GBPAUD trade ideas

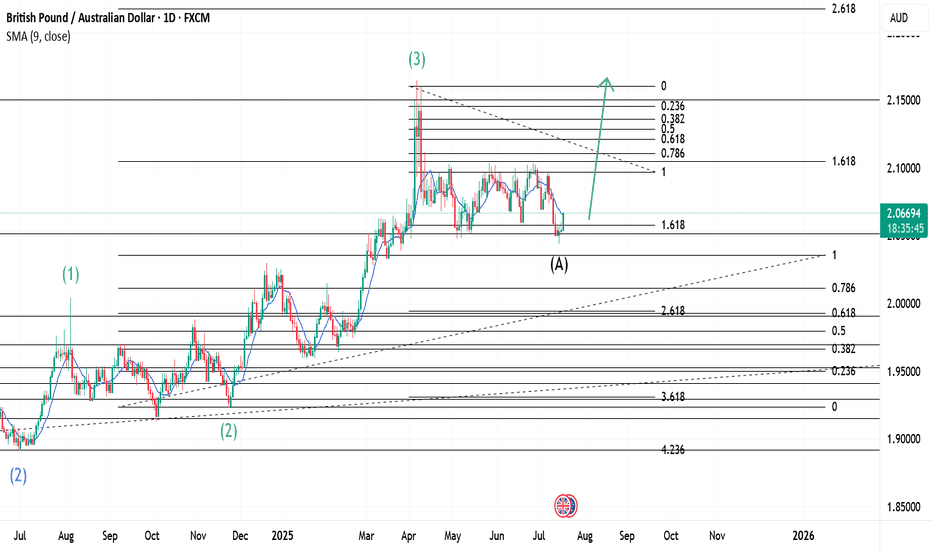

GBPAUD and the Elliott Wave TheoryFrom the bottom left of the chart, we see the price move upwards to form a Wave 1(Green) then a 2(Green). It is important to note that this Wave 2(Green) was a Zigzag correction. This means we should expect a Flat Correction for Wave 4(Green). Wave 3(Green) is long and goes beyond the 161.8% Fib. level, and this normal expressive behaviour for Waves. Our Wave 3(Green) retests on a W1 Chart Fib. level and then drops. This drop is our Wave A(Black). Wave A(Black) retests severally around the 161.8% Fib. level. We should expect a Flat correction as stated earlier, and this means Wave B should go beyond the ending of Wave 3(Green). A confirmation on the D1 Chart would trigger formation of Wave B(Black).

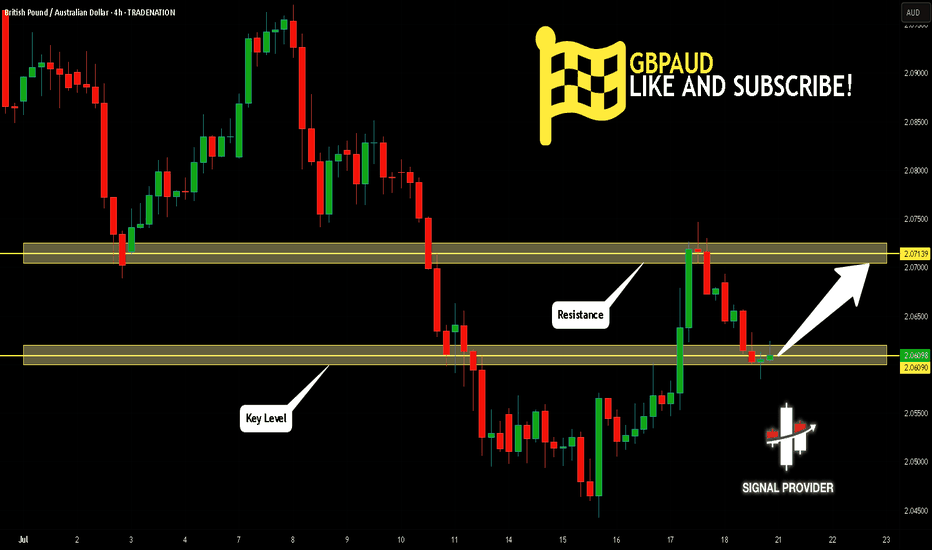

GBPAUD Will Go Up From Support! Long!

