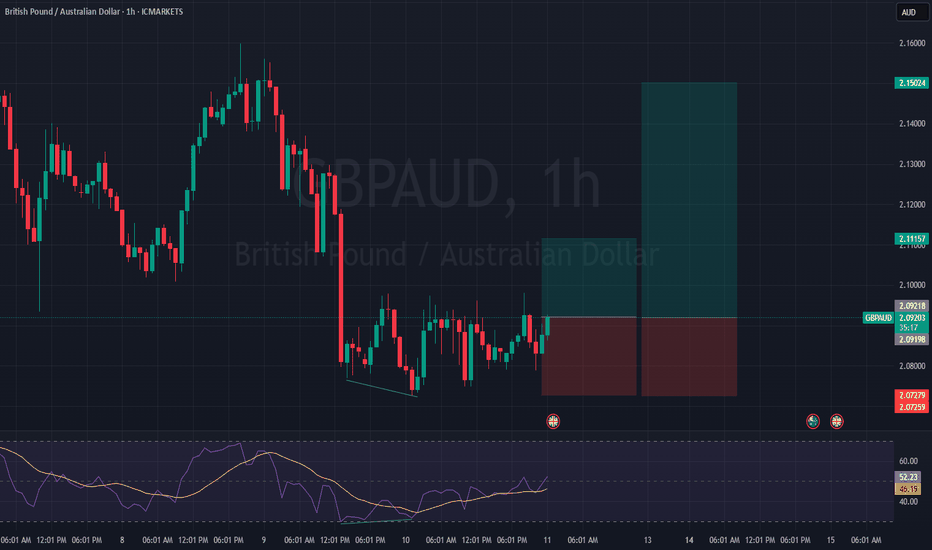

#GBPAUD: After A Strong Drop Price Seems To Rebounding! The British pound (GBPAUD) took a nosedive when the US president announced new tariffs on several countries. This caused gold to rise, and so did the Australian dollar (AUD).

You see, gold and the AUD are like best friends, they always move together. But things are changing now, and we’re not sure what’s going to happen next.

That’s why there are two different opinions in the market. When trading GBPAUD, it’s important to use accurate risk management and make decisions based on your risk tolerance.

Good luck and trade safely!

Much Love ❤️

Team Setupsfx!

GBPAUD trade ideas

Could the price bounce from here?GBP/AUD is falling towards the pivot which is an overlap support and could bounce to the 1st resistance which acts as an overlap resistance.

Pivot: 2.0624

1st Support: 2.0413

1st Resistance: 2.1029

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

WHY GBPAUD IS BULLISH ?? DETAILED ANALYSISGBPAUD is currently breaking out of a textbook falling wedge pattern on the 2H timeframe, a structure widely recognized for its bullish implications. After an aggressive bullish impulse at the start of April, the pair entered a consolidation phase marked by lower highs and lower lows. However, the recent breakout above wedge resistance signals a potential continuation of the prior bullish trend. This clean technical breakout, combined with tight consolidation, suggests a build-up of bullish pressure likely to push the pair toward the 2.1300–2.1600 zone.

From a technical standpoint, the falling wedge pattern acted as a corrective structure following strong bullish momentum. The breakout confirms buyers stepping back in, with a solid support base forming around 2.0800. As long as GBPAUD holds above this level, the bullish outlook remains intact. Volume has also started to increase post-breakout, which typically reinforces the validity of the move.

On the fundamental side, the British pound is gaining traction amid optimistic UK economic indicators and renewed hawkish undertones from the Bank of England. Traders are pricing in a more cautious approach to rate cuts compared to other central banks, which gives GBP an edge. On the other hand, the Australian dollar is under pressure due to weak employment data and China-related risk sentiment, both of which are weighing on AUD. This divergence creates a favorable macro backdrop for GBPAUD bulls.

This setup is gaining attention among traders on TradingView due to its clear structure and the alignment between technicals and fundamentals. With a bullish breakout confirmed, I'm expecting follow-through momentum in the sessions ahead. Watching for intraday retests near 2.0850 for possible re-entries, with a medium-term upside target near the 2.1500 zone.

GBPAUD Poised For a Bearish Wave GBPAUD Poised For a Bearish Wave

GBPAUD has confirmed a double top pattern on the 4-hour chart. After breaking through the support zone, the price retraced and tested the level again.

As expected, GBPAUD reacted at this zone, increasing the likelihood of a valid bearish setup.

However, market uncertainty remains due to a lack of clear direction following recent comments from Trump.

As a result, the price might continue to fluctuate within this range before a strong bearish wave resumes.

Key support zones to watch: 2.0630 and 2.0360.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/NZD Short, GBP/USD Long, AUD/USD Short and GBP/AUD ShortEUR/NZD Short

Minimum entry requirements:

• Corrective tap into area of value.

• 4H risk entry or 1H risk entry after 2 x 1H rejection candles.

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

• If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

• If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

GBP/USD Long

Minimum entry requirements:

• Corrective tap into area of value.

• 4H risk entry or 1H risk entry after 2 x 1H rejection candles.

Minimum entry requirements:

• Tap into area of value.

