HSBC – Big Bank EnergyHSBC. The name alone sounds like it should be engraved in stone above a massive marble doorway somewhere in London, guarded by two lions in tuxedos. It’s one of those banks that’s been around forever – the kind of institution that probably has an emergency plan for a meteor strike… and a tea protocol for after.

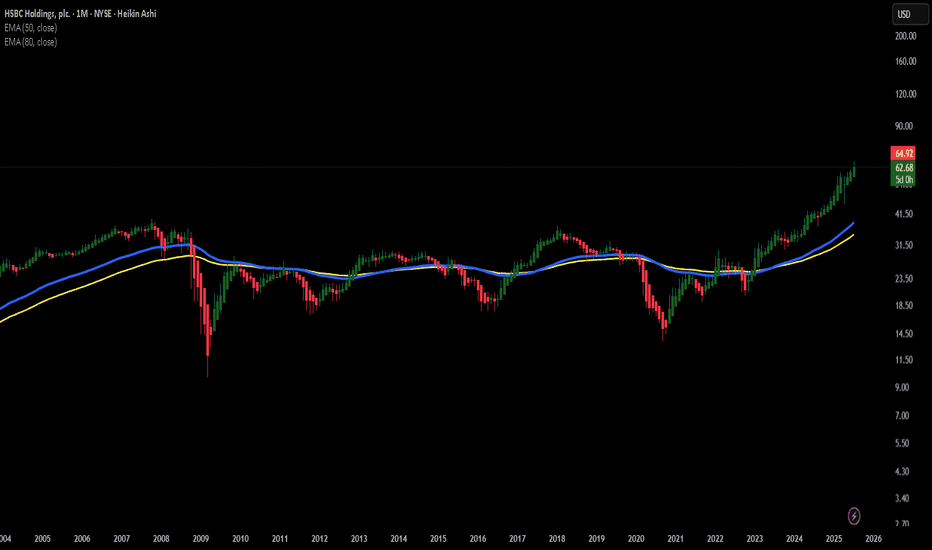

And yet, when I look at the chart, I don’t just see a slow-moving financial giant. I see a potentially elegant bulldozer gently carving its way upward. Recent price action has been forming what looks like a series of higher lows, and we might just be watching a classic "big-bank-breakout" in slow motion.

From a chart perspective:

Price has been flirting with key resistance, perhaps like a banker flirts with risk – cautiously, from a safe distance, and only with proper documentation. But if momentum keeps building, it might finally stop sipping tea and actually make a move. Possibly upward. Possibly politely.

There’s no guarantee, of course. This isn’t a prediction – more like the market equivalent of a raised eyebrow and a curious “hmm.” I’ll be keeping an eye on HSBC to see if this old titan is ready to shake off the pinstripes and surprise us all.

A lighthearted market musing, not financial advice!

HBC1 trade ideas

HSBC (HSBC) – $54 Risk Zone if ABC Correction Is Triggered HSBCHSBC is currently trading within a rising wedge, but a potential short-term drop of approximately 5% could trigger a full ABC correction pattern. This scenario is not confirmed yet, as the chart remains structurally bullish.

However, should the price reverse and break below the rising channel, it would likely mark the start of wave C, completing an A-B-C corrective sequence. This development could lead the price toward the $54 support zone, which aligns with a previous demand area.

While there is no immediate breakdown or weakness, traders should remain alert. A simple -5% drop might be all it takes to activate the next phase of correction.

Pattern: Potential ABC correction

Trigger: 5% decline from current levels

Target: $54

Bias: Neutral – watch for reaction if price softens

HSBC eyes on $53.xx: Key Resistance to recovery of UpTrendHSBC looking quite strong compared to other banks.

Just poked through a key Resistance at $53.01-53.40

Strong break should retest highs above at $58.11-58.65

.

Previous Analysis that caught a long PERFECTLY

=================================================

HSBC eyes on $44.xx: Major Support that could launch next legHSBC dropped into a major support.

Enter here for a scalp or long term.

Nearby resistance for scalp target.

$ 44.76 - 44.91 is the exact support zone.

$ 47.91 - 48.15 is first resistance and TP.

$ 49.86 - 50.16 will be serious, bigger TP.

=====================================

.

HSBC "Amazing Opportunity"After the UK CPI came hotter than expected, short positions are shining on the horizon. The UK100(FTSE) index looks over-extended to the bullish side, but better than shorting the index itself is finding a highly correlated with the index position, which in our case is HSBC.

