INL trade ideas

INTC INTC- Just had a golden cross on the daily chart (50 MA crossing above the 200 day MA); Cup and handle on the daily scale; breakout from here can take it to $72, just below 75.75, a multi-year resistance of a multi-year bowl/cup. Biden admin reviewing semiconductor/REE/etc supply, rumored to be signing an exec order to fuel the US semiconductor industry soon.

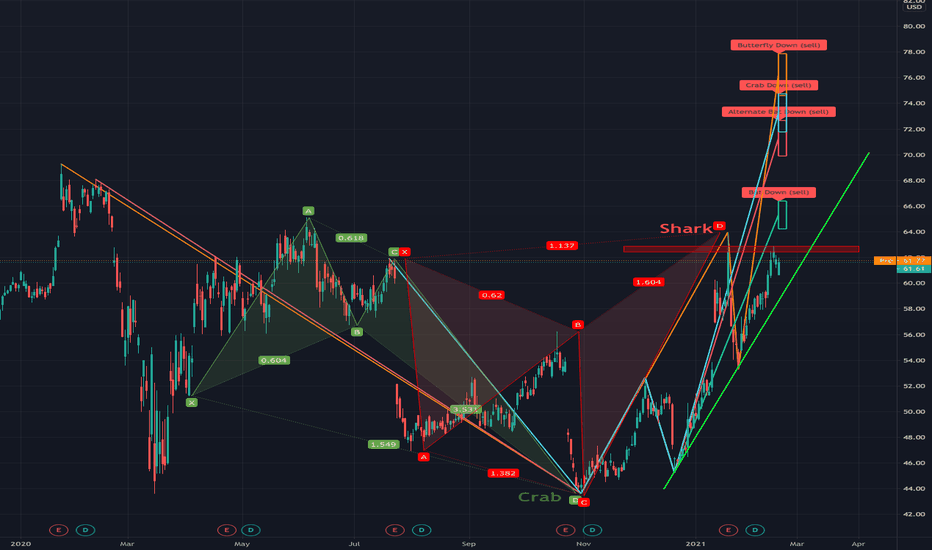

Intel - 4 possible harmonic patternsIntel has formed a bullish Crab at the end of October, followed by a bearish Shark in January. After returning to the upward trend, it has recently bounced off from the resistance level at around $62.50 (red rectangle).

However, if it breaks that resistance line, we have multiple possible harmonic formations that can form above:

Bat at $64-$66

Alternate Bat at $69-$72

Crab at $74-$71

or even a Butterfly at $78-$75

Around $59, we have a support line (green line).

There is a lot going on in this chart, so here is another one without harmonic predictions:

All the formations use 5% error margin.

Cup and HandleINTC was trading in an inverse H&S and has broken neckline which is now support..

Is it my imagination, or is this just not a stock to own during earnings? (o: Earnings were on 1-21 and it looks like they beat EPS and revenue. It must have been guidance? Comments welcome.

Just seems like this one does that a lot, go down after earnings right when it is getting race car ready to make a rally. No bearish rising wedges in yearly chart.

Stock is considered by many to be undervalued..Long term high is 75.83 from like 21 years ago. Yearly high is 68.09. 3 Year high is 69.29..NV and OBV are very high..

There is support at the HL, Mid cip and at the neckline so seems like a fairly safe trade. If you want to hold on, place your stop somewhere sneaky and somewhere safe. Mr Market is known to go stop loss hunting on occasion.

Cups form as price start to ride, then pull backs occur forming the rounded Bottom. you want to see a U shaped cup with a rounded bottom, an EVE bottom (o: Cup and handle patterns form in all time frames and are seen often in the market. They are relatively easy to spot. The rims should be close to the same price level but not exact. A cup with a handle that is very close to the top, can have a more explosive breakout. The handle has a median of 22 days to form but can be longer or shorter in formation. A shorter handle can indicate a better break out performance than one that takes eons to form. When price floats around forming a handle for months, stuff happens and it is not always good. Price could even get stuck in a rectangle etc.

Not a recommendation

It seems we are having more volatility as of late. That can get yoou stopped out and surprises happen that change patterns in a heartbeat. I am not sure what Monday will bring, but I hope it is not another rainy Monday )O:

INTC - EW analysis - ABC zigzag down INTC - It dropped sharply as wave A and expected to correct in B wave soon. So if B wave is sideways three wave bounce then it will be good shorting opprtunity for C wave down as zigzag correction. The move up was double zigzag correction.

Give thumbs up if you really like the trade idea.