• 1H impulse up above area of value.

• If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

• If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

• If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

AUD/USD Short

Minimum entry requirements:

• Break above area of value.

• 1H impulse down below area of interest.

• If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

• If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

• If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

GBP/AUD Short

Minimum entry requirements:

• Corrective tap into area of value.

• 4H risk entry or 1H risk entry after 2 x 1H rejection candles.

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

• If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

• If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

GBPAUD sellThere are a lot of sell confluences for this pair in all timeframes.

Here are the reasons for my bias:

- First of all, there was a very strong 3 month target that was hit at 2.1050 on 4th April

- Price hit a major monthly and 3M level at 2.1500 and we saw sharp rejections of that rejection.

- The monthly candlestick is looking to close very bearish since there is a long wick that has rejected the 2.1500 region

- 2.03 is a major monthly level that was broken but was never retested. I believe that price is due for a retest now.

- On the weekly timeframe, there is a bearish candlestick formation which is followed by last week's small indecision candlestick.

-Whenever we see an indecision candlestick, it usually means that price is collecting orders before we see a major move to either direction.

- I believe that the indecision candlestick is meant to indicate that price is headed lower.

- On the daily timeframe, Friday (11th April) candlestick is clearly bearish indicating that price is headed lower.

- Price has been consolidating for quite sometime indicating that orders are being collected.

- The next notable region on the daily timeframe is at 2.0600, which I believe we will see this week.

- I am currently in a sell setup since the 4h and 1h timeframe have confirmed my bias

- Price on the 4 hour has hit a major liquidity region at 2.09 where we have seen bearish rejections in previous price action

- Price has formed an entry on the 1 hour timeframe by forming a double top with a huge bearish rejection

- My take profit is at 2.0640, as this is the next major liquidity region.

GBPAUD NULLISH OR BEARISH DETAILED ANALYSIS GBPAUD is currently trading around the 2.0850 level, hovering just above a strong confluence support zone as seen on the 12H chart. Price action has formed a bullish symmetrical triangle pattern following a strong impulsive rally earlier this month. This compression near a major demand zone signals a potential bullish breakout as price builds pressure right above the support base. The 2.0700–2.0600 region has historically acted as a key level, now reinforcing itself as solid structure support.

Technically, this setup is clean and aligned with classic continuation pattern behavior. We had a strong rally leading into the triangle, and the market has been respecting both the lower support boundary and declining resistance trendline. The recent candles show signs of rejection from the lower bounds of the wedge, adding to the bullish sentiment. A confirmed breakout above 2.0900 could trigger a fresh wave of upside momentum targeting the 2.1300–2.1600 zone in the coming sessions.

Fundamentally, GBP remains supported by stronger-than-expected inflation data and ongoing hawkish tones from the Bank of England. Markets are dialing back expectations of near-term rate cuts, giving the pound further upside traction. Meanwhile, AUD is weakening amid soft Chinese economic data, increasing risk aversion, and fading demand for commodities. Australia’s labor market also showed signs of cooling, reducing the RBA’s tightening pressure and putting the Aussie on the back foot.

This is a high-probability swing setup gaining traction on TradingView due to the combination of strong technical formation and macro divergence. With the pattern maturing above support and a clear bullish structure, GBPAUD is offering an attractive risk-to-reward scenario for bulls eyeing continuation into Q2. Patience on the breakout confirmation will be key, but the bias remains clearly bullish from both a chart and economic perspective.

Is GBPAUD Finally Ready to Drop?Price is currently struggling to break through a key resistance area. That’s not a problem – I’m not looking to catch the entire move, I only need a clean 1:3 RR and potentially the completion of the Asia range.

🔻 Bias: Bearish

On the 4H chart, I’ve identified the 50 EMA as a possible point of rejection, and it lines up perfectly with a 15m POI (Orderblock).

Since the Asia session opened higher, this creates a solid intraday short opportunity targeting the unfilled Asian range.

✅ I’ve marked two potential zones where price could react. If I get clean bearish price action in either zone – such as a BOS on the 1m or strong rejection patterns – I’ll look to execute the short.

Patience until the setup aligns. Let's see how it plays out. 🔍💯

Bullish bounce?GBP/AUD is falling towards the pivot which acts as an overlap support and could bounce to the 1st resistance which is an overlap resistance.

Pivot: 2.0624

1st Support: 2.0413

1st Resistance: 2.1029

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GBPAUD I Your Next Long Opportunity in the UptrendWelcome back! Let me know your thoughts in the comments!

** GBPAUD Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

GBPAUD - BullishGBPAUD – Bullish Divergence Formed, Watching Key Resistance

🕐 Timeframe: 1H

📉 Signal: Bullish Divergence (Price forming LL, RSI forming HL)

📍 Status: Reversal setup forming, but strong resistance ahead

🧠 Trade Idea (Plan the Trade):

✅ Entry: Wait for confirmation candle or break and retest above resistance zone

🔁 Divergence Support: Momentum suggests buyer pressure building

📍 Key Zone to Watch:

Resistance at must break for sustained bullish move

If rejected again, wait for a higher low retest or bullish flag

📏 Trade Plan:

Buy Stop: Above resistance breakout (wait for 1H close above)

SL: Below the divergence low (tight structure)

TP1: Minor resistance zone (~1:1)

TP2: Major fib level or last swing high (~1:2)

🛑 Note:

Strong resistance = no rush. Let the price show strength.

