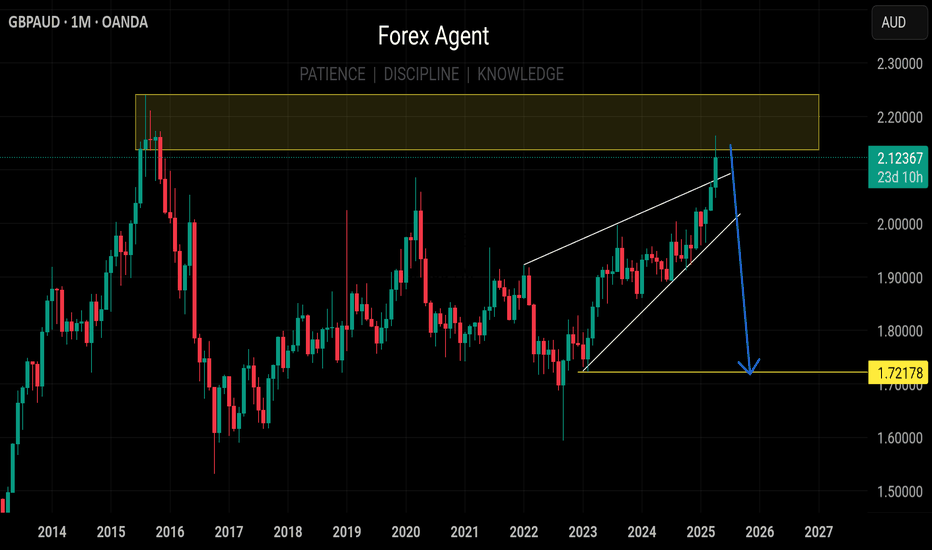

GBPAUD: Double Top Pattern - Bearish Momentum Is IncreasingGBPAUD Forms Double Top – Bearish Momentum Is Increasing

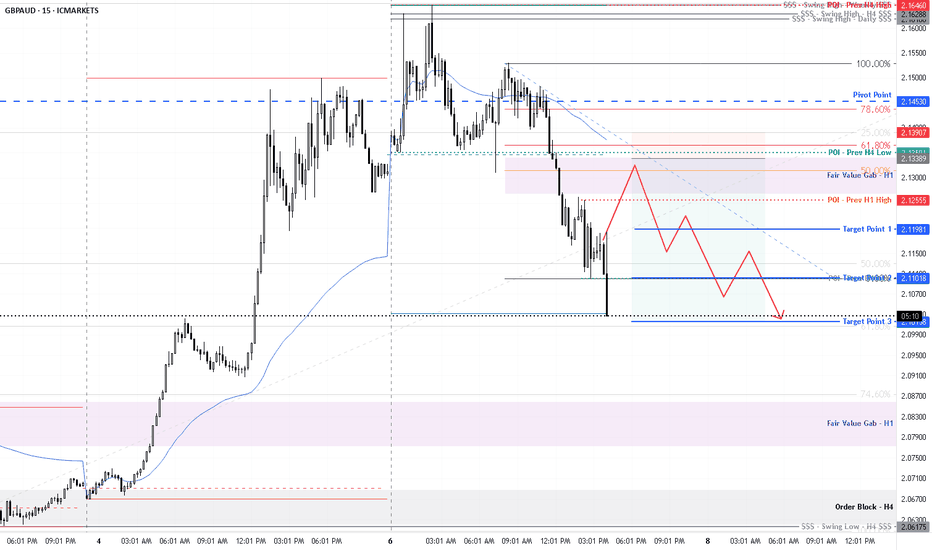

GBPAUD has confirmed a double top pattern on the 4-hour chart. After breaking through the support zone, the price retraced and tested the level again.

As expected, GBPAUD reacted at this zone, increasing the likelihood of a valid bearish setup.

However, market uncertainty remains due to a lack of clear direction following recent comments from Trump.

As a result, the price might continue to fluctuate within this range before a strong bearish wave resumes.

