SII trade ideas

$WPM can rise in the next daysContextual immersion trading strategy idea.

Wheaton Precious Metals Corp., a mining company, primarily sells precious metals in Canada and internationally.

The demand for shares of the company looks higher than the supply.

These and other conditions can cause a rise in the share price in the next days.

So I opened a long position from $41,00;

stop-loss — $40,50.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

Could WPM Pass that $45 Threshold -> To the Moon!First off, please don't take anything I say seriously or as financial advice. As always, this is on opinion basis. That being said, let me get into a few key insights. WPM had its 52 week high recently, is a relatively low cost gold stock compared to companies like RGLD, and is on track to potentially pass a $45 threshold which would be an all time high for the entire history of the stock symbol. It does seem to have a lot of potential at this moment.

WPM: initiating SHORT position in Jan10 PutsBased on my prediction that Gold (and Silver) are due for one last SHARP decline in the coming weeks, I am taking a SHORT position in WPM.

Here's the PUT: WPM JAN 10, 2020 $27 put

Currently offered around $0.16

My target for WPM in the coming weeks is an attack on the $24 level. If correct, this put would reach $3.00

That being said, you could short essentially ANY precious metals related stock and profit greatly in the coming weeks (if my prediction of a strong sell-off holds true).

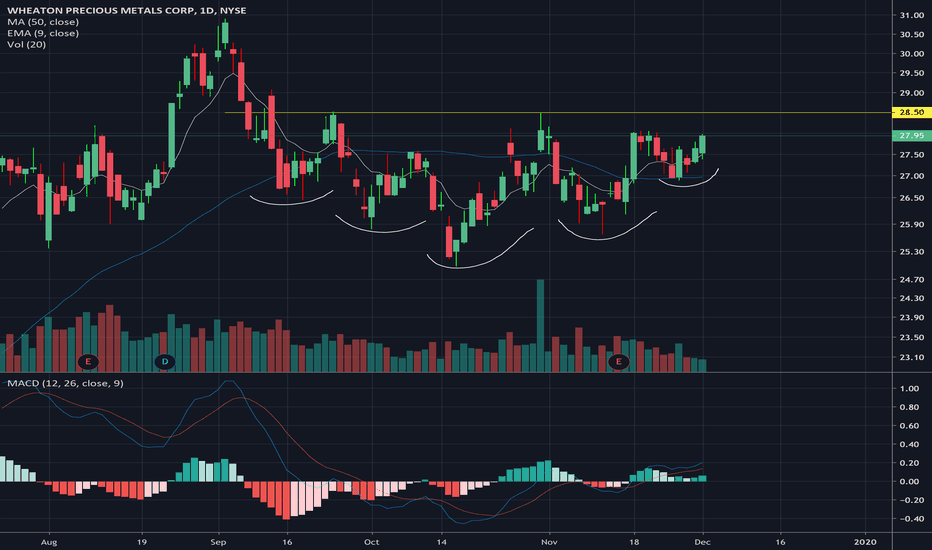

[Long] WPM, Inverted Head & Double ShoulderWants to test 28.50

Breakout above 28.50 => tests 30.90, breakout over that = precious metals bull market

Gold & Silver are bullish against a fundamental backdrop of rising inflation and slowing growth (hello ISM print this morning). Streaming companies especially are one of the safer plays in the Gold Mining space, as they have no actual mining operation to worry about (or at least are diversified across 100+ mining streams). They also benefit from depressed Gold & Silver prices because they are able to secure more attractive streams. Explains why RGLD and FNV have performed so well even through Gold's bear market.

WPM Share prices breached 28.10 up 3%WPM - Wheaton Precious Metals- Another great stock to consider trading or investing in times of financial market uncertainty. Share prices breached 28.10 resistance and pushed hard to the upside in today's session, reaching 29.85 from the time of reporting up 3.04%.

Share prices have breached another resistance price level in today's trading session at 29.70. It needs to remain above this point to extend its run to its next estimated target at 30.70. Support levels are expected at 28.70, 28.10, 27.10, and 26.15

LONG WHEATON PRECIOUS METALS=====LONG TERM PRICE TARGET $41.50========.

SHORT TERM PRICE TARGET $31

FOR AS LONG AS PRECIOUS METALS RALLY STICK WITH THE STOCK, CURRENT MARKET TURBULENCE WORLDWIDE IS A MAJOR POSITIVE FOR $WPM

Wheaton Precious Metals Corp. is a mining company, which engages in the sale of precious metals and cobalt production. It operates through the following segments: Gold, Silver, Palladium, Cobalt, and Other. It focuses on the following precious metals streams: Salobo, Peñasquito, Antamina, Constancia, Stillwater, San Dimas, Sudhury, Zinkgruvan, Yauliyacu, Neves-Corvo, Pascua-Lama, Rosemont, Voisey's Bay, and others. The company was founded by Peter Derek Barnes on December 17, 2004 and is headquartered in Vancouver, Canada.

[Long] WPM backtesting small breakoutInstead of chasing the move late last week, one could have waited to see a backtest today. This can be a spot for fast positions.

It can trend toward 31 before hitting larger resistance.

I don't think it stops at resistance, because of the extremely strong gold/silver bull market. But, 31 would be a place to reduce leverage or reduce risk.

taking advantage of dumb moneyso the theory here is: not all ETF holdings are created equally. WPM has a 15-25% holdings weight in a few silver mining etfs. with the feds pivot and likely need to make aggressive accommodation in the future and likely resumption of QE. id expect money to flow likely wine into precious metals etfs. but... not all etf holdings are evenly distributed. wpm is one that will capture a good bang for the buck.