Microsoft - A Little Lower And Much Higher!Microsoft ( NASDAQ:MSFT ) is about to retest strong support:

Click chart above to see the detailed analysis👆🏻

In mid 2024 Microsoft perfectly retested the previous channel resistance trendline and the recent weakness has not been unexpected at all. However the overall trend still remains rather bullish and if Microsoft retests the previous all time high, a significant move will most likely follow.

Levels to watch: $350

Keep your long term vision!

Philip (BasicTrading)

MSF trade ideas

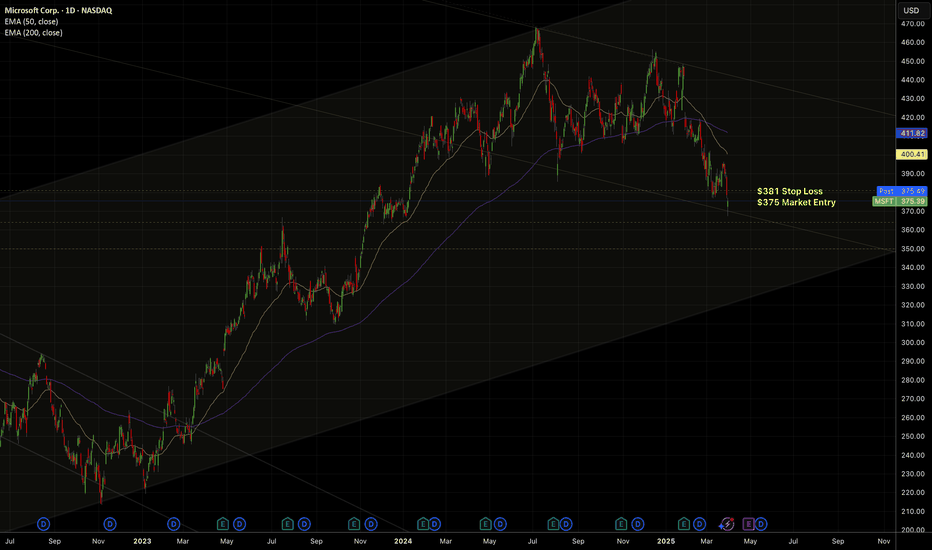

MSFT Short – Death Cross Confirmed | Breakdown Targeting $345🔻 **Trade Idea: SHORT MSFT**

I'm shorting Microsoft after a confirmed **death cross** on the daily chart (50 EMA crossed below 200 EMA), signaling long-term weakness.

### 📉 Structure:

- Breakdown of support at $384

- Clean retest + rejection at $377

- Lower highs and lower lows in play

- Volume spike on breakdown confirms seller strength

### 🎯 Trade Plan:

- **Entry**: $375–377 zone

- **Stop**: $381 (above last swing high)

- **Targets**:

- TP1: $364 (prior base)

- TP2: $357 (structural low)

- TP3: $345 (macro demand zone / 200W EMA)

### 🧠 Thesis:

- MSFT has transitioned from distribution to downtrend

- EMAs are bear-aligned

- Rejection confirmed on intraday wick + volume

- R:R = 3:1+ with clear invalidation

> "We don't chase weakness — we short structure when the market begs us to."

Open to thoughts — let’s trade clean.

