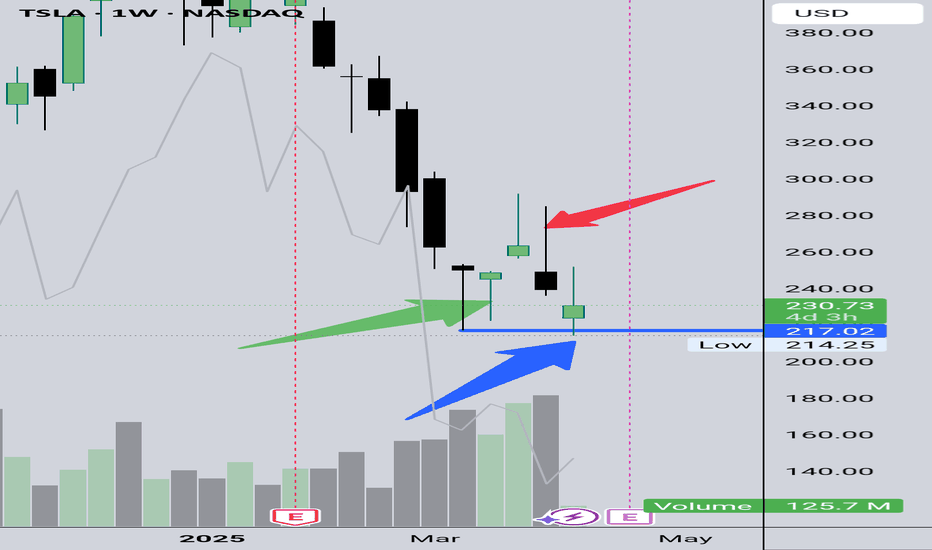

Tesla Taps the Golden Zone – Is the Launch Sequence Engaged?Tesla (TSLA) has shown textbook precision by respecting the golden zone after a significant sweep of previous highs. Rather than violating the last HTF low—which would’ve hinted at deeper downside—price instead retraced cleanly into the OTE (Optimal Trade Entry) range and reacted with strong bullish intent.

This move indicates a healthy retracement rather than weakness, suggesting a continuation to the upside. Confirmation of this potential bullish leg would be a sustained close above the 272–300 level, which aligns with previous buyside liquidity zones and Fibonacci confluence.

Key Observations:

- Golden Zone respected: Price bounced cleanly between the 62–79% fib levels.

- HTF low protected: No violation of higher timeframe bullish structure.

- Volume spike supports the reversal move.

Targets:

- Short-term: 300.61

- Mid-term: 416.67

- Long-term swing: 861.17 (over 255% potential gain)

Conclusion:

Tesla looks set for lift-off 🚀. The reaction at the golden zone and the preservation of structure give high confluence for a potential explosive move higher. Wait for confirmation via price continuation and structure integrity.

As always — DYOR (Do Your Own Research).

TL0 trade ideas

TSLA | Long | Technical Buy Zone + Volume Spike | (April 9, 2025

1️⃣ Insight Summary:

Tesla is pulling back into a strong demand zone with rising volume, signaling potential accumulation. While fundamentally overvalued, the technicals show this could be a high reward-risk trade if price retests lower levels.

2️⃣ Trade Parameters:

Bias: Long (if retest happens)

Entry Zone: $220 – $223 (ideal buy zone on a potential pullback)

Stop Loss: Below $206 (breakdown from structure and invalidation of support)

TP: $440.36 (2x reward-to-risk potential)

Risk/Reward Ratio: ~1:15 (based on current setup)

Status: Not yet in position — watching for a retest into support zone

3️⃣ Key Notes:

✅ Significant buy-side volume showing up around current levels

✅ Buy signals and price action bouncing from higher-timeframe demand

✅ Although TSLA is widely viewed as fundamentally overvalued, technical setups like this can still offer solid short- to mid-term returns

❌ Invalidation is clearly below $206 — that breaks the thesis and the base

📉 Waiting for confirmation of a pullback and bounce before entering; chasing here isn't ideal for the reward-risk profile

4️⃣ Follow-up Note:

Watching price closely for a potential re-entry toward $220. Will update this trade idea if we get a clean test or breakout.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

TSLA movement 09-04-2025Teslas old support and resistances have flipped. To wait to see if either new trend line is broken and a new trend establishes is imperative. But with the market beeing so bearish the new support will probably be the one to break and a continuation of the bearish trend will most likely continue. however the lower the price moves the better the profit margins will be when trend eventually reverses.

