CIT trade ideas

$CTAS with a Bullish outlook following its earnings #Stocks The PEAD projected a Bullish outlook for $CAT after a Positive over reaction following its earnings release placing the stock in drift B

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

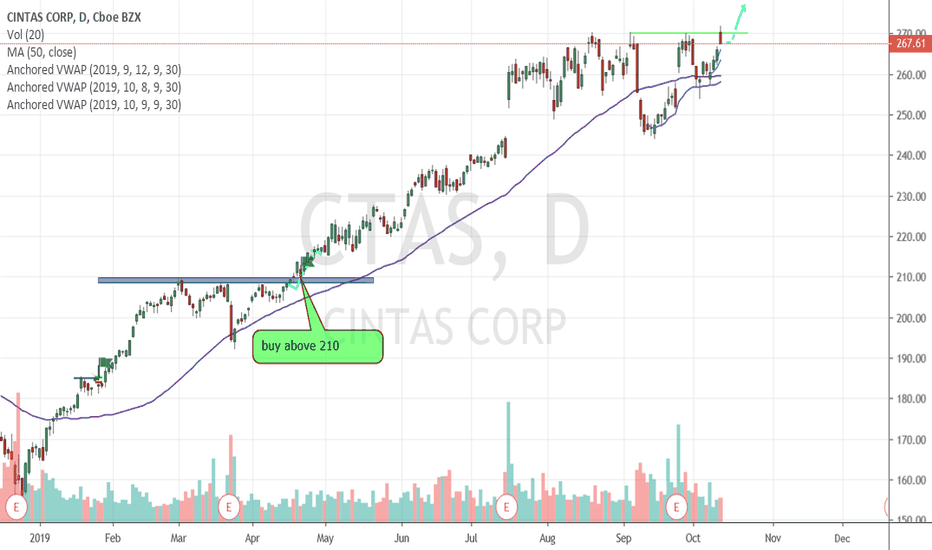

$CTAS Pennants, flags, wedges, ascending triangle, cup & handle$CTAS on daily chart.

Took a few minutes to publish some easy to recognize, bullish and bearish chart patterns on daily charts. Enjoy!

Note: Ascending triangles are generally seen as bullish but can be bearish when the lower trendline is broken.

$CTAS with a slight bullish outlook after earning releaseThe PEAD projected a slight bullish outlook for $CTAS after a negative over reaction following its earnings release placing the stock in Drift C

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

Bull Flag Earnings 7-23 BMOI have never owned this stock but have been watching it.

Earnings are very soon and I would think CTAS would have to beat to get to any targets

Since they deal a lot in work uniforms and office stuff. I would be concerned since a lot of folks are on the government payroll right now, and I do not think they are required to wear a uniform, But Zack says it is a HOLD with positive growth, and Zack supposedly knows everything! LOL

Who knows? Short percent is reasonable

The flag is pretty though and it remains to be seen if they can pull it off

Cintas Corporation provides corporate identity uniforms and related business services primarily in North America, Latin America, Europe, and Asia. It operates through Uniform Rental and Facility Services and First Aid and Safety Services segments. The company rents and services uniforms and other garments, including flame resistant clothing, mats, mops and shop towels, and other ancillary items; and provides restroom cleaning services and supplies, and carpet and tile cleaning services, as well as sells uniforms. It also offers first aid and safety services, and fire protection products and services. The company offers its products and services through its distribution network and local delivery routes, or local representatives to small service and manufacturing companies, as well as major corporations. Cintas Corporation was founded in 1968 and is based in Cincinnati, Ohio.

CTAS enters a weekly bullish trend. Expect Uptrend continuationA buy signal is generated. Cintas Corporation (CTAS) is predicted to grow by 2% to $279.1 or more within the next week. With its winning streak extending for a consecutive week, CTAS is expected to continue climbing following the week-long Uptrend ― the odds of an Uptrend continuation are 74%.

$CTAS Cintas beats and raises once againEntry level $268.91 = Target price $280 = Stop loss $265

Beats on earnings and raises guidance.