As you can see the periods in the past are marked with verticals, whenever the index corrects HSBC follows. Currently, the level at which the stock price is sitting is at a weekly resistance zone.

Most traders who are only attracted to the risk-to-reward ratio would most likely skip such an amazing opportunity. Here comes the options. I am not going to short the stock itself but rather buy put options. To be even more specific I am buying puts at 44$ which costs 0.50$ for the 21st of June.

Long story short with 3000$ dollars you can buy 60 puts.

At 40$ your puts will be worth ~12,000$ or slightly more due to the premium.

You may say But what if it goes up and I lose my 3K, but that's not the case here.

The moment I am buying the puts I am buying 1000 shares long.

At 43$ my stock shares will be exactly 3K$ profit so my initial investment is fully covered on top of that I can still sell my put options even though they will be worth around 0.10$ but still possibly +600$.

To keep it simple:

At 40$ your 60puts will be worth 12,000$.

12,000$- 3,000$(cost of puts) - 1000shares*-4.30(4300) so we will have net profit of +4,700$

The potential win versus the initial investment may seem as unfavourable but keep in mind we are making an arbitrage trade here and the chance of losing capital is close to zero.

The ATR (Average True Range), which represents the average movement of an instrument for HSBC is 1.65$ on a weekly basis. This means that the 5 weeks we have until the strike of the option we can easily expect 4-5$ to move in either direction.

On top of that, we have NVIDIA reporting Q1 aftermarket, which will set the tone for the markets for the rest of the week.

Every comment gets answered:)

Before you jump on this financial rollercoaster, remember: past performance is like your ex's mixtape—nostalgic but not always relevant! 🎢💸 Always consult with a financial advisor before you trade your lunch money for stock options.

M&S & HSBC UK Collaborate to Elevate Digital Banking ExperienceIn a dynamic move to cater to evolving consumer demands, UK retailer Marks and Spencer (M&S) has cemented a new seven-year partnership with NYSE:HSBC UK, aimed at revolutionizing the credit and digital payment landscape through its banking arm, M&S Bank.

The collaboration signifies a strategic shift for M&S, which made the bold decision to streamline its focus on credit and digital payments by shuttering its current and savings accounts along with M&S Bank branches in 2021. Now, with this fresh alliance, M&S is poised to amplify its credit offerings and enhance the digital shopping experience for its loyal customer base.

At the heart of the partnership lies the objective of seamlessly integrating digital payments and loyalty rewards, aiming to deliver a more connected and personalized shopping journey for M&S customers. This entails leveraging innovative solutions like the M&S Club Rewards program, designed to incentivize and delight members with extra loyalty points and treat vouchers.

Building upon their existing collaboration, which saw the successful digitization of M&S rewards vouchers and the introduction of the Sparks Pay digital payment solution, M&S and HSBC UK are primed to unlock new realms of convenience and customization. By intertwining M&S' rewards, digital payments, and credit offerings, the duo endeavors to forge an enriched in-app experience that resonates with modern consumer preferences.

Paul Spencer, CEO of M&S Bank, underscores the strategic imperative of catering to evolving customer needs in today's digital age. With over two million credit card users under its belt, representing a significant portion of M&S' turnover, M&S Bank is well-positioned to leverage this partnership to drive meaningful value and engagement.

The roots of M&S Bank trace back to its inception as M&S Money in 1985, transitioning into M&S Bank in 2012 following HSBC's acquisition of Marks and Spencer Retail Financial Services Holdings Ltd in 2004. Now, with the renewed vigor of this strategic alliance, M&S and HSBC UK are set to chart new territories in the realm of digital banking, poised to redefine the future of financial services for the discerning consumer.

Potential Symmetrical triangle?I find the chart on HSBC interesting. Last year, we witnessed the market break a significant downtrend that had been in place since 2007. Currently, it appears we are on the verge of completing a symmetrical triangle pattern. Considering the market's support from its 200-week moving average and the weekly cloud, and taking into account the previously broken downtrend, I am inclined to believe that the price will break upwards. The top of the triangle is around 40.95 and the July 2023 high is 42.47 and those of the two nearby resistance points to watch. A close above the first should be enough to complete the triangle and a close above the second will confirm the break higher.

