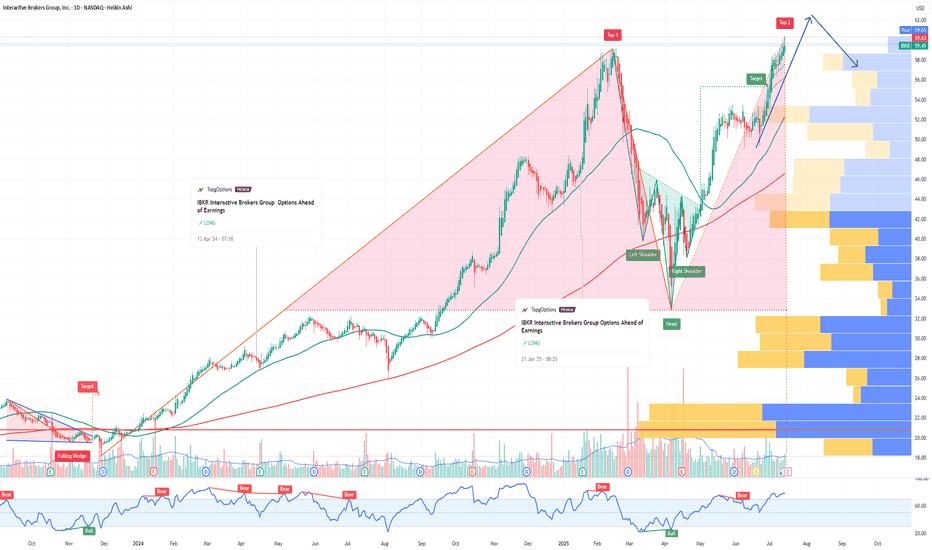

IBKR Interactive Brokers Group Options Ahead of EarningsIf you haven`t bought IBKR before the rally:

Now analyzing the options chain and the chart patterns of IBKR Interactive Brokers prior to the earnings report this week,

I would consider purchasing the 60usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $3.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

KY6 trade ideas

Donchian Channel Strategy like The Turtles TradersThe Turtle Traders strategy is a legendary trend-following system developed by Richard Dennis and William Eckhardt in the 1980s to prove that trading could be taught systematically to novices. Dennis, a successful commodities trader, bet Eckhardt that he could train a group of beginners—nicknamed "Turtles"—to trade profitably using strict rules. The experiment worked, with the Turtles reportedly earning over $100 million collectively. Here’s a detailed breakdown of their strategy, focusing on the core components as documented in public sources like Curtis Faith’s Way of the Turtle and other accounts from the era.

Core Philosophy

Trend Following: The Turtles aimed to capture large price trends in any direction (up or down) across diverse markets—commodities, currencies, bonds, and later stocks.

Systematic Rules: Every decision—entry, exit, position size—was predefined. No discretion allowed.

Volatility-Based: Risk and position sizing adjusted to each market’s volatility, not fixed dollar amounts.

Long-Term Focus: They targeted multi-month trends, ignoring short-term noise.

Two Trading Systems

The Turtles used two complementary breakout systems—System 1 (shorter-term) and System 2 (longer-term). They’d trade both simultaneously across a portfolio of markets.

System 1: Shorter-Term Breakout

Entry:

Buy when the price breaks above the 20-day high (highest high of the past 20 days).

Sell short when the price breaks below the 20-day low.

Skip the trade if the prior breakout (within 20 days) was profitable—avoid whipsaws after a winning move.

Initial Stop Loss:

Exit longs if the price drops 2N below entry (N = 20-day Average True Range, a volatility measure).

Exit shorts if the price rises 2N above entry.

Example: Entry at $100, N = $2, stop at $96 for a long.

Trailing Stop:

Exit longs if the price breaks below the 10-day low.

Exit shorts if the price breaks above the 10-day high.

Time Frame: Aimed for trends lasting weeks to a couple of months.

System 2: Longer-Term Breakout

Entry:

Buy when the price breaks above the 55-day high.

Sell short when the price breaks below the 55-day low.