Key support zones to watch: 2.0630 and 2.0360.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPAUD trade ideas

GBPAUD market outlookFX:GBPAUD

Price has reached and reacted off significant level of resistance zone at 2.16400, which was last seen on the 2nd of November 2015. On Friday's NY open, price created a false bullish signal with a 190 pips pin bar candle on the H1 chart. Instead, price reacted off its recent swap zone and continued its downtrend. If it breaks below 2.07720, we can anticipate a short-term continuous downtrend to the daily demand range, which is about 200 to 300 pip movement.

On the fundamentals, the Aussie dollar has recently hit a 5 year low against the USD, trading at just 60.5 US cents as the two world's largest economies have been ramping up tariffs to as high as 125%. The AUD may be impacted due to China being Australia's biggest trading partner and the trade war is only increasing uncertainty risks. On the bright side, the ASX 200 surged by 4.5% on a single day as Trump announces tariff pause, which was the highest increase in value on a single day ever since the pandemic in 2020. Both the UK and Australia have been imposed the same reciprocal tariff rates of 10%, for now, I expect a short-term downtrend before its continuation upwards, but we'll see what the coming week brings to us.

GBP/AUD SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

The BB upper band is nearby so GBP-AUD is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 2.090.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPAUD Bullish Forecast: Precise Entry with EASY Trading AIAccording to the EASY Trading AI strategy, GBPAUD currently presents a bullish formation. My analysis identifies a favorable entry point at 2.14135, aiming for a projected profit target of 2.15917667, while managing trading risks with a strategic stop loss level set at 2.11198667. The bullish outlook is supported by recent momentum indicators suggesting buyers' strength at pivotal support zones. AI analysis confirms market volume and price action patterns that align this move toward higher resistance levels. Keep an eye on price consolidations around entry for confirmation.

gbpaud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPAUD Short Opportunity Spotted: Precise Entry Levels DefinedBased on the EASY Trading AI strategy, I've identified a clear selling opportunity on GBPAUD. Current analysis suggests bearish movement from the entry price at 2.12431, targeting a take profit at 2.09018, with a protective stop loss at 2.16143.The strategy signals weakening upside momentum, aligning technical factors for a probable downward correction. The clear break of key support at 2.12431 would confirm sellers' control, directing the pair towards our profit goal.Ensure disciplined risk management at specified stop loss levels. Keep an eye on upcoming market updates!

GBPAUD INTRADAY overbought consolidation supported at 2.1100GBPAUD retains a bullish outlook, driven by the prevailing uptrend. The latest price movement suggests a corrective pullback toward a previous consolidation zone, offering potential for trend continuation.

Key Support Level: 2.1100 – prior consolidation area and immediate decision point for bulls

Upside Targets:

2.1550 – initial resistance

2.1720 and 2.2000 – medium to longer-term bullish targets

A bullish bounce from 2.1100 would signal resumption of the upward trend, targeting the above resistance levels.

On the flip side, a confirmed break and daily close below 2.1100 would invalidate the bullish structure, setting up a deeper pullback toward 2.0860, with additional support at 2.0690 and 2.0580.

Conclusion

GBPAUD remains bullish above 2.1100. A bounce from this level favors upside continuation. A daily close below 2.1100 would shift momentum bearish, opening the path to deeper retracement targets.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

This 5 Step System Boosts The Rocket Booster StrategyThis 5 Step System Boosts The Rocket Booster Strategy

1. DAY- Strong Buy/Sell

2. 4 HOUR- Strong Buy/Sell

3. 2 HOUR- Strong Buy/Sell

4. 1 HOUR- Strong Buy/Sell

5. 30 MINUTES- Strong Buy/Sell

In this video we dive into the best way to trade forex

now even though it looks easy at a glance you need

to be careful.

Thats why i made this video for you

because i want to show you

how exactly the strategy works

Trust the process but always learn how to

verify this strategy using technical analysis

and thats the power of this video inside

it am showing you how to confirm the entry signal

using technical analysis

Watch this video to learn more.

Rocket boost this content to learn more

Disclaimer:Trading is risky please learn risk

management and profit taking strategies

and feel free to use a simulation trading account.