GBPCAD trade ideas

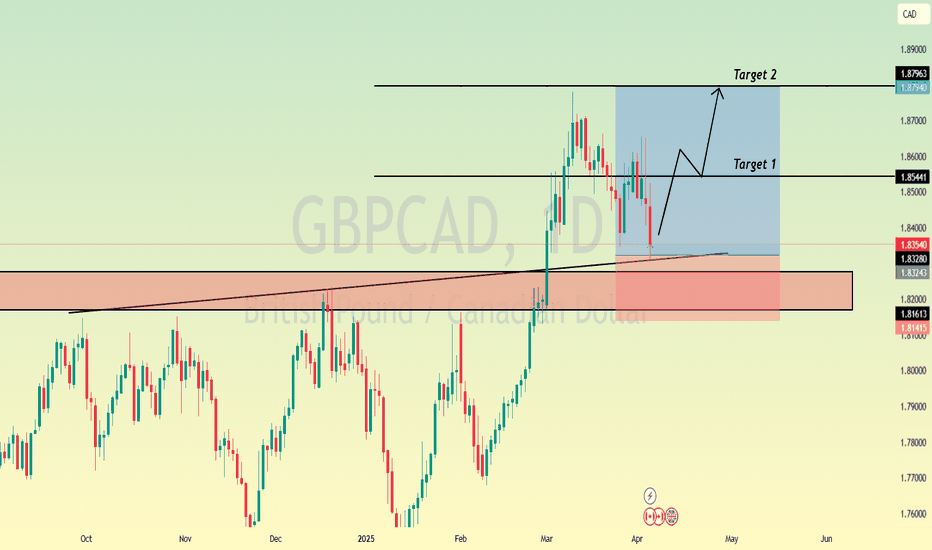

GBPCAD Its been a month since price broke out of the weekly resistance and now we are retesting. Got an H4 support that has been broken, if price goes back above the zone giving a retest we could see movement to the next week resistance zone of 1.90000. Also price action is similar to what happened on 5th Jan 2023.( Daily TF)

GBPCAD will Fly , All Confirmations are in the Bullish SideHello Traders

In This Chart GBPCAD HOURLY Forex Forecast By FOREX PLANET

today GBPCAD analysis 👆

🟢This Chart includes_ (GBPCAD market update)

🟢What is The Next Opportunity on GBPCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

GBPCAD Set To Grow! BUY!

My dear friends,

Please, find my technical outlook for GBPCAD below:

The instrument tests an important psychological level 1.8357

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.8460

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBP/CAD SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

We are targeting the 1.851 level area with our short trade on GBP/CAD which is based on the fact that the pair is overbought on the BB band scale and is also approaching a resistance line above thus going us a good entry option.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPCAD: Will Start Growing! Here is Why:

The recent price action on the GBPCAD pair was keeping me on the fence, however, my bias is slowly but surely changing into the bullish one and I think we will see the price go up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPCAD - Is Bullish Breakout Ahead?TF: 4h

GBPCAD is initiating along opportunity by completing 4th intermediate wave at 1.83464 . We can expect a retracement then reversal with near the lower trendline of the parallel channel.

Once price comes down, we will have the opportunity to go long with minimum stop level at low of the wave 4 at 1.83640 . The bullish scenario is capable GBPCAD to provide 1.8654 - 1.8748 targets to the buyers.

If the breakdown occurs, wave (4) will go deep. We update this chart time to time. Traders should only buy after a clear reversal.

Gbpcad SellPrice has been making LL pointing to strength in downtrend and now price closed below the oh so very important 1.85172. the stop i wouldve like to put it above the last high but its ok im still is comfortable with it due to the volume nice scalp based on how fast the trade should hit tp or sl.

GBPCAD My Opinion! BUY!

My dear friends,

Please, find my technical outlook for GBPCAD below:

The price is coiling around a solid key level - 1.8475

Bias - Bullish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 1.8526

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPCAD INTRADAY Breakout retest The GBP/CAD currency pair maintains a bullish sentiment, supported by the prevailing uptrend. Recent intraday price action shows a corrective pullback toward the previous consolidation zone and the support trendline area.

Bullish Scenario:

The key trading level to monitor is 1.8400, which represents the previous consolidation range. A successful bullish bounce from this level could trigger an upside move toward the 1.8640 resistance. Sustained bullish momentum could then target the next resistance levels at 1.8730 and 1.8800 over the longer timeframe.