Here is our detailed technical review for GBPAUD.

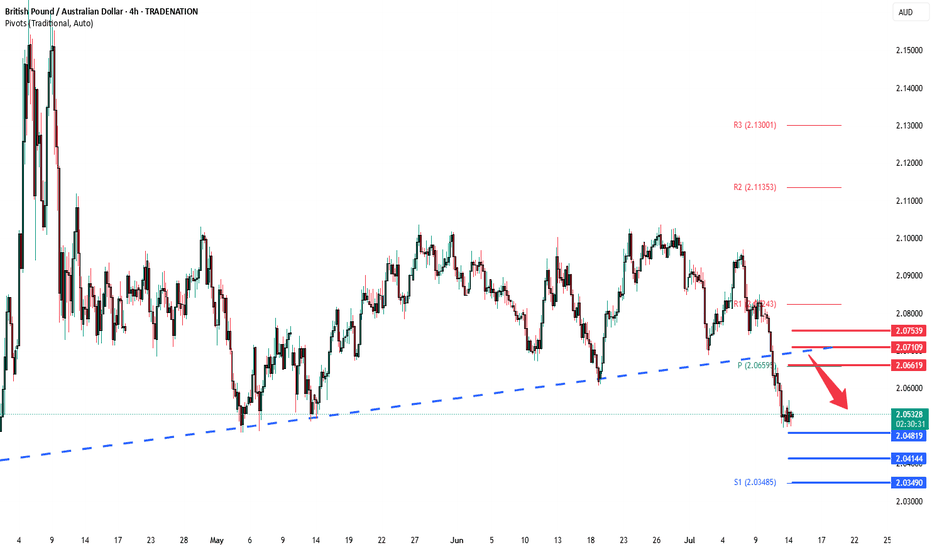

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 2.060.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 2.071 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

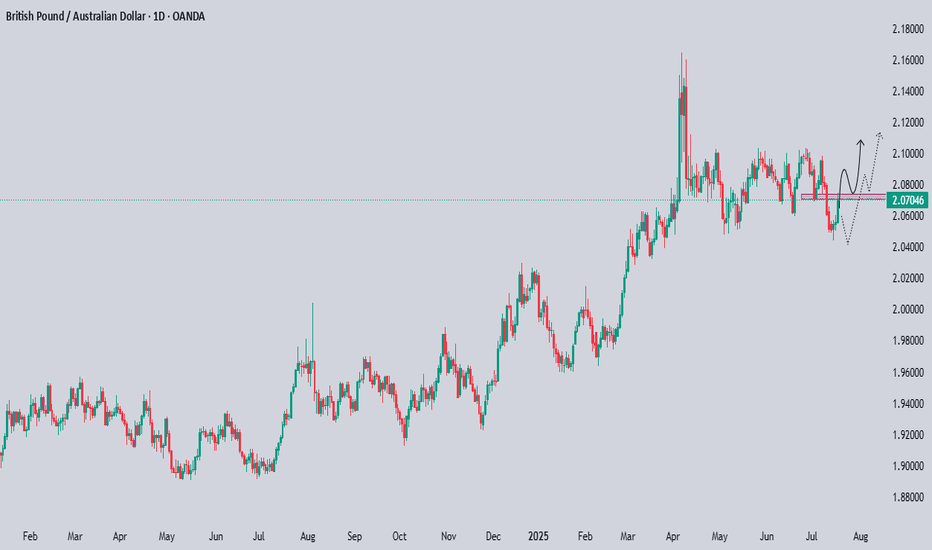

GBPAUD Technical & Order Flow AnalysisOur analysis is based on a multi-timeframe top-down approach and fundamental analysis.

