Our opinion on the current state of MASTDRILL(MDI)Master Drilling (MDI) is a South African company that specialises in drilling exploration and other holes for the mining industry. It has diversified into drilling for hydro-electrical projects and construction. The company has moved away from the South African mining industry and now provides servi

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.105 EUR

16.22 M EUR

252.28 M EUR

65.58 M

About MASTER DRILLING GRP LTD

Sector

Industry

CEO

Daniël Coenraad Pretorius

Website

Headquarters

Fochville

Founded

1986

ISIN

ZAE000171948

FIGI

BBG01H2TTQ24

Master Drilling Group Ltd. is an investment holding company, which engages in the provision of specialized drilling services to blue chip major and mid-tier companies in mining, civil engineering, construction, and hydro-electric power sectors. It operates through the following geographical segments: Africa, Central and North America, Rest of the World, and South America. The company was founded by Daniël Coenraad Pretorius in 1986 and is headquartered in Fochville, South Africa.

Related stocks

Our opinion on the current state of MASTDRILL(MDI)Master Drilling (MDI) is a South African company specializing in drilling exploration and other services for the mining industry, with a diversified portfolio that now includes drilling for hydro-electric projects and construction. The company has strategically shifted its focus away from the South

Our opinion on the current state of MASTDRILL(MDI)Master Drilling (MDI) is a South African company specializing in drilling exploration and other holes for the mining industry, and it has diversified into drilling for hydro-electrical projects and construction. The company has moved away from the South African mining industry and now provides servi

Our opinion on the current state of MDIMaster Drilling (MDI) is a South African company that specialises in drilling exploration and other holes for the mining industry, and which has diversified into drilling for hydro-electrical projects and construction. The company has moved away from the South African mining industry and now provide

Our opinion on the current state of MDIMaster Drilling (MDI) is a South African company that specialises in drilling exploration and other holes for the mining industry, and which has diversified into drilling for hydro-electrical projects and construction. The company has moved away from the South African mining industry and now provide

Master Drilling Interim ReportJSE:MDI came out with positive figures; 34% revenue growth, 57% EPS increase, and 19% cash increase from continuing operations. No interim dividend as per company's dividend policy.

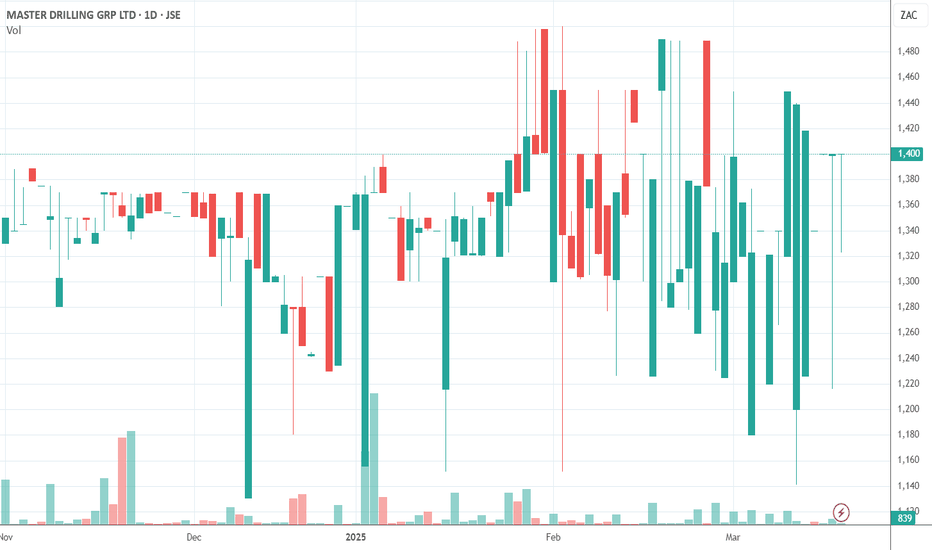

Technically, the stock is on an uptrend, at an area of value. Potential buy area, R14.50/share.

$JSEMDI Master Drilling Company. Consolidating Master drilling has been consolidating in a flag pattern since the strong move up from 520c levels to 900c levels. A convincing (volume) break above 800c could see this share go to 930c and 978c levels.

Warning: Low liquidity on this share could see some wild swings.

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange MASTER DRILLING GROUP LTD stocks are traded under the ticker I49.

Yes, you can track MASTER DRILLING GROUP LTD financials in yearly and quarterly reports right on TradingView.

MASTER DRILLING GROUP LTD is going to release the next earnings report on Sep 2, 2025. Keep track of upcoming events with our Earnings Calendar.

I49 net income for the last half-year is 13.18 M EUR, while the previous report showed 2.82 M EUR of net income which accounts for 366.91% change. Track more MASTER DRILLING GROUP LTD financial stats to get the full picture.

MASTER DRILLING GROUP LTD dividend yield was 4.78% in 2024, and payout ratio reached 30.74%. The year before the numbers were 3.86% and 20.93% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MASTER DRILLING GROUP LTD EBITDA is 54.32 M EUR, and current EBITDA margin is 20.73%. See more stats in MASTER DRILLING GROUP LTD financial statements.

Like other stocks, I49 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MASTER DRILLING GROUP LTD stock right from TradingView charts — choose your broker and connect to your account.