Nasdaq 100 Index Hits New Highs Ahead of Big Tech EarningsNasdaq 100 Index Hits New Highs Ahead of Big Tech Earnings

Earlier, we noted signs of optimism in the Nasdaq 100 index as the market anticipated earnings reports from major tech firms.

Now, companies such as Alphabet (GOOGL) and Tesla (TSLA) have already released their results (we previously covered their charts → here and here). Up next are the most highly anticipated earnings reports: this week, tech giants including Microsoft (MSFT), Amazon (AMZN), Meta Platforms (META), and Apple (AAPL) are set to publish their results. The combined market capitalisation of these four companies exceeds $11 trillion, and their reports could have a significant impact on a stock market that is already showing strong bullish sentiment:

→ The Nasdaq 100 index has climbed to an all-time high, surpassing the 23,400 mark.

→ The signing of trade agreements between the US and Europe (and earlier, Japan) has eased concerns about the negative impact of tariff barriers.

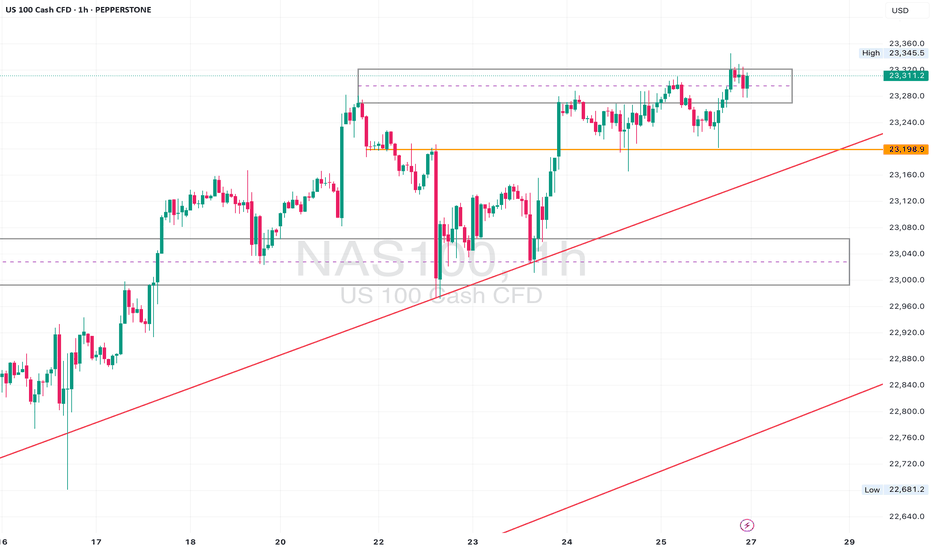

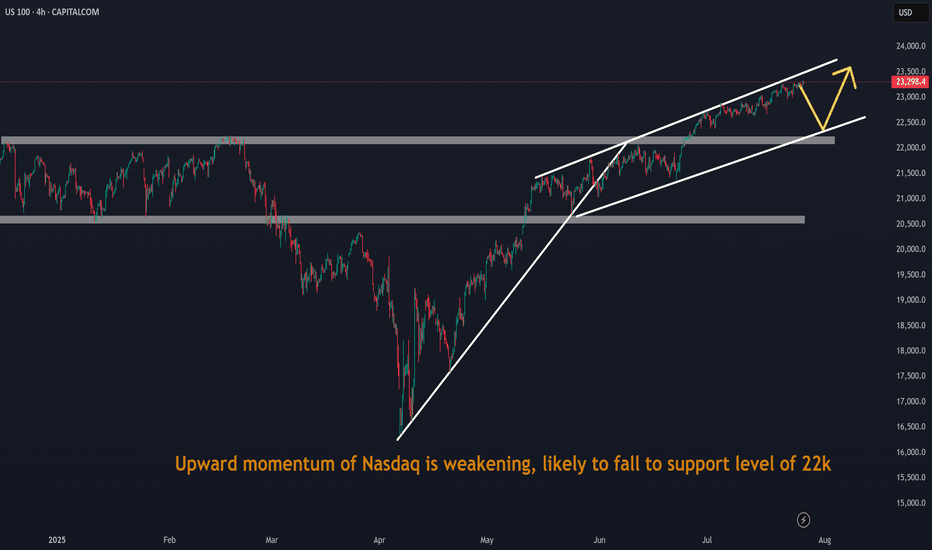

Technical Analysis of Nasdaq 100

The chart supports growing signs of optimism: earlier in July, the price remained within a rising channel (marked in blue). However, towards the end of the month, price action has begun to follow a steeper upward trajectory (marked in purple).