NASDAQ:TSLA

TSLA Best Level to BUY/HOLD 100% bounce🔸Hello traders, today let's review daily chart for TSLA. we are

looking at a 67% correction, almost complete now, another 67%

recent correction presented on the right.

🔸Most of the bad news already price in and we are getting

oversold, expecting a bottom in weeks now not months.

🔸Recommended strategy bulls: BUY/HOLD once 67% correction

completes at/near strong horizontal S/R 140/150 USD, TP bulls

is 280/300 USD, which is 100% unleveraged gain.

**Tesla (TSLA) Market Update – April 9, 2025**

📉 **Stock Decline:** TSLA closed at $221.86, down 4.9%, amid new tariffs and CEO Elon Musk's political involvement

**Analyst Downgrades:*

Wedbush's Dan Ives cut the price target by 43% to $315, citing a "brand crisis"

Wells Fargo's Colin Langan set a target at $130, anticipating a potential 50% drop

📊 **Delivery Shortfall:** Q1 deliveries fell 13% year-over-year to 336,000 vehicles, missing expectations by about 40,000 unis.

🌍 **Tariff Impact:** President Trump's new tariffs are expected to increase costs and disrupt Tesla's supply chain, especially concerning Chinese operatins.

💡 **Investor Sentiment:** Analysts express concern over Musk's political ties affecting Tesla's brand and sales, particularly in China.

Why Support and Resistance are Made to Be Broken ?Hello fellow traders! Hope you're navigating the markets smoothly. As we go through the daily dance of price action, one thing becomes clear support and resistance are just moments, not walls. They're temporary. Momentum and trend strength? Now that’s where the real story lies.

This publication dives into how these so-called key levels break and more importantly, how to position yourself smartly when they do. Stay flexible, trade with confidence, and let the market lead. Let’s get into it.

Why Support and Resistance Levels Break

Support and resistance are some of the most talked-about tools in technical analysis. But here's the truth they’re not meant to last forever.

No matter how strong a level may appear on your chart, it eventually gets tested, challenged, and often broken. Why? Because the market is dynamic. The real edge for a trader lies not in hoping a level holds, but in reading when it’s about to fail and being ready for it.

No Resistance in a Bull, No Support in a Bear

Ever seen a strong bull market pause just because of a resistance line? It doesn’t. Price keeps pushing higher as buyers keep stepping in. Same goes for a strong bear market support levels collapse as fear takes over and selling snowballs.

Instead of clinging to lines on a chart, think bigger: Where is the momentum? What’s the trend saying? That’s where your trading decisions should come from.

Support and Resistance: Not Fixed, Always Shifting

Yes, these levels matter but only as zones, not exact prices. They’re areas where price has reacted in the past, where traders might expect something to happen again. But they’re not magic numbers.

When traders treat these levels as absolute, they fall into traps false confidence, poor entries, tighter than-needed stop losses. Always remember: market sentiment, liquidity, and institutional activity are constantly changing. So should your interpretation of the chart.

The Temporary Nature of These Levels

Markets move on supply and demand. A level that acted as resistance last week could easily become support next week. Or break completely.

Take the classic example support turning into resistance. When support breaks, former buyers might now be sellers, trying to get out on a bounce. That flip happens because behavior and sentiment have shifted. And as traders, that’s the real pattern we need to track not just price levels, but the psychology behind them.

“Strong” Support? It’s Mostly an Illusion

We all love the idea of a strong level something we can lean on. But large players? They don’t think like that.

Institutions don’t place massive orders at a single price point. They spread across a zone building positions slowly without moving the market too much. What looks like a strong level to us might just be an accumulation or distribution range for them. Always think beyond what’s visible on the surface.

How to Spot Breakouts Before They Hit

Here’s what separates seasoned traders from the rest the ability to spot potential breakouts before they explode.

🔹 Volume Confirmation: If a resistance level is tested repeatedly on rising volume, that’s a big clue buyers are serious.

🔹 Structure Shifts: Higher highs in an uptrend or lower lows in a downtrend signal that the old levels are being challenged.

🔹 Liquidity Traps: Watch out for fakeouts. These are designed to trap impatient traders just before the real move.

