WHO LOVES A STRONG JPY ( YEN )BASKET FORECAST Q2 W22 Y25WHO LOVES A STRONG JPY ( YEN )BASKET FORECAST Q2 W22 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

✅The JPY Basket tracks the overall strength of the JPY against a weighted average of other currencies.

✅It can be used as an indicator of YEN strength which can be a tool for analysing and potentially hedging for or against the Index.

✅ Pairs to watch - GBPJPY, USDJPY EURJPY, CADJPY, AUDJPY

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

JPYBASKET trade ideas

JPYBASKET 2WYen Basket – 2-Week Timeframe

Let’s take a look at this chart.

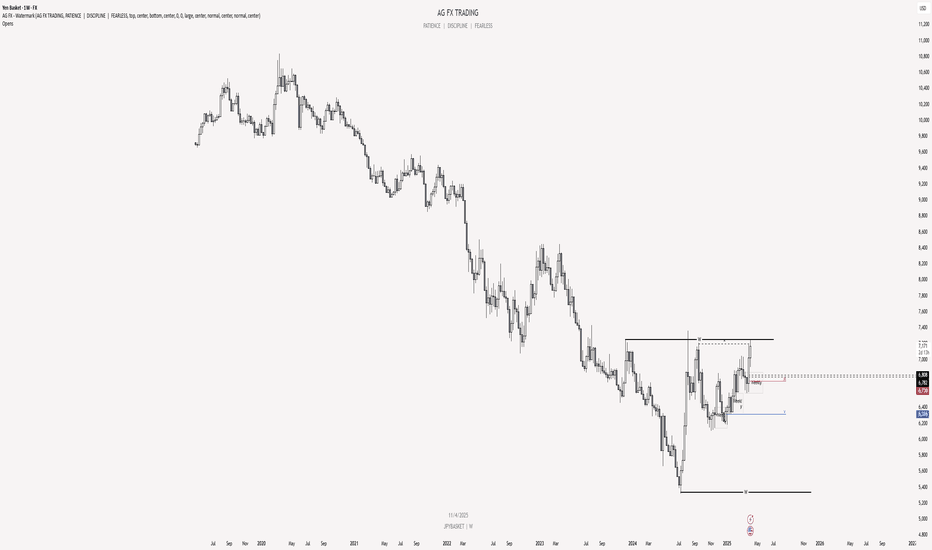

Since 2019, the trend has been strongly bearish.

Now, what’s important is that the price has managed to break the long-term downtrend line, but it’s still facing a strong resistance zone (that blue area). It’s tried to break through a few times, but hasn’t been able to so far.

If the price can hold above the 7,200 level, we might say there’s a good chance the trend could shift and a bullish move could begin. But if it gets rejected again, it might drop back down and even retest previous lows.

Summary: For now, we need to keep a close eye on this key resistance. Until it’s clearly broken, we can’t confidently talk about a bullish reversal.

JPY ( YEN )BASKET FORECAST Q2 W18 Y25JPY ( YEN )BASKET FORECAST Q2 W18 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

✅The JPY Basket trackS the overall strength of the JPY against a weighted average of other currencies.

✅It can be used as an indicator of YEN strength which can be a tool for analysing and potentially hedging for or against the Index.

✅ Pairs to watch - GBPJPY, USDJPY EURJPY, CADJPY, AUDJPY

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

CREDIT CRISISWe are beginning to see evidence of a credit crisis starting. low demand for US bonds can trigger a currency crisis for the USD, higher rates will lead to refinancing company problems (especially with all the zombie companies that should have blown up over a decade ago.) and major economic depression-style job losses.

Currently, we are very early stages but things are moving at lightning speed on a macroeconomic level.

I know this is likely gibberish to most here pon trading view but it is of MASSIVE importance to your trading and investing.

CAUTION IS IN ORDER!!

Click boost, follow, and subscribe! I can help you navigate these crazy times.

JPYBASKET Potential Move – Technical OutlookJPYBASKET has just broken out of its bearish channel, signaling a potential shift to bullish momentum after being under pressure since March.

Currently, price action suggests a move to close the gap and target the 6.844 resistance level, with a possible extension toward 6.942.

However, before confirming a strong bullish continuation, a deep retracement could occur. This aligns with the Fibonacci retracement levels and key support zones (as marked on the chart), making them crucial areas to watch.

