CHV trade ideas

CVX SELL (CHEVRON CORPORATION)Hi there. For short term, price is forming a continuation pattern to the downside. Wait for the price to complete the pattern and watch strong price action for sell.

For longer term, wait for the price to hit the bottom of the bigger pattern and watch strong price action for buy.

Chevron analysisOil (purple line chart) sell off caused a big loss for oil companies' stocks, waiting for the bottom of oil prices will be a good time to go long on oil companies as well. Chevron being one of the biggest and oldest oil companies has broken through 200 SMA and buy support zone above 50% fib is tested now. 100 level being psychological barrier, it could be a setup for a long if we hear positive news about oil at the start of 2019, or short through.

#CVX - Descending triangle breakout alertBreakout alert descending triangle on CVX.

Chevron Corp. engages in the provision of administrative, financial management, and technology support for energy and chemical operations. It operates through the Upstream and Downstream segments. The stock is listed on the New York Stock Exchange.

CVX price formed an almost one year-long reversal pattern as descending triangle, with the lower boundary as strong support at 108.90 levels. The horizontal boundary has been tested several times during the chart pattern formation until its breakout.

In addition, we must bear in mind 3 relevant factors on the technical structure of the stock:

1.- Double top at 133.85 levels, without a higher high.

2.- Breakdown the trendline since 2015

3.- Breakdown the trendline since 1974

So that:

- A daily close below 105.63, confirms the breakout of the chart pattern.

- The possible price target of the reversal chart pattern is at 87.33 levels.

Please don't forget to give a like if you appreciate it :)

Note: Entry and exit prices are provided only as reference according to the principles of the classical charting. Each trader must take his own decisions depending on their own strategy and tactics. These levels do not indicate the specific entry and exit price, these levels only suggest a possible technical structure change.

CVX 11 RRR short positionReposting this since TV removed this idea earlier for containing links to my telegram group.

Trading Methodology:

1. An asymmetric bullish/bearish pennant is drawn using ascending and descending curved trend lines with a minimum of three price action touche points per line. The direction is determined by the previous trend.

2. The angle tool is applied from the earliest two trend touch points, beginning at the earliest touch point.

3. A trend-based Fibonacci retracement triangle is drawn starting from the earliest trend touch point and ending at the earliest touch point of the opposite trend line .

4. Based on the degree, of the earlier defined angle, the appropriate (and secret) levels are selected for the fibonacci retracement ; two levels for stop-loss and two levels for take-profit. The closest stop-loss level to the current price level is the top priority stop-loss. Though the secondary stop-loss level is often chosen for some markets such as FX and some equities in order to account for seldom unexpected resistance breaks. The greater target level is the top priority, and where majority of the shares are sold, though some may choose to close part of the position at the first target level or set it to be the stop-loss once price exceeds it. Entries should be laddered in around the levels closest of the yellow line.

This trading strategy can be applied to any market and time frame, and positions most often garner the greatest risk-to-reward ratio with the highest success rate. What more can you ask for? I will only be posting my unique trading strategy until EOY. I work solely with price action to identify pennants and apply unique trend-based fibonacci retracement levels for SL and TP levels. Reach out to me if you have any questions.

What can I Say About These ClownsCorporate Vision is Important. I can’t stress that enough. It’s also important to work on one’s flaws, to be the best one can be. I look at this Crew and I just shake my head. Some how these F’Ups manage to succeed and move forward despite themselves. I guess there is a lot to be said for being in the right place at the right time…

This is a company I know way too much about, technologically and financially. These guys invest in their business, but they are always playing catch up technologically. They have no problem putting money into their operation in order to conduct business, but their capital utilization is horrifically low. These guys will never be the innovators of their industry, but they will squeeze the last drop of value out of the technology they have.

The Elliot Wave pattern implies that after this decade, this company should do really well. The company is positioned really well to take advantage of the growth in the middle class of the Asian markets. Could be a pretty bumpy ride in the mean term.

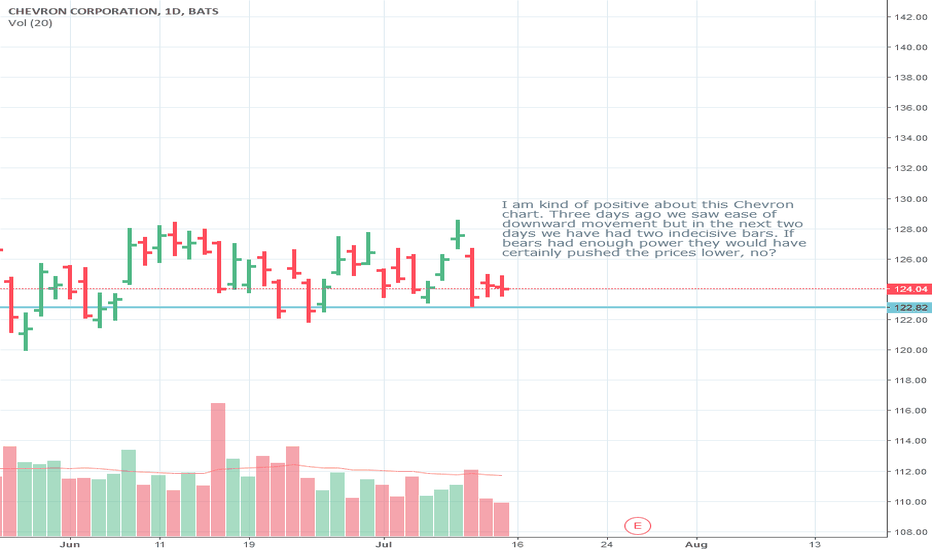

Selling Chevron sharesAt the daily chart of CVX shares, the price has started a new downtrend, as the instrument has fixed below Alligator indicator with AO crossing below the zero line. Also, a sell signal was formed in a form of the fractal, breakdown of its level would be an optimal level to open short.