Key facts today

On August 1, 2025, Goldman Sachs disclosed its positions in Qualcomm Inc, confirming no major agreements impacting voting rights or future acquisitions.

On August 1, 2025, Bank of Montreal revealed its positions in Qualcomm Inc. under the Takeover Code, detailing transactions involving purchases, sales, and derivatives.

MAK Capital One LLC disclosed a Form 8.3 on August 1, 2025, revealing a 1% or greater interest in Qualcomm Inc. amid the Alphawave IP Group plc offer.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

8.88 EUR

9.11 B EUR

34.99 B EUR

1.08 B

About QUALCOMM Incorporated

Sector

Industry

CEO

Cristiano R. Amon

Website

Headquarters

San Diego

Founded

1985

FIGI

BBG000FDJWX7

QUALCOMM, Inc. engages in developing and commercializing foundational technologies and products used in mobile devices and other wireless products. It operates through the following segments: Qualcomm CDMA Technologies (QCT), Qualcomm Technology Licensing (QTL), and Qualcomm Strategic Initiatives (QSI). The QCT segment develops and supplies integrated circuits and system software based on technologies for use in voice and data communications, networking, application processing, multimedia, and global positioning system products. The QTL segment grants licenses and provides rights to use portions of the firm's intellectual property portfolio. The QSI segment focuses on opening new or expanding opportunities for its technologies and supporting the design and introduction of new products and services for voice and data communications. The company was founded by Franklin P. Antonio, Adelia A. Coffman, Andrew Cohen, Klein Gilhousen, Irwin Mark Jacobs, Andrew J. Viterbi, and Harvey P. White in July 1985 and is headquartered in San Diego, CA.

Related stocks

Qualcomm: Beyond the Smartphone Storm?Qualcomm (NASDAQ:QCOM) navigates a dynamic landscape, demonstrating resilience despite smartphone market headwinds and geopolitical complexities. Bernstein SocGen Group recently reaffirmed its "Outperform" rating, setting a \$185.00 price target. This confidence stems from Qualcomm's robust financia

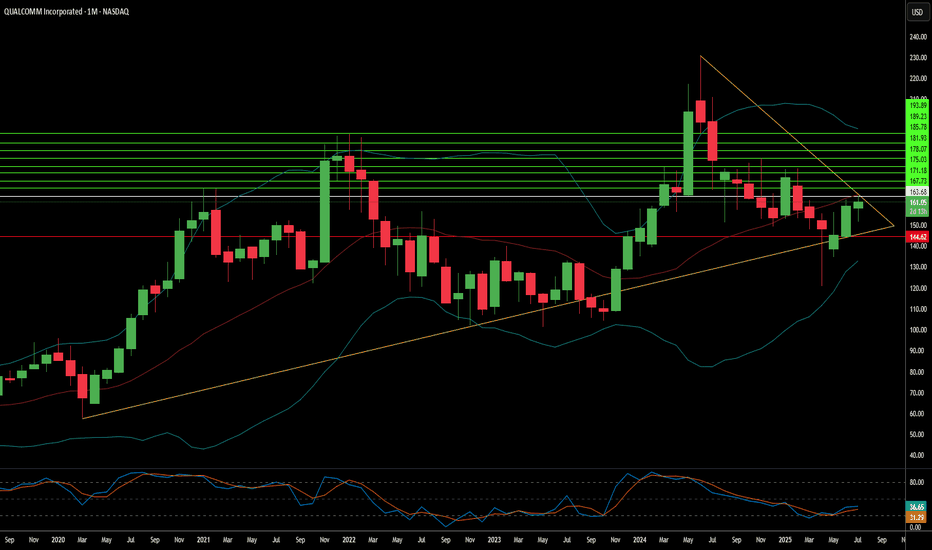

QCOM: Identifying Key Levels for a Potential Bullish ReversalOverview:

The chart for QCOM displays significant price action over the past year-plus, marked by a strong uptrend followed by a substantial correction/consolidation phase. Your drawings highlight critical demand and supply zones, and a potential bullish trade setup.