📌 Key Levels to Watch:

Support Levels: Fibonacci retracement areas (see marked levels)

Resistance Targets: 6.844 → 6.942

⚠️ Disclaimer: These are my personal views, not financial advice (NFA). Always trade with proper risk management.

JPY Basket: Trend Reversal in Play – Bullish Breakout ExpectedThe JPY Basket is showing signs of a potential bullish reversal after reaching a key support zone at 6,183. Last week’s hammer candlestick signals strong buying pressure, reinforcing the likelihood of a trend shift.

Technical Analysis

Key Support & Market Structure Shift:

Price previously tested the 6,183 support level, where buyers stepped in.

A Change of Character (CHoCH) occurred around 7,330, indicating a shift in momentum.

The market formed a lower high near the 6,183 level, suggesting that sellers are losing control.

Trendline Breakout Expectation:

Price is currently trading below a bearish trendline.

A breakout above this trendline would confirm a bullish continuation.

If price holds above 7,330, further upside momentum is expected.

Confirmation & Target:

Last week's hammer candlestick provides additional confirmation for a bullish bias.

Targeting 8,456, aligning with previous structural highs and liquidity zones.

Trade Plan

Entry: On a confirmed breakout of the bearish trendline.

Stop Loss: Below recent swing low for risk management.

Target: 8,456 (next key resistance).

JPY Bias: Strong buy signal; expect JPY strength across pairs where it is the quote currency.

Conclusion

The JPY Basket is positioned for a bullish breakout, supported by a key support bounce, CHoCH, and trendline dynamics. With last week's hammer candlestick as added confirmation, we anticipate JPY strength moving forward.

🚀 JPY BUY BIAS: Expect Weakness in JPY-quoted Pairs! 🚀

JPY Basket 4hr TFThe JPY Basket has made a 3.3% move without any significant pullback, which suggests a strong momentum, but this move lacks the typical retracement I’d expect to see for a more balanced market. It has reacted off a key level that I’ve identified as an area of interest. However, to gain a higher level of confidence in the direction, I’m waiting for a "double tap" — a second test of this area — which would signal that the market is likely to move lower.

The confluences supporting this bearish view are strong. First, the trend line is indicating a potential reversal point, aligning with a daily rejection zone, where price has shown resistance previously. Additionally, we have the -0.618 Fibonacci extension level on the daily chart, which often acts as a target for price retracements or continuations. Given these factors, I’m expecting the market to pull back to at least the 6664 level before potentially moving lower.

The Yen has reasons for strengthen! Hello everyone!

🇯🇵Yen is Ready for a Breakout!💴

The Japanese Yen GPI Basket Index is testing a key resistance level at 6,750-6,840. Over the past three weeks, the index has been steadily approaching this level without sharp movements. Fundamental factors suggest a potential breakout, but a short-term consolidation may occur first.

If the resistance is broken, the index could accelerate toward the next major level at 7,150-7,250, which aligns with the midpoint of the anticipated parallel channel. Currently, lower timeframes indicate overbought conditions, suggesting the need for liquidity accumulation.

In case of a breakout, short positions on GBPJPY and EURJPY appear the most promising, as these pairs have strong movement potential. 🤑

#Forex #Trading #JPY #ForexAnalysis #Yen #FX #MarketUpdate #TechnicalAnalysis #GBPJPY #EURJPY #ForexSignals

JPY next impulsive up to the upside Posting about buying JPY in late november and price impulsed up.

Now we have another big buy opportunity.

Price has pulled back close to 61.8 FIB and 4h is about to break structure

to the upside.

Tomorrow's Fed's rate or/and Thursday's JPY news should be the catalyst.

Looking to go long on YenBig yen news tomorrow.

BOJ Policy Rate.

Posted about this last week. Saying we expect the move at the end of the month.

We've tapped into the zone i mentioned. Currently waiting for 4h to break structure to be bullish.

Will this be another Yen Carry trade to give the stock market the correction?

Yen strength to kick in at the end of the month??Been waiting for JPY strength to kick in for weeks.

Finally a slow corrective pullback into 50 FIB also a Demand zone.

Big Yen news at the end of the month should send the Yen going up again.

Will this cause another Yen Carry trade to the stock market?