Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.00 EUR

−462.17 K EUR

4.07 B EUR

528.16 M

About Microchip Technology Incorporated

Sector

Industry

CEO

Steve Sanghi

Website

Headquarters

Chandler

Founded

1989

FIGI

BBG000BHKTT2

Microchip Technology, Inc. engages in the provision of semiconductor products. It operates through the Semiconductor Products and Technology Licensing segments. The Semiconductor Products segment is involved in designing, developing, manufacturing, and marketing microcontrollers, development tools and analog, interface, mixed signal, connectivity devices, and timing products. The Technology Licensing segment offers license fees and royalties associated with technology licenses for the use of SuperFlash embedded flash and Smartbits one-time programmable technologies. The company was founded on February 14, 1989 and is headquartered in Chandler, AZ.

Related stocks

$MCHP | Microchip Technology — Monthly Macro PlaybookNASDAQ:MCHP | Microchip Technology — Monthly Macro Playbook

This chart illustrates the multi-decade rhythm of NASDAQ:MCHP , highlighting how past cycles and technical structure provide clarity on the current setup.

Historical Market Cycles & RSI Trends

Each gray circle marks a key market struc

MCHP – 30-Min Long Trade Setup!📈

🔹 Ticker: MCHP (NASDAQ)

🔹 Setup: Falling Wedge Breakout + Oversold Bounce

🔸 Breakout Zone: ~$40.74 (yellow zone breakout)

📊 Trade Plan (Long Position)

✅ Entry Zone: $40.60–$40.80

✅ Stop Loss (SL): Below $39.08 (white key level)

✅ Take Profit Targets:

📌 TP1: $43.27 (red zone – resistance shelf)

📌

MCHP – 30-Min Long Trade Setup!📈

🔹 Ticker: MCHP (NASDAQ)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Falling Trendline Break + Support Reclaim

🔸 Breakout Price: ~$48.47

📊 Trade Plan (Long Position)

✅ Entry Zone: $48.40–$48.50 (bullish breakout + yellow resistance zone retest)

✅ Stop Loss (SL): Below $47.62 (white support zone – str

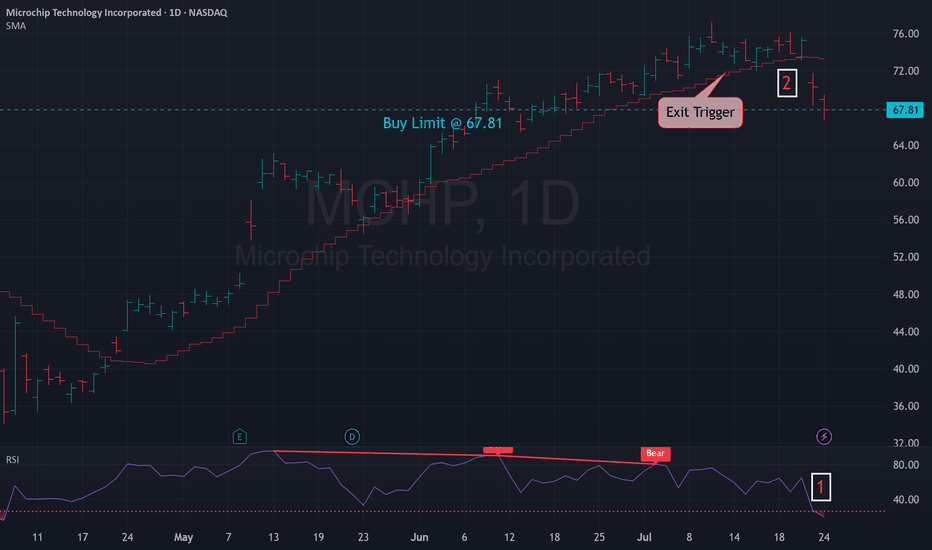

Bullish Re-Entry on MCHP – Strong Support & Long-Term TrendI’ve gone bullish on NASDAQ:MCHP once again, making this the third entry after being stopped out twice recently. Last Friday, I re-entered because the stock is in a strong, long-term bullish trend and currently holding at a key support level . Volume has also increased , showing renewed inte

MCHP Bullish Setup – 1:25 R:R with 3 Consecutive Doji CandlesNASDAQ:MCHP has arrived at a key historical support level, and we’ve now seen 3 consecutive doji candles, indicating indecision but a potential bullish reversal. The stock remains in a long-term uptrend, with the all-time high (ATH) not far off.

