GBPCHF.P trade ideas

POTENTIAL SHORT TRADE SET UP FOR GBPCHFAnalysis: Utilizing chart patterns, highs & lows, and impulses & corrections, the focus is on identifying a continuation corrective structure following a breakout.

Entry: The price approached the previous swing high zone with an ascending structure on the higher time frame (HTF), then plummeted from the swing high area signaling a bearish shift, and formed another bearish continuation-like pattern on the LTF. We shall be looking for an entry with a small bearish continuation structure here targeting the base of the bigger structure

Expectation: A downward move is anticipated.

⚠️ Reminder: Conduct your own analysis and implement proper risk management, as forex trading carries no guarantees. This is a high-risk endeavor, and past performance does not predict future outcomes. Trade responsibly!

GBPCHF might bounce from this level.As seen in the chart GBPCHF has respected this level throughout the history. As we reach this level and seems like a reversal confirmation, I believe overreaction to the tariffs soon will be correct itself. My first take profit level is around 1.13, looking further to 1.14 levels.

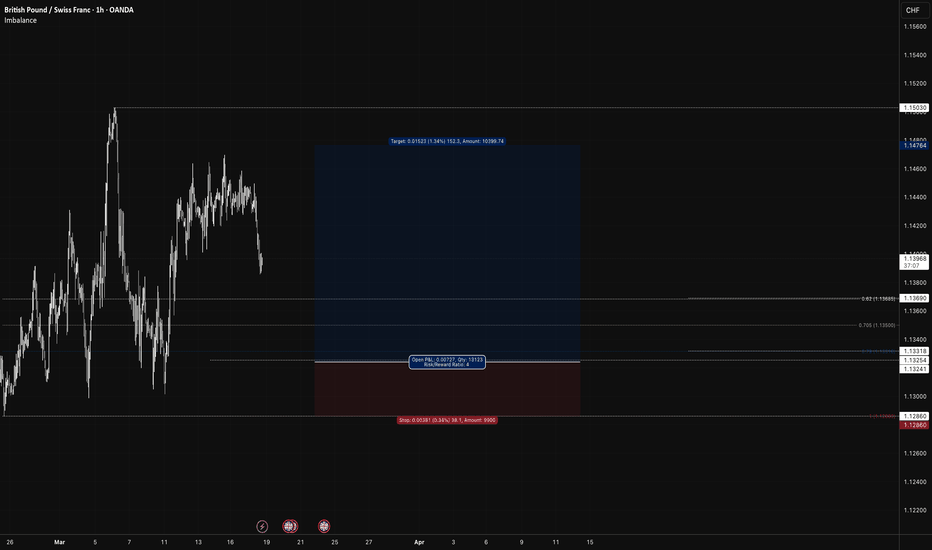

USD/CHF (Long)USD/CHF

Daily:

Price > 200EMA

Swing Period 10

Swing Low: 1.10884

Swing Low: 1.15030

Volume Imbalance: 3 Candles

Daily Order Block: 1.12253 / 1.11294

H4:

Price > 200EMA

Swing Period: 7

Swing High: 1.15030

Swing Low: 1.12860

Volume Imbalance: 2 Candles

H4 Order Block: 1.13452 / 1.13089

H1:

Swing Period: 5

Swing High: 1.15030

Swing Low: 1.12860

Volume Imbalance: 25 Candles

H1 Order Block: 1.13452 / 1.13089

Model 1:

Entry Price: 1.13241

Stop Loss: 1.12860

TP1: 1.14003 @ 1:2 / 50%

TP2: 1.14383 @ 1:3 / 25%

SL: Breakeven

TP3: 1.14764 @ 1:4 / 25%

Model 2:

Entry Price: 1.13690 - 1.13318

Entry Trigger: 9EMA X 21EMA

SL: Above recent swing low

TP1: 1:2

SL: Trailing 9EMA

GBP/CHF - Long Analysis (multiple entry models)Summary of my analysis o GBP/CHF - I trust you will provide me with some feedback this will encourage me to share my thought process to the wider community. I am not a signal provider just sharing knowledge and ideas using theories I have learnt over the years.

