS forecasts are trending lower, which could weigh on sentiment.

🏗️ CX operates globally in construction materials (cement, concrete, aggregates) with exposure across U.S., Mexico, Europe, and Asia.

4️⃣ Optional Follow-up Note:

This setup is worth watching closely. If the triangle breaks upward with volume, I’ll update the post and potentially scale into the trade further.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not a financial advise. Always conduct your own research. This content may include enhancements made using AI.

CEMEX/CPO - Buying OpportunityCEMEX/CPO - Buying Opportunity.

TF analysis: 4H.

According to technical analysis, we can observe that we are in an uptrend channel, in which the price is gaining greater inclination by making higher lows. The projection of the possible upward movement is located up to the upper end of the channel.

The importance of using different TimeframesWhen visualizing the market and conducting technical analysis, it is crucial to interpret different timeframes.

Multi-timeframe analysis can enhance the probability of success in our trading by utilizing support and resistance levels from higher timeframes than our base timeframe.

It is also useful for identifying candlestick patterns in other timeframes and assessing their alignment with other signals observed in our analysis.

CX CEMEX Commodity Infrastructure Stimulus IdeaJust sharing a series of investing ideas that interest me. This is not investment advice or licensed research.

CX has moved quite a bit off of its cycle low but still maintains quite a bit of upside, I think it has multi-bagger potential.

Incoming Infrastructure stimulus will be between $4 and $10 trillion just in 2021 alone.