Historical Price Action (Light B

Qualcomm Remains BullishLike the market as a whole, Qualcomm shares recovered significantly. With the downward movement on May 1, which many market participants interpreted as a continuation of the bearish trend, the share delivered a precise 50% correction. This should not be seen as bearish, but rather gives hope for fur

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

QCOM4984947

Qualcomm Incorporated 3.25% 20-MAY-2050Yield to maturity

6.55%

Maturity date

May 20, 2050

QCOM4499061

Qualcomm Incorporated 4.3% 20-MAY-2047Yield to maturity

5.97%

Maturity date

May 20, 2047

QCOM5410503

Qualcomm Incorporated 4.5% 20-MAY-2052Yield to maturity

5.95%

Maturity date

May 20, 2052

QCOM4246685

Qualcomm Incorporated 4.8% 20-MAY-2045Yield to maturity

5.66%

Maturity date

May 20, 2045

QCOM5500546

Qualcomm Incorporated 6.0% 20-MAY-2053Yield to maturity

5.52%

Maturity date

May 20, 2053

QCOM6081110

Qualcomm Incorporated 5.0% 20-MAY-2035Yield to maturity

4.85%

Maturity date

May 20, 2035

QCIA

QUALCOMM 15/35Yield to maturity

4.84%

Maturity date

May 20, 2035

QCOM5086635

Qualcomm Incorporated 1.65% 20-MAY-2032Yield to maturity

4.81%

Maturity date

May 20, 2032

QCOM6081111

Qualcomm Incorporated 4.75% 20-MAY-2032Yield to maturity

4.62%

Maturity date

May 20, 2032

QCOM5500472

Qualcomm Incorporated 5.4% 20-MAY-2033Yield to maturity

4.44%

Maturity date

May 20, 2033

QCOM5410500

Qualcomm Incorporated 4.25% 20-MAY-2032Yield to maturity

4.37%

Maturity date

May 20, 2032

See all QCI bonds

Curated watchlists where QCI is featured.

Frequently Asked Questions

The current price of QCI is 127.80 EUR — it has decreased by −0.71% in the past 24 hours. Watch QUALCOMM INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange QUALCOMM INC stocks are traded under the ticker QCI.

QCI stock has fallen by −5.12% compared to the previous week, the month change is a −5.35% fall, over the last year QUALCOMM INC has showed a −22.60% decrease.

We've gathered analysts' opinions on QUALCOMM INC future price: according to them, QCI price has a max estimate of 197.09 EUR and a min estimate of 122.63 EUR. Watch QCI chart and read a more detailed QUALCOMM INC stock forecast: see what analysts think of QUALCOMM INC and suggest that you do with its stocks.

QCI stock is 2.99% volatile and has beta coefficient of 1.46. Track QUALCOMM INC stock price on the chart and check out the list of the most volatile stocks — is QUALCOMM INC there?

Today QUALCOMM INC has the market capitalization of 140.06 B, it has decreased by −2.59% over the last week.

Yes, you can track QUALCOMM INC financials in yearly and quarterly reports right on TradingView.

QUALCOMM INC is going to release the next earnings report on Nov 5, 2025. Keep track of upcoming events with our Earnings Calendar.

QCI earnings for the last quarter are 2.35 EUR per share, whereas the estimation was 2.30 EUR resulting in a 2.06% surprise. The estimated earnings for the next quarter are 2.52 EUR per share. See more details about QUALCOMM INC earnings.

QUALCOMM INC revenue for the last quarter amounts to 8.80 B EUR, despite the estimated figure of 8.77 B EUR. In the next quarter, revenue is expected to reach 9.42 B EUR.

QCI net income for the last quarter is 2.26 B EUR, while the quarter before that showed 2.60 B EUR of net income which accounts for −12.93% change. Track more QUALCOMM INC financial stats to get the full picture.

Yes, QCI dividends are paid quarterly. The last dividend per share was 0.78 EUR. As of today, Dividend Yield (TTM)% is 2.32%. Tracking QUALCOMM INC dividends might help you take more informed decisions.

QUALCOMM INC dividend yield was 1.94% in 2024, and payout ratio reached 36.77%. The year before the numbers were 2.88% and 48.27% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 49 K employees. See our rating of the largest employees — is QUALCOMM INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. QUALCOMM INC EBITDA is 11.73 B EUR, and current EBITDA margin is 30.69%. See more stats in QUALCOMM INC financial statements.

Like other stocks, QCI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade QUALCOMM INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So QUALCOMM INC technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating QUALCOMM INC stock shows the neutral signal. See more of QUALCOMM INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.