🔹 News & Events: Never ignore macro triggers. Earnings, economic data, or geopolitical surprises can fuel breakouts that crush technical levels.

🔹 Break & Retest: A solid strategy — wait for the level to break, then get in on the retest.

🔹 Momentum Tools: Indicators like RSI, MACD, or even EMAs can offer extra confidence that a move has legs.

3 Practical Trading Setups

1. Breakout Trading

Mark key levels on daily or weekly charts.

Watch for volume and momentum confirmation.

Enter after a clear breakout or retest.

Stop-loss: Just below resistance (for longs) or above support (for shorts).

2. Range Trading

If price is stuck between support and resistance, trade the range.

Look for price rejection (wicks, pin bars, etc.).

Use RSI or Stochastics to time entries.

3. Trend Following

Identify the dominant trend using moving averages or price structure.

Avoid going against the trend unless reversal signs are very clear.

Let profits run use trailing stops instead of fixed targets.

Mind Over Market: Psychology of S&R

One of the biggest traps in trading? Overtrusting support and resistance.

We get emotionally attached. We want the support to hold or the resistance to reject. And that bias clouds our judgment. How many times have you seen price break a level — and you freeze because it “wasn’t supposed to”?

To break free of that:

✅ Trade with a plan.

✅ Set your risk before the trade, not after.

✅ Don’t treat any level as sacred.

✅ Stay open to what the market is telling you not what you want it to say.

Final Thoughts

Support and resistance are great tools but they’re just one part of the puzzle. The real power lies in reading price action, watching volume, and understanding market sentiment. Don’t ask, “Will this level hold?” Ask instead, “What happens if it breaks?”

That shift in thinking? It can make all the difference.

Stay sharp, stay adaptive, and keep evolving with the market.

Wishing you green trades and growing accounts!

Best Regards- Amit Rajan.

TSLA Breakdown Looks Weak! Bearish Momentum Builds Under Key ZonTSLA just broke down from a key structure with rejection under $243 and failed to reclaim it. Price is now stuck in a bearish SMC range and sitting inside a demand zone that’s showing signs of weakening. Here’s how it’s setting up:

📉 Market Structure & SMC

Price is clearly trending inside a downward channel with consecutive break-of-structure (BOS) moves. The most recent bearish BOS confirms continuation, and there has been no clean change-of-character (CHoCH) to suggest bulls are regaining control. Supply remains untouched above $243, while price has now tested the $214–$221 zone multiple times.

📊 Indicators – MACD & Stoch RSI

MACD histogram is fading and showing no momentum crossover. Stochastic RSI is deeply oversold but not turning up yet — this could signal either a pause or a weak bounce before continuation down.

📉 TrendInfo Summary (1H)

The TrendInfo panel is heavily tilted bearish:

Momentum (MACD, RSI, DMI) is all red

Volume remains average but favoring red candles

Fear & Greed sentiment reads at Fear (-14.42)

Final recommendation: Sell (90%)

This confluence supports the bearish thesis unless bulls step in aggressively at $214.

🧠 Options GEX Insight

On the options side, we’re seeing a major wall of negative gamma around the $215–$220 zone — and the highest negative NETGEX / put support sits at $214.25, right where price is hovering.

If this level breaks, gamma flows could accelerate downside volatility toward $200–$210, with no real put wall protection below until $190.

On the flip side, the upside is heavily capped at $237.5 with HVL at that level. The nearest significant resistance lies at $260–$262, aligning with major call walls and the 62% GEX call resistance zone.

IVR is extremely elevated at 137.8, with IVx at 140.2, showing strong option demand and volatility pricing. However, most of the flow is put-heavy (1.6%), suggesting institutions are not betting on a recovery just yet.

🎯 Trade Thoughts & Scenarios

If price bounces here, we may see a short-term move to $230–$237.5 (gap fill or HVL reversion). However, unless TSLA reclaims $243, the broader structure remains bearish and rallies are likely to be sold.

If $214 breaks, that opens downside to $210 and even $200 fast — especially with this kind of GEX structure.

Swing traders can consider shorting failed bounces with tight risk above $230. Intraday scalpers can hunt rejections at $225–$230 zone.

Final Thoughts:

TrendInfo, order flow, and SMC structure are all leaning bearish. TSLA needs a strong shift in sentiment or macro support (like QQQ/SPY bottoming) to reverse this trend. Until then, bears are in control.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and trade responsibly.