If breakout is weak, stay flat and wait for better confirmation.

Consider combining with volume or trendline break for added conviction.

GBPAUD – 1H Bullish DivergenceGBPAUD – 1H Bullish Divergence Detected 🟢

✅ Setup Overview:

Pair: GBPAUD

Timeframe: 1 Hour

Signal: Bullish Divergence (Price making lower lows, but oscillator making higher lows – RSI/MACD)

Bias: Short-Term Long (Bullish Reversal Expected)

🔍 Technical Confluence:

Bullish Divergence visible on 1H

Support Zone holding structure

Potential double bottom/trendline support acting as a reversal catalyst

No major bearish momentum continuation — signs of exhaustion

📈 Trade Plan – Long Setup:

Entry:

On break of minor resistance or first bullish engulfing / Heikin Ashi green candle

Or upon RSI cross above 30–40 zone

Stop-Loss:

Below recent swing low or divergence base

~30–40 pips below entry (adjust per volatility)

Take-Profit Targets:

TP1: Previous resistance zone (~1:1 R:R)

TP2: Fib 0.618 retracement of last bearish leg (~1:2 R:R)

⚠️ Notes:

Ideal to combine with volume confirmation or trendline break

Watch out for AUD-related news or GBP volatility events

GBP/AUD Daily Timeframe (DTF) – Fundamental and Technical AnalysGBP/AUD Daily Timeframe (DTF) – Fundamental and Technical Analysis

Technical Outlook:

On the DTF, GBP/AUD has broken above the second major key support level at 2.0600, following a period of consolidation between 2.0300 and 2.0600. Price then approached 2.0950, a minor resistance level, where it attracted retail buy orders—creating a liquidity zone. Instead of a clean breakout, price action shows signs of a liquidity grab, triggering stop-losses from buyers.

Currently, the pair is in a liquidity zone. We're waiting for a clean breakout above 2.10450, which could confirm a bullish continuation.

However, we are not underestimating a potential downside move. If price breaks below the 1st major key support at 2.0300, it may signal a short-term bearish reversal—especially if AUD gains momentum from the weakening USD and global risk sentiment favors commodity currencies.

Trade Plan (Bullish Bias):

Entry (Buy Stop): 2.10450

Stop Loss: 2.06300 (below liquidity zone)

Take Profit: 2.20930 (next minor key resistance)

GBP/AUD Daily Timeframe (DTF) – Fundamental and Technical Analysis

Fundamental Outlook:

GBP/AUD continues to exhibit bullish momentum on the daily timeframe, driven by both technical and fundamental factors. Anticipation of a positive UK Claimant Count Change report (forecasted at 30.3K vs. the previous 44.2K) is strengthening the British pound, signaling potential improvements in the UK labor market.

In contrast, while the Australian dollar remains under pressure due to global trade war fears, which have pushed it to five-year lows, and traders are pricing in further rate cuts ahead of this week’s RBNZ meeting with a 22% probability of another 50-basis point cut, recent developments have provided temporary support, with the AUD appreciating by approximately 1% to US$0.6289 due to the weakening U.S. dollar and increased investor interest in alternative currencies amid market volatility from new U.S. tariff announcements.

📌 Disclaimer:

This analysis is for informational and educational purposes only and should not be considered financial advice. Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consult with a financial professional before making any investment decisions.

GBPAUD: Double Top Pattern - Bearish Momentum Is IncreasingGBPAUD Forms Double Top – Bearish Momentum Is Increasing

GBPAUD has confirmed a double top pattern on the 4-hour chart. After breaking through the support zone, the price retraced and tested the level again.

As expected, GBPAUD reacted at this zone, increasing the likelihood of a valid bearish setup.

However, market uncertainty remains due to a lack of clear direction following recent comments from Trump.

As a result, the price might continue to fluctuate within this range before a strong bearish wave resumes.

Key support zones to watch: 2.0630 and 2.0360.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPAUD Is Going Up! Long!

Here is our detailed technical review for GBPAUD.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 2.091.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 2.157 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBP/AUD "Pound vs Aussie" Forex Bank Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/AUD "Pound vs Aussie" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk ATR Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout then make your move at (2.07100) - Bearish profits await!"

however I advise to Place sell stop orders below the Breakout level (or) after the breakout of Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (2.10000) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 2.04700 (or) Escape Before the Target

💰💵💴💸GBP/AUD "Pound vs Aussie" Forex Bank Heist Plan (Day / Scalping Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness).., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets & Overall Score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

gbpaud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPAUD: Pullback From Support 🇬🇧🇦🇺

GBPAUD nicely reacted to the underlined intraday support.

The price formed a double bottom pattern on that

and violated its horizontal neckline.

With a high probability, the price will rise more

and reach 2.0907 resistance.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.