GBPAUD analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPAUD trade ideas

GBPAUD BUY TRADE PLAN🔥 GBP/AUD TRADE PLAN

📅 Date: April 2, 2025

🔖 Plan Type

Main Swing Plan

📈 Bias & Trade Type

Bullish Reversal Setup – Long-term trend continuation after pullback

🔰 Confidence

⭐⭐⭐⭐ (80%)

Reasons:

– D1 bullish BOS structure

– H4 OB + Liquidity sweep alignment

– Rejection wicks and EMA defense

– AUD weakness and GBP relative strength

– Macro sentiment moderately Risk-On

📌 Status

✅ Waiting for first tap into zone

(Zone not touched – fresh institutional entry opportunity)

📍 Entry Zones

Primary Buy Zone: 2.0490 – 2.0515

(H4 OB + FVG + EQ lows liquidity sweep)

Secondary Buy Zone: 2.0445 – 2.0465

(Deeper liquidity + refined OB with inducement)

❗ Stop Loss

SL: 2.0390

(Under all key structural lows and invalidation wick)

🎯 Take Profits

🥉 TP1: 2.0625 – Partials & SL to BE

🥈 TP2: 2.0700 – Swing liquidity pocket

🏆 TP3: 2.0785 – D1 premium zone target

📏 Risk:Reward

Minimum R:R = 1:3.4

Optimized for swing precision setups

🧠 MANAGEMENT STRATEGY

– Enter only after confirmation in zone

– Move SL to BE after TP1

– Scale partials at TP2

– Let final position run with trailing SL toward TP3

– If missed: wait for rejection candle + consider refined re-entry

⚠️ Confirmation Criteria

– H1 bullish engulfing or pin bar in zone

– MACD or RSI momentum shift on M30+

– Volume spike near OB or FVG

– Rejection during London or NY open for best fill

⏳ Trade Validity

Valid for 1–3 days (H4 swing bias)

❌ Invalidation if H4 closes below 2.0390

🌐 Fundamental Alignment

✅ GBP remains resilient on wage/inflation expectations

✅ AUD pressured by weak commodities + dovish RBA

✅ Risk-On tilt mildly favors GBP flows

📋 Final Summary

We are looking to buy GBP/AUD from 2.0490–2.0515 zone, with deeper buffer at 2.0445–2.0465. Structure, liquidity, OB + momentum all align for a clean bullish swing continuation. Only execute after proper zone confirmation. Smart Money model fully supports this setup.

OPPORTUNITY FOR SELL GBPAUDEven though this pair is above all major levels and probably will continue higher, now should be a good time to sell.

We have these indicators for SELL opportunity:

- Reflection from the top of the parallel channel

- Resistance from previous peak (2020)

- Low volume to continue the current direction

- Potential for retest: Year high + 6M high + 3M high + 1M high

We define 3 goals:

TP 1 = 80 pips

TP 2 = 200 pips

TP 3 = 400 pips

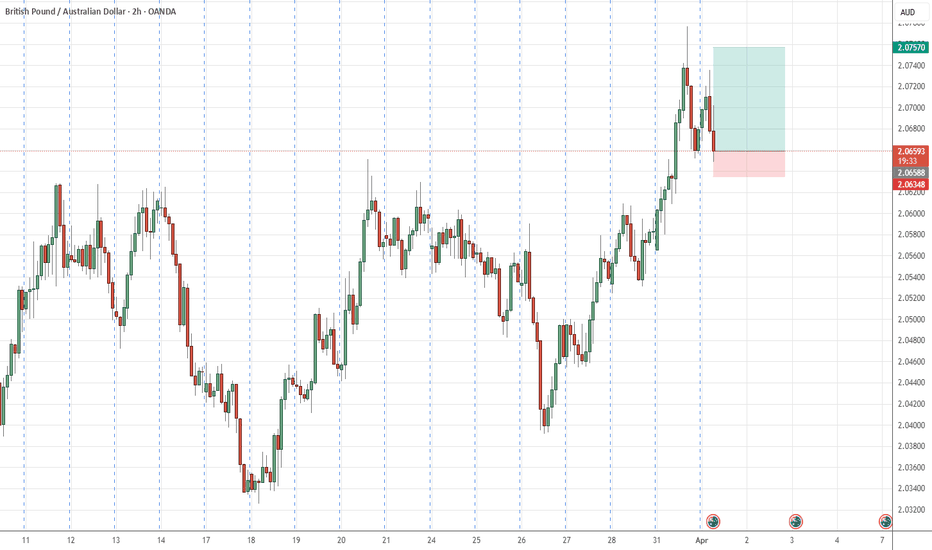

GBPAUD Wave Analysis – 1 April 2025

- GBPAUD reversed from long-term resistance level 2.0820

- Likely to fall to support level 2.030

GBPAUD currency pair recently reversed from the resistance area located between the long-term resistance level 2.0820 (former multiyear high from 2020), resistance trendline of the weekly up channel from 2024 and the upper weekly Bollinger Band.