No skip rule—take every breakout, even after a winner.

Initial Stop Loss:

Same as System 1: 2N below entry for longs, 2N above for shorts.

Trailing Stop:

Exit longs if the price breaks below the 20-day low.

Exit shorts if the price breaks above the 20-day high.

Time Frame: Targeted trends lasting several months (e.g., 6-12 months).

Position Sizing

Volatility (N): N, or “noise,” was the 20-day Average True Range (ATR)—the average daily price movement. It normalized risk across markets.

Unit Size:

Risk 1% of account equity per trade, adjusted by N.

Formula: Units = (1% of Account) / (N × Dollar Value per Point).

Example: $1M account, 1% = $10,000. Corn N = 0.5 cents, $50 per point. Units = $10,000 / (0.5 × $50) = 400 contracts.

Scaling In: Add positions as the trend confirms:

Long: Add 1 unit every ½N above entry (e.g., entry $100, N = $2, add at $101, $102, etc.).

Short: Add every ½N below entry.

Max 4 units per breakout, 12 units total per market across systems.

Risk Management

Portfolio Limits:

Max 4 units in a single market (e.g., corn).

Max 10 units in closely correlated markets (e.g., grains).

Max 12 units in one direction (long or short) across all markets.

Stop Loss: The 2N stop capped risk per unit. If N widened after entry, the stop stayed fixed unless manually adjusted (rare).

Drawdown Rule: If account dropped 10%, cut position sizes by 20% until recovery.

Markets Traded

Commodities: Corn, soybeans, wheat, coffee, cocoa, sugar, cotton, crude oil, heating oil, unleaded gas.

Currencies: Swiss franc, Deutschmark, British pound, yen.

Bonds: U.S. Treasury bonds, 90-day T-bills.

Metals: Gold, silver, copper.

Diversification across 20-30 markets ensured uncorrelated trends.

The AI Revolution in Quantitative TradingHow AI-Driven Quantitative Trading Will Render Traditional Analysis Obsolete

In the fast-evolving world of finance, artificial intelligence (AI) is reshaping how investment strategies are developed and executed. One of the most significant transformations is occurring in the realm of quantitative trading, where AI algorithms are beginning to overshadow traditional methods like fundamental and technical analysis. This article explores how AI-driven quantitative trading might lead to the obsolescence of these conventional approaches in the near future.

Understanding Traditional Trading Methods

Fundamental Analysis involves scrutinizing financial statements, management effectiveness, industry conditions, and economic factors to determine a company's intrinsic value. Investors using this method look for stocks that are undervalued or overvalued based on their intrinsic worth.

Technical Analysis, on the other hand, relies on historical price movements and trading volumes to predict future market behavior. Chartists and traders look for patterns and indicators to make buy or sell decisions.

Both methods have been foundational in trading for decades, providing insights based on human interpretation of data.

The Advent of AI in Quantitative Trading

Quantitative Trading uses mathematical models to identify trading opportunities. With the integration of AI, these models have become more sophisticated:

Machine Learning: AI systems can learn from vast amounts of data, spotting complex patterns that might be invisible or too subtle for human analysts. Over time, these systems adapt, refining their predictive models to improve accuracy.

High-Speed Data Analysis: AI can process and analyze data at a speed and scale unattainable by human analysts, allowing for real-time trading decisions based on global economic indicators, news, and market sentiment.

Algorithmic Execution: AI-driven algorithms can execute trades at optimal times to minimize impact costs or maximize profit from fleeting market inefficiencies.

How AI Might Outpace Traditional Analysis

Speed and Scale: AI can analyze millions of data points in seconds, something that would take humans days or weeks. This speed allows for quicker reactions to market changes, giving AI-driven systems a significant edge.

Complexity Handling: AI can manage and interpret complex, multi-dimensional data sets that traditional analysis might oversimplify. For instance, AI can incorporate sentiment analysis from social media alongside traditional financial metrics.

Learning and Adaptation: Unlike traditional methods, AI systems continuously learn and adapt. If market conditions change, AI can recalibrate its strategies automatically, reducing the lag time associated with human intervention.

