HKG33 trade ideas

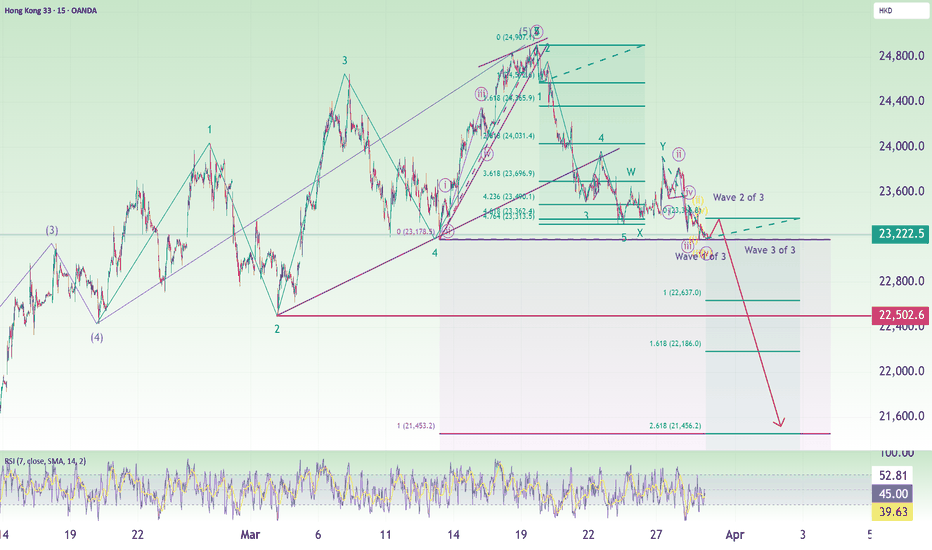

Hang Seng Short: Expecting Wave 2 of 3 and 3 of 3Hang Seng had been amazingly resilient on Friday, falling much lesser than the US indices. However, I believe it is just lagging by 1 impulse wave.

If you have seen my last few updates on the wave counts, you will know that I counted completion of wave 3 of 3 for the tech stocks and that Nasdaq itself is nearing the target completion of 5 waves of wave 3 (now on wave 4 of 3). Thus, to me, Hang Seng is lagging by 1 impulse wave.

Back to this analysis, for the last down wave on Friday, you will see that I've plotted a purple minute wave with the 5th wave further broken down into orange minuette waves. The orange minuette wave is only on it's 4th wave. However, I believe that we might not actually see a proper wave draw by price movement. I propose that the fifth wave will be unseen. How so?

Gap down on Monday opening (marking the end of minuette wave 5) and then a shallow retracement up that is likely to happen during the 1st hour of HK trading session to complete purple minute wave 2 before we see Hang Seng crashing for a wave 3. It might be similar to what happened to Nikkei on Friday's Japan trading hours.

Good luck!

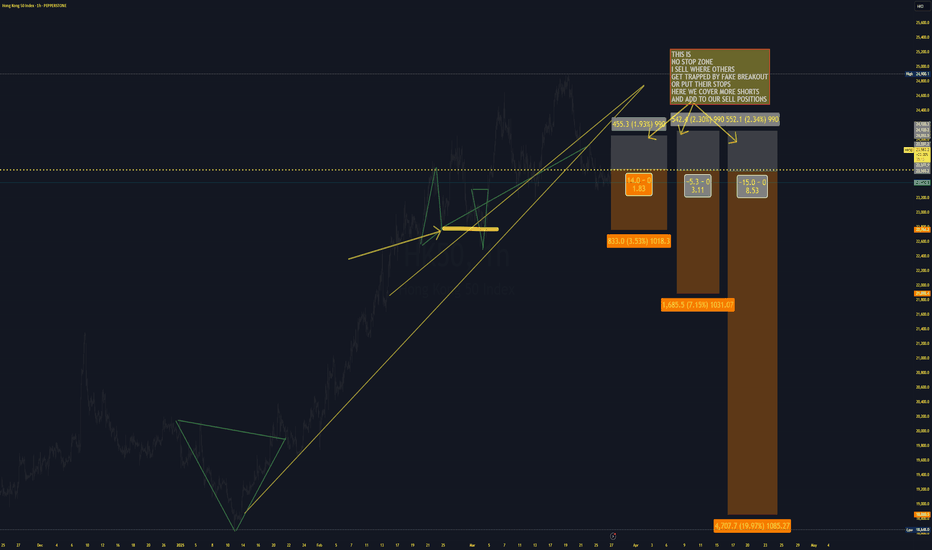

HK50 HongKong Index ShortMore pro-active policies in China

More tariffs on Copper

This will put the asian indices more under pressure

3 apporaoches

and 3 different targets

My entries are aggressive and conservative

Where others use the stop zone,there I aggressively buy/sell into my targeted potential direction(cover more shorts in this case)