Daily: Bullish

Daily

Price above 200EMA and 50EMA > Bullish Bias

The last valid swing low was 1.12860, and the last valid swing high was 1.15030.

The last bullish breakout occurred on March 3, 2025, confirming the trend.

Confirmed liquidity sweeps were executed at key levels.

An anchored VWAP was set to the last swing low that triggered a breakout price above the bullish bias threshold.

Daily OB High: 1.13977

Daily OB Low: 1.13977

A high volume node is located within the daily OB range at 1.13721.

H4

Utilised Fibonacci Retracement to Identify the Optimal Trading Entry Zone

Draw Fibonacci retracement lines from the most recent swing high or low to a recent structural break. Marked the identified Optimal Trading Entry Zone (OTE) as a potential entry point.

High of the Trend (H4 OB): 1.13524

Low of the Trend (H4 OB): 1.13048

Confirmed High Volume Node (HVN) within the H4 OB Price Objective (POC): 1.13479

H1

**Identified Swing Point:** The swing point that caused the broken structure on the H4 chart.

**Confirmed H1 Order Block:** The H1 order block within the OTE area is valid. This is confirmed by aligning the POC (Price of Control) and High Volume Nodes (HVN) at 1.13479.

**H1 Order Block:**

* High: 1.13612

* Low: 1.13435

**Entry Model:**

**Option 1 (Limit Order):**

* Entry Price: 1.13497

* Stop Loss (SL): 1.13294 (20 pips)

* Risk-Reward Ratio: 1:2, 1:3, or 1:4

**Option 2 (Limit Order):**

* Entry Price: 1.13497

* Stop Loss (SL): 1.12839 (67 pips)

* Risk-Reward Ratio: 1:2

* Breakeven Point: 1:1

**Option 3 (EMA Confirmation Entry):**

* Enter when the 9EMA crosses the 21EMA near the OTE price level.

* Volume confirmation should be bullish volume above the 21MA on each tick.

* Stop Loss (SL): ATR (Average True Range) X 2

* Risk-Reward Ratio: 1:2

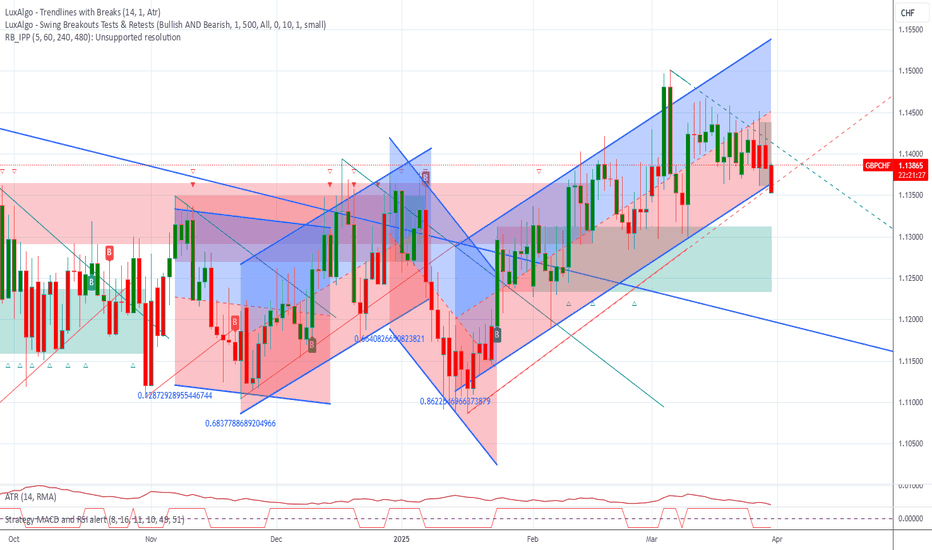

GBPCHF INTRADAY corrective pullback capped at 1.1430Trend Overview

The GBP/CHF currency pair remains in a bearish trend, with current price action reflecting a potential oversold bounce within a broader downtrend.