What could happen next? Much will depend on the earnings results and forward guidance from these tech giants.

On the one hand, continued enthusiasm around AI adoption could accelerate further growth. The stronger the optimism, the more fuel it may add to discussions around a potential bubble — with some analysts already drawing parallels to the dot-com era of the early 2000s.

On the other hand, earnings could temper market excitement and prompt a correction. For example, the index may retreat to the support level around 23,020, which is reinforced by the lower boundary of the blue trend channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NDQM trade ideas

We Got The Deal - Time To Sell The NewsOkay, so we have the long-awaited deal between the US and the EU. After a large up-gap was announced last night, it now seems as if a “sell the facts” scenario is unfolding.

Such a wave of selling would also fit in well with the typical seasonal weakness that we often see in the markets from August onwards.

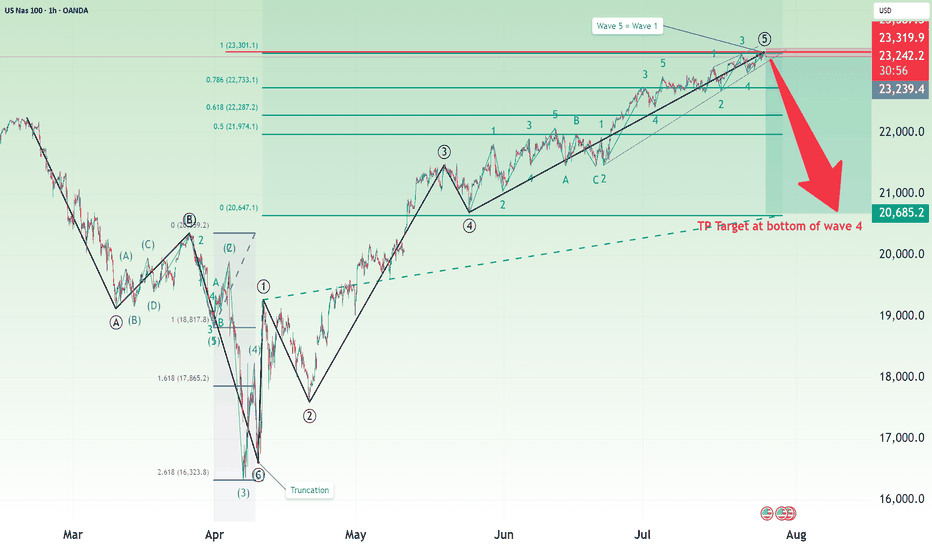

Nasdaq Short: Completion of 5 waves with wave 5=wave 1Over here, I present a short case for Nasdaq (and S&P500 by default since their correlations are high). The main reasons are:

1. Completion of 5 waves structure both on the high degree and on low degree, as shown in the chart.

2. Fibonacci measurement where wave 1 = wave 5.

The stop of this idea is to be placed slightly above the high, in this case, I placed it at around 23320. The take profit target is at the bottom of primary wave 4, around 20685.

Take note that this is a positional short, meaning the strategy is to short and hold and periodically adjust your stop loss based on unfolding on wave structure. Sizing is based on your risk tolerance.

Good luck!