More details: Please take a look at the chart above

HSI testing resistance levels —will it break through or bounced?25/03/2025

🚨🚨🚨

HSI resistance is being tested for short-term!

Investors tend to take profit towards quarter end.

HSI:HSI

MACD - Deadcross formed 20/3/2025.Resistance 24750-24600 level.

4H chart: PEPPERSTONE:HK50

at point of writing ✍️: the Index uptrend mode is paused and moving out of bound from the uptrend channel.

MACD : moving below zero line - Bearish mode.

KDJ: below 30 level in the bearish zone. Hopefully the divergence cycle completing soon for a strong reversal.

BB - ranging at lower BB; mid-line:23986 (this is your 🗝️ level for your long/short TP/SL level)

Set your TP/SL and let the markets works.

For this week trade plan: Most likely short the index for days to few weeks until get confirmation of trendline back to uptrend channel. Buy into support Sell at resistance. Set your TP/SL.

🚨 as of ✍️ :

Support/Resistance Levels :

22979

23030

23242(23374)

23526

23997

24385

24586

24648

24945

🗝️🗝️🗝️Level: 23526-23620

HSI continues its Bullish mode.

W Chart:-

17Mar2025 -

24Mar2025 -

📰 another -ve news, but this might be distraction. 🚨

www.tradingview.com

Shares in Hong Kong slumped 487 points or 2.0% to 23,417 on Tuesday morning, reversing gains from the prior session amid concerns over U.S. recession risks and China’s deflation threat.

www.tradingview.com

** Hong Kong's benchmark Hang Seng Index declined 2.2%, and the Hang Seng Tech Index

HSTECH lost 3.5%.

For current markets condition, the CHN & HKG can be volatile with the continuing noise from tariff.

🎯 Reminder: For long term (6-18 months) continue to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets. If you don't know how or where, you may ask Deepseek/Chatgpt for most reputable Trading courses nearest to you.

Let's follow our own strategy and zen with 📙 and 🍵 for profits.

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Share your trading journey to encourage the trading buddies.

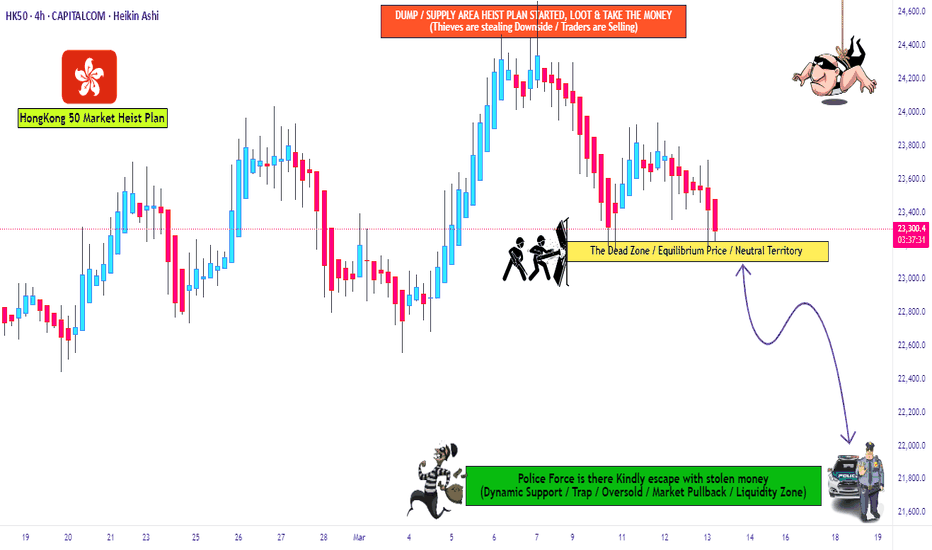

HK50 "HongKong50" CFD Index Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the HK50 "HongKong50" CFD Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (23000) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or Swing high or low level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (24000) swing Trade Basis Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 21800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

HK50 "HongKong50" CFD Index Market is currently experiencing a Neutral trend to Bearish., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

HSI Short: Break of TrendlineIn my 18th March 2025 idea on Hang Seng Index, I said that an ending diagonal has formed for HSI and to prepare to short (linked in this idea). I also reiterate that it will be a sharp move down because that's what proceeds from an ending diagonal.

