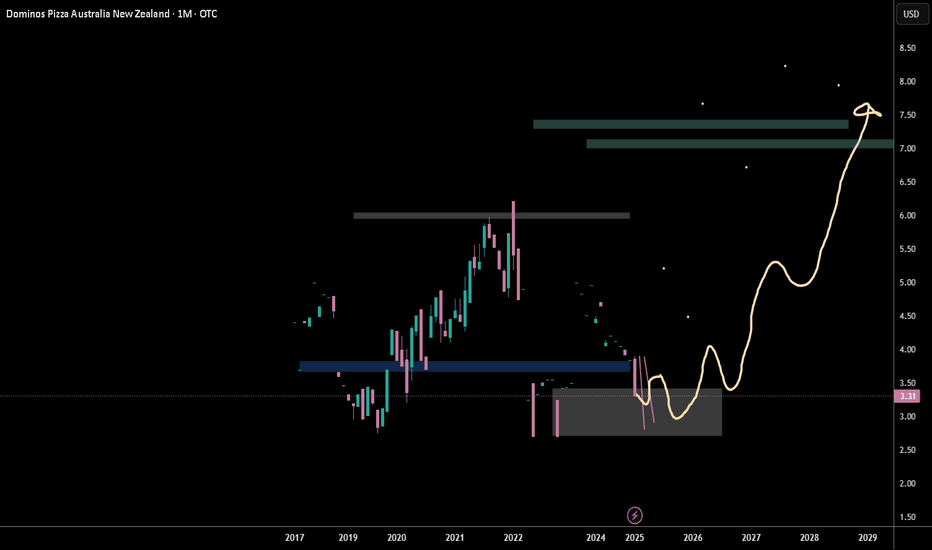

DMP's long setupsRisk On approach with discounts ahead. win win ;)

- Technical Analysis is KEY with timing ..

-Both their charts AUD and NZD seem to be

cleanest dirty shirts in the wash.

- Fundamentals helped my confluence levels

-Retesting demand zone but price structure needs better PA within zone before triggering entry. Give it time for confirming our PA,

- Multiple t/fs helped

- AUD chart DMP is alot clearer with PA atm but also needing some more patience with data candles and still with dynamics before she sets sail as long term hold.

DKOB trade ideas

Q&As: order bookThere are people who trade based in order book exclusively & promote these so called orderflow trading platforms, even these days. Surely, it's a great deed to learn this interesting, exotic & unusual skill, but the thing is it's completely unnecessary.

The real use cases for DOM aka LOB aka order book aka Level 2 data are mitigating adverse selection, reducing market impact & spotting potential counter agents.

If you think deeper, all these issues are really all about position sizing and nothing else, you can operate as big as it's possible (depending how much diminishing returns you can let go), and the only thing that can help you figure it all out is order book.

The one & only principle of orderbook analysis is to understand where's us (operators), and where's them (ones who just need to be filled), be nice with yours & be a nice counter agent for them.

It's very simple, clients place big orders that immediately stand out. Everything else is us, we're spreading our orders equally all around the book.

For some reason not many think about it, but as a maker it's good to not only provide liquidity aka make the market, but also to consume these huge limit orders if it lets you to offload some risk or to open a position if the prices are good. By doing so you always make the market better, the faster and in more clear fashion the market activity is unwinding - better for all of us.

If you look at order book histogram and imagine it turned horizontally, you'll see peaks & valleys. So being inside a loading range (past a level) or nearby risk offloading areas (predetermined exit areas), you spread your limit orders the way they kinda fill these valleys, and you can also use market orders to kinda smooth the sharp peaks in order book. That's how you reduce your market impact.Your impact will start being too high when by filling the valleys you'll be creating new peaks, and by smoothing peaks you'll be creating new valleys. Easy enough? All the wise-ass reinforced learning & stochastic control models will output the same behavior, just a bit worse because they'll never defeat your "feel". They way you can process a feedback loop, as an organic, is DOPE.

By monitoring your position in the queue you can decide to replace some limit orders that sit deep to somewhere where probabilities won't be your enemies. If you're not in the first 5% of the queue at these places, your're prone to adverse selection. Closer you are to the front of the level, the worse position in the queue is ok. Negligible but stable adverse selection has a huge negative long term impact, should be taken very srsly.

In theory, it makes sense to care about order book as soon as you start trading more than 1 lot or if 1 lot is already a serious size on a given instrument. In practice, when you notice a statistically significant drop in revenue per lot on a given instrument, minding all other factors are equal, it's time to open dem books.

Domino's pizza to $480Huge upside here, oversold on every level keeps bouncing off the 200ma and looking for a price target of $480 fast to be honest, wall street had better expectations, but this had to do with the crappy delivery drivers and lack of employment. Things are changing in the company as far as paying the right price and as well as the cost of pizza will no longer be cheap... and well us Americans love us some delivered to the door hot pizza. Great buy opportunity here that won't retract for months to come.

Cup & Handle on domino's pizza!!Anyone thinking the price of pizza going down is fooling themselves, even though it didn't meet "wall streets" expectations it met mine and i bought the dip today below the trend line, tons of possibilities here and once this stock moves it moves and can easy clear $430 this week if the market allows it. Not much volume either surprised people aren't seeing this. Clear channel up as well again up and handle has hit and formed and formed strong!

Dominoes riding the Rona waveA new pivot point has been created, Dominoes was having some issues with their bigger franchises hampering their ability to expand in the UK. They seem to have kicked that to the side and are now happily expanding. The share price reflects this, however we have seen this area of the chart as a key resistance level, so it will be critical to see some accumulation at this point by the institutions. If this drives the share price upwards to create a new base level then we can expect to see further upside. A fairly tight stop loss will be required as the main true support levels could be as low as 290p. An initial entry at the 360p level as a starter position is ideal. If accumulation does occur then this will allow a scale in and raising of the stop, for the benefit of a breakout to the upside.