Reduction of Bias: Human traders might be influenced by psychological biases or emotional reactions. AI, devoid of such biases, can make more objective decisions based purely on data.

The Future Landscape

While the complete extinction of fundamental and technical analysis seems unlikely due to their established practices and the human element they retain, their dominance in trading decisions could significantly wane:

Niche Applications: Fundamental analysis might become more niche, used by specific investors or for qualitative assessments where human judgment still holds value, such as in evaluating corporate governance or long-term strategic fit.

Complementary Tools: Technical analysis might shift from being a primary decision tool to more of a complementary one, used in conjunction with AI to validate or provide alternative perspectives to algorithmic predictions.

Educational Shift: There might be a shift in how finance is taught, with more emphasis on programming, data science, and machine learning rather than traditional chart reading or financial statement analysis.

Challenges and Considerations

Regulatory Scrutiny: As AI becomes more entrenched, regulatory bodies might increase oversight to ensure market fairness and prevent systemic risks from highly correlated AI strategies.

Ethical and Transparency Issues: The "black box" nature of some AI algorithms could lead to transparency concerns, making it harder for regulators or investors to understand decision-making processes.

Market Stability: If too many traders rely on similar AI models, it could lead to synchronized market behavior, potentially destabilizing markets.

Conclusion

While human judgment will always play a role in financial markets, the overwhelming advantages of AI-driven quantitative trading suggest that traditional fundamental and technical analysis-based approaches will become increasingly marginalized. The future belongs to those who can effectively harness the power of AI and machine learning in their trading strategies.

However, this transition won't happen overnight, and there will likely be a period where human-driven and AI-driven approaches coexist. The key for market participants is to understand and adapt to this changing landscape, leveraging AI tools while maintaining the flexibility to respond to new challenges and opportunities as they emerge.

The extinction of traditional trading approaches may be an overstatement, but their role will certainly diminish as AI-driven quantitative trading continues to demonstrate superior performance and capability. The future of trading belongs to those who can successfully integrate artificial intelligence into their investment process while maintaining the adaptability to navigate an ever-evolving market environment.

Speculative Madness: The Market’s Bubble Stocks Some stocks areSpeculative Madness: The Market’s Bubble Stocks

Some stocks aren't just overvalued—they're in full speculative bubble mode. Fundamentals? Irrelevant. When euphoria takes over, rationality disappears.

Here’s my list of bubble stocks that scream unsustainable pricing:

SBUX, T, PLTR, BMY, PYPL, NFLX, GS, ISRG, ARM, C, SHOP, BSX, SPOT, UBS, IBKR, RELX, CEG, CRWD, MSTR, MMM, DASH, COF...

And let’s not forget the obvious: TSLA, META, AMZN, AVGO, GOOGL, JPM, MA, V, WMT.

Honestly, the entire banking sector, brokers, and tech are in bubble territory.

What the hell is going on with this market? Why are algos just buying, buying, buying, squeezing all the shorts?! Unbelievable.

The dump will be insannnnnnnne!!! 🚨

Interactive Brokers Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Interactive Brokers Stock Quote

- Double Formation

* 1st (TL) | Measurement On Session | Subdivision 1

* 2nd (TL) | Uptrend Feature

- Triple Formation

* 123.00 USD | Area Of Value | Subdivision 2

* Numbered Retracement | Support area | Subdivision 3

* Daily time Frame | Trend Settings Condition

Active Sessions On Relevant Range & Elemented Probabilities;

European Session(Upwards) - US-Session(Downwards) - Asian Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

IBKR Interactive Brokers Group Options Ahead of EarningsIf you havne`t bought IBKR before the previous earnings:

Now analyzing the options chain and the chart patterns of IBKR Interactive Brokers Group prior to the earnings report this week,

I would consider purchasing the 200usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $3.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

IBKR: BUY THE TECHY BROKERNASDAQ:IBKR reported strong results for Q3 2024, with adjusted earnings per share of $1.75, reflecting a 12.9% increase from the prior year, albeit slightly below the consensus estimate of $1.78. The company has shown significant growth in customer accounts and daily average revenue trades (DARTs), key drivers behind its performance.