Hang Seng Index had falled almost 1400 points since then. So what now?

I believe that it is still a short because technically, it has broken a trendline. If you still have short position, you can adjust your stop loss just above the trendline. But if you have no position and is waiting to enter, my recommendation is to scale in your shorts, but definitely short it if and when price moves up to the trendline because support should turn into resistance.

Good luck!

HSI charging forward, but watch that resistance!Helloy everyone,

Yesterday the Index performed quite well; bullish.

Trying to go back to the uptrend channel.

PEPPERSTONE:HK50

at point of writing ✍️:

MACD - Deadcross formed. Sell/Short at resistance level 24730-24650

BB - 23953(lower BB) mid-line:24350 (this is your 🗝️ level for your long/short TP/SL level)

Quote from 17/3/2025 post

For this week trade plan: Buy into support Sell at resistance. Set your TP/SL.

🚨 as of ✍️ :

🗝️ Level : 22979-23242(23374)- 23997- 24385 - 24586 - 24648 - 24945

To retest 24385 again.

Set your TP/SL, let the market do its thing, and ride the trend with confidence! Manage your risk/reward (r/r).

HSI continues its Bullish mode.

HSI:HSI

W Chart:-

📰 another +ve news, but this might be distraction. 🚨

www.tradingview.com

🎯 Reminder: Continue to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets. If you don't know how or where, you may ask Deepseek/Chatgpt for most reputable Trading courses nearest to you.

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Share your trading journey to encourage the trading buddies.

While wait for the markets cook, you may zen with 📙 and 🍵because stress won’t make the candles move! 🚶

Happy Trading!

HKInd May Recover Chinese Stimulus The Hang Seng Index, a key barometer of Hong Kong's economy, is currently hovering around 24,130 points. However, a number of fundamental, technical and policy factors suggest the possibility of a rebound towards 26,253 points. This analysis explores the main reasons for this possible recovery, integrating recent market information and the Chinese government's strategy to stimulate consumption.

Macro Context

a) Support from Mainland Investors: One of the most decisive dynamics is the growing participation of investors from mainland China. According to Reuters, recent weeks have seen strong buying activity through the Stock Connect mechanism, driving the market rally and contributing to increased liquidity in the Hong Kong index. This increase in participation suggests a shift in investor sentiment that could set the stage for a sustained recovery.

b) Stimulus Measures and Economic Recovery: The macroeconomic environment has been favored by stimulus policies implemented in 2024, such as interest rate cuts, home purchase incentives and financing schemes. These measures have contributed to reversing historical downward trends, achieving remarkable annual growth in the Hang Seng index and reviving market confidence.

Impact of China's Consumer Stimulus Actions

This recent announcement adds a new dimension to the country's recovery outlook, especially with regard to Chinese indices and the Hang Seng in particular. This measure will seek to increase household income by raising wages, and opening up new forms of wealth generation especially in the rural environment. It also seeks to reduce the economic burden per family in terms of education, health care and elderly care expenses, while offering subsidies for child care and education, thus stimulating the pending account with the Chinese population curve. Finally, fostering a favorable environment for consumption by improving commercial infrastructure, protecting labor rights and reducing spending restrictions. This strategy reflects a shift in the public spending model, prioritizing social welfare and strengthening domestic demand. The plan, which includes the issuance of approximately 300 billion yuan in bonds to boost the renovation of household appliances and electronics, seeks to counteract the low demand and deflationary pressures that have affected the economy. Strengthening domestic consumption may translate into greater dynamism for Hong Kong-listed companies, contributing to the index's recovery.