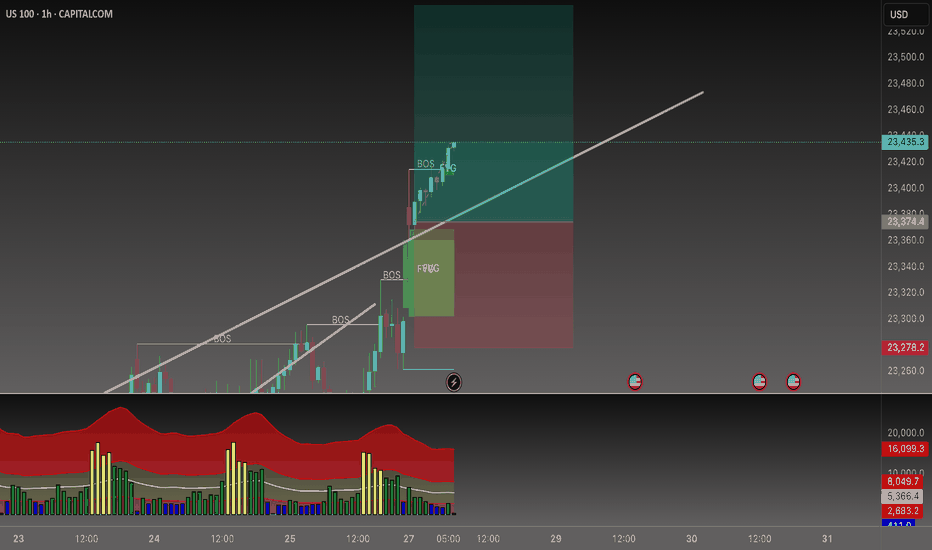

Trend Exhaustion Detected – Bearish Structure AheadUS100 (NASDAQ) 30-minute chart as of July 26, 2025, with technical insights based on the visible elements.

🔍 1. Trend Analysis

Primary Trend: Uptrend (bullish structure)

The price has been respecting a rising parallel channel, marked by:

Ascending support (lower boundary)

Ascending resistance (upper boundary)

Market structure shows:

Higher Highs (HH)

Higher Lows (HL)

✅ This indicates continuation of bullish momentum until structure breaks.

📐 2. Market Structure Elements

Structure Type Label on Chart Price Zone (approx.)

Break of Structure (BOS) BOS (center-left) ~22,950

Higher Low (HL) HL (2x) ~22,700 (1st), ~23,050 (2nd)

Higher High (HH) HH (2x) ~23,150 and ~23,300

Resistance Labelled ~23,300–23,320

Demand Zones Labelled ~22,450–22,700

🔁 Break of Structure (BOS)

The BOS occurred after a prior swing low was broken, followed by a new higher high, confirming a bullish shift.

🧱 3. Support / Resistance Analysis

🔼 Resistance Zone

The price is testing strong resistance around 23,300–23,320

Multiple rejections in this area

Trendline resistance also aligns here

A rejection arrow is drawn, indicating potential bearish reaction

🔽 Support Zone (Immediate)

23,180–23,220: highlighted green box is a local support block

If broken, likely to revisit 23,000–23,050, or even down to 22,900 range

🟩 4. Demand Zones

Zone 1:

22,450–22,600: Strong bullish reaction historically — likely to act as a key demand if a deeper pullback occurs

Zone 2:

22,850–22,950: Validated with prior accumulation & BOS event

🧠 5. Key Observations

Price is at a critical inflection zone:

Testing a resistance zone

At the upper trendline of an ascending channel

A bearish reaction is projected (black arrow)

Possibly targeting the green support zone around 23,180–23,220

If that fails, demand at ~23,000 will likely be tested

Ichimoku Cloud:

Currently price is above the cloud → still bullish

Cloud is thin → potential weakness or upcoming consolidation

⚠️ 6. Trading Bias & Setup Ideas

✅ Bullish Bias (if price holds above ~23,180)

Long entries can be considered on bullish reaction from support

Target: retest of 23,300–23,350 or even breakout continuation

❌ Bearish Bias (if breakdown below support)

Short entry valid below 23,180 with:

TP1: 23,050

TP2: 22,900

A breakdown from the ascending channel would signal trend exhaustion

🔚 Conclusion

Current Price: 23,298.4

Trend: Bullish, but at resistance

Next move: Watch for reaction at resistance and support box below

Bias: Neutral-to-bullish unless the structure breaks below ~23,180

NAS/TEC100 - LETS GET NASTY ON NAS100Team, NAS currently sitting at 23480, before the US market open

however during the market open, please be aware of the volatility that may hit your stop loss

You have 2 options to trade on this NAS- NASTY

Option 1: wait for market open, if it hits 23500-23515 - then short with stop loss at 23580

Option 2: Short at the current market with small volume - and if the market open with volatile, you can take another advantage of shorting more volume as per option 1 instructed.

OK, pick your strategy! do NOT be shy.