And a couple more things, with breaks out of symmetrical triangles – I tend to like them to be dramatic, and we frequently get a return to point of break out with these patterns.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

HSBC Day to Investment Conservative Trend TradeConservative Trend trade 7F

+ long balance

+ ICE level

- support level

+ 1/2 correction

+ biggest volume 2Sp+

Calculated affordable virtual stop loss

Take profit:

+ 25% 1/2 R/R

+ 75% T1 of Monthly

Hourly Context

+ long impulse

Daily Context:

+ long impulse

+ 1/2 correction

+ T2 level

+ support level

+ biggest volume 2Sp+

Monthly Context:

+ long impulse

+ SOS level

+ 1/2 correction

+ support level

+ 2Sp- + test"

HSBC (NYSE: HSBC) Launches $150m Venture Debt ProductHSBC is introducing a venture debt offering in Australia to help scale-up companies that might otherwise struggle to attract more traditional forms of funding to achieve new growth.

Launching this month, the bank has allocated $150 million (AUD 227 million) to lend between $6.6 million and $19.8 million to late stage venture capital-backed companies operating in the technology and new economy sectors.

Venture debt forms an attractive alternative to equity investment for high-growth companies, as it offers a non-dilutive form of capital that preserves ownership stakes without the need to forego additional equity.

Compared to traditional bank loans, venture debt can also be delivered quicker and typically with more favourable repayment terms.

It is a space that has remained markedly vacant within the Australian scale-up market, especially given high inflationary environments and the lack of serious partners to the sector since the collapse of lender Silicon Valley Bank.

HSBC plans to bolster its newfound product by granting start-ups access to “a specialised banking service” containing a range of APIs, digital payment and onboarding solutions, as well as the HSBCnet digital platform for commercial banking.

The launch this month marks HSBC’s latest attempt to reposition its foothold in the APAC region. In September, it sold its billion-dollar mortgage portfolio in New Zealand to Australian non-bank lender Pepper Money, but then agreed to purchase Citi’s retail wealth management portfolio in China the following month for $3.6 billion.

Price Momentum

HSBC is trading near the top of its 52-week range and above its 200-day simple moving average.

What does this mean?

Investors have been pushing the share price higher, and the stock still appears to have upward momentum. This is a positive sign for the stock's future value.

HSBC: MACD Bearish Divergence with PPO Confirmation at Bat PCZWe have the strongest form of Double PPO Confirmation on the Daily and a weaker form on the Weekly, all at the PCZ of a Bearish Bat; if it performs it will very likely begin a severe decline of up to 62%+ especially due to how much exposure it has to chinese Real Estate.

HSBC Melts Higher as it Absorbs SVBHSBC pulled back along with other financials in March. It played a role in the crisis by absorbing Silicon Valley Bank’s British operations, and now the global bank could be drifting to new highs.

The first pattern on today’s chart is the rally between November and February. HSBC retraced almost exactly half that move the subsequent month before bouncing.

Next is the series of higher lows since mid-March. Prices peaked around $38.59 a few times during that consolidation, which produced an ascending triangle. That’s a potentially bullish continuation pattern.

Interestingly, HSBC escaped the top of the triangle last week.

The longer-term trend may have grown more bullish after the 50-day simple moving average (SMA) had a “golden cross” above the 200-day SMA earlier in the year.

Now the shorter-term could be following a similar trajectory. Notice how the shares broke above the 50-day SMA in early May. The 8-day exponential moving average (EMA) has also remained steadily above the 21-day EMA.

Finally, MACD is just now turning positive again.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

Important Information

TradeStation Securities, Inc., TradeStation Crypto, Inc., and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., all operating, and providing products and services, under the TradeStation brand and trademark. TradeStation Crypto, Inc. offers to self-directed investors and traders cryptocurrency brokerage services. It is neither licensed with the SEC or the CFTC nor is it a Member of NFA. When applying for, or purchasing, accounts, subscriptions, products, and services, it is important that you know which company you will be dealing with. Please click here for further important information explaining what this means.

This content is for informational and educational purposes only. This is not a recommendation regarding any investment or investment strategy. Any opinions expressed herein are those of the author and do not represent the views or opinions of TradeStation or any of its affiliates.

Investing involves risks. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options, futures, or digital assets); therefore, you should not invest or risk money that you cannot afford to lose. Before trading any asset class, first read the relevant risk disclosure statements on the Important Documents page, found here: www.tradestation.com .