Based on our assessment, the price is expected to return to the monthly level.

DISCLAIMER: This analysis may change at any time without notice and is solely intended to assist traders in making independent investment decisions. Please note that this is a prediction, and I have no obligation to act on it, nor should you.

Please support our analysis with a boost or comment!

GBPAUD Will Move Higher! Buy!

Please, check our technical outlook for GBPAUD.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 2.052.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 2.082 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

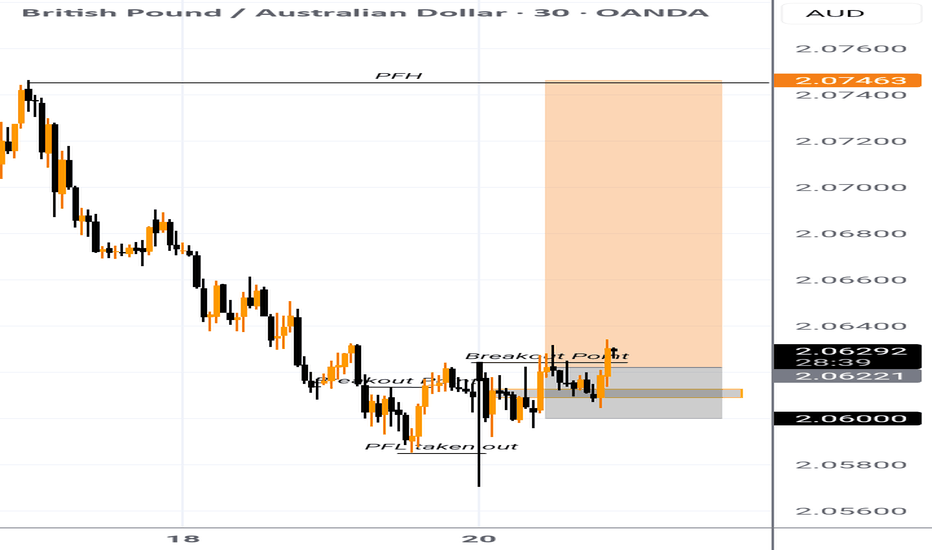

GBPAUD previous support now resistance at 2.0660The GBPAUD pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the previous support zone, suggesting a temporary relief rally within the downtrend.

Key resistance is located at 2.0660, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 2.0660 could confirm the resumption of the downtrend, targeting the next support levels at 2.0480, followed by 2.0410 and 2.0350 over a longer timeframe.

Conversely, a decisive breakout and daily close above 2.0660 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 2.0710, then 2.0750.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 2.0660. Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

