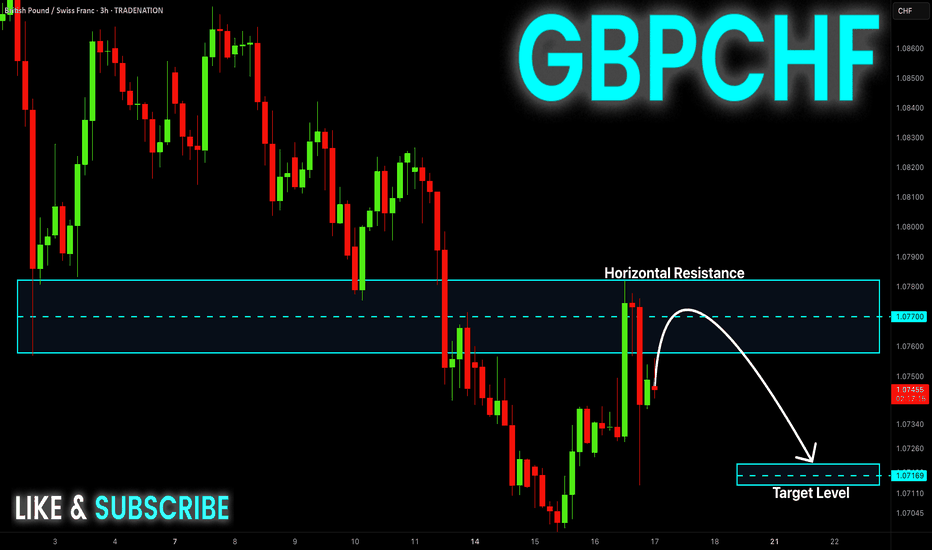

GBPCHF - Continuation Setup towards 1.0770GBPCHF recently descended with strength, and I’ve been watching to see how price reacts here.

Price now hovers above and this is a great indication for us to use for possible continuation move, that could send price into the 1.0770 level.

But if price breaks above with momentum, then I’ll back off the bearish bias and reassess, and I’d consider the continuation idea invalidated, with potential for further upside.

Just sharing my thoughts for the charts, this isn’t financial advice. Always confirm your setups and manage your risk properly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPCHF trade ideas

X1: GBPCHF Long Trade Risking 1% to make 1.35%OANDA:GBPCHF Long trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

Risking 1% to make 1.35%

This is good trade, don't overload your risk like greedy, be disciplined trader, this is good trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

GBPCHF Technical Analysis! BUY!

My dear followers,

I analysed this chart on GBPCHF and concluded the following:

The market is trading on 1.0733 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.0775

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPCHF Potential Bearish SetupDistribution pattern with breakdown below key support suggests downside momentum.

Break above our Resistance zone will invalidate our trade setup; good idea to watch out if that happens.

- Breakdown Level: 1.08149 -1.08133

- Entry Strategy: Sell orders at BOS

- Stop Loss: Above Resistance zone

- Target Zones:

- Primary Target: Target 1 (R:R 1:2)

- Secondary Target: Target 2 (R:R 1:3)

- Extension Target: Target 3 (R:R 1:4)

Bearish/Bullish Confirmations:

🔻 Rejection candlestick patterns

🔻 Bearish Reversal patterns

🔻 Impulsive moves in line with setups directional bias

Position Management:

- Exit: Partial profits at targets

- Stop adjustment: Trail stops when target are hit

GBPCHF - Bullish BUY Market has formed a strong divergence in the bearish trend on 1H time frame- market has also formed as wedge patter which is a good sign of reversal.

market has currently broken the last LH.

we take instant entry and place SL as defined on the charts with R:R of 1:1 and 1:2 we put our TPs.

GBP-CHF Bearish Breakout! Sell!

Hello,Traders!

GBP-CHF is trading in a strong

Downtrend and the pair

Broke the key horizontal

Level around 1.0780 which

Reinforces our bearish

Bias and we will be

Expecting a further

Bearish move down

On Monday!

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-CHF Local Short! Sell!

Hello,Traders!

GBP-CHF made a retest of

The wide horizontal resistance

Of 1.0780 and we are already

Seeing a bearish pullback

So as the pair is trading in a

Downtrend we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBCHF Will Fly from a Old support LevelHello Traders

In This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBP/CHF LONG FROM SUPPORT

Hello, Friends!