Technical Analysis:

In the 2 sessions of Thursday and Friday the index closed in positive, piercing today the 24,663 points zone without much strength. If we review the zone of the last quarter of 2021 and first quarter of 2022, the current price is fluctuating in this range, testing the possibility of a perforation towards 25,082 points. If this situation is strongly generated the next milestone of 26253 points. If the price consolidates above 24,071 points we will be able to see the mentioned climb, if this price does not hold it is possible that the price will fall towards 21,000 with strength and subsequently seek to test 19,937 points which is the support zone of the last price climb. The control point (POC) is now located around 19974 points. If we look at the most traded range between the last quarter of 2023 and the beginning of 2025, movements have moved from the low of 14,566 points to 19,437 points.

Risks and Considerations

Although the outlook is positive there are certain risks to consider. Regulatory interventions and international tensions with China may negatively influence market sentiment on the index. The risk of a slowdown in consumption if the domestic consumption initiative does not succeed is still there. Finally, the sustainability of the recovery will depend on whether investors support the initiative in the long term and improvements in month-on-month economic indicators are perceived. In other words, the combination of solid support from mainland investors, economic stimulus policies and the new action plan to boost consumption in China create a favorable scenario for the index's recovery. Overcoming the 26,253-point barrier will depend on the materialization of expectations on both the macroeconomic and technical fronts. The key now is to keep an eye on these and other regulatory and geopolitical developments affecting the Chinese market, as well as the evolution of these policies, in order to take advantage of the opportunities that arise in this context of economic transformation.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

Was the break over? HSI bulls are back on the field and ready?Hello everyone, happy Monday!

Last week movement, HSI retraced consecutive 4 trading days and slight recover on Friday yet closed with loss 271pts; -1.12% for the week of 10 Mar 2025. However, YTD it has logged an increased of +4216.69pts; +21.02%. HSI:HSI

MACD - Goldencross was marked in Green (5Mar25; 14Mar25)

BB - Currently trading within upper BB channel.the Mid-line 4H chart at 23789 at point of writing ✍️.

For this week trade plan:

Buy into support Sell at resistance. Set your TP/SL.

🚨 as of ✍️ :

🗝️ Level : 22979-23242(23374)- 23997- 24385 - 24586 - 24648 - 24945

To retest 24385 again.

The Index continues its Bullish mode.

With some catalyst news to support Long call.

www.tradingview.com

🎯 Reminder: Continue to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets. If you don't know how or where, you may ask Deepseek/Chatgpt for most reputable Trading courses nearest to you.

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Share your trading journey to encourage the trading buddies

The Index seems hits the ceiling ;trade cautiously!Hello everyone, is Friday! Last trading of the week! This week has been a challenging one.

Hope everyone stick to the trading plan.

Trade plan is the same, buy into support and sell at resistance based on your trade tf.

4H Chart PEPPERSTONE:HK50

This morning the MACD seems has reversal sign although the GoldenCross form below zero line ,at least showing the end of the bear, monitor to confirm it's not a fake reversal. 🚨

As the D chart showed the Index still out of uptrend channel again as mentioned from previous post, as long as the Index out of the upper trend channel then the pullback is inevitable for the next wave.

However longer tf, it's still bullish which created higher high for thr W Chart. HSI:HSI

it would be great if this week could close 24669(last week Hi). But unlikely, what do you think?

Happy trading everyone.

** Please Boost 🚀/LIKE 👍,FOLLOW 🔔 SHARE 🔁 and COMMENT ✍️ if you enjoy this idea! Share your trading journey toencourage the trading buddies.

HK50; Heikin Ashi Trade IdeaPEPPERSTONE:HK50

In this video, I’ll be sharing my analysis of HK50, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

What's next for HSI? Hello everyone, how was the Monday strong pullback?

my short break did not stop the participation of the index slope down ski 😂 😂 😂

Hope everyone stick to the trading plan.

Trade plan is the same, buy into suppysel at resistance based on your trade tf.

4H Chart

Today probably a reversal happens but it could still in retracement mode., trade cautiously.🚨

As the D chart showed after the Monday 477pts plunged pushed the Index out of uptrend channel again as mentioned from previous post, as long as the Index out of the upper trend channel then the pullback is inevitable for the next wave.

However longer tf, it's still bullish which created higher high for thr W Chart.

it would be great if this week could close 24669(last week Hi)

Happy trading everyone and zen with 📚 and 🍵 once your SL/TP set.