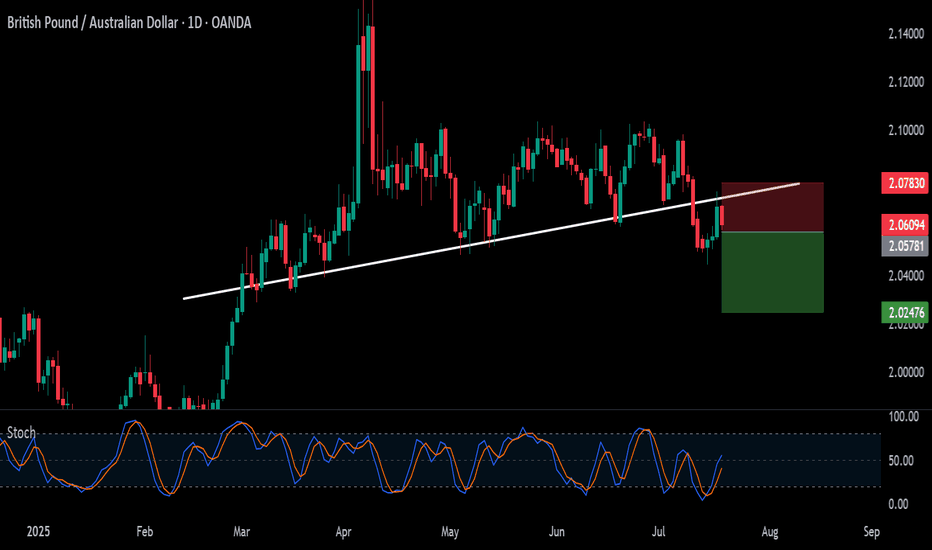

GBP/AUD SHORT FROM RESISTANCE

GBP/AUD SIGNAL

Trade Direction: short

Entry Level: 2.098

Target Level: 2.062

Stop Loss: 2.122

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/AUD: Familiar support holds as global growth fears biteThe bearish unwind in GBP/AUD stalled in familiar territory, bouncing from 2.0500 in Asian trade, continuing the pattern seen since April when Donald Trump first unveiled reciprocal tariff rates on U.S. trading partners. Now, like then, the bounce likely reflects concern about the outlook for the global economy following the unveiling of 30% tariff rates on E.U. imports entering the United States from August 1. The headline-driven nature of the move overrides the deeply bearish message coming from momentum indicators like RSI (14) and MACD.

If the pair were to move towards 2.0500 again, it would create a decent long setup where positions could be established above the level with a stop beneath for protection. 2.0600 and 2.0700 screen as possible targets, although the most appealing target would be 2.0800 from a risk-reward perspective—that level has seen plenty of work either side of it over recent months and has the 50-day moving average located just above.

If the pair were to reverse back through 2.0500 and close there, the bullish setup would be invalidated, opening the door for bearish trades to be set targeting support at 2.0300.

Good luck!

DS

GBP-AUD Risky Long! Buy!

Hello,Traders!

GBP-AUD keeps falling and

The pair is locally oversold

So as the pair is retesting

The horizontal support

Of 2.0480 we will be expecting

A local bullish correction

On Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP/AUD BEARS ARE STRONG HERE|SHORT

GBP/AUD SIGNAL

Trade Direction: short

Entry Level: 2.092

Target Level: 2.060

Stop Loss: 2.114

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPAUD SHORTMarket structure bearish on HTFs DH

Entry at both Daily and Weekly Rejection

Weekly Rejection at AOi

Daily Rejection At AOi

Previous Structure point Daily

Around Psychological Level 2.09000

H4 Candlestick rejection

Rejection from Previous structure

Levels 4.22

Entry 95%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

GBP_AUD LONG FROM SUPPORT|

✅GBP_AUD fell down sharply

But a strong support level was hit at 2.0500

Thus I am expecting a rebound

And a move up towards the target of 2.0580

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPAUD Pre-Market Analysis📉 GBPAUD Pre-Market Analysis – Weekly Outlook

Date: July 13, 2025

Session: Pre-London Open

Analyst: Papalui | Sub Saharan Technicals

🕵️♂️ Macro Outlook

The British Pound / Australian Dollar (GBPAUD) is currently showing signs of trend exhaustion after reaching major highs around the 2.14932 zone (Marked MHH – Most Recent Higher High). A strong bearish reaction is emerging from this area, suggesting potential for long-term downside retracement or even a reversal.

🔍 Technical Structure Breakdown (1W)

MHH (Major Higher High): 2.14932

WHH (Weekly Higher High): 2.06088

Current Price: 2.05049

Fib 50% Level: Aligned around recent resistance and acting as a pivot zone.

BOS (Break of Structure): Occurred in early 2022, later invalidated by strong bullish rally.

MLL (Major Lower Low Target Zone): Projected zone around 1.59109 - 1.57752

📉 Bearish Scenario: Reversal Play

🔽 Bias: Bearish Reversal

Context: Price has formed a new high but is rejecting near the 50% Fibonacci retracement and supply zone.