I am going to have small short position and will consider adding more during US market opening after 5-10 minutes, much easier to see the direction of the market - we do LIVE trading everyday. Please note: if NAS fall below 23450-40 bring stop loss to BE (Break even)

1st TARGET range: 23435-23416 - make sure take 70% volume

2nd target at 23390 to 23376

Why do I short on NAS when tomorrow rate decision, i think this quarter report, market will not be the same as last quarter, even rate cut!

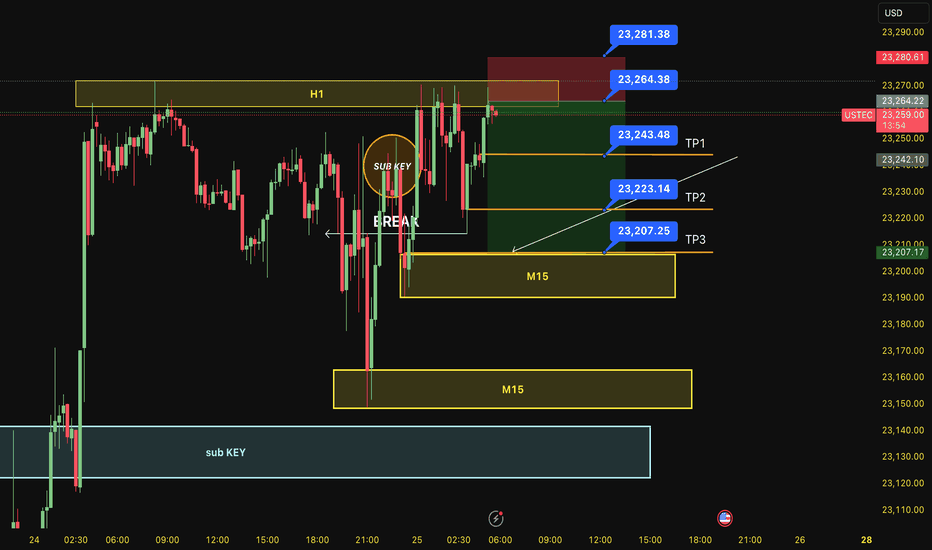

SELL USTEC 25.7.2025Reversal trade order: SELL at H1~M15 (all-time high - ATH)

Type of entry: Limit order

Reason:

- The price breakout the sub key of M15, confirming it will hit the main key M15.

- There is a key H1 support at the entry point.

Note:

- Management of money carefully at the price of bottom of M15 (23,343)

Set up entry:

- Entry sell at 23,264

- SL at 23,281

- TP1: 23,243

- TP2: 23,223

- TP3: 23,207

Trading Method: Price action (No indicator, only trend and candles)

USNAS100 - Tech Weakness & Tariffs Drag NASDAQ LowerTariff Day Pressure Builds as Amazon Miss Weighs on Markets

Markets were hit by a wave of risk-off sentiment on Friday as renewed tariff headlines, weakness in pharma stocks, and a disappointing earnings report from Amazon clouded investor confidence. All this comes just ahead of the U.S. jobs report, which is expected to challenge the market's already diminished expectations for Fed rate cuts.

While macro markets appeared resilient earlier in the week, Wall Street futures and global equities turned cautious as sentiment deteriorated.

NASDAQ – Technical Outlook

The NASDAQ has dropped nearly 850 points from its recent all-time high of 23690, as anticipated in previous updates. The index remains under bearish pressure.

For today, the market is expected to remain sensitive due to recent macro and earnings-driven volatility.

If the price breaks below 22875, the decline is likely to extend toward 22710, with a deeper support zone at 22615.

To shift back to a bullish bias, the index must break and close above 23045 on the 1H chart.

Support Levels: 22875 • 22710 • 22615

Resistance Levels: 23140 • 23240 • 23320

Bias: Bearish while below 23045

Bullish confirmation: 1H close above 23045

SWING TRADE NASDAQIs this another case of Trump moving the markets so his buddies can get better entries? 👀

Not saying anything... but July candles were way too friendly in that yellow box. Institutions were loading up like it was Black Friday.

I jumped in too—snagged a clean 10RR 😎📈

Now, with seasonality (August 3.5% average past 10 years) + Commitment of traders data backing me up( July COT is heavy longs), I’m risking light for a tiny 27RR setup.

Will it work? No clue.

Will I be dramatic about it? Absolutely. 🎭📉📈

NAS100 - Potential TargetsDear Friends in Trading,

How I see it,

I know I'm posting the same old overbought pattern...

