Bottom of the RangeMunich Rueck held stable this year. Now we've seen the retracement of the rise since March by almost 38 %. However a further retracement is possible I consider the chance of a recovery from here. We have reached the bottom of the trading range which we are in since April and the current level of our favoured Moving Average.

MUV2 trade ideas

A safe gain in a few weeksI think the stock will reach its pre covid level verry soon.

I drew the bouncy ball scan on the chart. We have three lower lows, a strong support line and a strong uptrend. Additionally we have a cup with a handle. The handle is unfortunatelly not giving as much pullback as it would in a textbook example. But the steadily growing quartal erarnings and the todays announced opening of businesses in Germany are a verry positive Signal, confirming the trend.

Buying MUV2 is great choice for dividende gainers, because they payed 9.8 EUR per share for a one year hold.

Cheers.

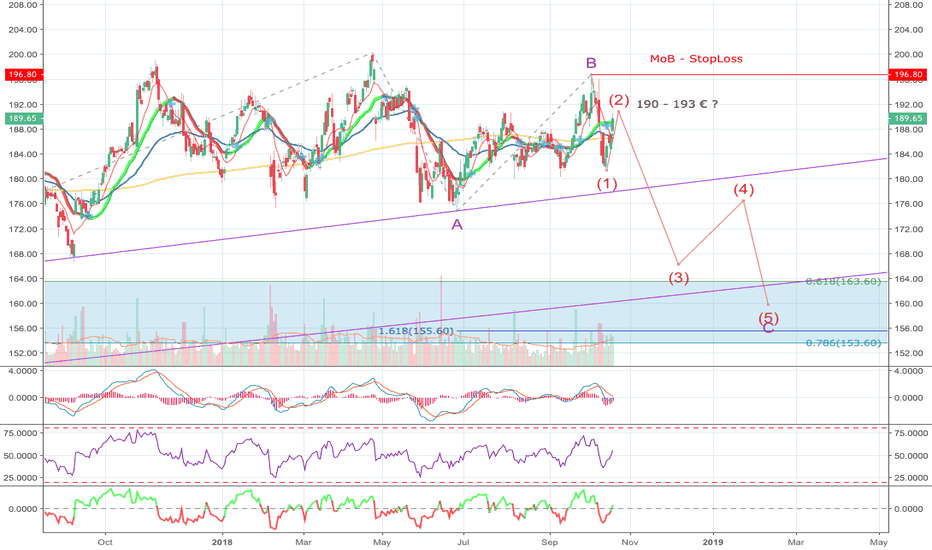

Munich Re - Down - ShortTermThe Pacific Ring of Fire is increasing in activity. The volcanic eruptions and earthquakes and their consequences such as tsunamis have increased significantly compared to the previous two years.

At the same time, the sun is in a solar minimum.

Huge sun holes at the North + South Pole and the equator seem to release relatively many solar winds.

Is there a connection here?

Does the neutrino radiation of the Sun in the Earth change into matter?

Anyway, the increased volcanic eruptions and earthquakes will affect the biggest reinsurer in the world. This should then be reflected accordingly in the chart and move the stock from the current $ 190 to $ 160.

Currently, the chance risk ratio-(CRR)-is very good for this trading plan, as the stop loss at $ 196.80 leads to a-CRR-of 4 to 1.