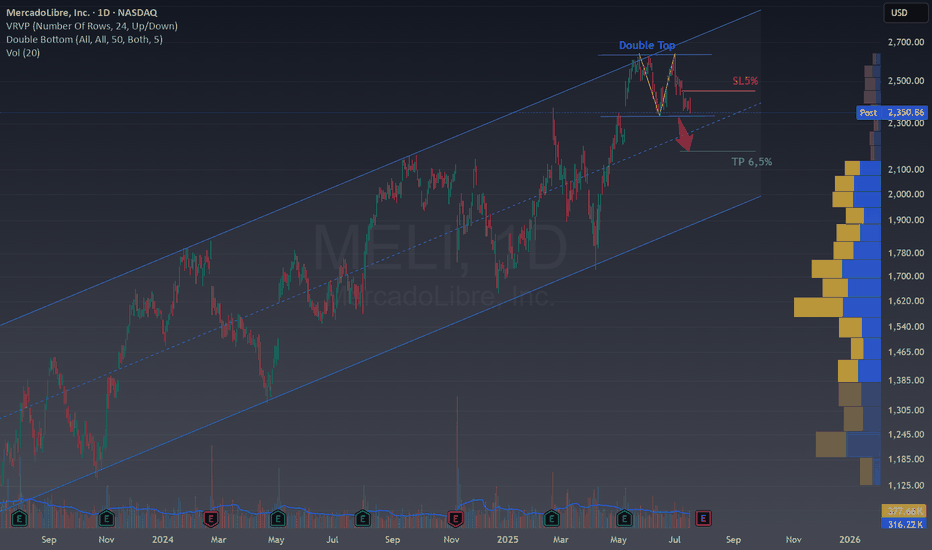

Double Top in MELI – Potential Reversal Inside a Channel🧠 Double Top in MELI – Potential Reversal Inside a Channel

Ticker : MercadoLibre, Inc. (MELI)

Timeframe : 1D (Daily Chart)

Pattern : Double Top

Bias : Bearish Reversal within a Bullish Channel

Technical Breakdown

We're spotting a clean Double Top at the upper boundary of a long-term ascending channel , a key zone where price has struggled multiple times in the past.

Here’s what stands out:

Two clear peaks around $2,700, signaling buyer exhaustion.

Price has now broken the minor support (neckline) around $2,350, which could trigger further downside in the short term.

The pattern is forming inside a well-defined upward channel, so this move could just be a healthy pullback within the larger trend, or the beginning of something deeper...

📐 Trade Setup

Entry : After the neckline break (~$2,350)

Stop Loss : Above recent highs, at 5% risk

Take Profit : Projected to 6.5% lower, toward the midline of the ascending channel and a high-volume node on the VPVR

📊 The Volume Profile (VPVR) supports this setup:

Lower liquidity between current price and the $2,200–2,250 zone may accelerate the move.

High-volume support is found at the TP zone, which makes it a smart target.

📘 Educational Insight

This setup is a great example of how classic chart patterns (like the Double Top) can still be relevant, even within strong uptrends.

A key lesson here:

Not every reversal is a trend change. Sometimes, it’s just a rotation to rebalance price within structure (like this channel). Risk management becomes crucial.

💬 What do you think? Is MELI heading for a deeper pullback or just catching its breath?

Hit the 🚀 if this helped clarify the setup, and follow for more clean, educational ideas!

MLB1 trade ideas

$MELI: Long term trend activeThe dominant e-commerce and fintech player in Latin America, MercadoLibre, has demonstrated robust growth in the first quarter of 2025.

With a significant increase in gross merchandise volume and total payment volume, the company is capitalizing on the region's digital transformation.

Key metrics to watch include user growth on its platform and the performance of its credit and asset management services.

Time at mode and valuation analysis paint a solid picture here, with ample relative strength against the broad market in all timeframes overall as well.

Best of luck!