"I think I found a background I like at last - Just Testing"

1) A previously discussed we will notice a "SIGNAL" Type candle

2) It can be on 1HR-4HR-1D TF

3) Today is FOMC and Friday NFP

These two events will for sure give us the signals we need to clarify

the way forward

Let this very important week play out, I'll touch base again next week

I sincerely hope my point of view offers a valued insight

Thank you for taking the time study my analysis.

US100The US100 (Nasdaq 100) has shown a dramatic shift in trend, forming what appears to be a large-scale bearish harmonic pattern or potential M-top structure. After reaching its peak in mid-2025, the index has entered a sharp downward trajectory, shedding significant value in a short span.

This chart raises a critical question for long-term investors and traders:

Are we witnessing the early phase of a prolonged bear market that could stretch into 2026 and beyond?

🔻 Key Observations:

Bearish structure developing with aggressive selling pressure.

Potential breakdown from long-term support trendlines.

Momentum suggests institutional risk-off behavior.

Stay alert for macroeconomic cues, interest rate policy, and earnings season signals. A break below 13,000 could confirm a deeper bear cycle

NDX – Double Top & Divergence (H4, D FRL Setup)Hello friends! It's time for our beloved Nasdaq index to cool down. I expect a correction amid the strengthening of the dollar.

H4: clear Double Top forming near 23,000.

Daily: bearish MACD divergence confirms momentum shift.

📐 FRL (H4): neckline at 23,000, perfectly aligned with 100 SMA on H4.

🎯 Target: 0.618 Fib retracement at 20,500 – confluence with 100 & 200 SMA on Daily and strong horizontal support.

NAS100 - EXPECTING THE DUMPTeam, we got short well today with AUS200 - both target hit

we have set up the NAS entry , this is the entry price 23268 - 23200

STOP LOSS at 23100

Once it break above 23320 - bring stop loss to BE

Target 1 at 23320-60 - take 50%-70& partial

Target 2 at 23380-23400

LETS GO

NAS100 Retesting Breakout – Eyes on 23170 for Bullish PushDaily Analysis:

Price is testing the upper boundary of the long-term ascending channel. Structure is still bullish with no major breaks of support. If momentum holds, we could extend toward the channel top.

4H Analysis:

Retesting breakout structure. Support is forming around 23000–23050. Bullish momentum remains valid unless price closes below this zone.

1H Analysis:

Micro-breakout confirmed with bullish impulse above 23120. If 23170 holds, continuation toward 23280–23320 is likely.

Confirmation & Entry:

Watch for continuation above 23170. SL below 23080. TP: 23280+

Use caution if 23000 breaks — this would weaken short-term bias.

Nasdaq US100 Wave 3 Expansion Toward 31,606 in PlayNasdaq US100 has completed a significant wave cycle with a confirmed wave 1 in the broader Elliott Wave structure. Following this, price underwent a corrective wave 2 that extended from the $22,237 supply zone down to $16,334, marking the conclusion of the previous cycle’s correction. This structure now signals the initiation of a fresh upward impulse, setting the stage for a powerful wave 3 advance.

The emergence of wave 3 will gain full confirmation once price successfully breaks above the external supply zone, reclaiming $22,237. If this breakout occurs with sustained momentum, the wave 3 projection targets an expansion toward $31,606, which aligns with the 161.8% Fibonacci extension from the prior cycle. This forthcoming rally is anticipated to unfold in a five-subwave format, indicative of a high-momentum bullish leg.

As long as price action remains above the key support at $16,334, the bullish cycle remains valid. All eyes should now be on the breakout structure and volume profile around $22,237, as it represents the gateway to a much broader impulsive move.