Increased volume suggests renewed buying pressure, o

Long trading idea on $MCHPLong trading idea on NASDAQ:MCHP

Reasons to buy:

The stock has arrived at a strong support level, maintaining its long-term uptrend.

We're not far from the all-time high (ATH), offering a favorable risk/reward ratio of 1:18 until ATH.

Increased volume and the formation of a doji signal a potent

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MCHP5196527

Microchip Technology Incorporated 4.25% 01-SEP-2025Yield to maturity

5.99%

Maturity date

Sep 1, 2025

MCHP5960316

Microchip Technology Incorporated 4.9% 15-MAR-2028Yield to maturity

4.56%

Maturity date

Mar 15, 2028

MCHP5960317

Microchip Technology Incorporated 5.05% 15-FEB-2030Yield to maturity

4.55%

Maturity date

Feb 15, 2030

MCHP5767179

Microchip Technology Incorporated 5.05% 15-MAR-2029Yield to maturity

4.52%

Maturity date

Mar 15, 2029

MCHP6091412

Microchip Technology Incorporated 0.75% 01-JUN-2030Yield to maturity

1.26%

Maturity date

Jun 1, 2030

MCHP4610421

Microchip Technology Incorporated 1.625% 15-FEB-2027Yield to maturity

−28.74%

Maturity date

Feb 15, 2027

See all MCP bonds

Curated watchlists where MCP is featured.

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange MICROCHIP TECH. DL-,001 stocks are traded under the ticker MCP.

We've gathered analysts' opinions on MICROCHIP TECH. DL-,001 future price: according to them, MCP price has a max estimate of 76.48 EUR and a min estimate of 48.44 EUR. Watch MCP chart and read a more detailed MICROCHIP TECH. DL-,001 stock forecast: see what analysts think of MICROCHIP TECH. DL-,001 and suggest that you do with its stocks.

Yes, you can track MICROCHIP TECH. DL-,001 financials in yearly and quarterly reports right on TradingView.

MICROCHIP TECH. DL-,001 is going to release the next earnings report on Aug 7, 2025. Keep track of upcoming events with our Earnings Calendar.

MCP earnings for the last quarter are 0.10 EUR per share, whereas the estimation was 0.10 EUR resulting in a 5.07% surprise. The estimated earnings for the next quarter are 0.20 EUR per share. See more details about MICROCHIP TECH. DL-,001 earnings.

MICROCHIP TECH. DL-,001 revenue for the last quarter amounts to 897.07 M EUR, despite the estimated figure of 889.76 M EUR. In the next quarter, revenue is expected to reach 896.67 M EUR.

MCP net income for the last quarter is −142.90 M EUR, while the quarter before that showed −51.78 M EUR of net income which accounts for −176.00% change. Track more MICROCHIP TECH. DL-,001 financial stats to get the full picture.

Yes, MCP dividends are paid quarterly. The last dividend per share was 0.40 EUR. As of today, Dividend Yield (TTM)% is 2.74%. Tracking MICROCHIP TECH. DL-,001 dividends might help you take more informed decisions.

As of Aug 2, 2025, the company has 19.4 K employees. See our rating of the largest employees — is MICROCHIP TECH. DL-,001 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MICROCHIP TECH. DL-,001 EBITDA is 1.04 B EUR, and current EBITDA margin is 25.57%. See more stats in MICROCHIP TECH. DL-,001 financial statements.

Like other stocks, MCP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MICROCHIP TECH. DL-,001 stock right from TradingView charts — choose your broker and connect to your account.