** Please Boost 🚀/LIKE 👍,FOLLOW 🔔 SHARE 🔁 and COMMENT ✍️ if you enjoy this idea! Share your trading journey toencourage the trading buddies.

Hang Seng Index Short: Potential ReversalIf you have seen my previous posts on Hang Seng or the China/HK market, you will know that I am a long-term bull and sometimes short-term bear on the Chinese markets.

So, this post is really against my personal bias that the China/HK markets are long-term bull because if the wave counts are correct, the recent move up are but triple combinations corrective up moves.

Here, I present a short-term target for short with stop-loss above the recent high.

Good luck!

Hang Seng Index Reaches Three-Year HighHang Seng Index Reaches Three-Year High

A month ago, while analysing the uptrend in the Hang Seng index (Hong Kong 50 on FXOpen), we noted that:

→ Positive sentiment was driven by the success of the DeepSeek startup, boosting Chinese tech stocks and mobile operators.

→ Price movements formed a bullish structure based on Fibonacci proportions.

→ Analysts predicted the uptrend could persist until the second half of March.

Today, the Hang Seng index (Hong Kong 50 on FXOpen) surged above the 24,500 level for the first time since February 2022. According to Reuters, investor enthusiasm for artificial intelligence continues to fuel the rally.

Technical Analysis of the Hang Seng Chart

New price data support the construction of a large-scale upward channel (marked in blue).

From a bullish perspective:

→ The median line of the blue channel has shifted from resistance to support (as indicated by arrows).

→ The price remains within the intermediate purple ascending channel.

From a bearish perspective:

→ The last two candlesticks show long upper wicks—an indication that sellers are active, possibly locking in profits.

→ The RSI indicator is forming a bearish divergence.

Given these factors, the price appears vulnerable to a pullback. However, the future trajectory will largely depend on fundamental factors, particularly the ongoing tariff tensions between China and the United States.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

oh wow, seems the Index has the wheel to run!Hello everyone! Happy Friday!

News📰 : anticipate more positive news to come (of course mixed with some -ve for retracement) 🔮

Look at the HSI D Chart

- posted 28Feb2025

- posted 3Mar2025

- 7March2025 at point of writing; the index trading above the support level of 23500 (the 28Feb2025 Hi); it tried to go back to uptrend channel and staying above! (broke on 28Feb2025).

Monitor the Trading volume: finance.yahoo.com

Avg past 3 months : 77.909Bn (+19.18% for the past avg vol); this imply the fund flow is abundance, hopefully this continues! Although the vol is slightly less than the last Oct 2024.

Look at the 4H chart

PEPPERSTONE:HK50

The HSI last Dec 2021 Hi @ 24385 is being tested again today!

Now, what's next? 25147, btw now and then Next level that we are looking at to break (oh wow! we need to add in past Higher Hi):

22840-22900

23241-23275-23314- 23471 (need to break above this level to change back to uptrend movement, else probably is gonna be sideways, continue to monitor and confirm)

23952-24101

24385

24586

24747

24800

25147

🚨 as of ✍️ :

Resistance : 24385 - 24586 - 24800. Let's monitor; this level is now being tested and see if breaks and staying above.

🗝️ support level

22750 -23535 (this level being tested few times; it's now became strong support level). Don't think this can easily broke down.

MACD - Goldencross was marked in Green (5Mar25)

KDJ - Remained at Bullish green zone since 4Mar25, the CFD is now in a short bullrun cycle.

BB - Still within lower BB channel and gap up trading at upper BB channel/

the Mid-line 4H chart at 22960-975 was corrected from 23320.

Trade Plan : 23477-24385 - 24751

Buy into support & Sell at resistance

the 1H showing it's now bullrun on the 2nd half of today. Ride on the waves and locked in your profits.

🚨🚨🚨 Locked your profits and watch out for reversal for retracement!

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵 for profits.

Happy Trading everyone!

🎯 Start to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets.

HKEX:2800 - 22.90-22.82 if it happens to retrace back to this level, otherwise anytime NOW is entry point! It's confirmed by the 200MA (above in W chart) ; also the W chart MACD GoldenCross. Cross-check it; if need helps let us know.

HKEX:2823 - 13.17-14.75 can start to open position and start accumulate, is allowed to wait for confirmation once it breaks 14.75 level. But you will be getting at higher cost...