The downward reversal from this resistance area stopped the earlier short-term impulse wave 3 of the weekly upward impulse sequence (3) from the start of 2024.

Given the strength of the resistance level 2.0820 and the overbought weekly Stochastic, GBPAUD currency pair can be expected to fall to the next support level 2.030.

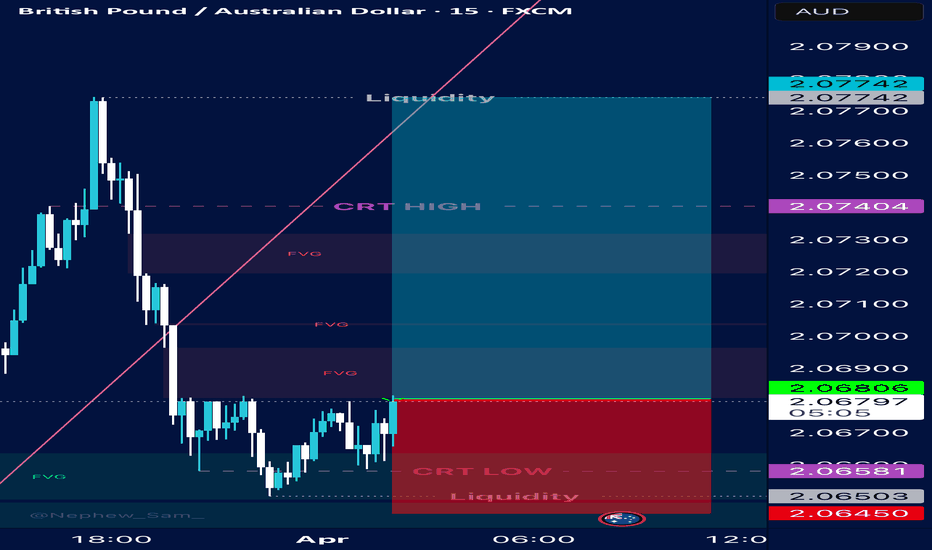

GBP-AUD Free Signal! Buy!

Hello,Traders!

GBP-AUD is trading in a

Local uptrend and the pair

Made a local correction

Of the horizontal support

Level of 2.0634 so we can

Enter a long trade with the

Take Profit of 2.0724 and

The Stop Loss of 2.0582

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPAUD-LONGCash rates came out at 4.10% as expected, causing a small retracement on GA. Im still bullish on GA. Its been consolidating in this zone for a couple of days now and to see price break above confirms bullish momentum and a possible push to our next key level. We will wait for price to reject previous resistance level from our consolidation, and for news that align with our bias before entering buys.

GBPAUD: Important BreakoutThe GBPAUD is currently in a strong bullish trend on a daily basis. Over the past three weeks, the pair has been trading within a horizontal range.

As the market opens after the weekend, the pair is showing strong bullish momentum. Breaking above the resistance line of the range suggests that a bullish accumulation has been completed.

This breach of resistance confirms the strength of buyers and suggests a likely continuation of the bullish trend.

The next resistance level to watch for is at 2.0800.

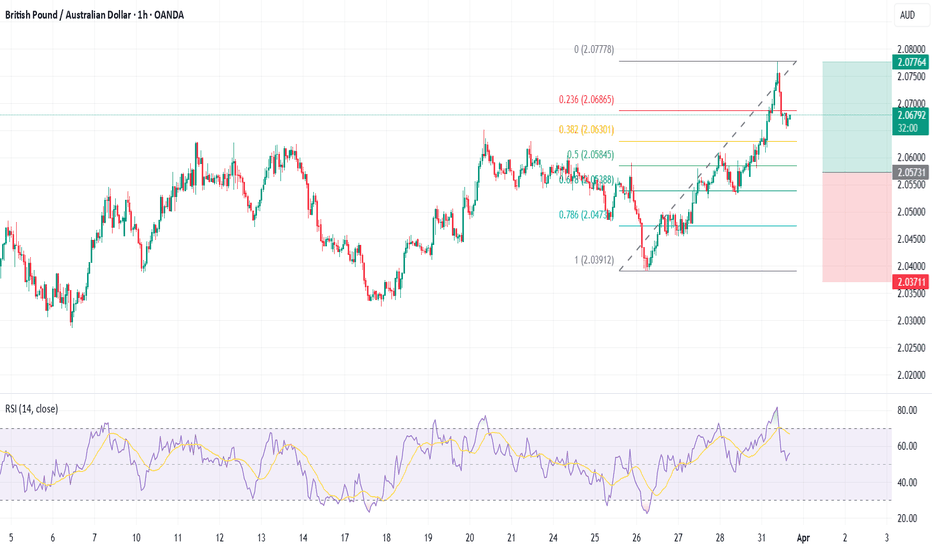

GBPAUD Bullish breakout supported at 2.0596Trend Overview:

The GBPAUD pair remains in a strong uptrend, with recent price action confirming a breakout above a previous consolidation zone, now acting as a key support level at 2.0596.