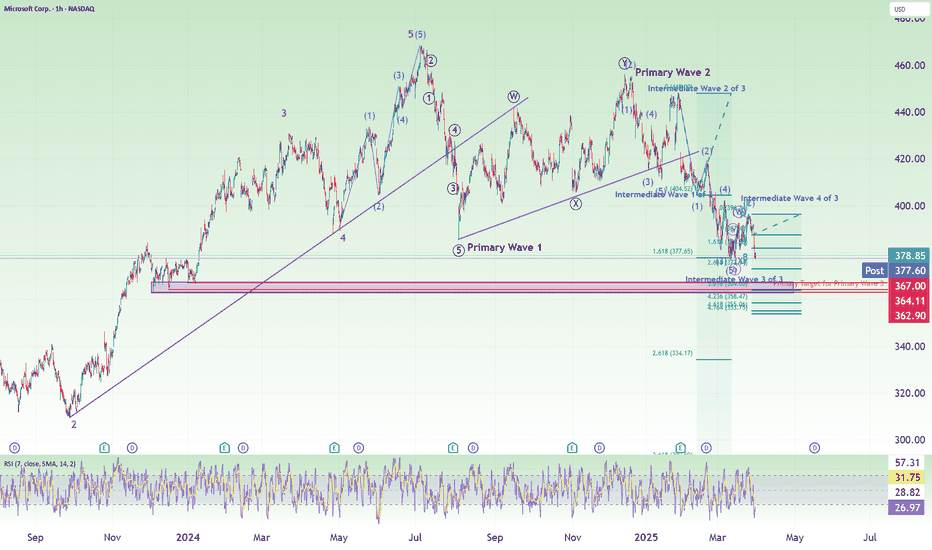

MSFT Short to Neutral: Last Wave 5 of 3 (Target: $364)A video update to Elliott Wave Counts and Price target for MSFT (and Nasdaq).

A summary:

1. Intermediate wave 3 of 3 has ended.

2. Intermediate wave 4 of 3 has ended in a double combination.

3. We are in Minor wave 3 of Intermediate wave 5 of Primary wave 3.

4. Using Fibonacci Extension from Minor wave 1 of against overall Intermediate wave 5 gives us a target of $364, which is within a support zone. This is the Primary Wave 3 completion target.

5. Using Nasdaq, we also noted that we still have a little bit more to our final target.

MSFT Approaching a Key Reversal Zone – Will Bulls Defend Gamma?🔎 Technical Analysis (TA) – Intraday Outlook

Current Price: ~$389.27

* MSFT is pulling back after making a local high near 396.31.

* The price is now sitting just above a demand block, marked by previous CHoCH and BOS levels, signaling a potential bounce zone.

* Structure is showing early signs of weakness, but key support at 382-385 is still intact.

Indicators:

* MACD: Bearish crossover with histogram declining — watch for a potential shift if buyers step in at support.

* Stoch RSI: Oversold, hinting at possible bounce if support holds.

Key Support Zones:

* 385 → Critical intraday support with 2nd PUT Wall.

* 382.87 → High confidence PUT level.

* 376.85 → Strong PUT support and bottom of the SMC zone (high reward bounce setup if defended).

Resistance Zones:

* 392.59 → Local rejection level.

* 396.31 → Key intraday resistance.

* 400 → Highest Positive NetGEX & Gamma Wall (major resistance zone).

* 405 → 2nd CALL Wall.

🧠 GEX & Options Flow Analysis (TanukiTrade GEX Zones)

* GEX Sentiment: 🟢🔴🟢 (Mixed — but put wall support is closer, bullish if held)

* IV Rank (IVR): 31.3

* IVx avg: 26.1 → Options pricing not overly volatile

* PUT$%: 9.6% – Moderate, suggesting dealers may provide support on dips

* Gamma Wall: At 400, major resistance

* PUT Support: At 380 with strong negative GEX (key defensive zone)

* HVL Cluster: Near 390 (May expiry), could pin price today if no catalyst.

🛠️ Trade Scenarios

📈 Bullish Setup – Support Bounce from 385 or 382

* Price bounces from key SMC demand zone and starts reclaiming 390+

* Entry: 386–387 zone reclaim + volume

* Target 1: 392

* Target 2: 396

* Target 3: 400

* Stop-Loss: Below 382.5

* Options Play:

* Long Apr 12 $390 Calls on bounce confirmation.

* Sell $385 Puts if confident in bounce continuation.

📉 Bearish Setup – Breakdown of 382

* If support fails at 382, expect a retest of 376.85 PUT support.

* Entry: Break below 382 with momentum

* Target 1: 376.85

* Target 2: 374 (liquidity sweep zone)

* Stop-Loss: Above 385.5

* Options Play:

* Long Apr 12 $380 Puts

* Debit Spread: Buy $385 Put / Sell $380 Put

🧭 Final Thoughts & Bias

* Short-Term Bias: Neutral → Leaning bullish if 382-385 holds

* GEX Context: Gamma compression is possible between 382-392 – breakout above or breakdown below will trigger expansion.

* Intraday Plan:

* Watch for bounce at 385 zone.

* Flip bearish only below 382 with strong volume.