GBP/CHF pair is in the downtrend because previous week’s candle is red, while the price is obviously falling on the 1D timeframe. And after the retest of the support line below I believe we will see a move up towards the target above at 1.116 because the pair oversold due to its proximity to the lower BB band and a bullish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/CHF Headed to 1.10 – But Bulls Might Regret It📉 1. Price Action & Technical Structure (D1)

Key demand zone tested with bullish reaction:

Price reacted strongly around the 1.0790–1.0840 structural demand area, previously the origin of a significant bullish impulse. The latest daily candle closed above the previous swing low, suggesting a potential technical rebound.

Immediate target:

The 1.0980–1.1010 zone, aligning with:

A clear supply area

RSI bouncing from oversold territory

A visible imbalance left unfilled

Technical bias: Short-term LONG to fill the imbalance before a potential institutional-driven short setup at supply.

2. Retail Sentiment

86% of traders are LONG, with an average entry of 1.0997

Only 14% are SHORT, with lower volume and better pricing

Current price: 1.0833, meaning most long traders are in drawdown

Contrarian view:

The heavy long positioning creates a liquidity pool between 1.0990–1.1010, making that zone highly attractive for institutional distribution and liquidation of retail longs, especially if accompanied by a structural shift.

🎯 Operational impact:

Supports a technical long to 1.10, but high risk of reversal once that level is reached.

3. COT Report

GBP (British Pound – CME)

Non-commercials:

Long: -6,434 → massive unwind of bullish exposure

Short: +2,028 → rising bearish bets

Net positioning is increasingly bearish

Commercials:

Long: +7,459 → increasing coverage against GBP weakness

Short: -569 → slight reduction

Positioning is mixed, but commercials are taking defensive long positions

GBP interpretation:

Bearish pressure rising from institutional speculators, despite some commercial support.

CHF (Swiss Franc – CME)

Non-commercials:

Long: +327

Short: +1,215

Net positioning still heavily short, but shorts increasing again

Commercials:

Long: +1,909

Short: +307

Commercials are accumulating long CHF positions (bullish sign)

CHF interpretation:

Divergence between commercials (bullish CHF) and speculators (still short) → shift may be underway.

4. July Seasonality

GBP:

Historically strong in July, especially the last 2 years (+3.5%)

Positive tendency across 10y/15y/20y averages

CHF:

Also seasonally positive in July, but underperforms GBP across most timeframes (except 2Y where CHF is also strong)

Operational impact:

Favors short-term bullish GBP/CHF bias, supported by seasonal momentum.

✅ Final Outlook

Current short-term bias is bullish, driven by:

Clear technical rebound

Visible imbalance toward 1.10

Seasonal divergence in favor of GBP

However, excessive retail long positioning + COT speculative pressure on GBP suggest this rally could be a distribution phase, offering an optimal short opportunity at 1.10.

GBP/CHF Long Setup📈 GBP/CHF Long Setup

🕒 1H Timeframe

📍Entry: 1.0800

🎯 Target: 1.0889

I'm currently long GBPCHF after seeing a strong bounce from a key demand zone. Price has printed a higher low and is showing bullish structure on the 1H. Targeting a break above local resistance toward 1.0889.

🔍 Multiple rejections from demand + bullish momentum = high probability setup.

📊 Let’s see if price can push through those liquidity levels.

📍 Risk-managed and eyes on PA — updates to follow.

#GBPCHF #Forex #TradeSetup #PriceAction #SmartMoney #MarketStructure #SwingTrade

Swiss Vault Job: GBP/CHF Entry Blueprint Unlocked🕵️♂️💼 GBP/CHF: The Swiss Vault Infiltration Protocol 💼🕵️♂️

(Swing/Day Plan — Executed in Silence, Paid in Profits)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Silent Operators, 🤑💰💸✈️

Welcome to the Thief Trading Syndicate's Strategic Playbook – today’s mission targets the GBP/CHF vault. We’ve cooked up a master plan powered by our signature blend of technical finesse and stealthy macro-insight. This setup is based on institutional footprints and high-stakes zones where liquidity flows like digital gold.

📊 Current Bias:

🟥 Bearish weight remains, but we smell bullish smoke beneath — reversal setups in play.

📈 Entry Strategy:

Long (Bullish) — Scout entry above 1.06500+ in higher timeframes (4H+). Retest confirmation required.

Short (Bearish) — “The vault’s unguarded! Slip in short anywhere up top—clean sweep mode.”

🛑 Stop Loss Placement:

Place SL near recent swing highs/lows on the 5H chart (swing basis). Customize per lot size and multiple entries. Your risk defines your escape rope.

🎯 Profit Extraction Target:

Long TP: Aim for the 1.11500 vault door (or vanish before it slams).

Short TP: Dive to 1.06500, or pull the plug earlier if guards wake up.