Key Levels:

Support: 2.0596 (key level), 2.0530, 2.0440

Resistance: 2.0755, 2.0840, 2.0895

Bullish Scenario:

A pullback to 2.0596, followed by a bullish bounce, would reinforce the support level and signal further upside momentum. A breakout above 2.0755 may extend gains towards 2.0840 and 2.0895 in the longer term.

Bearish Scenario:

A daily close below 2.0596 would weaken the bullish outlook, increasing the likelihood of a retracement towards 2.0530, with 2.0440 as the next downside target.

Conclusion:

GBPAUD remains bullish above 2.0596, with potential upside targets at 2.0755, 2.0840, and 2.0895. However, a break below 2.0596 could shift momentum to the downside, targeting 2.0530 and 2.0440. Traders should monitor price action at 2.0596 for confirmation of the next directional move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

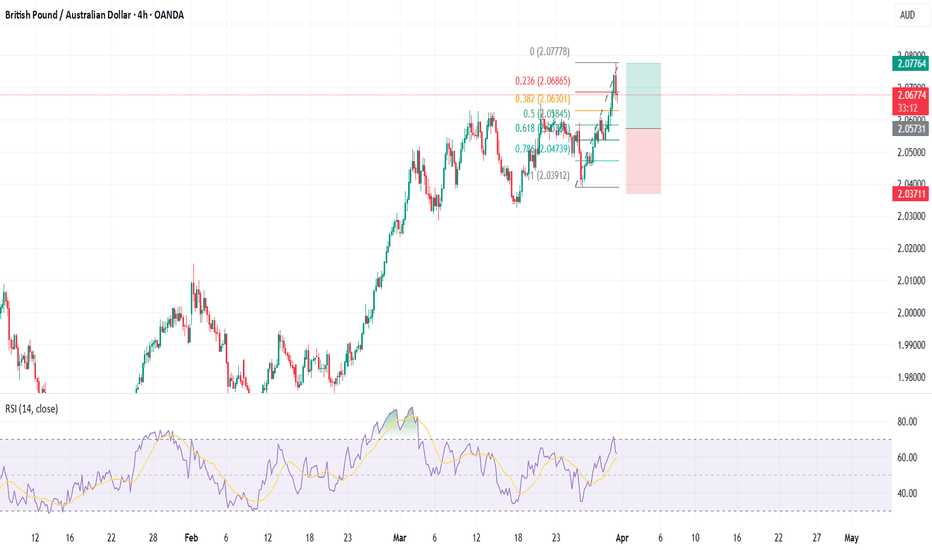

#GBPAUD WAITING FOR CONFIRMATION TO GO SHORT#GBPAUD created a CHOCH move on the 4h chart after bouncing off the weekly resistance zone.

Once GBPAUD enters the pullback area and confirms it's continuation to the downside, I will be looking to enter a short position there with a potential target being the long-term upward trendline.

GBP/AUD: Bulls Eye Breakout, But Momentum Signals CautionThursday’s bullish engulfing candle and rising risk aversion have GBP/AUD knocking on the door of a bullish breakout, with the pair testing resistance at 2.0627 in early Asian trade on Monday.

Stepping back, GBP/AUD remains within an ascending triangle pattern, bouncing off uptrend support on four separate occasions this month. While convention suggests traders should watch for a topside break, momentum indicators are less convincing—RSI (14) has been diverging from price in recent weeks, while MACD is easing lower despite staying in positive territory.

The conflicting price and momentum signals reinforce the need for a decisive break above 2.0627 before considering bullish setups. A confirmed break and close above the level could open the door for longs targeting 2.0859, the swing high from March 2020, with a stop beneath to protect against reversal.

A failure at 2.0627 could see the setup flipped, with shorts established beneath the level and a stop above for protection. The initial downside target would be uptrend support, currently around 2.0425.

Good luck!

DS

GBPAUD expecting GBP to start weakening

OANDA:GBPAUD price in channel, its make bullish push in last periods, in week before we are have BOE and some events in last day two like GBP CPI, from events looks like GBP is gather bearish power and technicals on lower TFs are strong bearish.

We are have and TRIPLE TOP apttern, on top of channel.

Here for next periods expecting bearish changes.

SUP zone: 2.06200

RES zone: 2.01500, 2.00600