HKEX:2801 - open position at price : 23.73-23.80 or anytime NOW! if ever retraced back to 23.36-23.66 accumulate more.

HKEX:3067 - open position now, add position when it retraced to 11.63,,11.33 or below. If you have missed, you may tk position still good to start at 11.85,11.99,12.15

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Share your trading journey to encourage the trading buddies

GPS recalculating, HSI is finding its way back to the bull routePEPPERSTONE:HK50

D chart : it tries to returning into uptrend channel.

HSI:HSI

D Chart

We look forward to see it at 24192, 24385! Let's continue to monitor.

W Chart PEPPERSTONE:HK50

in 1H 4H chart mentioned the Index is intact and in the Bullish runway!

Look at longer term and trade zen-ly!

Cultivating and nurturing your trading mindset:

Pay attention to your trading strategy becoming a great trader but not profits from one trade.

Happy Trading Everyone.

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Share your trading journey to encourage the trading buddies *

National People's Congress: Boosting China's EconomyThe National People's Congress opens this week as one of the most eagerly awaited events, with the market on tenterhooks over the possibility of stimulus measures to boost economic recovery. During this meeting, Chinese leaders will discuss measures aimed at strengthening growth, controlling deflation and providing crucial support to the real estate sector. As part of these deliberations, a potential increase in public spending is on the horizon, an action that could boost various productive sectors and generate a positive ripple effect throughout the economy. In addition, boosting innovation, particularly in the field of artificial intelligence, is emerging as a key strategy. Renowned technology companies, such as Hua Hong Semiconductor and Tencent Holdings, have made remarkable progress, but the challenge is to maintain this pace in an environment of increasingly fierce global competition. Boosting domestic consumption is also a priority. The authorities seek to implement policies that not only stimulate demand, but also strengthen strategic sectors, such as the automotive and household appliances sectors. Well-known manufacturers, such as BYD, Geely and Haier, could benefit from these measures, which would translate into a virtuous circle that favors the stability and growth of the domestic market. On the other hand, the real estate sector remains one of the big question marks. There is speculation about the possible issuance of approximately 800 billion yuan in local bonds to support developers. This initiative, if it materializes, could provide needed relief to companies in the sector such as China Vanke and China Resources Land, helping to counter the uncertainty that has characterized the market in recent times.

Technical Analysis Hankg Seng (Ticker AT: HKInd)

Last Friday the index closed trading at new highs, partially correcting in what looks like a bullish bounce. Today's Asian session seems to have confirmed it with a bullish engulfing. The checkpoint zone (POC) is located at 17,696 points well below the area of the last impulse and support point which is located around 19,437 points. RSI at the session highs was at 81.52% and currently this overbought level has moderated to 68.22% but this does not mean that the trend has stopped but that it is looking for new highs. The next milestone to expect will be generated if the index pierces the highs of 24,071 towards 25,000 points.

All in all, the National People's Congress is shaping up to be a strategic platform that could redefine China's economic course. With a focus on stimulating investment, boosting innovation and strengthening consumption, the meeting promises to lay the foundations for a new stage of growth in the Chinese economy, generating optimistic expectations both domestically and internationally.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

is the Trumph speech boost the Index? n is Wednesday the humpdayHello everyone! How was yesterday trade? Hope everyone stick to the strategy set the SL/TP for your day trade.

News📰 : as expected and anticipate more positive news this week 🔮

www.tradingview.com

**China shares waver, HK bounces as Beijing vows more support for consumption, AI**

HSI +1.30% at this news published.😂

Look at the HSI D Chart

- posted 28Feb2025

at point of writing; the index closed below key support level of 22900-23000 (the strong level of 23000 which is the 10MA level, the uptrend is broken 28Feb25); as mentioned this level has been retest 3 times, let's continue to monitor.

However, today the Index open Hi. So trade ⚠ cautiously. Don't chase Hi.

