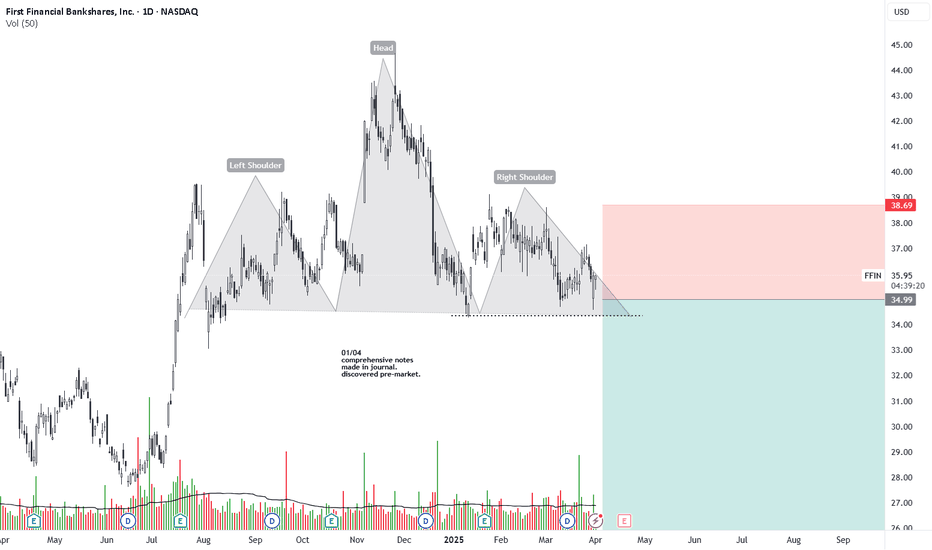

FFIN Shortwe are probably marking the bottom by posting this. current US market conditions have prompted us to scout for shorts. FFIN provides us a classic (arguably) Heads & Shoulders pattern.

a close above the right shoulder could invalidate the pattern. PT of $25.65 was derived by measuring the distance between the neckline and the head and transposing it to the downside.

the bulls will rightly point out the fact that price is bouncing off support. the bear will counter by questioning the sustainability of the bounce .

FI6 trade ideas

$FFIN with a bullish outlook following its earnings #BeststocksThe PEAD projected a bullish outlook for $FFIN after a negative under reaction following its earnings release placing the stock in drift D

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

$FFIN posting earnings with a slight of positive surprise.$FFIN posted earning on the positive side, but PEAD projected a bearish outlook for the stock for the coming period, with price currently trading below the lower boundary of the projected PEAD Cone.

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

$FFIN weekly #chart with ascending triangle #breakout$FFIN stock made a low in MAR'18 at 27.13 on very big volume that to me it signals capitulation

Since then the stock has formed an ascending triangle with resistance at 33.42

Last week the ER have come in above expectations and the stock had the weekly close above the resistance

MACD and RSI both nicely bottomed out and curved up in supportive mode

Measured target is at 39.71

Good Luck,

TA

FFIN Short SIGNs - PINBAR/VOLUME/TREND-LINE/...Hi traders,

yesterday´s SHORT trade in the NASDAQ:FFIN market contains many confirmations. INSIDERS became heavy sellers and Price Action showed many resistance levels, that can stop the market in case of a long move.

Connection of PinBar, Value area, Volume profile, and trend-line created the whole picture, that we need for a decision.

Parameters of the trade:

Direction: SHORT

Market: NASDAQ:FFIN

Entry: 26.81

SL: 28.96

PT: 22.51

Good trading!

Jakub

FINEIGHT

FFINSystem T Performances: Annual Compound Profit 40%, Win Rate 55%, Risk/Reward Ratio 1:2, 20 Years of Backtesting Data, Over 100 Markets.

* Click Like and Follow to Support My Work!

---

Hi Traders,

I'd like to introduce the System T, a computerized trading system that analyzed and backtested the 20 years history data of over 100 markets.

This post is my sharing of how I think about systematic trading and the signals generated by the System T.

(This is my opinion only, NOT the financial advice.)

I think that for the system to open a trade and manage risk, it only needs a buy signal & a stop-loss signal clearly on the chart.

Once the system finds a good trend, it will ride it as long as possible. The stop-loss will be adjusted accordingly to the new price movement.

(Remember to follow this trade idea and follow my profile to get updates about the stop-loss adjustment and sell signal based on the latest price and market conditions daily.)

System T performances above will give you an idea of how it performs in the last 20 years.

Notice that this result was achieved only if I strictly followed the rule: "Only and Always Buy & Sell based on the System Signals".

Don't sell when there is no sell signal as we all want to follow the good trends til the end like everything in life does. \(^-^)/

Also, my system is extremely diversified through over 100 markets so that it only risks less than -1% of the total capital per trade.

Thank you and good luck!

---

DISCLAIMER:

I am NOT a financial advisor, and nothing I say is meant to be a recommendation to buy or sell any financial instrument.

My views are general in nature and I am not giving financial advice. You should not take my opinion as financial advice. This is my opinion only.

Do your own due diligence, and take 100% responsibility for your financial decisions.

Trading and investing are risky! Don't invest money you can't afford to lose, because many traders and investors lose money. There are no guarantees or certainties in trading.

- Content is for education purposes only, not investment advice.

- Trading involves a high degree of risk.

- We’re not investment or trading advisers.

- Nothing we say is a recommendation to buy or sell anything.

- There are no guarantees or certainties in trading.

- Many traders lose money. Don’t trade with money you can’t afford to lose.