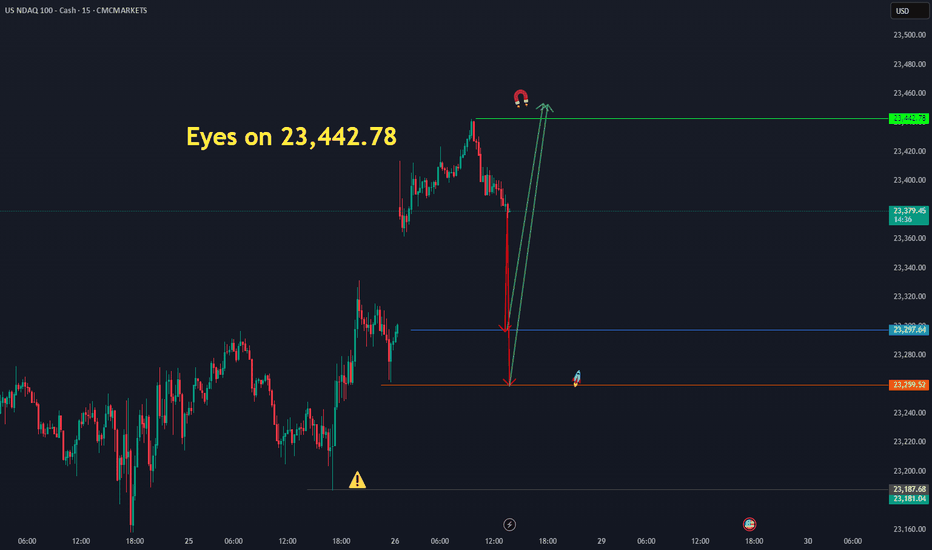

Beyond the Chart – NAS100 Through Technicals & Fundamentals📊 CAPITALCOM:US100 Analysis

Today, NAS100 opened with a huge gap up following former President Trump’s announcement that the U.S. has officially reached a trade agreement with the European Union.

🕳️ After price rejected the gap zone, and volume gets low low. I’m now looking for a potential test of the 23,540 level.

💼 With Q2 earnings season kicking off, stock-moving news will be hitting fast. While retail traders might scramble to catch up, smart money is already positioning for surprise earnings beats.

Stay sharp, this week could set the tone for the next major move.

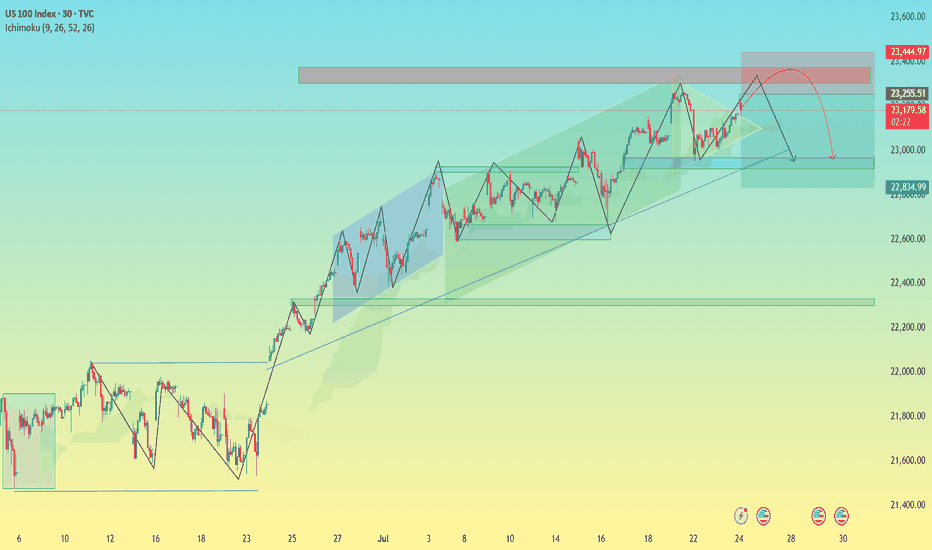

US100 Index – Potential Bearish Reversal in Key Resistance Zone🧠 US100 Index – Potential Bearish Reversal in Key Resistance Zone

Timeframe: 30-Minute | Chart Published: July 24, 2025

---

🔍 Overview

The US100 (NASDAQ) has been trading in a well-structured ascending channel, forming higher highs and higher lows. However, recent price action suggests that the index is testing a critical supply zone near 23,400, with signs of weakening bullish momentum. This may signal a potential corrective phase or bearish reversal.

---

📈 Technical Analysis Breakdown

🔵 Trend Structure:

Price is respecting a clear ascending trendline (blue), connecting multiple higher lows.

Multiple bullish flag/channel formations have been completed within the uptrend, showing healthy momentum until the current point.

🟥 Resistance Zone:

Strong supply zone marked between 23,250 – 23,450.

Price action shows stalling candles and rejection wicks within this zone, indicating buyer exhaustion.