[TSLA] Bear Market to $15: Musk’s Empire at Risk?Tesla’s market cap now surpasses the combined market cap of all major automobile producers. Elon Musk is undeniably a genius, yet this staggering valuation owes much to a robust bull market and post-COVID hype. If Tesla were valued using the same earnings and revenue multiples as the average automaker, its stock price would hover between $15 and $20 per share.

TECHNICAL ANALYSIS

Tesla’s chart is one of the most striking I’ve ever seen. It reflects a powerful bull market that has completed an Elliott Wave five-wave structure, signaling that a bear market is likely next.

Wave 4 formed a running triangle—a pattern typical in strong trends—and was followed by a short Wave 5, exactly as expected. Running triangles paired with a brief Wave 5 often indicate distribution. Indeed, Tesla’s chart reveals a beautiful four-year distribution phase (2021–2025). During this period, the stock struggled to climb higher due to persistent selling pressure. Strong hands have now offloaded their shares to weaker hands, setting the stage for a bear market.

A triple divergence on the monthly RSI further confirms extreme overbought conditions and reinforces the case for selling. There’s no significant support until the $15–$20 range.

If my prediction of a 2008-style crash in the S&P 500 (see related ideas) holds true, Tesla could bottom out around $15—a level that, intriguingly, aligns with its COVID-era low.

"Bull market geniuses turn into bear market fools."

Elon Musk net worth derives value mostly from Tesla and SpaceX as other companies are illiquid and very speculative.

Current Musk's Tesla stake is worth around $100 billion if the price falls down to $15 it would be worth $6 billion, all other things being equal that alone would put a significant dent in his net worth.

Musk is widely recognized as someone who leverages his Tesla shares and SpaceX to fund other ventures and lifestyle.

It is not clear at what price level his margin calls are and what arrangements he has with banks but if crash of this magnitude happens all his Tesla shares could be wiped out with possible full blown bankruptcy.

I wish him well and hope he does well, but this scenario is not unlikely and interesting to ponder.

TSLA Needs More Clear Signs for a Trend Shift

Tesla's price action in 2024 has shown signs of weakness, casting doubt on the strength of its long-term upward trend. After a sharp decline from its peak, the stock is now at a critical juncture where key levels and momentum are in play. Here’s an in-depth look:

Potential Bounce at Key Support: Tesla is currently heading toward the 180/140 support zone, which could act as a pivotal point for a potential rebound. If the stock manages to hold above these levels, it could set the stage for a recovery move toward the 300 resistance zone. The importance of this support level cannot be overstated, as a failure to hold could lead to further downside.

Weak Momentum: Despite attempts at upward movement, Tesla's long-term bullish trend has significantly weakened due to a lack of momentum in 2024. The stock is struggling to build on past gains, and this lack of follow-through is a warning sign for those expecting continued growth. Momentum is a critical factor in maintaining an uptrend, and without it, the path of least resistance may be down.

Breaking Below Key Levels: A significant development is the breakdown below the 300 level, a key psychological and technical level for Tesla. This breach signals a shift in market sentiment, and until the price can reclaim this level, the bearish pressure is likely to persist. Reversals from such levels often require strong confirmation, which has not yet materialized for Tesla.

Trading Below Moving Averages: Tesla is now trading below both its 200-day and 20-day moving averages, further confirming the weakness in the trend. These moving averages act as important indicators of market sentiment and trend direction. Being below these averages suggests that momentum is against the stock, and the risk of further declines remains high unless a significant reversal occurs.

50% Decline from Peak: Since reaching its peak at 488.54, Tesla has seen a 50% decline, and there are no clear signs of a reversal in the short term. This prolonged decline suggests that the bearish trend is still in control, and the stock must show stronger signs of recovery before a sustainable upward move can be expected.

Key Takeaway: Tesla’s current technical setup does not signal a clear shift to the upside. If the price continues to fall, the 180/140 support zone could become a crucial turning point for a potential trend reversal. However, the overall trend remains weak, and recent upward swings have lacked the strength needed to confirm a shift. In the short term, more evidence is needed before calling for a sustained move higher.

TSLA 4/8/2025Per my mentor (He would kill me for calling him that lol)

TSLA Is currently in the middle of a 5 year range...

Meaning Bargain no question.