* If 392.5 breaks, bulls may charge back toward 396-400 zone.

📛 Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own due diligence and manage risk.

MSFT Below Critical Reversal Zones! Watch Carefully! Quick update on MSFT based on the 1-hour chart setup, with special attention to reversal zones.

📈 Technical Analysis (TA):

* MSFT is currently consolidating right within a key green reversal zone (around $393). This area indicates potential bullish exhaustion, signaling a possible reversal if price fails to break higher.

* Immediate support marked clearly by the red reversal zone around $380. This significant area indicates potential bullish opportunities if tested.

* A Change of Character (CHoCh) has been detected at both reversal zones, emphasizing their significance.

* Pay close attention to how price reacts at the current green reversal zone; a confirmed rejection here could initiate bearish momentum towards $380.

📊 GEX & Options Insights:

* Highest positive NET GEX and strongest CALL resistance are at $400—critical gamma resistance.

* Strong PUT support at $380, aligning closely with our red reversal zone—highly significant for downside defense.

* IV Rank is moderate at 25.1%, providing opportunities for both bullish and bearish spread strategies.

* Extremely low PUT ratio at 3.6%, indicating prevailing bullish sentiment; however, caution at reversal levels is advised.

💡 Trade Recommendations:

* Bearish Play: Consider puts if MSFT strongly rejects the current green reversal zone around $393, targeting the red reversal zone support at $380.

* Bullish Play: If MSFT clearly breaks above the green reversal zone (above $395), target the gamma level at $400. Tight stop-loss around $390.

* Neutral Approach: Iron Condors or credit spreads between the reversal zones ($380–$400) could benefit from current moderate volatility.

🛑 Risk Management: Given the significance of these reversal zones, carefully manage positions and respect stops.

Stay cautious and trade smart!

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

#MSFT - HTF Distribution - Waiting for key levels to be taken.Clear HTF distribution. There’s a potential pullback (if it occurs) into the 1W PHOB before a downward continuation.

Personally, I’d like to get involved between the HTF Demand zone and the 1M PHOB + 4W HOB, which, in my opinion, could serve as a potential reversal level, so keep an 👀 out

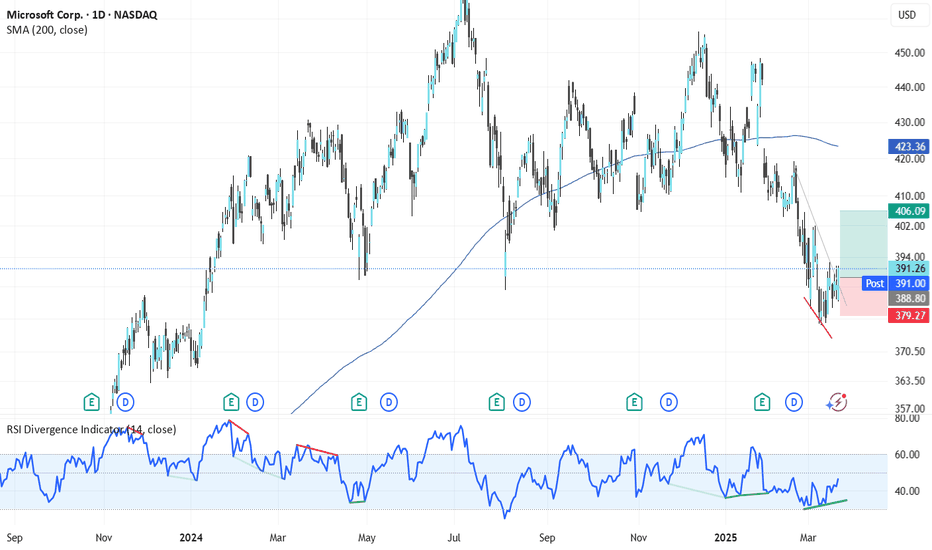

Microsoft (MSFT) faces a challenging outlook after a 16% drop Microsoft (MSFT) faces a challenging outlook after a 16% drop from its July 2024 peak. The long-term bullish structure has broken, with critical support at 380.65 providing temporary relief. Short-term recovery targets include 395.20, 404.40, 418.70, and 427.70. A significant market pullback could drive shares toward 357-348, 333.50-324.50, or even 310.00-300.00, mirroring historical declines of approximately 35%.