Cheers,

Ivan Labrie.

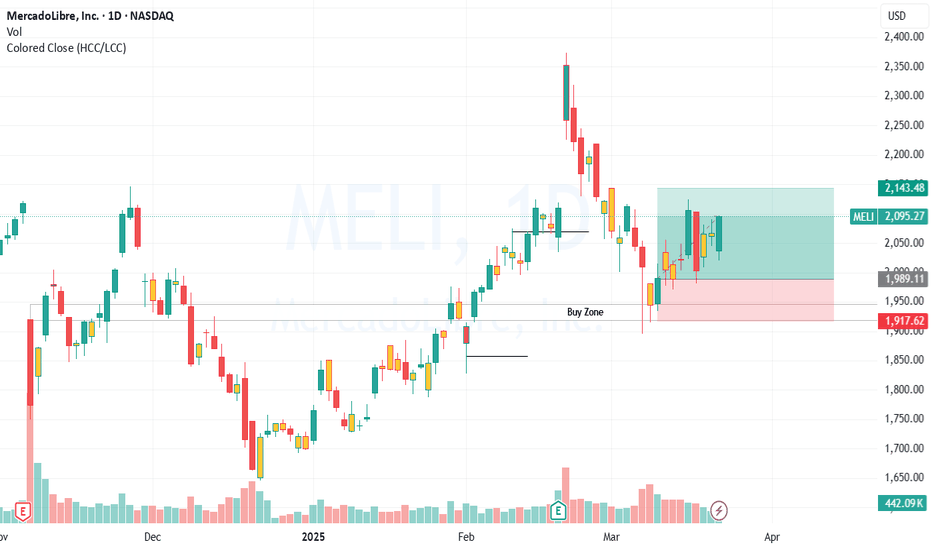

MercadoLibre Pulls BackMercadoLibre rallied to new highs last month, and some traders may see an opportunity in its latest pullback.

The first pattern on today’s chart is the $2,374.54 level. MELI first touched that price on February 21 after reporting strong earnings. The stock gapped above the level in May on another strong quarterly report and has now retested it. Will the old resistance emerge as new support?

Second, price gains after the last two quarterly reports may reflect positive fundamental sentiment in the Latin American e-commerce company.

Third, stochastics have dipped to an oversold condition.

Check out TradingView's The Leap competition sponsored by TradeStation.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

MercadoLibre setting up for good buy opportunityHello,

MercadoLibre, Inc. engages in the development of an online commerce platform with a focus on e-commerce and related services. It operates through the following geographical segments: Brazil, Argentina, Mexico, and Other Countries.

TECHNICAL ANALYSIS- Checklist

1. Structure drawing (Trend line drawing on past price chart data)- As shown below

2. Patterns identification (Naming patterns on past price chart data for future wave)- The stock is currently correcting & forming a bullish expanding triangle.

3. Future indication (Reading indicator for future wave)- 0 crossover about to happen

4. Future wave (Drawing on future price chart using future indication from indicator)- As shown below

5. Future reversal point (Identifying trend reversal point on price chart using structure)- Target point as shown

From 2018 to 2023, the company experienced significant growth in its financial metrics. Total revenue rose from $1.44 billion in 2018 to $14.47 billion in 2023. Gross profit increased from $655.55 million in 2018 to $6.95 billion in 2023. Net income shifted from a loss of $36.59 million in 2018 to a profit of $987 million in 2023. The company’s earnings per share (EPS) improved from -$0.82 in 2018 to $19.35 in 2023. Total assets grew from $2.24 billion in 2018 to $17.65 billion in 2023, while total liabilities increased from $1.90 billion in 2018 to $14.58 billion in 2023.

Highlights of the Nine months ended September 30th 2024

net revenue and financial income reached $14.718 billion, a significant increase from $10.698 billion in the same period of 2023.

Gross Profit: Gross profit rose to $6.828 billion for the nine months ended September 30, 2024, compared to $5.540 billion in the same period of 2023.