I like a buy right now.

Personally believe they will still lead EV sector by substantial #s a decade from now

Long term vision beats short term gain

TSLA short swing ideaI like the RR in this trade, that's why I am choosing TSLA over others. As we are bearish on current order flow, the price prints are showing bearish movement in the coming days. One possibility is that it might take out buystops before trending lower and I think today's day will give more information on that. However, the technicals are there that favors the trade. Weekly Sibi, Daily SIBI, and H1 breaker + FVG.

Tesla: bounce expected at $200 Support?NASDAQ:TSLA is currently approaching an important support zone, an area where the price has previously shown bullish reactions. This level aligns closely with the psychological $200 mark, which tends to carry added weight in the market .

The recent momentum suggests that buyers could step in and drive the price higher. A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would increase the probability of a bounce from this level. If I'm right and buyers regain control, the price could move toward the 260.00 level.

However, a breakout below this support would invalidate the bullish outlook, potentially leading to more downside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

TSLA Trade Thesis (Test)TSLA is holding strong at current demand. In order for price to rise, it will have to invalidate closest supply, if demand cannot hold, expecting price to sell off

:bulb: Trade Plan:

Entry Zone: $75.34

Stop Loss: $42.85

:dart: Targets:

Target 1: $139.27

Target 2: $217.02

Raise your stop-loss to entry price once we price reaches $98.95

:mag: Reasoning:

The double correction may be ending at that level for the stock market.

TSLA descending wedge into heavy support bounce? 300-330 pttesla has been slaughtered by the tariffs and social justice warriors, but it seems to be finding footing.

here we see a triple bottom on very heavy volume combined with a possible descending wedge. with earnings coming up in a few weeks (4/22, surprisingly not sunday 4/20 ha), it seems the risk/reward here is looking reasonable.

one possible way to play this with minimal cash outlay is TSLL. this is a 2x leveraged etf that also has options available on it. thile not suitable for a long term 'buy and hold', it can work well for shorter term trades without having to blow out too much cash making the risk/reward here look somewhat attractive.

target 300-330, or about a 30-40% bump from here. stops should be around 200-210, or pessimistically sub 200.

TESLA Always Pay YOURSELF! Tsla Stock were you PAID? GOLD Lesson

⭐️I want to go into depth regarding the this topic but it is a long one with PROS & CONS for doing and not doing it.

Every trader must choose what's best for them but you will SEE when I finally get to the write up that MANY OF THE PROS are NOT FINANCIAL but PSYCHOLOGICAL❗️

Another of 🟢SeekingPips🟢 KEY RULES!

⚠️ Always Pay YOURSELF.⚠️

I know some of you chose to HOLD ONTO EVERYTHING and place your STOP at the base of the WEEKLY CANDLE we entered on or the week priors base.

If you did that and it was in your plan GREAT but... if it was NOT that is a TRADING MISTAKE and You need to UPDATE YOUR JOURNAL NOW.

You need to note EVERYTHING. What you wanted to see before your exit, explain why not taking anything was justified to you, were there EARLY exit signals that you did not act on. EVERYTHING.

🟢SeekingPips🟢 ALWAYS SAYS THE BEST TRADING BOOK YOU WILL EVER READ WILL BE YOUR COMPLETE & HONEST TRADING JOURNAL ⚠️

📉When you read it in black amd white you will have YOUR OWN RECORD of your BEST trades and TRADING TRIUMPHS and your WORST TRADES and TRADING ERRORS.📈

✅️ KEEPING an UPTO DATE JOURNAL is STEP ONE.

STUDYING IT IS JUST AS IMPORTANT👍

⭐️🌟⭐️🌟⭐️A sneak peek of the LESSON after will be HOW & WHEN TO ENTER WHEN THE OPEN BAR IS GOING THE OPPOSITE WAY OF YOUR IDEA.👌

🚥Looking at the TESLA CHART ABOVE you will see that we were interested in being a BUYER when the weekly bar was BEARISH (GREEN ARROW) and we started to consider TAKE PROFITS and EXITS when the (RED ARROW) Weekly bar was still BULLISH.🚥

First let's go down a little more and then retest broken supportFifth Elliott wave is forming. This wave may possibly extend to $160.

It is likely to test the support it broke later around $250.

* The purpose of my graphic drawings is purely educational.

* What i write here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose your money.