Trading volume: finance.yahoo.com

Date Volume

Mar 3,2025 4,338,200,000

Feb 28, 2025 6,578,300,000

Feb 27, 2025 6,257,000,000

Feb 26, 2025 5,138,100,000

Feb 25, 2025 4,449,800,000

Monthly

Mar 1 2025 - 4,338,200,000 (as of todate)

Feb 1 2025 - 93,960,700,000 (+7.53% from prev month)_correction

Jan 1 2025 - 52,385,800,000

Dec 1 2024 - 56,349,200,000

Avg past 3 months : 77.909Bn (+19.18% for the past avg vol); this imply the fund flow is abundance, hopefully this continues! Although the vol is slightly less than the last Oct 2024.

Look at the 4H chart

PEPPERSTONE:HK50

The HSI last Oct Hi @ 23241 has been broken, this level could be the resistance level for the Index to break the next level Hi. The HK50 last Oct Hi @ 23258.

Now, what's next?

As updated:-

Next level that we are looking at to break:

20985

21336-21350

22020-22535, 22840-22900

23241-23275-23314- 23471 (need to break above this level to change back to uptrend movement, else probably is gonna be sideways)

23952-24101

24385

🚨 as of ✍️ :

it stays above 22535(retest 3 times and this might formed very strong support level).

🗝️ support level :

22990 broken :22340-22750 (this level being tested 3 times 17,20Feb & 4Mar; last tested at 22535.3)

MACD - Deadcross was marked in Green, continue to curving down (4h Chart)

KDJ - Reverse to Bullish green zone on 4Mar25; the CFD continue to trading the upwards trend till now.

BB - Still within lower BB channel and gap up trading at upper BB channel/

the Mid-line 4H chart at 22960-975 was corrected from 23320.

Trade Plan: might pullback to 23020 to fill the gap. Range : 23025-23258

Buy into support : 22880-22960(confirm with indicators)

Sell at resistance : 23150, 23190, 23372/400, 23454,23512(it soared to hit ,this morning)

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵 for profits.

Happy Trading everyone!

🎯 Start to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets.

HKEX:2800 - 22.90-22.82 if it happens to retrace back to this level, otherwise anytime NOW is entry point! It's confirmed by the 200MA (above in W chart) ; also the W chart MACD GoldenCross. Cross-check it; if need helps let us know.

HKEX:2823 - 13.17-14.75 can start to open position and start accumulate, is allowed to wait for confirmation once it breaks 14.75 level. But you will be getting at higher cost...

HKEX:2801 - open position at price : 23.73-23.80 or anytime NOW! if ever retraced back to 23.36-23.66 accumulate more.

HKEX:3067 - open position now, add position when it retraced to 11.63,,11.33 or below. If you have missed, you may tk position still good to start at 11.85,11.99,12.15

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea or need help! *

Tariff Carnival with the U.S.: Chinese ReactionIon Jauregui - ActivTrades Analyst

The recent decision by the United States to increase tariffs on Chinese products has reignited tensions in the trade relationship between the two powers. With Washington's intention to raise additional tariffs on products from China by up to 20%, Beijing is considering levies on agricultural and food exports from the United States. If unilateral measures persist, a firm and forceful response from Asia is likely to be triggered. Possible countermeasures include both the imposition of new tariffs and the implementation of non-tariff barriers, focusing on strategic sectors for the U.S. economy, such as agriculture and food. The Chinese Ministry of Commerce had already expressed its opposition to Washington's plans, arguing that these tariffs violate the rules established by the World Trade Organization (WTO) and jeopardize the multilateral trading system. The escalation follows a series of previous measures, in which the US government had announced an additional 10% surcharge on Chinese products, on top of a previously established 10%, in response to criticism of China's insufficient action to combat the entry of fentanyl into the United States. Previously, Beijing had responded to criticism that China had not taken sufficient action to combat the entry of fentanyl into the United States. Previously, Beijing responded to the first tariff measures applied by the US administration with tariffs ranging from 10% to 15% on certain products, along with new controls on exports of strategic minerals and an investigation against the technology giant Google (NASDAQ: GOOGL). The current scenario, can be defined as a “Tariff Carnival” , as it is only worth highlighting the volatility and risk involved in this trade dispute initiated by Trump with all the countries with which it maintains trade relations, whose effects could extend beyond the borders of the two largest economies in the world.

