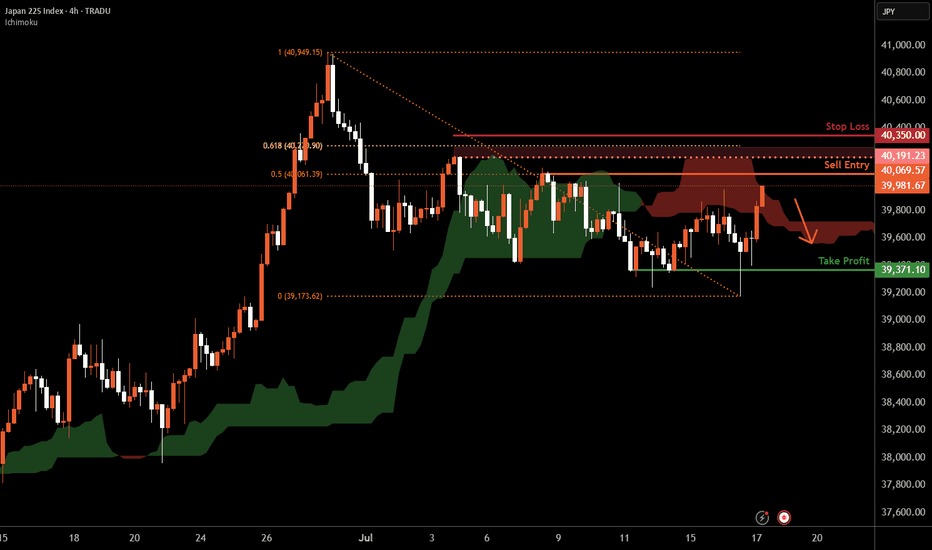

Nikkei 225 H4 | Swing-high resistance at 50% Fibo retracementThe Nikkei 225 (JPN225) is rising towards a swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 40,069.57 which is a swing-high resistance that aligns with the 50% Fibonacci retracement.

Stop loss is at 40,350.00 which is a level that sits above the 6

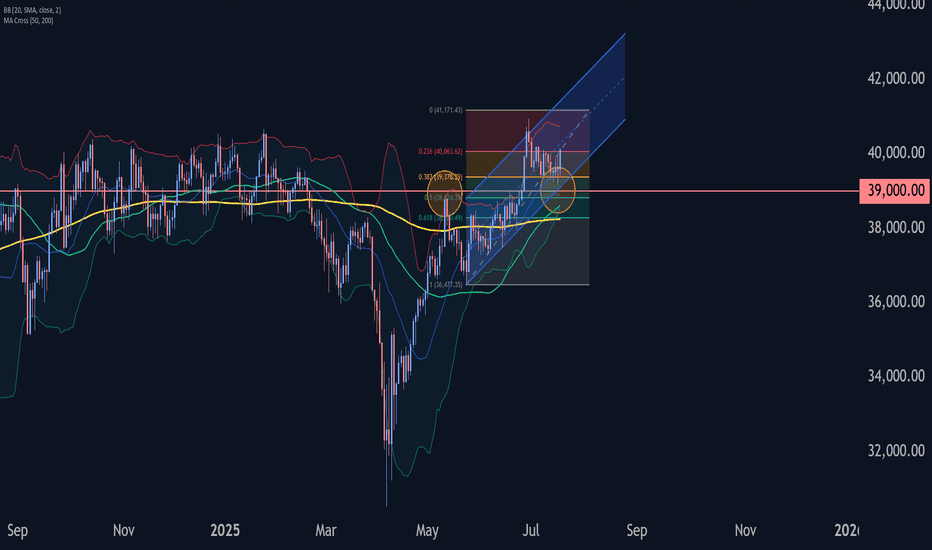

JP225 Long Trap or Bull Escape? Heist in Motion.🦹♂️🎯 JP225 Ninja Heist: Breakout Loot Plan 💥💰 (Long Game Playbook)

🌟Hi! Hola! Ola! Bonjour! Hallo! Assallamu Allaikum!🌟

Dear Money Makers, Market Raiders & Silent Robbers, 🤑💰💸✈️

It’s time to gear up for the ultimate breakout heist on the JP225 / NIKKEI Index CFD Market. Based on my 🔥Thief Trading

NI225 NIKKEI 225 25-7-11Japan stocks remind me the most of this time in 1975, which marked a bottom. It’s not identical at all. Just the closest I could compare it to. It’s at all time highs and after a year or so of consolidation. The thing is now looks even better for a textbook W reversal up now. It’s a striking pattern

Bit of a delay - New Falling Wedge ready to break upJapan like Hong Kong is showing strong signs of growth.

We first had the breakout above the Cup and Handle and now we are awaiting the breakout above the Falling Wedge...

There are some strong signs of upside fundamentally...

💼 1. Solid GDP & corporate profits

Japan’s economy grew about 2.7% a

NI225: Will Go Up! Long!

My dear friends,

Today we will analyse NI225 together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 39,581.12 will confirm the new direction upwards with the target being the next key level of 39,719.48 and a reconvened placement o

Nikkei 225 H1 | Swing-high resistance at a Fibo confluence zoneThe Nikkei 225 (JPN225) is rising towards a swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 40,196.22 which is a swing-high resistance that aligns with a confluence of Fibonacci levels i.e. the 78.6% projection and the 127.2% extension.

Stop loss

NIKKEI Buy Plan — ATH Breakout Incoming!🚀 NIKKEI Buy Plan — ATH Breakout Incoming!

Buyers should stay alert and confident — NIKKEI is not just aiming to break its previous all-time high, it's preparing to print a brand new one. The recent price action shows strong bullish continuation, supported by:

✅ Weekly Fair Value Gap respected and

Nikkei 225 Wave Analysis – 17 July 2025

- Nikkei 225 reversed from support area

- Likely to rise to resistance level 40550.00

Nikkei 225 index recently reversed up with the daily Doji from the support area located between the key support level 39000.00 (former resistance from May) and the support trendline of the daily up channel from M

JAPAN as a HERO? UP! GOKU Last Fight! JAPAN is the last one to join the party! The final fight for the #BlowoffTop.

Why is this so important? If you look at correlations with BTC, global liquidity, China, the Fed’s interest rates, and more, Japan plays a key role. After China, Japan is the next to wake up and give the final push to t

NI225: Strong Growth Ahead! Long!

My dear friends,

Today we will analyse NI225 together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 39,810.33 So a bullish continuation seems plausible, targeting the next high. We should enter on confirm

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

JPN225 reached its highest quote on Jul 10, 2024 — 42,485.00 JPY. See more data on the JPN225 chart.

The lowest ever quote of JPN225 is 30,269.00 JPY. It was reached on Oct 4, 2023. See more data on the JPN225 chart.

JPN225 is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy JPN225 futures or funds or invest in its components.