Net Income: Net income surged to $1.272 billion for the nine months ended September 30, 2024, up from $0.822 billion in the same period of 2023.

Earnings Per Share (EPS): Basic earnings per share as of September 30, 2024, stood at $25.09.

Total Current Assets: As of September 30, 2024, total current assets were $17.824 billion, up from $14.294 billion as of September 30, 2023.

Total Current Liabilities: Total current liabilities as of September 30, 2024, increased to $4.308 billion, compared to $3.278 billion as of September 30, 2023.

Opportunities

The rising adoption of digital payments and growing preference for online shopping reinforce a strong, long-term growth trajectory for MercadoLibre.

Expanding its first-party sales business enables MercadoLibre to better compete during major holiday seasons by offering strategic discounts on flagship products.

Providing consumer and small-business loans addresses critical gaps in traditional financial services while fostering stronger ties between merchants, customers, and the MercadoLibre platform.

Risks to consider

Intense competition among fintech rivals may lead to slower-than-anticipated growth or reduced net interest margins for Mercado Pago's consumer, merchant, and credit card product lines.

Escalating macroeconomic challenges in Argentina could heighten foreign exchange losses or, in extreme scenarios, disrupt the market entirely.

Unique linguistic, trade, and cultural differences in the region pose challenges for cross-border sales, necessitating the upkeep of distinct marketplace platforms in each country.

Our recommendation

MercadoLibre’s profitability missed expectations, but the company’s focus on strengthening its competitive position is encouraging. Key areas like its logistics network (Mercado Envios), growing ads business, and new Prime-like program (Meli Mais) continue to improve. Despite slight underperformance, strong growth in consumer credit and a better business environment in Argentina are positives. With $6.7 billion in cash and a $400 million credit facility, MercadoLibre is financially strong. Shares remain slightly expensive, but the current correction could present a buying opportunity around the $1,850 level.

Our recommendation is a wait to buy at around $1,850 with a target of $2,600.

Current price: $1952 (3rd December, 2024)

MELI at Risk from Momentum Shift and High ValuationMELI has gained over 35% since the April dip, but momentum has been fading since September. The slowdown has become increasingly visible, and last week's high may remain the top for some time unless Wednesday’s earnings report surprises the market on the upside.

The consensus estimate for MELI’s revenue is $5,497.05 million, representing a 26.86% year-over-year increase but a 9.27% decline quarter-over-quarter. MELI is currently trading at a forward P/E of 41.9x, which is significantly higher than the 19.8x average of comparable companies. Its geographic advantage over U.S.-based peers gave MELI an edge in April, but without strong earnings to support the high valuation, the stock could become vulnerable.

Over the past five years, MELI averaged 56.2% annual sales growth. That figure is expected to fall to an average of 22.1% over the next three years, which remains solid but signals a clear deceleration.

MELI could move more than 7% on earnings day, depending on the report. If the stock falls below 2,000, it may present a buying opportunity. However, the loss of momentum is usually a negative signal for sustaining trends, so the risk of buying the dip is higher than before.

Technical Analysis of $MELI (MercadoLibre) - For Long TermAfter a thorough analysis of MercadoLibre ( NASDAQ:MELI ) charts on 1M, 1W, and 1D timeframes, here’s a summary covering market context, key levels, trading opportunities, and price phases. Perfect for traders or investors looking for actionable insights.

Market Context

1M/1W: Strong bullish trend, with Higher Highs (HH) and Higher Lows (HL). The surge to the ATH ($2374.54) after the February 2025 earnings (+13%) and a post-HL move (+15%) show robust momentum. No clear signs of weakness (increasing volume, no RSI divergences).

1D: Likely in a temporary correction or consolidation within the $1700-$2140 range since August 2024. One Lower High ($2202, $2121) without Lower Lows (LL) suggests no confirmed bearish reversal. Bullish MACD (crossing above signal line) and rising volume (except the last 4 days) hint at a potential bounce.