Hang Seng Analysis

In today's trading day, the retracement was not long in coming, closing the week with a bearish session, and continuing today's Asian trading day with a bearish closing. Although the trend is clearly bullish on a daily time frame, it can be seen that there has been a new bounce off the highs. In other words, after breaking new highs at 24,071.50 points the stock has corrected to an area just below the previous highs, in the body area. If the price action loses strength it could generate a bearish crossover that corrects the price in the direction of the previous price support zone at 19573 points. If the stock continues to beat the market strongly we will see a new attempt to pierce the highs. It should be noted that the RSI has marked excessive overbought at the time of the correction at 81.79% and the POC is located in the area of the previous impulse of 17,200 points. Therefore, a small price correction is quite foreseeable if these tariffs have a sufficient impact on the index's corporate results.

In conclusion, the scenario is shaping up as a “Tariff Carnival” , where the escalation of protectionist measures and chain reactions could extend their effects beyond the two largest economies in the world, significantly impacting international trade and the stability of financial markets.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

Looks like HSI got a morning energy boost is not a Weakday!3/3/2025

Hello everyone! Happy Monday today is not a Weakday but a wonderful weekday start of the week 🫰 🫶

News📰 : this was from 28Feb2025

www.tradingview.com

N this is this morning 3Mar2025 - what do you think? I suspect more good news will come this week. 🔎🔮

www.tradingview.com

Look at the HSI D Chart

- posted 25Feb2025

- posted 26Feb2025

- posted 27Feb2025

- posted 28Feb2025

at point of ✍️; the index closed near the key support level of 22900-23000 (the strong level of 23000 which is the 10MA level); as mentioned this level has been retest 3 times, let's continue to monitor.

Trading volume: finance.yahoo.com

Date Volume

Feb 28, 2025 6,578,300,000

Feb 27, 2025 6,257,000,000

Feb 26, 2025 5,138,100,000

Feb 25, 2025 4,449,800,000

Feb 24, 2025 5,264,600,000

Monthly

Mar 1 2025 - 93,960,700,000 (+7.53% from prev month)

Feb 1 2025 - 87,382,400,000

Jan 1 2025 - 52,385,800,000

Dec 1 2024 - 56,349,200,000

Avg past 3 months : 77.909Bn (+19.18% for the past avg vol); this imply the fund flow is abundance, hopefully this continues! Although the vol is slightl less than the last Oct 2024.

Look at the 4H chart

PEPPERSTONE:HK50

The last Oct Hi @ 23241 has been broken, this level could be the resistance level for the Index to stay above for the next level.

Now, what's next?

As updated:-

Next level that we are looking at to break:23330, 23525, 23990, 24101, 24385.

🚨 as of ✍️ :it seems it stay above the key support level of 22990.

🗝️ support level : 23500 (broken) , 23175 (broken), 22990 (testing), 22741

MACD - last marked WAS deadcross and curving down as marked in YELLOW. After 8 bars-it reversed as marked in GREEN. and NOW it formed Deadcross again (as marked in YELLOW)

KDJ - Remained in bearish red zone with chance that it could reverse upwards.

BB - Still within lower BB channel and testing to break the BB mid-line for 4H chart at 23330.

Today Trade Plan: 22785-23504

Buy into support : 22900 ,23,005, 23169,23283 (confirm with the indicator if it's on the bullish zone)

Sell at resistance : 23400, 23353, 23335 (short/TP with shorter timeframe bearish zone, cross-check and wait for confirmation.)

Monitor the 1H,4H movement with confirmation using MACD & KDJ indicator.

Set your tf, have your entry and exit plan!

Pay attention to the Goldencross/DeadCross; practice makes perfect.

Let's follow our own strategy and zen with 📙 and 🍵.

Happy Trading everyone!

🎯 Start to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets.

HKEX:2800 - 22.90-22.82 if it happens to retrace back to this level, otherwise anytime NOW is entry point! It's confirmed by the 200MA (above in W chart) ; also the W chart MACD GoldenCross. Cross-check it; if need helps let us know.

HKEX:2823 - 13.17-14.75 can start to open position and start accumulate, is allowed to wait for confirmation once it breaks 14.75 level. But you will be getting at higher cost...

HKEX:2801 - open position at price : 23.73-23.80 or anytime NOW! if ever retraced back to 23.36-23.66 accumulate more.

HKEX:3067 - open position now, add position when it retraced to 11.63,,11.33 or below. If you have missed, you may tk position still good to start at 11.85,11.99,12.15

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea or need help! *