Key Levels & Scenarios

Resistance: 1.1440 (previous consolidation zone)

A bearish rejection from this level could reinforce downside momentum.

Downside targets: 1.1340, followed by 1.1300 and 1.1200 over a longer timeframe.

Bullish Breakout Scenario:

A daily close above 1.1440 would invalidate the bearish outlook.

Upside targets: 1.1480, followed by 1.1500.

Volume analysis indicates limited buying pressure, keeping the bearish bias intact unless 1.1440 is breached.

Conclusion

As long as 1.1440 holds as resistance, GBP/CHF remains in a bearish structure, targeting 1.1340 and lower levels. A break above 1.1440 would signal a potential shift toward 1.1480 and 1.1500.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPCHF Trade IdeaGBPCHF Trade Idea

Analysis & Justification:

• Price is currently above the 200 EMA, indicating an overall bullish trend.

• A Break of Structure (BOS) has occurred, serving as a second confirmation that the price is in an uptrend and likely to continue its upward movement.

• Price has also rejected the Demand Zone at the BOS level, further reinforcing the bullish momentum after testing this key support area.

Trade Parameters:

• Entry Price: 1.14407

• Target Price: 1.14929

• Stop Loss: 1.14146

• Risk-Reward Ratio (RRR): 2

This setup aligns with the trend-following strategy, leveraging trend continuation signals and demand zone rejections.

GBPCHF: Short Signal Explained

GBPCHF

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell GBPCHF

Entry - 1.1424

Stop - 1.1436

Take - 1.1402

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBP_CHF LONG FROM RISING SUPPORT|

✅GBP_CHF is trading along the rising support

And as the pair will soon retest it

I am expecting the price to go up

To retest the supply levels above at 1.1413

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPCHF Massive Short! SELL!

My dear subscribers,

GBPCHF looks like it will make a good move, and here are the details:

The market is trading on 1.1428 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.1410

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBP-CHF Bullish Bias! Buy!

Hello,Traders!

GBP-CHF is trading in an

Uptrend along the long-term

Rising support line and the pair

Is going down now to retest

The support from where

We will be expecting a

Bullish rebound and

A strong move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPCHF Ready to Surge? Bullish Momentum Unfolding After Retail The latest retail sales data for GBP has exceeded forecasts, signaling strong consumer demand and economic resilience.

After four consecutive bullish candles, we observed a pullback that formed a hammer—a key reversal signal—potentially completing a morning star pattern. This price action suggests that buyers are regaining control, and momentum is shifting to the upside. If confirmed by further bullish movement, we could see GBPCHF pushing higher in the coming sessions.

GBPCHF: Bears Will Push

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to sell GBPCHF.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPCHF INTRADAY coiling energy build up supported at 1.1366The GBP/CHF currency pair shows a bullish sentiment, supported by the prevailing uptrend. Recent intraday price action indicates a bounce back from the rising trendline support zone.

Bullish Scenario:

The key trading level to watch is 1.1366, representing the previous consolidation range. A corrective pullback to this level, followed by a bullish bounce, would likely target upside resistance at 1.1470. Further bullish momentum could see prices reaching 1.1510 and 1.1570 over the longer timeframe.

Bearish Scenario:

On the other hand, a confirmed loss of the 1.1366 support level, accompanied by a daily close below this point, would invalidate the bullish outlook. This would pave the way for a deeper retracement toward 1.1300, with the next support level at 1.1240.

Conclusion:

The prevailing sentiment remains bullish as long as 1.1366 holds as support. Traders should monitor this level for potential bounce signals to confirm continued upside momentum. A decisive break below 1.1366 would signal a shift to a bearish outlook, targeting lower support zones.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBP_CHF LONG SIGNAL|

✅GBP_CHF is trading in an uptrend

Along the rising support line

Which makes me bullish biased

And the pair is about to retest the rising support

Thus, a rebound and a move up is expected

So we can enter a long trade with

The TP of 1.1410 and SL of 1.1350

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.