📰 Strategic Conditions:

This pair’s behavior is currently driven by mixed macro triggers — smart money positioning (COT), sentiment clusters, and market structure traps.

→ For full details: Fundamental macros, COT leaks, sentiment drift, and institutional zones — check your sources.

🚨 News & Risk Protocols:

No new entries during red-folder events.

Use trailing stops to lock loot and run.

💥 Boost Our Bandits!

Smash that ❤️ to strengthen our robbing force. Each tap fuels future missions. No indicators. Just raw street-smart trading edge.

👀 More heists incoming. Stay low. Stay sharp. Stay profitable. 🐱👤🎯📈

GBPCHF Wave Analysis – 3 July 2025- GBPCHF reversed from strong support level 1.0785

- Likely to rise to resistance level 1.0950

GBPCHF currency pair recently reversed up from the strong support level 1.0785 (which has been steadily reversing the price from last August as can be seen below).

The upward reversal from the support level 1.0785 created the daily Japanese candlesticks reversal pattern Bullish Engulfing.

Given the strength of the support level 1.0785 and the oversold daily Stochastic, GBPCHF currency pair can be expected to rise to the next round resistance level 1.0950.

Perfect short on GBPCHFI went short on GBPCHF because of the bearish pennant pattern that formed on the 8hr , price action than continued to break below the level and pulling back to the pattern and forming a bearish evening star pattern on the 8hr as well and I entered the trade at 9am est on the opening of the new 8hr candlestick

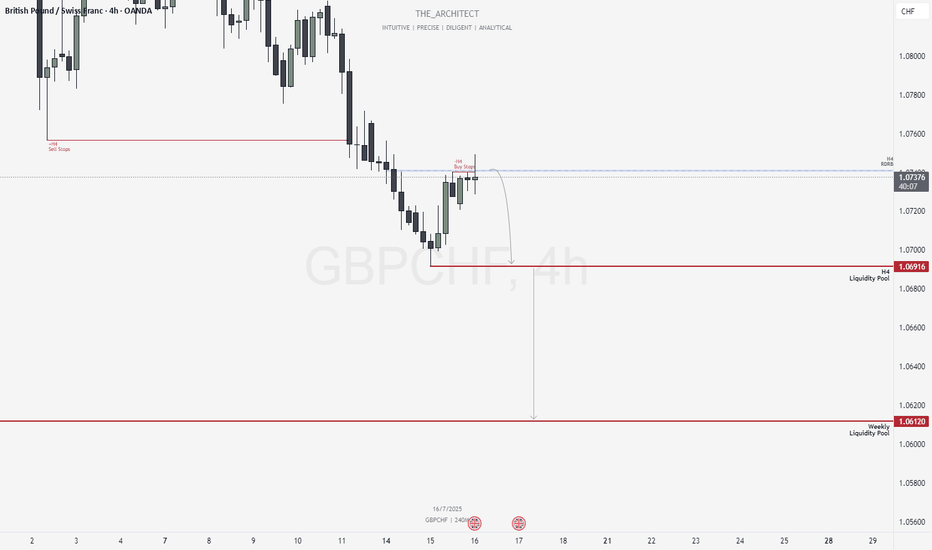

GBPCHF: Bearish Structure Aligns for Potential Sell Setups!Greetings Traders,

In today’s analysis of GBPCHF, we observe that the institutional order flow is currently bearish, and as such, we aim to align with this bias by identifying selling opportunities from key institutional resistance zones.

Higher Timeframe Context:

Weekly TF:

The weekly timeframe, which serves as our macro bias, is firmly bearish. This sentiment is reinforced on the H4 timeframe—our intermediate structure—which is also delivering consistent lower highs and lower lows. The alignment between these two timeframes strengthens our conviction to trade in the direction of institutional bearish order flow.

Key Observations on H4:

Re-delivered & Re-balanced Price Zone: Price has retraced into a previously balanced area that has now been re-delivered into, signaling institutional interest. Rejection from this zone adds to our bearish bias.

Buy Stop Raid: Price action has swept H4 buy stops in this area, providing confirmation that smart money may have used this liquidity for order pairing into short positions.

Entry Zone: The current rejection suggests a high-probability shorting opportunity from this region, provided confirmation on the lower timeframes.

Trading Plan:

Entry Strategy: Await confirmation at the current H4 resistance for short entries.

Targets: First target is the H4 liquidity pool located at discount prices. The longer-term objective is the weekly liquidity pool, which represents the primary draw on liquidity.

Continue to monitor price action closely, maintain patience for confirmation, and manage risk according to your trading plan.

Kind Regards,

The Architect 🏛️📉