Key Levels

Supports:

$1700-$1723.90: Equal Low (EqL), Point of Control (POC), Fibonacci 61.8%.

$1646-$1660: Pre-ATH low, historical level (2021).

$1830-$1870: High Volume Node (HVN).

Resistances:

$2100-$2140: Equal High (EqH), Order Block ($2000-$2100), HVN ($2060-$2100).

$2374.54: ATH.

Liquidity: Short stops above $2190, long stops below $1700. A false breakout at $2100 suggests potential manipulation.

Trading Opportunities

Bullish:

Bounce from $1700-$1723.90 targeting $2000-$2100, supported by POC, Fibonacci, bullish MACD, and Fair Value Gap ($1960-$2045) as a magnet.

Breakout above $2140 with high volume could target the ATH ($2374.54) or $2400-$2500 (analyst price targets).

Bearish: No clear reversal signals (no Change of Character, no bearish divergences). A break below $1700 with high volume might target $1646-$1660.

Range: Trade the $1700-$2140 range (buy at support, sell at resistance) until a clear breakout occurs.

Strength and Price Phase

1M/1W: In a bullish trend phase (Wyckoff). The -20% pullback post-ATH (linked to Galperin’s $300M share sale) is a correction within the trend. Pre-ATH consolidation supports this phase.

1D: In a lateralization phase (Wyckoff), with the $1700-$2140 range indicating accumulation or distribution, pending confirmation. The false breakout at $2100 suggests manipulation to sweep stops.

Additional Notes

Fundamentals: $5.8B investment in Brazil and $2.6B in Argentina (2025) bolster growth. Analysts (Cantor, Benchmark) target $2400-$2500, but Trump’s trade tariffs could add volatility.

Technical: Monitor volume on breakouts ($2140) or breakdowns ($1700), MACD (1D), and RSI (overbought at ATH, neutral now). Volume Profile (POC $1700, HVN $2000) and Order Blocks ($2000-$2100) are critical.

Suggestions: Consider lower timeframes (4H) for precise entries. Indicators like Stochastic RSI or Bollinger Bands could complement the analysis.

Conclusion: NASDAQ:MELI displays a robust bullish trend on higher timeframes, with a manageable consolidation on 1D. Supports ($1700-$1723.90) are strong, and signals (MACD, FVG, volume) point to a bounce or bullish breakout. Great for swing trading the range or going long on a $2140 break. Watch out for macro volatility!

What do you think? Anyone trading NASDAQ:MELI or have more insights to share?

**Disclaimer: This is not financial advice. Always trade responsibly.**

MERCADOLIBRE ($MELI) SOARS IN Q4—E-COMMERCE & FINTECH SHINE MERCADOLIBRE ( NASDAQ:MELI ) SOARS IN Q4—E-COMMERCE & FINTECH SHINE

(1/9)

Good evening, Tradingview! MercadoLibre ( NASDAQ:MELI ) is sizzling—Q4 revenue up 37%, a $ 6.1B haul 📈🔥. Fintech and e-commerce fuel a 33% surge—let’s unpack this Latin dynamo! 🚀

(2/9) – REVENUE RUSH

• Q4 Take: $ 6.1B—37% leap, tops $ 5.9B est. 💥

• EPS: $ 12.61—blasts past $ 7.94 hopes 📊

• Net Income: $ 639M—beats $ 402M dreams

NASDAQ:MELI ’s humming—growth’s got zing!

(3/9) – BIG MOVES

• GMV: $ 14.5B—56% jump FX-neutral 🌍

• Payments: $ 58.9B TPV—49% up 🚗

• Credit Boom: $ 6.6B—74% growth 🌟

NASDAQ:MELI ’s flexing muscle—full throttle!