MSFT morning analysisI don't normally apply Elliott Wave Theory to individual stocks, but MSFT is about as clean as it gets.

Wave 2 is a zigzag of long duration, wave 4 is a triple-three of relatively short duration.

RSI with bearish divergence.

If this proves to be correct, the ultimate buy/long would be back towards the March 2020/COVID low (white rectangle).

Microsoft (MSFT): The "Can’t Go Wrong" Stock... Until It DoesAh, Microsoft—the tech titan that could probably survive a meteor impact. 🌍☄️ With a market cap so large it could buy entire countries and still have spare change for a few yachts, MSFT is the stock that everyone loves... even when it’s overvalued. But hey, let’s take a look at the "genius" behind the current price action. 🔍💰

📊 The Almighty Stock Performance (Because Fundamentals Don’t Matter Anymore?)

📉 Price: $385.76 (up a whole 0.00584%! Call the champagne guy! 🍾)

📊 Intraday High: $387.88

📉 Intraday Low: $383.27 (because even Microsoft has bad days, right? 😅)

🔮 200-day moving average: $423.98 (oh look, it's trading below that... bearish much? 🐻)

So, let me get this straight. MSFT is 7.80% down year-to-date, but analysts are still screaming “BUY! 🚀.” Sure, because blindly trusting price targets has always worked out well for retail investors. 🤑

💰 Valuation: Overpriced? Who Cares, It’s Microsoft!

📢 Intrinsic Value Estimate: $316.34

😬 Current Price: $385.76

💰 Overvaluation? About 18%

But let’s be honest—does valuation even matter anymore? If people are throwing money at meme coins, why not pay a premium for MSFT? 🤷♂️ It’s basically a subscription service at this point—you pay every month, and the stock just keeps draining your wallet. 💸

🤖 AI Goldmine or Just Another Buzzword?

Microsoft has been riding the AI hype train harder than a teenager with ChatGPT. 🚂💨 Their enterprise AI growth is over 100%, and they’re pulling in a $13 billion annual run rate from AI services. But sure, let’s pretend that no one remembers the last time “the next big thing” crashed and burned. (cough dot-com bubble cough). 💀💾

Evercore analysts claim MSFT will dominate AI for enterprises. Well, duh. If you’re an enterprise and don’t buy Microsoft AI services, Satya Nadella himself might show up at your office and force you to install Windows 11. 🏢💻

📉 Risk Factors? No Way! MSFT is Invincible... Right?

🦅 Hawkish Fed = Potential Market Sell-Off (But don’t worry, just HODL, right? 🤡)

🚀 Tech Bubble Concerns (Microsoft will totally be the exception… like every overhyped stock before it. 😬)

🧐 Overvaluation? Pfft, who cares? (People said the same about Tesla at $400. Look how that turned out. 🪦)

📢 Analyst Hot Takes (Because They’re Always Right 😂)

📊 D.A. Davidson: Upgraded to Buy with a price target of $450. (Ah yes, let’s just throw numbers out there. Why not $500? $600? 🚀)

🔮 UBS: Predicts $3,200 for gold, but Microsoft will somehow go even higher. (Probably. Because… reasons. 🤷♂️)

🎭 Final Thoughts: Buy? Sell? Just Panic?

Microsoft is basically the “safe” tech stock everyone clings to while pretending that the market isn’t built on dreams and overleveraged hedge funds. 🏦💰 If you believe in the power of monopolies, overpriced AI services, and analysts pulling price targets out of thin air, then MSFT is your golden ticket. 🎟️💎

Otherwise, maybe—just maybe—waiting for a dip below fair value isn’t the worst idea in the world. But what do I know? I’m just some guy on the internet. 🤷♂️

🚀💸 Good luck, traders. You’ll need it. 😈📉

💬 What do you think? Drop your thoughts below! 👇🔥

MsftNasty distribution playing out here... End of Q2 target is 320-350

Monthly chart..

Reversal candle In Dec .

Structure is sideways for the entire 2024 which is an ENTIRE year of DISTRIBUTION.

Weekly chart

My minimum target for a Wyckoff off of this size is 345 or as low as the weekly 200ma

I don't think we go straight there.. I think in the next 2weeks price will draw down to close gap at 367.00 from Jan 2024 ..