Plan: Watch for lower timeframe confirmations (e.g., D1 or H4 structure breaks) below 2.04859 to initiate short positions.

Target Zones:

TP1: 1.86584

TP2: 1.81327

TP3: 1.59109 – aligning with weekly demand and structural lows

🔧 Invalidation: A sustained weekly close above 2.14932 would invalidate this bearish scenario and signal bullish continuation.

🔁 Trade Management Zones

Zone Type Action

2.06088 - 2.14932 Supply/Resistance Monitor for rejections or confirmations of reversal

1.86584 - 1.81327 Intermediate Support Partial TP or structure reassessment

1.59109 Major Demand Full TP / Trend reversal opportunity

🧠 Sentiment & Strategy

This pair has rallied over the past year, but the bearish impulse from the recent high suggests large players may be unloading positions. With key Fibonacci confluence and price action showing weakness, the current zone is a strong sell interest region. Traders should:

Stay alert for weekly or daily lower lows

Use smaller timeframes to refine entries

Avoid premature entries before price confirms lower timeframe structure breaks

📌 Summary

Bias Key Resistance POI Bearish Target

Bearish 2.14932 2.04859 1.59109

Risk Disclosure:

All trading involves risk. This analysis is for educational purposes only and should not be taken as financial advice. Always manage risk appropriately.

GBPAUD: Long Trade Explained

GBPAUD

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy GBPAUD

Entry Level - 2.0672

Sl - 2.0608

Tp - 2.0802

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

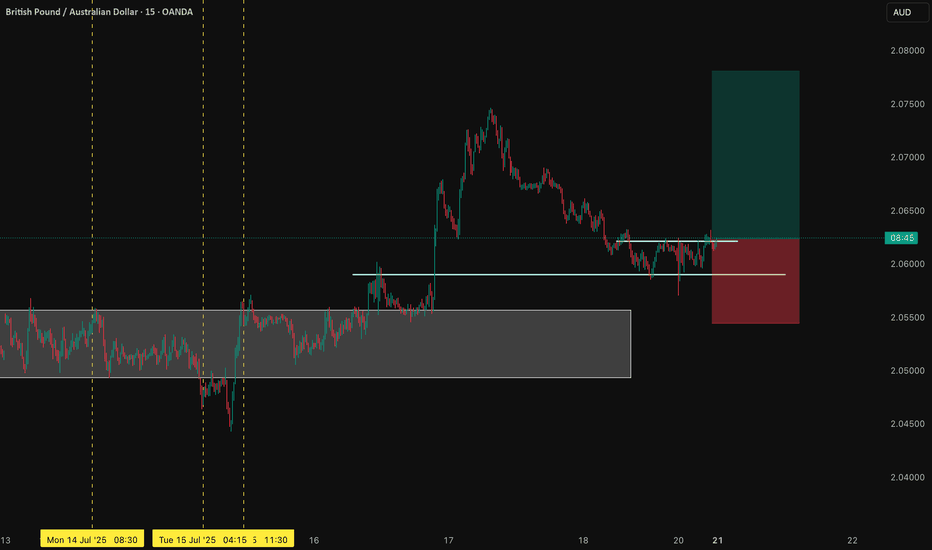

$GA (GBPAUD) 1HIf price holds and reacts from the OB, expect a short-term bullish leg toward:

Internal liquidity first (2.07400), Then external buy-side liquidity above 2.08000.

Price has been in a clear bearish structure, printing lower highs and lower lows.

Recently, price swept multiple layers of internal liquidity (marked as $$$) before tapping into a key Order Block (OB) just above the 2.06500 zone.

The OB zone aligns with a higher timeframe demand area, suggesting this could be a reaccumulation phase.

The OB zone has previously led to strong expansions, making it a valid area for institutional re-entry.

The current liquidity grab beneath the previous lows appears intentional — a trap for breakout sellers.

Smart money often waits for such sweeps to absorb sell-side liquidity before shifting the structure.