(4/9) – MARKET VIBE

• P/E: ~60—above Amazon’s 40, PDD’s 20 📈

• Growth: 37% smokes peers’ 10%

• Targets: 2,400−3,000—10-38% upside 🌍

Premium price—worth the juice?

(5/9) – RISKS ON DECK

• FX Woes: Brazil, Mexico currencies wobble ⚠️

• Comp: Amazon, locals eye the prize 🏛️

• Rates: $ 6.6B credit—defaults lurk? 📉

Hot run—can it dodge the heat?

(6/9) – SWOT: STRENGTHS

• E-comm: $ 14.5B GMV—LatAm king 🌟

• Fintech: $ 58.9B TPV—Pago’s gold 🔍

• Logistics: 6 new centers—zippy edge 🚦📉

NASDAQ:MELI ’s a double-threat dynamo!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: High P/E, FX swings 💸

• Opportunities: Ad bucks, untapped markets 🌍

Can NASDAQ:MELI zap past the bumps?

(8/9) – NASDAQ:MELI ’s Q4 surge—what’s your vibe?

1️⃣ Bullish—$ 3,000 in sight.

2️⃣ Neutral—Growth’s hot, risks hover.

3️⃣ Bearish—FX bites back.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NASDAQ:MELI ’s $ 6.1B Q4 and fintech flex spark buzz—$ 14.5B GMV shines 🌍🪙. High P/E, but growth rules—champ or chase?

Will MELI repeat its historic pattern ?The price action pattern in MELI since 2022 shows that whenever the stock has touched its green trendline and pushed to cross above the EMA line, the price action has typically led to approximately a 40% increase. In some instances, there was first a 20% increase followed by a correction, before continuing upward to reach the full 40% move.

Based on this historical pattern, if MELI follows the same behavior with its recent EMA breakout, the price could potentially:

1.Touch its ATH around $2,160

2.Push further to around $2,400

11.21.2024 BULLISH MELIBullish trade for the long-term portion of the portfolio.

MELI is Latin American ecommerce market, and currently only 15% of commerce in Latin America is conducted online.

Entry price 1950, target is 2100 to close the overhead SIBI (Sellside Imbalance Buyside Inefficiency)

After earnings gap down may be a knee jerk reaction to an otherwise solidly performing company.

2% risk

Entry 1950

Stop 1900

Target 2100

MELI eyes on $1965: Golden Genesis arbiter of the earnings Dump MELI earnings report caused a serious dip.

Recovery bounce is now at a critical level.

What happens here could start a new trend.

$1965.66 is the exact level of Golden Genesis

$2022.23 is a Covid fib above is a backstop.

$1906.44 is a Covid fib below and some support.

===========================================

.

New position MELI (long term account)MELI I have been watching for a long time. This dip is a great opportunity, the stock was testing a long-term channel breakout, now it falls to the median. Their earnings are heavily misunderstood. I believe they purposefully kept EPS down to invest in their long term payments business, they needed cash collateral for risk on debt they services, this debt is high margin, this will pay off long term.

Note another bottom of BBWP, this signals heavily oversold

MercadoLibre (MELI): A Powerhouse in Latin America! MELI is solidifying its position as a dominant player in the e-commerce and fintech markets across Latin America. With Argentina’s economic surge and aggressive expansion in Brazil and Mexico, MELI is poised for significant growth.

📈 Key Highlights:

Economic Recovery in Argentina driving e-commerce activity.

Expansion into logistics and food delivery diversifying revenue streams.

Growing adoption of Mercado Pago enhances its financial ecosystem.

While I see strong fundamentals supporting a buy rating, a 5% drop could offer a better entry point. My fair price estimate is $2,709, based on a 5 year DCF analysis.

Let's keep an eye on the support levels around $1,936 and $1,824.

#MELI #MercadoLibre #Investing #StockMarket #Ecommerce #Fintech #LatinAmerica #GrowthStocks #InvestmentOpportunities #Stocktobuy #Pullback