Bearish Scenario:

Conversely, a decisive break below 1.8400, with a daily close below this level, would invalidate the bullish outlook. This could open the way for a deeper retracement toward 1.8310, with further downside potential targeting 1.8200.

Conclusion:

The overall sentiment remains bullish as long as 1.8400 holds as support. Traders should look for bullish confirmation at this level to sustain upward momentum. A break below 1.8400 would indicate a potential trend reversal, signaling further downside risk.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPCAD SHORTMarket structure bearish on HTFs DH

Entry at Daily AOi

Weekly Rejection at AOi

Daily Rejection at AOi

Previous Structure point Daily

Around Psychological Level 1.85500

H4 EMA retest

H4 Candlestick rejection

Rejection from Previous structure

Levels 5.03

Entry 90%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

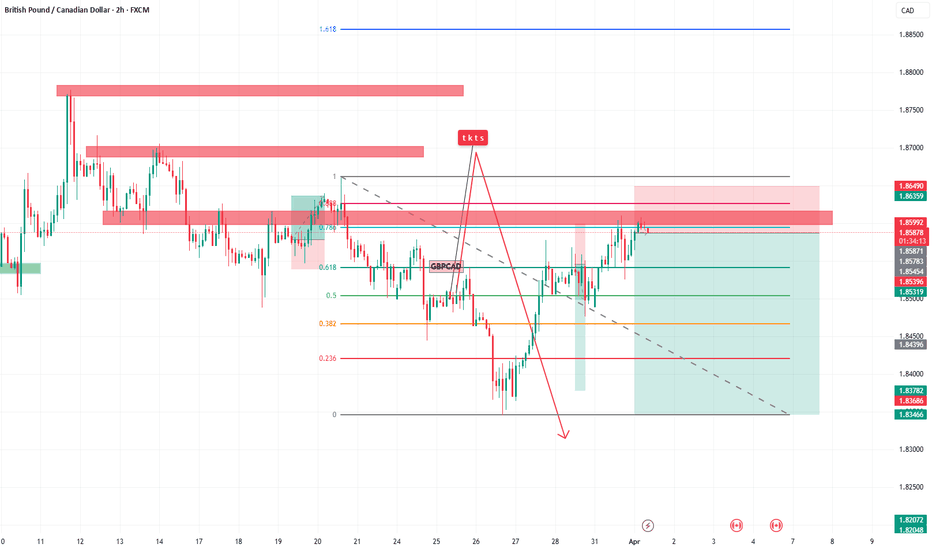

GBP/CAD 4H ANALYSIS – BULLISH BREAKOUT OR REVERSAL ?📉 Descending Channel

🔴 The price was moving inside a downward trend (channel) 📉, but it broke out ✅, signaling a potential bullish move 📈.

📍 Demand Zone (Support) at 1.85000 - 1.84201

🟦 Buyers stepped in here, pushing the price up 🚀.

🛑 Stop Loss: 1.84201 🔻 (If price falls below this, the bullish setup may fail ❌).

📍 Resistance Area Around 1.86000 - 1.86500

🔵 Key level to watch! If the price breaks above this zone, expect more upside 📈.

🎯 Target Point: 1.87727

🎯 If buyers remain strong, price could hit this level next! 🎯🚀

📊 Indicator Check:

📍 9-period DEMA (1.85000) 🟡 – Price is above this moving average, favoring a bullish bias ✅.

🔥 Possible Trade Setup:

✅ Buy Entry near 1.85000 - 1.85500

🎯 Target: 1.87727 📈

🛑 Stop Loss: 1.84201 🚨

If price breaks below 1.85000, be cautious ⚠️! A reversal to the downside could happen.

🚀 Overall Bias: Bullish (📈) above 1.85000, Bearish (📉) below **1

GBPCAD Set To Fall! SELL!

My dear subscribers,

My technical analysis for GBPCAD is below:

The price is coiling around a solid key level - 1.8578

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 1.8493

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

simple and suitableHow are you with the recent analyses guys?.It's incredibly simple and profitable.Don't look for people's abstruse analyses.Those are not suitable as much as those are hard.The market is the same.Today I'm going to say about GBPCAD pair.I see a range zone and a support level.Simply stand alert if the support level has been broken down get sell guard!

Subtilize the ascendant of the arrow is not target just position