CTAS is tuned into the ecpnomy more than any other compnay as it produces corporate uniforms, it look sset to make new highs as growth and earnings continue to rise.

Currently within a nice well defined channel, which provides a nice safe trade.

Company profile

Cintas Corp. engages in the provision of corporate identity uniform through rental and sales programs. It operates through the following segments: Uniform Rental and Facility Services, First Aid and Safety Services, All Other, and Corporate. The Uniform Rental and Facility Services segment consists of rental and servicing of uniforms and other garments including flame resistant clothing, mats, mops and shop towels, and other ancillary items. The First Aid and Safety Services segment comprises of first aid and safety products and services. The All Other segment includes fire protection services and its direct sale business. The Corporate segment consists of corporate assets such as cash and marketable securities. The company was founded by Richard T. Farmer in 1968 and is headquartered in Cincinnati, OH.

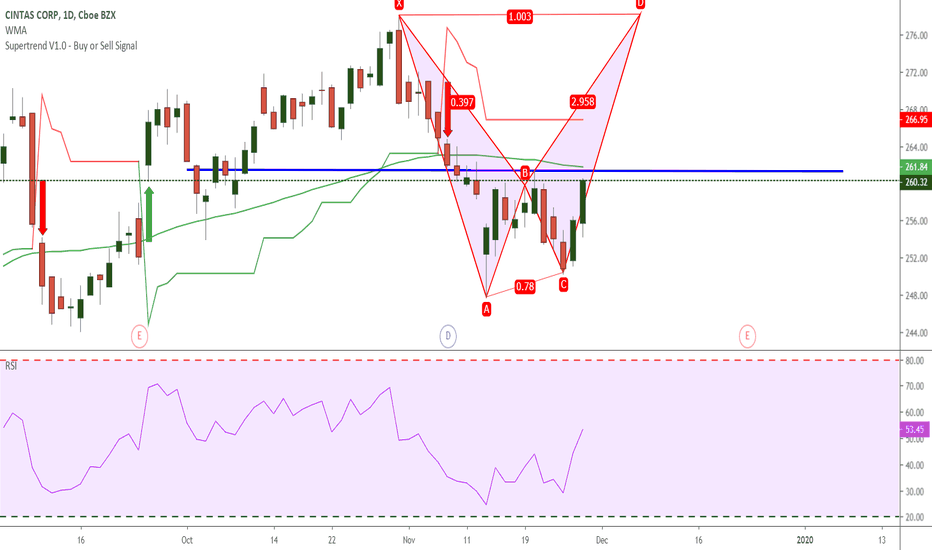

CTAS - DAILY CHARTHi, today we are going to talk about Cintas and its current landscape.

Cintas is poised to receive increasing attention from the market as relevant events are taking place. The company reports its earnings on Tuesday after the market had closed. With an apathetic performance these last months, this report could be a Cintas event to boost its momentum. However, Cintas has been pressured by competition, and its $2.2 billion acquisition of G&K Services hasn't brought the synergy to that company as previously promised, which could create an unpleasant surprise for the bulls.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.

Cintas has market dominance. Earnings Play long.Often overlooked by investors, Cintas is a true gauge of the economy, as the No 1 uniform supplier CTAS has been on real bull run and that looks set to continue. The hiring frenzy in retail pre christmas should come into the earnings report tomorrow, as customers stockpile uniforms for temporary seasonal workers.

Entry level $256

Target Price $285

Stop loss $250

P/e ratio 31

Company profile

Cintas Corp. engages in the provision of corporate identity uniform through rental and sales programs. It operates through the following segments: Uniform Rental and Facility Services, First Aid and Safety Services, All Other, and Corporate. The Uniform Rental and Facility Services segment consists of rental and servicing of uniforms and other garments including flame resistant clothing, mats, mops and shop towels, and other ancillary items. The First Aid and Safety Services segment comprises of first aid and safety products and services. The All Other segment includes fire protection services and its direct sale business. The Corporate segment consists of corporate assets such as cash and marketable securities. The company was founded by Richard T. Farmer in 1968 and is headquartered in Cincinnati, OH.