After an initially negative reaction to the earnings report due to the slight miss and overall market trends, shares are stabilizing today. This creates a brief window for a long trade, allowing for a tight stop level to establish a very favorable risk-reward scenario.

Key Highlights Supporting Further Gains:

Total Revenue: $1.37 billion, up 19.2% year-over-year.

Customer Accounts: Grew 28.3% to 3,120,000 accounts.

DARTs: Increased 41.7% to 2.7 million, aligning with expectations.

Strong Capital Position: Cash and equivalents total $69.9 billion, with total assets of $148.5 billion.

Daily Technical Analysis Overview:

Oscillators:

RSI (14): 66.07 (Neutral)

Momentum (10): 4.72 (Buy)

Bull Bear Power: 2.08 (Buy)

Moving Averages:

EMA (10, 20, 50, 100, 200): All in "Buy."

SMA (10, 20, 50, 100, 200): All in "Buy."

Conclusion:

The robust capital position of Interactive Brokers, along with growth in accounts and DARTs, supports a positive outlook for the stock. Despite a slight increase in expenses, the fundamentals remain strong, justifying a buy recommendation. This is a great opportunity to capitalize on the current trend pause. If you'd like to discuss stop levels or have any questions, feel free to reach out!

🚀 Don’t miss this opportunity and follow me for more trading ideas!

Disclaimer: This analysis and recommendation are for informational purposes only and do not constitute financial advice. Always conduct your own research and consult with a financial advisor before making any investment decisions. Past performance is not indicative of future results. Investing in stocks involves risks, including the loss of principal.

IBKR | Interactive BrokersInteractive Brokers Group, Inc. operates as an investment holding company, which engages in broker or dealer and proprietary trading businesses. It offers custody and service accounts for hedge and mutual funds, exchange-traded funds, registered investment advisors, proprietary trading groups, introducing brokers, and individual investors. The company was founded by Thomas Pechy Peterffy in 1977 and is headquartered in Greenwich, CT.

Scanner Idea: Above Average Volume near multi-month highs.

IBKR Interactive Brokers Group Options Ahead of EarningsAnalyzing the options chain and the chart patterns of IBKR Interactive Brokers Group prior to the earnings report this week,

I would consider purchasing the 135usd strike price Calls with

an expiration date of 2024-9-20,

for a premium of approximately $2.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall.

Trendline Breakout in IBKR

BUY TODAY SELL TOMORROW for 5%

IBKR Weekly Technical AnalysisIBKR Weekly - No RECOMMENDATION or ADVICE Status / EDUCATIONAL only - Support, Resistance, Pitchfork, Confluence, Clusters, Trend Lines, ABCD Pattern, Fibonacci Extensions - Hope it Helps, Good Luck

DISCLAIMER - This communication is not trading or investment advice, recommendation or solicitation to buy, sell or hold any investment product is provided for informational, educational and research purposes only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The author or persons involved in the conception, production and distribution of this material cannot be held responsible for transactions or any financial loss or damages resulting directly or indirectly from the use or application of any concepts or information contained in or derived from this material. Past performance is not indicative of future results. Any person who chooses to use this information as a basis for their trading assumes all the liability and risk for themselves.

IBKR (weekly chart) Buy on Pullback CandidateIBKR

20.78 % ROE

36.4% upside from 9/15 close (Finbox Models)

9% Free cash flow yield

High quality earnings

Piotroski Score 8 (excellent)

Sloan Ratio -2.6% (excellent income quality, no problem with accruals)

Debt/Equity 82.51% (Schwab is over 200%)

Cautions:

missed last two earnings

3 Analysts have recently revised downward earnings estimates

Insider sells

Assessment:

Would consider a long entry around 85.40, a .236 retrace, at the apex of volume profile, base of rising trend line, and near bull cloud top. Would reassess potential when the target buy area is reached.