Price has formed a controlled channel thats looking wedgy..

From 367 I expect a rebound up to

410-420

I don't think price gets back over 420, I think that's when MSFT and the rest of the market takes its next major leg down in May

AAPL and MSFT Reading Charts For Better Entries and ExitsOptions Trading Strategy Using Ichimoku Cloud, 200 SMA & Monthly Contracts

(Following Your 3 Trading Rules)

This strategy adapts the Ichimoku Cloud & 200 SMA trend-following method for trading monthly options contracts with a focus on high-probability setups. It leverages time decay (theta), trend strength, and proper timing to maximize gains while reducing risk.

🔹 Strategy Overview

We will trade monthly options contracts using:

Trend confirmation via Ichimoku Cloud & 200 SMA

Directional bias based on price positioning

Entry timing rules to avoid low-probability setups

Theta-friendly positioning (avoiding weeklies to reduce time decay risks)

📈 Trading Rules & Setup

(My 3 Golden Rules)

🚫 No trading on Mondays → Avoids choppy market structure from weekend gaps.

🚫 No trading on Fridays → Avoids gamma risk and weekend time decay.

⏳ No trades before the first 15-minute candle closes → Ensures market direction is established.

📊 Selecting the Right Option Contract

For monthly expiration contracts, select options that:

Expire within 30 to 60 days (avoid weekly contracts to minimize rapid time decay).

Are slightly in-the-money (ITM) or at-the-money (ATM) for higher delta (0.55–0.70).

Have open interest >1,000 and a tight bid-ask spread to ensure liquidity.

Example: If today is June 11, trade the July monthly contract (third Friday of the month).

📉 Bearish Put Play (Short Trade)

200 SMA Bias: Price is below the 200 SMA

Ichimoku Cloud Confirmation:

Price is below the cloud

Tenkan-sen is below Kijun-sen (bearish momentum)

Chikou Span is below price from 26 candles ago

Future cloud is red

Entry Trigger (After First 15 Min Candle):

Price pulls back into the Kijun-sen but rejects it

OR price breaks below the cloud after a weak consolidation

Enter PUT contract (monthly expiration)

Stop Loss & Take Profit:

SL: Above Kijun-sen or recent swing high

TP: First at the cloud’s lower edge, second at a key support level

Exit before Theta decay accelerates (last 14 days before expiry)

📈 Bullish Call Play (Long Trade)

200 SMA Bias: Price is above the 200 SMA

Ichimoku Cloud Confirmation:

Price is above the cloud

Tenkan-sen is above Kijun-sen (bullish momentum)

Chikou Span is above price from 26 candles ago

Future cloud is green

Entry Trigger (After First 15 Min Candle):

Price pulls back into the Kijun-sen but holds

OR price breaks out above the cloud

Enter CALL contract (monthly expiration)

Stop Loss & Take Profit:

SL: Below Kijun-sen or recent swing low

TP: First at the cloud’s upper edge, second at a key resistance level

📊 Trade Management & Adjustments

Rolling: If trade is profitable near expiry but not at the full target, roll to the next monthly contract.

Closing Early: If the trade is at 70-80% max profit, close early to avoid decay risk.

Cutting Losses: If price closes inside the Ichimoku Cloud, consider exiting early (trend loss warning).

🛠 Why This Works for Monthly Options?

✅ Avoids time decay risks of weekly options by trading monthly contracts.

✅ Uses strong trend confirmation from Ichimoku & 200 SMA.

✅ Only trades at high-probability times, avoiding choppy Monday & Friday moves.

✅ Allows scaling into strong trends rather than short-term noise.

MICROSOFT Channel Down bottom formation targets $440.Microsoft (MSFT) has been trading within a Channel Down since the July 05 2024 High. The stock is on its latest Bearish Leg in the past 3 months and almost completed a -17.62% decline, similar with the Bearish Leg that led to the August 05 2024 Low.

As the 1D RSI has Double Bottomed, which is what it did on the April 30 2024 Low that kick started a rally of +20.63%, we expect the stock to initiate its new Bullish Leg of the Channel. The previous one was +18.16%, so we expect a similar range and target $440.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