EBA trade ideas

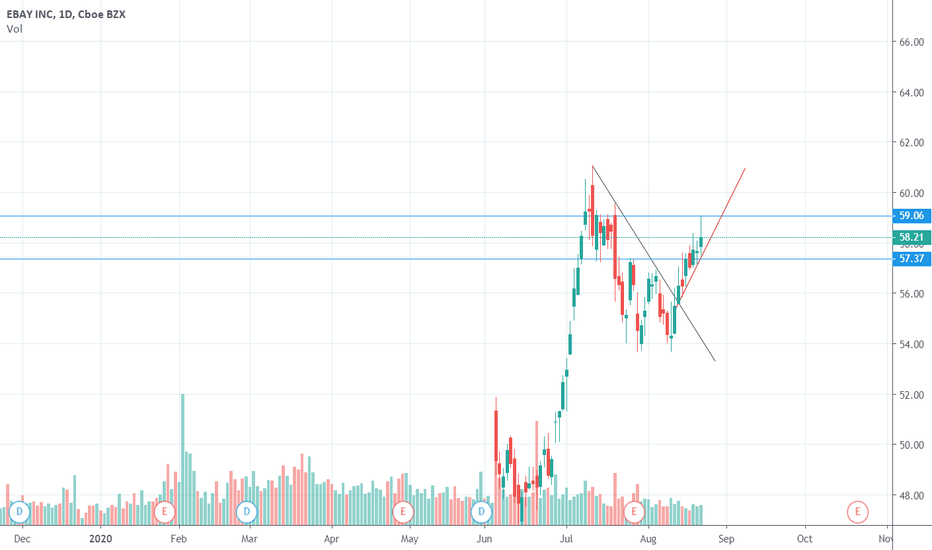

EBAY - 22.14% Potential Profit - Corridor BreakoutCorridor Breakout out of a 1-month price correction.

Target price set at resistance line bounce.

- Strong Uptrend

- RSI and STOCH well above 50

- MACD well above Signal

Suggested Entry $57.91

Suggested Stop Loss $56.88

Target price $70.80

Note that I tend to adjust stop losses in order to secure profits early and preserve capital. This means that the target price is going to be achieved as long as there are no strong pullbacks that trigger my new adjusted stop loss.

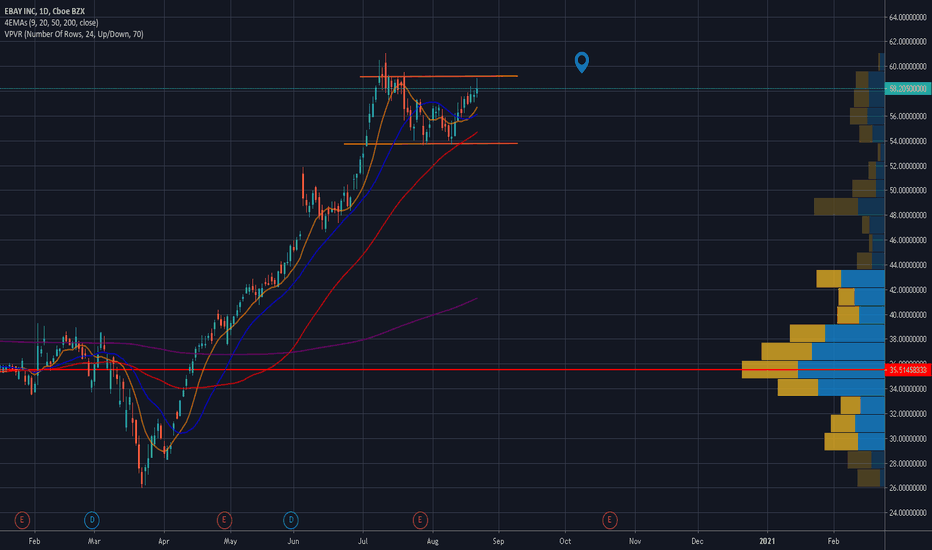

EBAY new ATH? - I think so!!EBAY is overall in strong uptrend and had recently reached ATH of 61.06.. consolidated for a while and ready to fly again.. based on my chart analysis it is going to new ATH

Same Descending Triangle breakout, Same IH&S pattern, same RSI

My Price Targets and Stop Loss

PT1 - 63.96

PT2 - 64.47

PT3 - 66.24

PT4 - 68.73

SL - 54

EBAY potential breakoutI bought 100 shares at the arrow I planted, I believe that Ebay has reached t's day low

Stop loss 54.99, I didn't give myself much lee-way.

News surrounding ebay isn't terrible, they have a potential to reach a new high

****ALSO, waving bullish flag pattern just under the arrow, we'll see what happens

Bull FlagI see a flag waving

Earnings in October

The digital economy and online marketplaces have certainly benefitted from Covid. It is like 2 groups of stocks out there right now. Good companies who do not benefit and good (and not so good) companies that do benefit. Ebay is one of the better considering the choices we have been given as of late

It makes for a difficult trading environment because news of a vaccine can make the old stocks that have been left in the dirt go up, and send some of the benefitters down quite a bit. Etsy comes to mind.

Ebay was in a rising wedge, a narrow one but definitely a narrowing rising wedge. This stock broke up and out of the wedge. Who knows if she will pull back to break the bottom trendline of the rising wedge? Has had quite a run. EBAY would have to dip down to 50ish to pierce that trendline

Not a recommendation/Just an observation