⚠ Bearish Patterns:

The red path projection suggests a head and shoulders-like structure forming at the top of the channel.

This, along with divergence in wave strength and shrinking momentum, supports a potential reversal.

🔵 Key Support:

First support lies around 23,000 — aligning with the ascending trendline and previous consolidation.

If broken, next demand zone is around 22,835 – 22,900, where historical consolidation took place.

---

🔁 Projected Scenario (as per visual path)

1. Price may attempt one last push into the 23,400–23,450 zone (possible false breakout).

2. Rejection from this level could trigger a fall toward the ascending trendline support.

3. A confirmed break of the trendline can lead to a larger correction toward the 22,800 zone.

---

🧠 Unique Insight

This chart combines multi-timeframe structure recognition with a real-time reversal formation inside a long-standing bullish trend. The analysis doesn’t just rely on textbook patterns—it recognizes real-time price behavior shifts, which makes it valuable for proactive traders.

---

📌 Conclusion

While the trend remains bullish overall, caution is warranted as the US100 approaches a historically significant resistance zone. The setup offers a compelling risk-reward short opportunity for aggressive traders, especially if the price confirms a break below trendline support.

---

🔧 Next Steps for Viewers

> “Watch for a clean rejection candle or lower high at resistance before entering short. If trendline breaks cleanly, 22,835 could be the next target zone.”

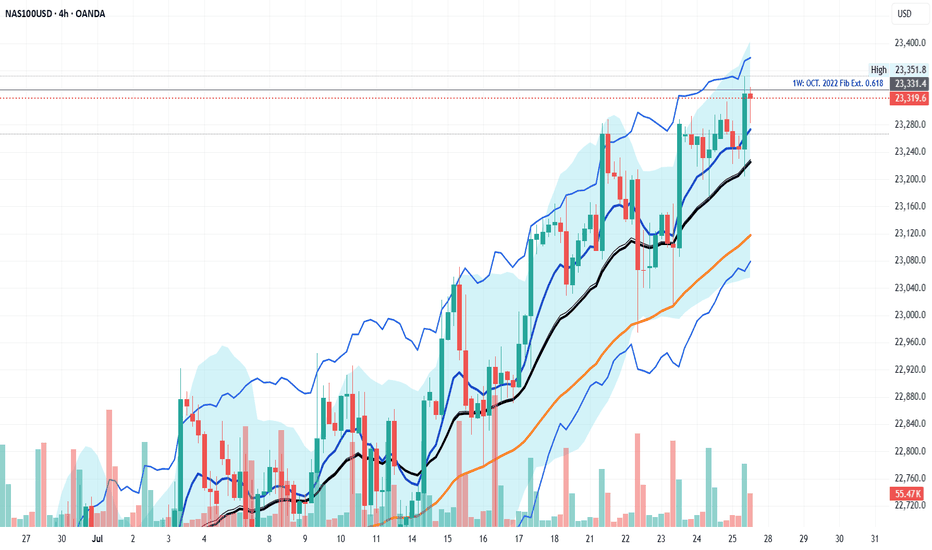

COULD THE NAS100 BREAKOUT THIS IMPORTANT FIB LEVEL?As examined similar to the SPX500, NAS100 has already reached the fib extension target of 0.618 and facing a resistance. There are indicator divergences on the weekly down to the 4H time frames suggestion a potential correction in likely soon. My thesis for this week is that NAS100 could briefly push through the resistance and clear liquidity above the fib resistance with a capitulation candle before a correction. Therefore the trade idea is caution to the upside as there are no major reversal candle yet on higher time frame but indicators are blowing warning horns so apply tight stop loss on the trade plan this week while watching for a reversal confirmation on the 4H or daily charts.

Fibonacci Retrace Strategy NAS100 Trade Idea📈 NASDAQ 100 (NAS100) is holding a strong bullish trend 🚀. After a weekend gap-up 🕳️➡️📈, price retraced back into the gap zone—exactly what you'd expect in a healthy trending market.

🔍 I'm applying my Fibonacci Expansion + Retrace Strategy 🔢, watching closely for a pullback into equilibrium ⚖️ within the previous price swing. That’s where I’ll be waiting for a bullish market structure break 🔓📊 to confirm my long bias.

🧠 Patience is key here—let the setup come to you.

📌 As always, this is not financial advice!